Make Contributions To Your Solo 401

Once all the paperwork is completed and the disclosures are reviewed, its time to fund your account. Most providers will accept a check, wire transfer, or automated clearing house payment to fund the Solo 401. Its up to you to decide whether you want to make monthly installments or fully fund the account in one lump-sum payment.

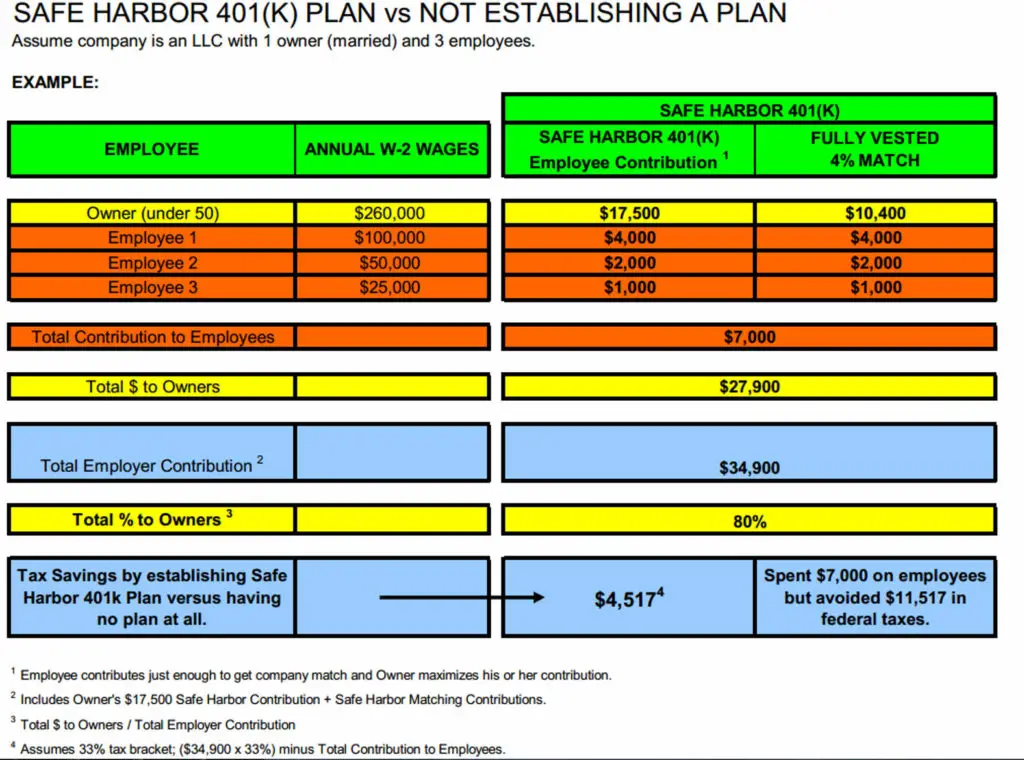

There are two pieces to the contribution strategy with a Solo 401. First, you are allowed to contribute up to $19,500 from your salary. If you are over 50 years old, you can contribute an additional $6,500. The second piece comes from the employer as a profit-sharing contribution of up to 25% of your net self-employment income. This earned income is your net profit minus your plan contribution to the Solo 401 and one-half of your self-employment tax.

The limit on compensation that can be used to determine your contribution is $290,000 in 2021. Consult your tax advisor to develop an optimal strategy thats IRS-compliant. Penalties for excessive contributions are applied in the year the contribution is made and when the money is distributed, so its important to get your contribution correct.

Once your account reaches $250,000 in assets, youll have new requirements, including filing Form 5500 with the IRS. If you ever hire employees who become eligible for your plan, youll need to make adjustments to accommodate these new participants.

To Roll Over Other Plan Assets

If you already have a retirement savings plan for your business, you may be able to roll over or transfer existing plan assets to a Self-Employed 401. Consult with your tax advisor or benefits consultant prior to making a change to your retirement plan.

