How Much Should Employees Contribute

Like the employer, employees are free to contribute as much as they like to the plan, within IRS limitations. For 2022, salary deferrals are $20,500, plus a catch-up contribution limit of $6,500 for employees 50 and older. Consider ways to help employees improve their financial wellness and increase their 401 participation. Doing so could benefit your business in the form of happier, less-stressed employees who are more engaged and productive.

If I Offer A 401 To My Employees Are There Compliance Regulations I Must Follow Or Can The Retirement Plan Provider Help With These

Certain employers who offer 401 and other retirement plans must abide by the Employee Retirement Income Security Act of 1974, as amended, which helps ensure that plans are operated correctly and participants rights are protected. In addition, a 401 plan must pass non-discrimination tests to prevent the plan from disproportionately favoring highly compensated employees over others. The plan fiduciary is usually responsible for helping comply with these measures.

This information is intended to be used as a starting point in analyzing employer-sponsored 401 plans and is not a comprehensive resource of all requirements. It offers practical information concerning the subject matter and is provided with the understanding that ADP is not rendering legal or tax advice or other professional services. For specific details about any 401 they may be considering, employers should consult a financial advisor or tax consultant.

Unless otherwise agreed in writing with a client, ADP, Inc. and its affiliates do not endorse or recommend specific investment companies or products, financial advisors or service providers engage or compensate any financial advisor or firm for the provision of advice offer financial, investment, tax or legal advice or management services or serve in a fiduciary capacity with respect to retirement plans. All ADP companies identified are affiliated companies.

Are 401k Contributions Tax

Yes. As mentioned earlier, 401k plans are tax-deductible for employers. Because 401k plans have several tax benefits, they are usually less expensive to offer than defined-benefit plans. The good news is that usually, every dollar a company contributes to a staff members 401k is a write-off. This is a common reason why companies choose to match a large amount of employee contributions. Higher matching means fewer taxes owed by the business.

Recommended Reading: How To Choose 401k Investment Options

Plans For Certain Small Businesses Or Sole Proprietorships

The Economic Growth and Tax Relief Reconciliation Act of 2001 made 401 plans more beneficial to the self-employed. The two key changes enacted related to the allowable “Employer” deductible contribution, and the “Individual” IRC-415 contribution limit.

Prior to EGTRRA, the maximum tax-deductible contribution to a 401 plan was 15% of eligible pay . Without EGTRRA, an incorporated business person taking $100,000 in salary would have been limited in Y2004 to a maximum contribution of $15,000. EGTRRA raised the deductible limit to 25% of eligible pay without reduction for salary deferrals. Therefore, that same businessperson in Y2008 can make an “elective deferral” of $15,500 plus a profit sharing contribution of $25,000 , andâif this person is over age 50âmake a catch-up contribution of $5,000 for a total of $45,500. For those eligible to make “catch-up” contribution, and with salary of $122,000 or higher, the maximum possible total contribution in 2008 would be $51,000. To take advantage of these higher contributions, many vendors now offer Solo 401 plans or Individual plans, which can be administered as a Self-Directed 401, permitting investment in real estate, mortgage notes, tax liens, private companies, and virtually any other investment.

What Are The Rules For A Roth Ira

Roth IRAs are only available to people making less than $129,000 a year as an individual, or $191,000 for married couples. They have contribution limits of $5,500 a year, or $6,500 for those over 50. Unlike 401ks and traditional IRAs though, there’s no penalty for withdrawing part of your contribution early.

