How Much Should I Have In My 401k Based On My Age

There are a few different schools of thought on how much a person should have saved in their 401k based on their age.

Every financial expert has a different opinion. When deciding what the right number is for you, I think one thing to keep in mind is that its better to have more saved than less.

Creating a potential post-retirement budget as a guideline will help you determine how much money youll spend after youre retired.

In an ideal world, you will be completely debt free by the time you retire and have minimal housing and other expenses.

Youll want to be prepare for these costs:

- Utility bills

- Travel

- Taxes

A persons income and expenses can make a difference when it comes to how much they should have saved at each interval age, but here are some general guidelines.

Use these guidelines in conjunction with your projected post-retirement budget to find out if you should have more or less saved by the time you retire than what is suggest ed here.

Do you have a 401k from an old employer that you need to rollover? Check out Capitalize which is free and will help take out the hassle of rolling over your 401k!

What Kinds Of Mutual Funds Should I Choose For My Roth 401

Diversifying your portfolio is key to maintaining a healthy amount of risk in your retirement savings. Thats why it’s important to balance your investment among four types of mutual funds: growth and income, growth, aggressive growth, and international funds.

If one type of fund isnt performing as well, the other ones can help your portfolio stay balanced. Not sure which funds to select based on your Roth 401 options? Sit down with an investment professional who can help you understand the different types of funds, so you can choose the right mix.

How Much Should I Have Saved So I Can Retire Early

The general rule of thumb for whatever age you plan on retiring is to have 80% of your pre-retirement income replaced. Create a careful budget of your expected total expenses per year in retirement and multiply that by how many years you wish to be in retirement. Suppose you plan on retiring around 40 or shortly after. In that case, you need to consider things like waiting to qualify for Medicare or Social Security benefits when considering how much your expenses will be.

Read Also: How Much To Withdraw From 401k

The 401 Contribution Limit Increased By $500 For 2020 Plus Workers 50 And Older Can Also Save An Extra Amount For Retirement

One of the best and most tax-friendly ways to build a nest egg for retirement is by contributing to an employer-sponsored 401 account. If your employer offers this benefit, jump in as soon as you can, because it’s never too early to start saving for retirement.

> > For more 2020 tax changes, see Tax Changes and Key Amounts for the 2020 Tax Year.< <

What Is The Average And Median 401 Balance By Age

401 balances can average roughly $6,000 at the age of 24 to more than $255,000 at the age of 65. Both average and median 401 balances can vary greatly depending on a few factors. This can include how long you have been saving for retirement or whether your company provides 401 matching, which is when your employer contributes to your retirement savings based on the amount of your contribution.

While savings are personal, the idea of a nest egg will likely make you contemplate what your financial future holds. Retirement might seem like a long way down the road, but time flies faster than we realize. And the earlier you start saving for retirement, the better off youll be later in life.

Knowing the 401 average by age can help you figure out where you stand and how you can be better prepared for the future. Heres what you can learn from Vanguards research on How America Saves in 2021:

| Age |

|---|

Also Check: How To Rollover Ira To 401k

What If Even 10% Is Too Much

For those who havent saved anything, I know its very hard to get started. But no matter what, you should at least contribute enough to get the employer match. A popular employer matching scheme is to match 50% of your first 6% of your salary. Lets say thats what your employer gives. For someone who make $50,000 a year that can contribute 6% a year, they will get $1,500 for free. $3,000 still sounds like a lot, I know, but do your best. Thats a little over $115 a paycheck. Find ways to spend less on what you already spend money on. Figure out what you can cut out of your budget. Think about it. Saving for retirement is still going to benefit you. Its not like you lose the money you saved in your 401k.

Next Steps To Consider

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Diversification and asset allocation do not ensure a profit or guarantee against loss.

Investing involves risk, including risk of loss.

Target Date Funds are an asset mix of stocks, bonds and other investments that automatically becomes more conservative as the fund approaches its target retirement date and beyond. Principal invested is not guaranteed.