Assets from the following plans may be eligible to be rolled over into a Self-Employed 401:

- Profit Sharing, Money Purchase, and 401 plans

What To Look For In A Solo 401k

Going through the process of shopping around for a solo 401k provider, I’ve learned a lot about what to look for. There are a lot of options and nuances that you should look for when shopping for a 401k. Many of the “free” providers offer simple generic plans, and if those don’t work for you, you can have a third party provider create a custom 401k plan for your business, which you can then take to a brokerage.

Whoa, that sounds confusing, and it can be. So let’s look at the major options that you need to consider when selecting a solo 401k provider.

- Does the 401k provider offer both Roth and Traditional contributions?

- Does the 401k provider offer after-tax contributions to do a mega backdoor Roth IRA.

- Does the 401k provider offer loans from the plan?

- What types of investment options are allowed in the plan?

- Does the provider allow rollovers into the plan and rollovers out of the plan?

- The costs to maintain the plan

- The costs to invest within the plan

Based on your wants and needs, there are a lot of things to compare when shopping for a solo 401k provider. Let’s compare some of the main firms that offer solo 401ks. We’re going to start with the 5 major firms that provide Prototype Plans. These are the “free” plans that the companies advertise.

Don’t Miss: How To Invest In 401k Without Employer

S To Creating Your Retirement Plan

Even if its a long way off, think about what you want your money to do for you when you retire.

Maybe you want to pay off your mortgage, help your grandkids with college expenses, camp in your 10 favorite national parks, or start a new hobby you havent had time for during your working years. If you can picture what you want retirement to look like, its easier to plan for it.

Tip: Refresh your memory by looking at retirement-related goals you set when you created your financial plan.

No matter what your goals are, saving and planning now is a smart idea, so lets walk through five steps to helping you create your retirement plan. to log your numbers as you go.)

Open A Solo 401k If I Also Participate In Day

QUESTION 4: If I already have a full-time job as an employee, can I still open a solo 401k plan for my side business?

ANSWER: If you are self-employed or have income from freelancing, you can open a solo 401k plan. Even if you have a full-time job as an employee, if you earn money freelancing or running a small business on the side with no full-time W-2 employees, you could take advantage of the potential tax benefits of a solo 401k plan. While you wont be able to make pretax or Roth solo 401k contributions if you have already maxed out these contributions to your day job employer 401k plan, you will still be able to make profit sharing contributions to the solo 401k plan.

Read Also: What 401k Do I Have

Ongoing Considerations For Your Solo 401k

One of the great things about a solo 401k is that they are relatively easy to maintain, for the most part. Since you are technically the administrator of your own plan, you are personally required to submit required filings for the plan.

There are two ongoing paperwork requirements that you will need to stay on top of. First, if your plan has over $250,000 in assets on the last day of the plan year, you have to file a form 5500. This can be a bit complicated, but if you can fill out all of that paperwork above, you can likely handle it yourself.

You can submit the IRS Form 5500 for free, electronically here: EFAST2 Filing From The IRS.

If you don’t want to do it yourself, you’ll need your CPA to handle this for you, and they’ll likely charge a fee to do it. However, if you’re using a non-prototype plan, most of the plan providers will help you prepare the Form 5500 each year as part of your annual fee.

The second form you need to keep in mind is a 1099-R, but that form is only required if you take distributions from your 401k plan or if you roll it over, withdraw money of any kind, or change providers. This form is also relatively easy to fill out, but there is no free electronic filing for this form. You either have to pay a service to file it, or mail it in yourself.

Find Out How Much Money You May Need In Retirement

Here’s how you do it: Use our Retirement Wellness Planner, a tool that gives a quick snapshot of how much income you may need in retirement. It also helps identify a surplus or gap.

Just plug in your current annual income, how often youre paid, your pre-tax contribution to your retirement account , current retirement savings, estimated Social Security benefit, current age, and desired retirement age. You can adjust your deferral to see how the numbers change.

This is also when a financial professional can be a big help if you want a customized plan for retirement. To learn more, read how to choose and work with a financial professional.