Also Check: How To Withdraw Money From My Fidelity 401k

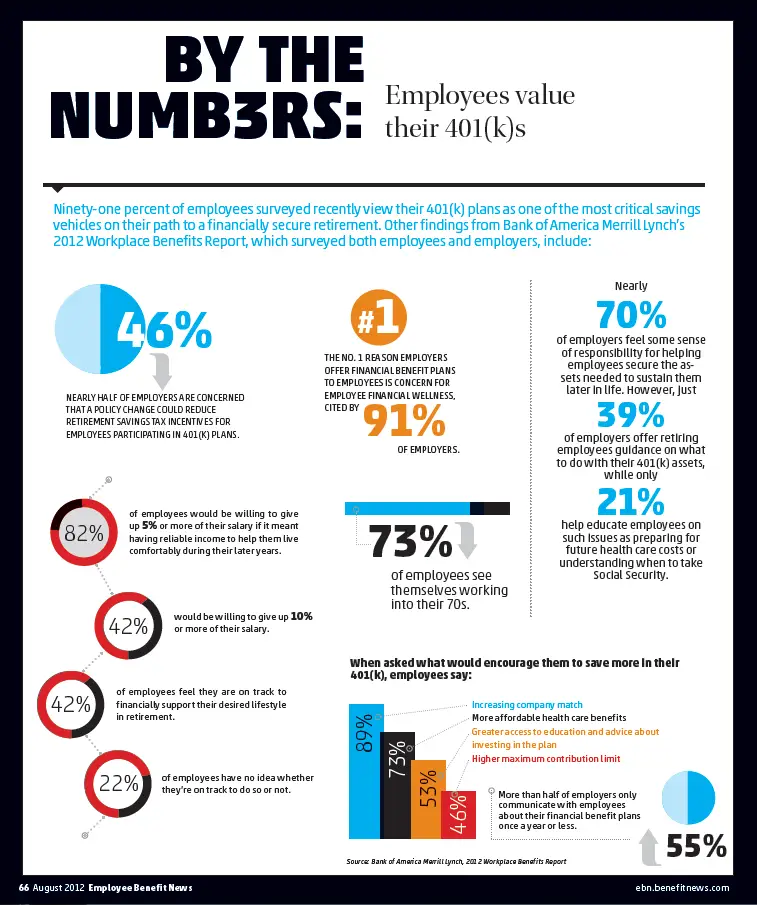

Ways To Promote Your 401 And Help Employees Save

Saving for retirement throughout ones working years is vital, and your 401 retirement plan is a great vehicle for employees to do so. However, employees often do not realize the importance of saving now. They might believe they cant afford to save right now or may choose to remove 401 money prematurely to cover a current financial need in their lives. Other employees do realize the value of contributing to a 401 plan but are simply overwhelmed by the complexity of investing and choose not to do anything as a result.

Consider the following suggestions to educate your employees and help them take full advantage of your retirement plan.

Can I Afford To Offer A 401

A 401 is a sought-after benefit by workers, ranked one of the top five benefits for employee satisfaction. By offering one, youll improve your ability to attract new talent and show employees you value them and care about their financial futures. This, in turn, can encourage employees to stay with you over the long-term, setting up your business for future success.

Glassdoor Internal Data, March 2017

But as you now know, theres a cost associated with providing a 401.

For example, using the basic costs we outlined above, a company with 10 employees can expect to pay $1,400 to $5,600 to get a plan up and running and cover the administration of it for the first year. And that figure doesnt take into account an optional employer match.

There are tax breaks that can help you reduce these costs, including the start-up cost tax credit, a deduction for some administrative costs, and a deduction for contributions if theyre less than 25% of an employees compensation.

If this range is still outside your budget, there are other retirement savings vehicles you could consider, like a SIMPLE IRA. This can be a good choice for smaller companies with 100 or fewer employees who dont want to pay a 401s annual administrative fees and want limited annual reporting and testing requirements. With a SIMPLE IRA, all youll be responsible for is a nonelective employer contribution of 2% of compensation or a dollar-for-dollar match up to 3%.

Read Also: How To Check My Walmart 401k

What Else Do Small Business Owners Need To Know About 401 Plans

Small business owners who offer retirement savings plans may be able to take advantage of tax incentives. Matching employee contributions, for instance, is generally tax deductible as a business expense. For the first three years of the plan, employers may also be eligible for tax credits up to 50% of the start-up and administration costs or $5,000 , as well as a $500 automatic enrollment credit per year.

Tools To Help You Save For Retirement

- SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- SmartAssets retirement calculator can help determine whether your retirement savings are on track.

Recommended Reading: When Can I Withdraw From 401k

What Are The Maintenance Costs For Setting Up A 401

Once you establish a 401, your business will have ongoing costs in the form of administrative fees and any matching contributions. Fees generally fall into three categories: day-to-day operations, investment fees, and individual service fees.

There are also potentially fees or penalties associated with being non-compliant with regular 401 benchmarking, which you’ll want to avoid at all costs. A few examples of 401 penalties include:

- Non-compliance with ERISA for failing to meet certain filing and notification requirements

- Failing to file Form 5500 with the IRS each year

- Not providing 402 notices to plan participants who are seeking distributions from their retirement plan accounts

One way to avoid fines and penalties is working alongside a knowledgeable retirement services provider that can help ensure compliance when it comes to retirement plan forms, deadlines, and notifications.

When Can You Withdraw From Your 401k Without A Penalty

Wondering when can you withdraw from 401k? 59 and 1/2 is the current age when you can take money out of your 401k without incurring a penalty. However, the money you take out is still taxed as income. At the age of 70, you will be forced by the IRS to start taking distributions from your retirement accounts.

