Do I Have A Deadline To Take Money Out Of My Old 401

When you leave a job, you arent forced to decide what to do with your 401 immediately.

The money already in your 401 is yours, so you can usually leave it as long as you want or roll it into an IRA at any time.

However, there are a few exceptions:

- If you contributed less than $5,000 to your 401, your employer is legally allowed to tell you to take the money and move it elsewhere .

- Contributions of $1,000 to $5,000 are subject to involuntary cash-outs. Thats when your former employer moves the full amount into an IRA.

- If you contributed less than $1,000, your former company can mail you a check for the full amount. You can deposit this amount into another retirement account within 60 days to avoid tax penalties.

Fidelity And/or Vanguard To Tiaa

Transfer funds from Fidelity and/or Vanguard fund into a TIAA fund

Open Your Rollover Ira In 3 Easy Steps We’re Here To Help You Along The Way Too

Investment, insurance and annuity products are not FDIC insured, are not bank guaranteed, are not deposits, are not insured by any federal government agency, are not a condition to any banking service or activity, and may lose value.

Consumer and commercial deposit and lending products and services are provided by TIAA Bank®, a division of TIAA, FSB. Member FDIC. Equal Housing Lender.

The TIAA group of companies does not provide legal or tax advice. Please consult your tax or legal advisor to address your specific circumstances.

TIAA-CREF Individual & Institutional Services, LLC, Member FINRA and SIPC , distributes securities products. SIPC only protects customers securities and cash held in brokerage accounts. Annuity contracts and certificates are issued by Teachers Insurance and Annuity Association of America and College Retirement Equities Fund , New York, NY. Each is solely responsible for its own financial condition and contractual obligations.

Teachers Insurance and Annuity Association of America is domiciled in New York, NY, with its principal place of business in New York, NY. Its California Certificate of Authority number is 3092.

TIAA-CREF Life Insurance Company is domiciled in New York, NY, with its principal place of business in New York, NY. Its California Certificate of Authority number is 6992.

Don’t Miss: What Is A Robs 401k

What If I Have Employer Stock In My Employer

You can choose to roll company stock into an IRA or a taxable brokerage account. If you decide to roll the stock to an IRA, its full value will be taxed as income at your regular rate if you move the stock to a taxable brokerage account, you might be able to save money by paying capital gains taxes on the difference between the stocks value and the price you paid for it. There are tax benefits to each, so consult your tax advisor and ask about the net unrealized appreciation strategy.

How Much Does It Cost To Roll Over A 401 To An Ira

If you do the process correctly, there should be few or no costs associated with rolling over a 401 to an IRA. Some 401 administrators may charge a transfer fee or an account closure fee, which is usually under $100.

Because moving your money from a 401 to an IRA allows you to avoid the 10% early withdrawal penalty that results if you withdraw money from a 401 before 59 1/2, itâs a far better option if you canât keep your money invested in an old employerâs plan or move it to a 401 at your new company.

You should consider whether rolling over a 401 to an IRA is a better option than either leaving it invested when you leave your job or moving the money to your new employerâs retirement plan. If you can avoid 401 management fees and gain access to investments with lower expense ratios, an IRA may be a cheaper account option.

Recommended Reading: How To Check My Walmart 401k

Read Also: What Happens To 401k Money When You Quit

How The Rollover Is Done Is Important Too

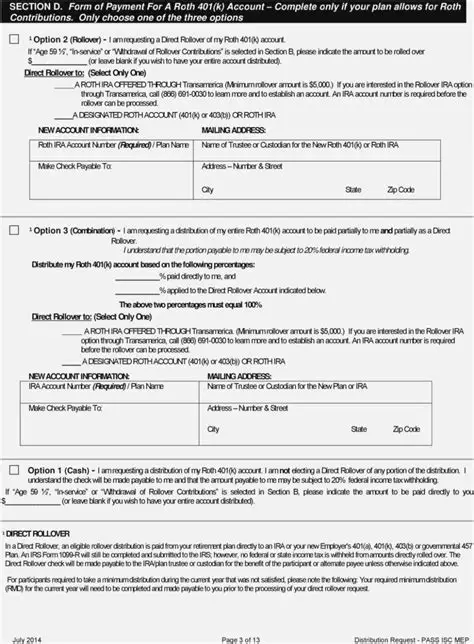

Whether you pick an IRA for your rollover or choose to go with your new employer’s plan, consider a direct rolloverthats when one financial institution sends a check directly to the other financial institution. The check would be made out to the bank or brokerage firm with instructions to roll the money into your IRA or 401.