Fidelity does not provide legal or tax advice. The information herein is general in nature and should not be considered legal or tax advice. Consult an attorney or tax professional regarding your specific situation.

With respect to federal taxation only. Contributions, investment earnings, and distributions may or may not be subject to state taxation.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

Read Also: What Happens If I Quit My Job With A 401k

How Much Do You Need To Retire Comfortably

How much you need to retire comfortably isnt black-and-white because the cost of living looks different for each individual. Consider what it takes to live comfortably and maintain your lifestyle. Many experts suggest that youll need roughly 80 percent of your salary after retirement to avoid making sacrifices.

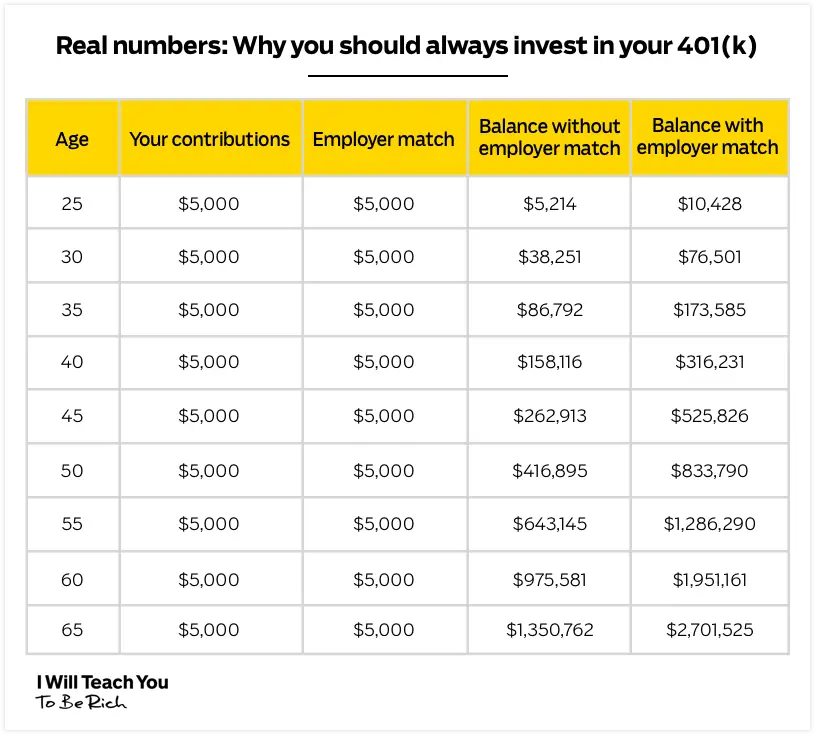

Taking Advantage Of An Employer Match Can Boost Your Savings

Better still, if your company provides a 401 match, not all of that $175 has to come out of your pocket. A match is free money your employer kicks in to help you save for retirement, based on how much you contribute. The average employer match works out to 4.7% of salary, according to Fidelity, while Vanguard’s How America Saves 2019 report found that two-thirds of companies match between 3% and 6% of pay.

For someone earning the average household income of $62,000, saving $4,550 a year works out to a bit more than a 7% contribution rate.

If you contribute 4% of pay to your 401, that works out to $2,480 a year, or roughly $95 per paycheck. A 4% employer match doubles your money, resulting in a total contribution of about $190 per paycheck.

That’s even more than you “need” for millionaire status: Someone starting at 25 could actually have $1.09 million by 65.

Video by Ian Wolsten

Recommended Reading: How Do I Get Access To My 401k

How Much Will You Need In Retirement

The sum youll need to retire is a highly personal question but needs careful consideration.

I believe retirement is a financial number versus a retirement age. Assess how much you need in your retirement account to live at least 20 years in retirement without having to go back to work to pay your bills, says Shaquana Watson-Harkness, personal finance coach and founder of Dollars Makes Cents, an online debt management and investing training course.