Don’t Miss: How Much Does Fidelity Charge For 401k

How To Write A Retirement Letter

A retirement letter should be a formal notice about your future retirement. You should include some of the relevant points in this letter if you want the manager to consider this letter professional and adequate for the given situation.

First of all, include the information like a specific date of your retirement. You should discuss this point before, in a conversation with your manager, and this should be the date of your formal leaving.

Also, mention the time that you have spent at the company and how it affected your life. You can emphasize the years of experience you have gained or the skills that you have learned. No matter the achievement, you can mention it in your letter of retirement.

You can thank your boss for the opportunities that you had and you can express gratitude at some point. There is also an option to offer future services in the form of freelance or part-time work. In this manner, you can help the organization until they find a complete replacement for your position.

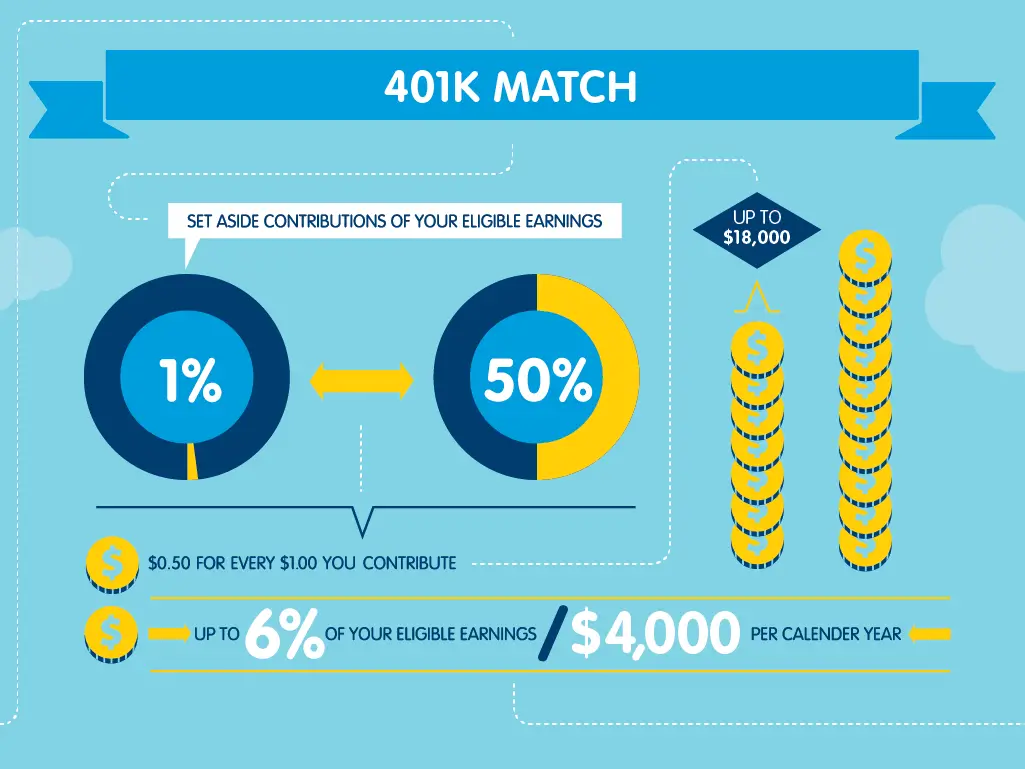

Are Businesses Required To Match Employees’ Contributions To A 401 And What Is The Standard Match

While businesses aren’t required to offer a contribution match, it’s still a good idea. Robertson said matching contributions generate goodwill and, since they are deductible, drive down a business’s tax liability.

If you want to offer a matching program but are afraid some employees will just take the money and run, consider a vesting schedule. With a vesting schedule, employees can’t take the employer’s contributions until they have participated in the retirement plan for a certain length of time.

For example, employer matching contributions might not fully vest for three years. If an employee leaves for another job before those three years are up, they aren’t entitled to all of the contributions the employer has made on their behalf. They do get to take all of the money they have personally contributed with them, of course.

Some companies opt for profit-sharing contributions to employees’ 401 accounts when business is good. As mentioned above, these contributions are also tax deductible.

“The typical 401 match is called a safe harbor nonelective match of 3% of salary,” Pyle said. “This means the employees get 3%, whether or not they participate in their employer’s 401 plan. Other match types are 100% on the first 3% of salary deferred and 50% on the next 2% of salary deferred.”

Don’t Miss: How Often Can I Change My 401k Investments Fidelity

What Is A 401 Plan

A 401 plan is a retirement savings plan offered by many American employers that has tax advantages to the saver. It is named after a section of the U.S. Internal Revenue Code.