The alternative, having a check made payable to you, is not a good option in this case. If the check is made payable directly to you, your employer is required by the IRS to withhold 20% for taxes. As if that wouldn’t be bad enoughyou only have 60 days from the time of a withdrawal to put the money back into a tax-advantaged account like a 401 or IRA. That means if you want the full value of your former account to stay in the tax-advantaged confines of a retirement account, you’d have to come up with the 20% that was withheld and put it into your new account.

If you’re not able to make up the 20%, not only will you lose the potential tax-free or tax-deferred growth on that money but you may also owe a 10% penalty if you’re under age 59½ because the IRS would consider the tax withholding an early withdrawal from your account. So, to make a long story short, do pay attention to the details when rolling over your 401.

Ira Rollover Vs Transfer

Although both rollovers and transfers allow you to move your retirement savings from one financial institution to another, the process for each is different, and each have different rules.

A 401 rollover occurs when you move retirement funds from an employer-sponsored plan to an IRA this is why its also called a Rollover IRA. This option is typically chosen when an employee leaves a job and is no longer contributing to the employer-sponsored retirement plan.

A Transfer is when you move your IRA to another IRA at a different institution. In the case of a transfer, funds or assets are sent between institutions, from the previous custodian or trust company to the new one. This is not only the quickest, but also the best method of moving your IRA to a self-directed IRA.

Recommended Reading: Can You Roll A 401k Into A Roth

Also Check: Can I Move My 401k To Bitcoin

The Way To Make An Esignature For A Pdf File In Chrome

The guidelines below will help you create an eSignature for signing principal 401k terms of withdrawal pdf in Chrome:

Once youve finished signing your principal 401k withdrawal form, choose what you wish to do next – download it or share the document with other people. The signNow extension gives you a selection of features to guarantee a much better signing experience.

How Can I Increase My 401k Contribution Through Principal

If youre already enrolled in a 401, 403, or 457 plan with services through Principal, you might consider increasing the amount you contribute from each paycheck. Even a few extra dollars per paycheck may add up significantly over timeand it only takes a few minutes. Log in to increase your contributions.

Recommended Reading: How Can I Get Money Out Of My 401k

All You Need To Know About A 401k Rollover

A 401k is an investment account to which most people begin contributing through an employer. The account allows you to dip your toe in the world of investments while saving money toward your eventual retirement. Many employers even offer 401k matches to encourage contributions from employees. But when you leave that company you may need to do a 401k rollover.

How To Roll Over Your Principal 401k

Find out your options when dealing with your Principal 401k. You and Your 401K

Leaving a job can be difficult and can create an array of tasks you need to deal with. In all of that change, it can be easy to overlook what happens with your Principal 401k. However, failing to roll over your retirement account could cost you in the long run.

Fortunately, the process of rolling over your Principal 401k can be painless and usually wont mean any additional fees or taxes.

Read more to take a closer look at the steps you should follow to roll over your Principal 401k.

You May Like: How To Manage 401k In Retirement

Short Of Cash Be Cautious

It may be tempting to pull money out of your 401 to cover a financial gap. Or, when you are considering rolling money over from a 401 to an IRA, you may wish to roll over only a portion of your retirement savings and take the rest in cash. But do you know the true cost? Use our 401 Early Withdrawal Costs Calculator first.

Investment and Insurance Products are:

- Not Insured by the FDIC or Any Federal Government Agency

- Not a Deposit or Other Obligation of, or Guaranteed by, the Bank or Any Bank Affiliate

- Subject to Investment Risks, Including Possible Loss of the Principal Amount Invested

Investment products and services are offered through Wells Fargo Advisors. Wells Fargo Advisors is a trade name used by Wells Fargo Clearing Services, LLC and Wells Fargo Advisors Financial Network, LLC, Members SIPC, separate registered broker-dealers and non-bank affiliates of Wells Fargo & Company.

WellsTrade® and Intuitive Investor® accounts are offered through WFCS.

Retirement Professionals are registered representatives of and offer brokerage products through Wells Fargo Clearing Services, LLC . Discussions with Retirement Professionals may lead to a referral to affiliates including Wells Fargo Bank, N.A. WFCS and its associates may receive a financial or other benefit for this referral. Wells Fargo Bank, N.A. is a banking affiliate of Wells Fargo & Company.

Dont Miss: How To Find My 401k Money

Reasons You May Want To Wait To Roll Over Your 401

- Temporary ban on contributions. Some plan sponsors impose a temporary ban on further 401 contributions for employees who withdraw funds before leaving the company. You’ll want to determine if the gap in contributions will significantly impact your retirement savings.