You May Like: How Do You Get Money From Your 401k

Solo 401k Rules For Sole Proprietor

Being a sole proprietor is the simplest and easiest way to start out in business. You typically do business under your personal name or you could have a DBA name. Most of the rules for a sole proprietorship are similar to any other business structure, except for a few main areas

When calculating contributions from your sole proprietorship you get to use net business income. Your salary deferral can be up to $19,500 or $26,000 if you are 50 years of age or older. This can be up to 100% of your net business income. Your employer profit sharing contribution is a little bit more complex to calculate. You can look at IRS publication 560 which has a deduction worksheet for self employed in chapter 6. This worksheet helps you calculate your employer profit sharing contribution. Its generally about 20% of your net business income minus half of your self employment income tax. You should work with a qualified tax professional to finalize your numbers. To get an estimate you can also use this Solo 401k calculator.

Your sole proprietorship contributions need to be made before your tax filing deadline. April 15 is the deadline for normal filing. If you file an extension you can make contributions all the way until October 15th. Put your tax deductible contributions on IRS Form 1040, Schedule 1, Line 15. You can write the check to make your contributions from your business checking account and deposit it into your Solo 401k Trust bank or brokerage account.

If Youre Short Decide How Youll Make Up The Difference

If there’s a gap between what youre saving now and what you may need, you have options. Consider the following.

- Defer more money into your 401 retirement plan, especially if youre not setting aside enough to get the full company match. Figure out how much it costs per week to put another 1% in your retirement plan. Make it bite-sized and its more doable. Then continue to bump your deferral another 1% as you can. A good time to do that is when you get a promotion or raise.

- Make annual contributions to a traditional Individual Retirement Account .Like a 401, it allows you to invest for the long-term and pay taxes on earnings later.

- Makecatch-up contributions to your 401 or IRA if youre age 50 or older.

- Manage debt so you have more money in your budget for long-term savings.

- Plan to work longer, if youre able. Delaying retirement by a year or two could help boost your savings.

- Work for a significant bump in income and then save it. How? Change jobs, try for a promotion, or turn a side hustle into extra cash flow.

- Win the lottery.

You May Like: What Percent Should You Put In 401k

What Is A Brokerage Firm

A brokerage firm is a company that helps buyers and sellers complete financial transactions. They earn money based on fees, or in some cases commissions, involved with the transaction. In many cases, special licensing is required to buy and sell financial products, which is where brokers are necessary and helpful. You might also find individual brokers who work independently, but typically brokers are connected to a larger team that can collaborate to help with transactions.

When Does It Make Sense To Open A Solo 401

A Solo 401 isnt the right investment strategy for everyone. Here are some scenarios when opening a Solo 401 makes sense:

- Youre a business owner and the only employee of your company: This might seem like a given, since this is the exact person Solo 401s are for, but its worth mentioning that its also the only person Solo 401s are for if youre not self-employed or if you have additional employees it wont work to open a 401.

- Youre self employed and want a retirement plan your spouse can contribute to: Since you can add contributions from your spouse to a Solo 401, opening one could be a strong strategy if your spouse currently doesnt have a retirement plan or if they havent maxed out other retirement contributions.

- You want the ability to take loans from the plan: While taking a loan from your own retirement plan isnt ideal, the realities of being a small business owner could mean you want or need that flexibility.

Read Also: Should I Roll My 401k Over To An Ira

Do I Need A Third Party Administrator For The Solo 401k

July 5, 2018 by Editorial Team

A Solo 401k plan is surprisingly easy to administer. With the Solo 401k plan by Nabers Group, you do not need a third party administrator. In fact, you are allowed to act as your own administrator. Read on to learn about the roles and duties of a 401k plan administrator and how you can make it work for your retirement plan.

Charles Schwab Solo 401k

Schwab is another discount brokerage that offers a prototype solo 401k plan for free. Since Schwab is continually working to improve their image in the low-cost brokerage space, I was interested to see what they offered.

I was disappointed to learn that Schwab only offers traditional 401k contributions – they do not have a Roth option on their plan. They also do not offer loans under their plan.

It appears that you can rollover a 401k into your Schwab solo 401k, but you cannot do an IRA rollover.