Rita-Soledad Fernández Paulino, a NextAdvisor contributor and creator of Wealth Para Todos, told us how she calculates her financial independence number using Trinity Studys 4% rule. According to the 4% rule, you can estimate how much money youll need to live on during retirement using this quick calculation:

Annual Expenses x 25 = Nest Egg .

For example, if your annual expenses are $40,000, multiply that by 25 for a total of $1M the amount youd need to retire, based on the 4% rule above.

If youre already freezing up thinking about million-dollar sums, remember youre not solely responsible for saving up this much on your own. The market, through compound interest, will do most of the heavy lifting for you, especially if you invest early and let your portfolio grow for decades.

Thats why starting early is so important.

If Youre In Debt Focus On High

If your employer matches 401 contributions, put in enough to get that match, even if youre in debt.

Next, if youre in credit card debt, stop. Put your extra money towards paying that off before making additional retirement contributions. Focus first on getting out of credit card debt and then come back.

Got student loans? Follow the above schedule anyway. Unless your private loans have double-digit interest rates, I dont recommend repaying student loans early.

Also Check: When Can You Start Drawing From Your 401k

Recommendation To Achieve A High 401k Amount By Age 50

Sign up for Personal Capital, the webs #1 free wealth management tool to get a better handle on your finances.

In addition to better money oversight, run your investments through their award-winning Investment Checkup tool to see exactly how much you are paying in fees. I was paying $1,700 a year in fees I had no idea I was paying.

After you link all your accounts, use their Retirement Planning calculator. It pulls your real data to give you as pure an estimation of your financial future as possible using Monte Carlo simulation algorithms. Definitely run your numbers to see how youre doing.

Ive been using Personal Capital since 2012. During this time, I have seen my net worth skyrocket thanks to better money management.

Why Should I Use One

Matching dollars, for one thing. Over 90% of employers that offer a 401 plan also kick in a company match, which means as you contribute, your employer will, too. Commonly, that match will be worth 50% to 100% of your contributions, up to a limit that typically falls between 3% and 6% of your annual salary. If your employer offers up this free money, a good rule of thumb is to do everything you can to contribute enough to take advantage of it.