- Early retirement. Most 401s allow penalty-free withdrawals after age 55 for early retirees. With an IRA, you must wait until 59 ½ to avoid paying a 10% penalty.

- Increased fees. IRA investors may pay more fees than they would in employer-sponsored plans. One reason: The range of more sophisticated investment options you may choose can be more expensive than 401 investments. Your advisor can help identify what extra cost a rollover may incur and if the benefits of the rollover justify those additional costs.

- Can take loans out. Your 401 may permit you to take out a loan from the account, but this is typically only for active employees. And you may have to pay in full any outstanding loan balances when you leave the company. You cannot take loans from IRAs.

Recommended Reading: How To Borrow From 401k For Down Payment

How Did I Get Here

Years ago, I began maximizing my annual 401k contribution. During the four and half years that I was at Startup Inc, I made the maximum contribution each year, front loading my contribution most of the years. Thats five years of maximum contributions, or $94,500. Startup Inc never made any matching contributions. I invested everything in the lowest fee options. At the end, I was 75% in an S& P 500 index and 25% in a small cap, S& P 600 index. Both have expense ratios of .05%. The last five years of compounding have been great.

My major beef with the plan has been the administration fee. Previous employers picked up the administration fee, but not StartupInc. Instead, they passed the fee on to the participants. In the early days when the assets under management and participants were both low, the administration fee was high. I cant recall exactly, but it was somewhere in the range of .75% or more. Now, with more participants and a higher total AUM, the fee is still pretty high, around .7%.

How does this translate to me? In 2018, I paid a total fee of $263. But this year, even with a lower administration fee ratio, Ive already paid nearly two-and-a-half times that, or $644.75. If I kept my money in the plan, I would break $900 in fees for the year.

To me, thats expensive.

I was looking forward to ditching those fees by rolling over my 401k.

Is Principal A Good 401k Provider

Historically, Principal has touted their 401k services as exemplary, and most 401k investors believe they are making acceptable returns in their 401k retirement plans. Principal has successfully perpetrated a marketing campaign to convince their clients that Principal is an ethical and profitable company.

Recommended Reading: What Happens To 401k If You Retire Early

How To Roll Over A Principal 401

If you have a 401 at Principal from a previous job, there are a few options for you to consider when doing a rollover. The process for Principal can be done either online, by phone, or by mailing or faxing their rollover request form. Once the rollover is initiated, Principal will usually send a check directly to your new account provider and you should see your funds deposited in 10-15 business days after youve submitted the request.

Confirm A Few Key Details About Your Empower 401

First, get together any information you have on your Empower 401. Its okay if you dont have a ton, but any details like an old account statement or an offboarding e-mail from your former HR team can help. 401 paperwork can be confusing, so just focus on identifying the following items:

Recommended Reading: Can I Have 2 401k Plans

Changing Jobs The Ins And Outs Of A 401 Rollover

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

If you’ve decided to leave your current job for another, you will need to decide what to do with the money that you have invested in your current company’s 401 plan. Options typically include leaving it where it is, rolling it over to a new employer’s plan, or opting for an IRA rollover.

If you are about to change jobs, here’s what you need to know about rolling over your funds into a new employer’s 401 plan and the ins and outs of other options.

Why Rollover A 401k

For me the decision was simple. I prefer the low cost Vanguard funds over Fidelity funds. Fidelity does offer some really low cost index funds, but Vanguard offers a wider variety of funds with rock-bottom expense ratios.

In addition, by moving funds over to Vanguard, I can qualify for even lower fees and more exclusive customer service. In addition to a standard account, Vanguard offers what it calls Voyager, Voyager Select and Flagship accounts. To qualify, however, you must have minimum account balances. By moving more money over to Vanguard, its easier to qualify for a higher level of service. Here are the requirements of each account type and what they offer:

Dont Miss: How To Know If You Have A 401k

Recommended Reading: How To Find Previous Employer’s 401k

Where Is My 401k Money

Contact Your Former Employer

Contact their human resources department. There, they should have all of the information as to the whereabouts of the 401 account you had with them. They should send you the proper paperwork and be able to facilitate the transfer of your funds to whatever account you choose.

Confirm A Few Key Details About Your Principal 401

First, get together any information you have on your Principal 401. Its okay if you dont have a ton, but any details like an old account statement or an offboarding e-mail from your former HR team can help. 401 paperwork can be confusing, so just focus on identifying the following items:

Also Check: How To Transfer Roth 401k To Roth Ira