Schwab does offer a lot of investing options, including Vanguard mutual funds and commission free ETFs.

There are no fees to open the solo 401k, and there are no yearly maintenance fees. Inside the 401k, traditional Schwab pricing applies – $0 per stock trade, with $0 on Schwab funds and ETFs.

Learn more about Charles Schwab in our Charles Schwab Review.

Also Check: How Much Should I Put In My 401k Calculator

Should You Do A Roth Solo 401k

One of the options that’s become important is allowing for a Roth solo 401k. Surprisingly, many brokerage firms currently don’t allow a Roth solo 401k, but it can be a valuable option.

When it comes to your solo 401k, it’s important to remember that you have two aspects of contributions to your plan:

Where a Roth option comes in handy is if you’re looking for tax diversification. With Roth contributions, you are using post-tax money. So, you will pay more in taxes today, but you will pay less in the future. However, if you’re putting in large profit sharing contributions into your solo 401k, then it might make sense to make Roth contributions.

The reason? It will give you tax diversification in retirement. You can choose whether you use taxable or tax free money in the future – and options are always great.

The important thing to remember here is options. You just want the options to be able to invest how you choose.

Solo 401 Withdrawals And Details

As with all qualified retirement plans, there are rules to when you can and must start taking withdrawals from your Solo 401 plan. You must begin taking the minimum required distribution no later than age 72 . There is a 10% early withdrawal penalty for distributions take before age 59 1/2, but exceptions may apply.

Please refer to the IRS page on individual 401s and review our Solo 401 Guide for additional details.

Read Also: When Can I Start Drawing From My 401k

Start Your Own Retirement Plan

When youre an employee, you can only use a 401 plan if your employer establishes a plan and youre eligible to contribute. All too often, thats not the case. But you still have options.

Ask for a 401: Your employer might be willing to set up a 401 they just havent done it yet. Start the conversation by asking why there isnt one, why you want one, and that there are potential tax benefits for employers. Explain that valuable employees like yourself would be even more valuable with excellent benefits. Offer to do some of the legwork required to get the plan up and running. In some cases, especially with small organizations, your employer simply doesnt have time to set up a plan. Cost is another factor companies and small nonprofits might be hesitant to pay plan costs . If cost is the primary concern, discuss less-expensive options like SIMPLE plans. Only time will tell if itll actually happen, but it never hurts to ask.

IRAs: If you dont have a 401, you may still be able to save in an individual retirement account , and you might even receive tax benefits similar to a 401. Unfortunately, the IRS sets maximum annual limits much lower for IRAs. Still, something is better than nothing. Evaluate traditional IRAs for potential pre-tax saving, and Roth IRAs for possible tax-free withdrawals . Another drawback of IRAs ) is that you may need to qualify to make contributions or receive a deduction. Speak with a tax expert before you do anything.

What Are The Benefits Of A Solo 401

Unlike other options, a Solo 401 account holder can choose between a traditional option and a Roth option. The traditional option allows you to deduct the amount you pay in from your income for that year, giving you an immediate tax break. With the Roth option, the income taxes on that money is paid immediately and you owe no taxes when you withdraw the funds.

The Solo 401 has far higher annual contribution limits than a plain-vanilla IRA, although that is also true for the SEP IRA and the Keogh plan.

The Solo 401 allows you to take loans from your account before you retire. This is not an option with many other retirement plans.

Finally, the Solo 401 is relatively straightforward in terms of paperwork, as it is designed for one-person shops, not corporations.

You May Like: Does Borrowing From 401k Affect Credit Score

Contributions Are Discretionary Loans Are Allowed

Individual 401 contributions are not mandatory every year. This allows sole proprietors to manage their cash flows and contribute the maximum amount in good years while contributing less or nothing at all if their business takes a turn for the worse. In addition, owners can take loans for as much as $50,000 or 50% of the value of the benefits in the plan .

Although the SEP IRA doesn’t require mandatory contributions, it has no such loan provisions. The ability to take a tax-free loan from your individual 401 in the case of an emergency should be taken seriously because sole proprietors often have variable incomes from year to year.