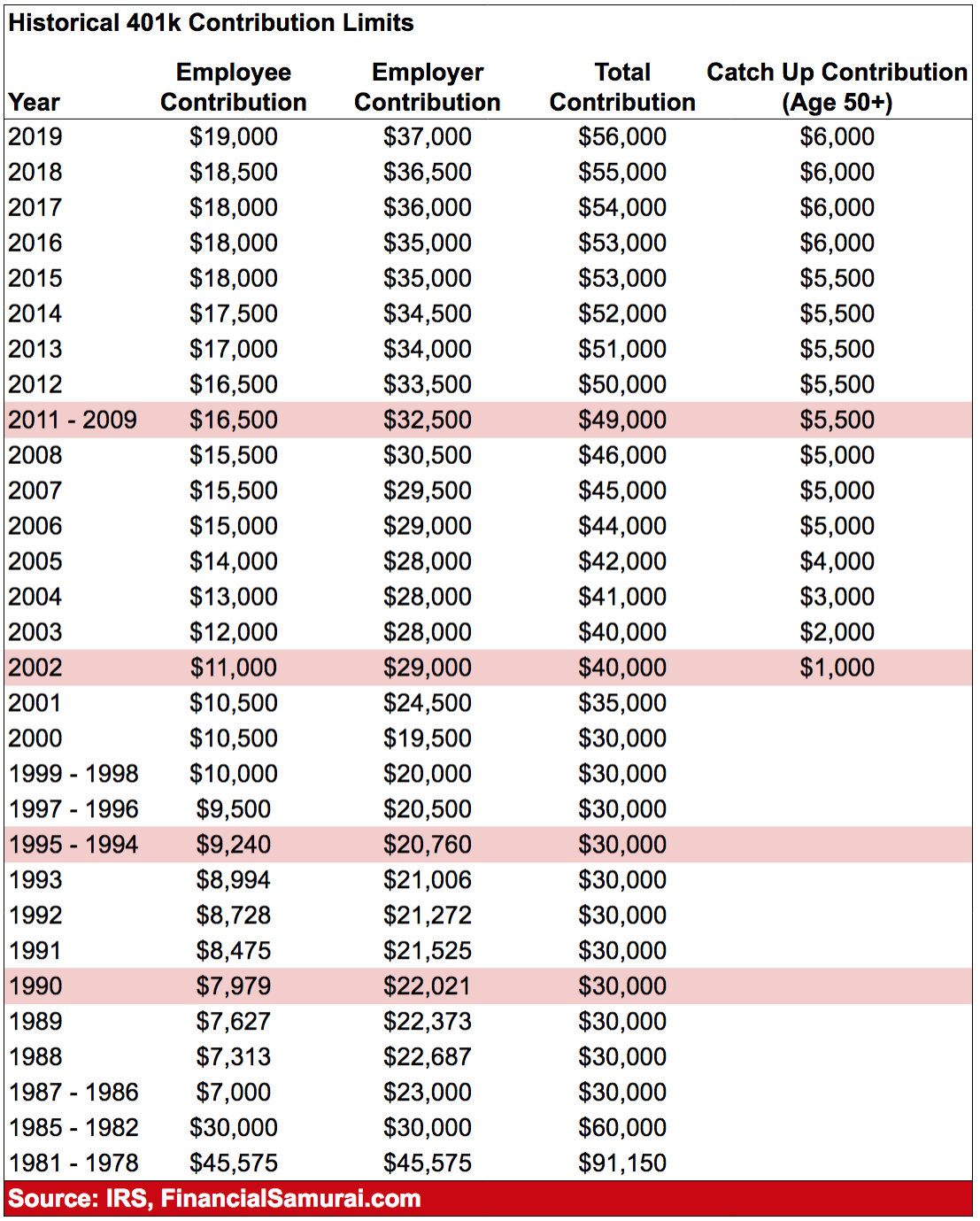

The other huge benefit of the 401 is that it allows you to put a lot of money away for retirement in a tax-advantaged way. The annual 401k contribution limit is $20,500 for tax year 2022, with an extra $6,500 allowed as a catch-up contribution every year for participants age 50 or older.

Don’t Miss: Where To Put My 401k

How Much Should You Save For Retirement In A 401

Experts recommend that workers save at least 15% of their income for retirement, including any employer match. For instance, if your employer contributes 3% then you would need to save an additional 12%.

If you arent saving that much right now, increase your contribution each year until you reach that goal. For example, if you are saving 3% now, increase that to 5% in 2022 then bump that up to 7% in 2023 and so on util you reach 15%.

Also Check: Should I Rollover My Old 401k To An Ira

Is Your 401k Savings On Track

Have you met your mark? If you arent there yet, dont panic. These are just rules of thumb. That means they only give you a rough estimate of what you should ideally have by the time you hit these ages. They do not take into account your individual income and experiences or other investments you might have in play.

In reality, theres no one hard answer to how much you should have in your 401k and anyone who tells you otherwise is either lying to you or just doesnt know much about finance. We could pull up a bunch of figures and show you how much someone in their 20s or 30s is saving but that would be a complete waste of time for two reasons:

1. Its impossible to compare two investors fairly. Everyone has their own unique savings situation. Thats why itd just be dumb to compare the Ph.D. student saddled with thousands in student loan debt with the trust fund baby who just snagged a cushy six-figure corporate gig the first month out of college. Theyre both going to save very differently, so its not worth comparing.

2. Most people arent financially prepared for retirement. The American Institute of CPAs recently released a study that found that nearly half of all Americans arent sure if theyll be able to afford retirement. Thats even scarier when you consider the fact that many people underestimate how much theyll need for a comfortable retirement.