The employee who signs up for a 401 agrees to have a percentage of each paycheck paid directly into an investment account. The employer may match part or all of that contribution. The employee gets to choose among a number of investment options, usually mutual funds.

A Beginner’s Guide To Understanding 401k Plans

The word 401k is synonymous with retirement, but how many of us actually know all the rules around 401k accounts? We’ll walk you through all the finer details, but we also know you’re busy, so we’ve also whipped up this handy table of contents for you, too. Feel free to self-serve some of the most frequently asked questions about 401k plans, or binge it all, top to bottom.

Now, onto the good stuff:

Read Also: How Much Money Can You Put In 401k Per Year

Choose A Plan That Meets Your Business Goals

Plan design optionsThe big difference between 401 plan designs is how and when an employer makes contributions on behalf of its employees. Here are three types of plan designs, their requirements, and some other implications:

What other 401 plan features should I consider?Offering retirement benefits is a great way to attract and retain talent. But specific plan features can really boost participation and make your small business 401 plan even more enticing.

Traditional vs. Roth 401. Whats the difference?Generally speaking, the key difference between the two is when employee contributions are taxed. With traditional accounts, contributions are made before taxes are taken out of pay. Under Roth accounts, contributions are taxed first and then deposited. When an employee retires, withdrawals from traditional accounts are taxed at ordinary income rates, whereas Roth withdrawals can generally be made on a tax-free basis.* Read more about traditional vs Roth accounts.

Should I match employee contributions?Matching contributions can be hugely beneficial for both employees and employers. For employees, theyre an additional form of compensation that can help maximize their retirement savings.

Sponsoring A Retirement Plan

Once you understand the different types of plans for your business, its important to take the proper steps to set it up. Below are the four main stages of implementing a retirement plan, according to the IRS:

You May Like: What Is The Tax Rate On 401k After 65

How Much Should An Employer Contribute To The Plan

The amount you as an employer decide to contribute is entirely up to you. As you make this decision, consider the tax savings you can receive for making employer contributions. Employer matches are tax-deductible on federal corporate income tax returns, and some administrative fees associated with managing a 401 plan are tax-deductible as well.

You can match as much as you want as long as it stays within the IRS limitations, which combine both employer and employee contributions. According to the IRS, this combined total is the lesser of 100 percent of an employee’s compensation or $61,000 for 2022, not including “catch-up” elective deferrals of $6,500 for employees age 50 or older.

Also consider factors such as the positive impact a matching contribution can have on employee morale and worker retention strategies. Given the steep costs of hiring and training new employees, an employer match offers the opportunity to truly invest in your workforce. These considerations may help guide your decisions about how much to contribute to the 401 plan.

How Can I Offer My Employees A 401 Plan

In this edition of Ask the Board, we asked Ben Thomason, executive vice president of revenue at Vestwell, if small businesses are in a position to offer workers a 401.

Vestwell’s Ben Thomason recommends that small businesses consult with an expert and start simple when choosing to offer employees a 401K plan.

If you could create your own fantasy Board of Directors who would be on it? CO connects you with thought leaders from across the business spectrum and asks them to help solve your biggest business challenges. In this edition, a CO reader asks whether it is feasible for a small business to sponsor a 401 plan for employees.

Ben Thomason, executive vice president of revenue at Vestwell, answers

Companies know its vitally important to have the right people on board to build the business, and a solid benefits package attracts the top talent they need. However, many small businesses assume they do not have the option to offer a 401 retirement savings plan.

That misconception is understandable, Thomason told CO, because cost and complexity had once put 401s out of reach for companies with lean resources. Thats no longer the case today, he said, thanks to the emergence of outsourcing options and technology advancements that streamline and ease the burden of 401 setup and administration.

To me, that is the why of offering 401s to attract the right talent so your business can grow the right way, Thomason said. The right people make all the difference.

Recommended Reading: How To Transfer 401k Without Penalty

Hidden 401 Fees That Can Drive Employer Costs Up

In addition to the standard costs youll pay for having a 401, there may be some surprise fees that youll want to watch out for. These could include costs for services like:

- Terminating the plan

- Rolling over funds from a previous provider or to a new one

- Changing your plan design, which requires a plan amendment

- Integrating your 401 with your payroll platform

Just be sure to carefully check your quote or fee schedule so you know what youre being charged.

Offer Some Financial Education

Bring a financial advisor or representative from your 401 administrator to provide employees information about the importance of saving, the concept of compounding, how much theyll likely need to live comfortably in retirement, different investment options, and how just a small amount from each paycheck can make a significant difference.

Also Check: How Do I Set Up A Solo 401k Plan