Also Check: How Much Money Should I Put In My 401k

Where To Invest If You Don’t Have A 401

Don’t worry if your employer doesn’t offer a 401 there are still ways you can save for retirement on your own.

Many big banks and brokerages offer Individual Retirement Accounts, or IRAs, that allow you to put your retirement money into a range of investments, such as individual stocks, bonds, index funds, mutual funds and CDs. Just like with a 401, you can set up automatic contributions into your IRA from a checking or savings account.

When shopping around for an IRA, choose an account that has no minimum deposits, offers commission-free trading and provides a variety of investment options. Taking these factors into account, Select narrowed down our favorites for every type of retirement saver.

Why Employers Offer 401s

In 1978, when the law authorizing the creation of the 401 was passed, employers commonly attracted and retained talent by offering a secure retirement through a pension . The 401 created an entirely new system, with more flexibility for both employer and employee. One of the ways it did so was by giving employers the option to match employee contributions.

Matching is a very transparent process: for every dollar you put into your 401, your employer also puts in a dollar, up to a certain amount or percentage of your income. Theres no mystery here. If your employer promises to match all 401 contributions up to 5% of your income, and you contribute that amount every month, your employer will match you dollar for dollar, every month. Its a win-win situation. You are doubling your money, and your employer is building a happy workforce.

Also Check: How To Rollover 401k To Ira Fidelity

What If You Can’t Meet Your Employer Match

If you aren’t yet in a position to contribute enough to meet your employer’s match, and thus not enough to reach the desired 15% savings rate, aim to boost your retirement contributions by 1% to 2% each year. If you opt in to do so, some companies will automatically raise your contribution rate annually, so it’s worth making sure you are signed up for what is called an “auto-escalation” feature.

Ivory Johnson, a CFP and founder of Delancey Wealth Management, recommends increasing your contribution rate as you get pay raises until you max out the limit. There is a limit to how much you can contribute annually to your 401. In 2021, the standard annual contribution limit is $19,500 for 401 plans. And those over age 50 can use catch-up contributions to add an extra $6,500 in their 401 account. Employer contributions don’t count towards those specific limits.

Lynch reminds retirement savers to be strategic with the magic number they would like to contribute to their 401 before automatically trying to max it out, however.

“Situations can arise where you may need to prioritize your cash savings in your emergency fund or save for a different reason, such as for a down payment on property or a vehicle,” she adds. “$19,500 isn’t a small chunk of change.”

Keep in mind that although you don’t pay income taxes on the money you set aside in a 401, you’ll have to pay taxes later on when you eventually withdraw the funds in your nonworking years.

How Much Should You Contribute To Your 401

Most retirement experts recommend you contribute 10% to 15% of your income toward your 401 each year. The most you can contribute in 2019 is $19,000, and those age 50 or older can contribute an extra $6,000. In 2020, you can contribute a maximum of $19,500. Those age 50 or older will be able to contribute an additional $6,500. However, you can use our 401 calculator to figure out how much you can expect to earn based on any contribution amount you choose.

Don’t Miss: How To Open 401k For Individuals

Diversify Your Investments Into Real Estate

Stocks are volatile compared to real estate. Therefore, if you want to dampen volatility and build wealth at the same time, invest in real estate. Real estate is my favorite asset class to build wealth.

The combination of rising rents and rising capital values is a very powerful wealth-builder. By age 60, I highly recommend having a healthy real estate portfolio to generate passive income.

In 2016, I started diversifying into heartland real estate to take advantage of lower valuations and higher cap rates. I did so by investing $810,000 with real estate crowdfunding platforms. With interest rates down, the value of cash flow is up. Further, the pandemic has made working from home more common.

Take a look at my two favorite real estate crowdfunding platforms. Both are free to sign up and explore.

Fundrise: A way for accredited and non-accredited investors to diversify into real estate through private eFunds. Fundrise has been around since 2012 and has consistently generated steady returns, no matter what the stock market is doing. For most people, investing in a diversified eREIT is the easiest way to gain real estate exposure.