Option : Roll Over Your Old 401 Into An Individual Retirement Account

Still another option is to roll over your old 401 into an IRA. The primary benefit of an IRA rollover is having access to a wider range of investment options, since youll be in control of your retirement savings rather than a participant in an employers plan. Depending on what you invest in, a rollover can also save you money from management and administrative fees, costs that can eat into investment returns over time. If you decide to roll over an old 401 into an IRA, you will have several options, each of which has different tax implications.

What Happens To My Retirement Money When I Reach Age 72

The IRS says you must begin withdrawing money from your employer plan account by April 1 following the year you turn 72 or retire, whichever is later . Withdrawals from traditional IRAs must begin by April 1 following the year you turn 72. If you dont withdraw the minimum required amount, the IRS will penalize you with a 50% tax on any amount that should have been withdrawn but wasnt. Roth IRAs are not subject to required minimum distributions.

The SECURE Act increased the age when required minimum distributions must begin from 70½ to 72, effective for individuals turning 70½ on or after January 1, 2020. If you reached age 70½ before this date, you are still required to take RMDs.

Ask Your 401 Plan For A Direct Rollover Or Remember The 60

These two words “direct rollover” are important: They mean the 401 plan cuts a check directly to your new IRA account, not to you personally.

Here are the basic instructions:

Contact your former employers plan administrator, complete a few forms, and ask it to send a check or wire for your account balance to your new account provider.

The new account provider gives you instructions for how the check or wire should be made out, what information to include and where it should be sent. You can opt for an indirect 401 rollover instead, which essentially means you withdraw the money and give it to the IRA provider yourself, but that can create tax complexities. We generally recommend a direct rollover.

If you do an indirect rollover, the plan administrator may withhold 20% from your check to pay taxes on your distribution. To get that money back, you must deposit into your IRA the complete account balance including whatever was withheld for taxes within 60 days of the date you received the distribution. .)

For example, say your total 401 account balance was $20,000 and your former employer sends you a check for $16,000 . Assuming youre not planning to go the Roth route, you’d need to come up with $4,000 so that you can deposit the full $20,000 into your IRA.

At tax time, the IRS will see you rolled over the entire retirement account and will refund you the amount that was withheld in taxes.

Recommended Reading: What Is The Best Percentage To Put In 401k

Rolling Over Into An Ira

Well handle the entire process for you online, for free!

- Well help you choose an IRA provider if you dont already have one

- Customer support available if you have questions along the way

- We get paid by the IRA provider if you open an account so our service comes at no cost to you!

Weve laid out a step-by-step guide to help you roll over your old Empower 401 in five key steps:

Hectic To Manage Multiple Accounts

As you move up the career ladder, it becomes hectic to manage the multiple 401s left with former employers, and over time, you will likely forget about some of your most precious retirement assets.

If you would like to trace your lost 401s, use Meetbeagle.com to find lost 401 accounts and transfer them to an IRA or your new employerâs retirement plan. Consolidating all your old 401s accounts helps ensure that the money is properly managed.

Don’t Miss: How To Start My 401k

Begin The Rollover Process

Youll have to fill out paperwork to conduct your rollover and it may require some back-and-forth conversations with your providers. You have several options to actually move the money from the old provider to the new one, but your best option is a direct rollover.

In a direct rollover, the funds are sent straight from your 401 into your new account without you touching the funds. Its important that you specify a direct rollover so that you dont have the check made payable to you. You could trigger a mandatory 20 percent withholding for taxes, and the IRS charges a 10 percent bonus penalty on withdrawals made before age 59 1/2.

Rolling Over A 401 To Your New Employers Plan

The process of rolling over a 401 might seem intimidating or inconvenient at first, especially if youre moving onto your second job and this is the first time youll be rolling over a 401. In actuality, the actual process of rolling over a 401 isnt too complicated once youve decided where your existing funds are going to go.

Recommended Reading: How To Set Up A 401k Account

Also Check: Can I Invest In 401k And Ira

How To Transfer An Ira Held At Millennium Trust Company To A Self

If you are self-employed and decide to open a self-directed solo 401k for investing in alternative investmentssuch as real estate, notes, cryptocurrency, metals or private investments, and want to fund the solo 401k account using your existing self-directed IRA , the following information will be helpful when working with your solo 401k provider to process the non-taxable IRA direct-rollover.

NOTE: If you use My Solo 401k Financial as your solo 401k plan provider, they will fill out the Millennium IRA transfer-out form for you.

What Is A 401 Rollover

A 401 rollover is the technical term for transferring the money in an old 401 account to another retirement account. Most people who roll over end up transferring their 401 savings into a new or existing IRA .

Let Capitalize handle your 401 rollover for you, for free! Weve made it our mission to make the 401-to-IRA rollover process easy for everyone. Learn more

You May Like: How Do You Take Money Out Of 401k

Recommended Reading: What Is The Tax Penalty For Early 401k Withdrawal

Tax Implications Of A 401 Money Transfer To Bank

A 401 is a tax-deferred retirement account, and the money contributed to the account grows tax-free. Any gains on investments are not taxed until when they are withdrawn.

When you make a withdrawal, you will owe taxes at the federal income tax rate. A higher withdrawal amount pushes you into a higher tax bracket, and you will have to pay higher tax amounts on your withdrawal. For example, if you withdraw $20,000, and you are in the 35% tax bracket, you will have to pay $7,000 in income taxes.

Tags

How Nua Can Save Taxes: A Case Study

Let’s go through an example to demonstrate these tax treatments.

Mike is 57, about to retire, and has company stock in his 401 plan. The original value of the stock was $200,000, but it is now worth $1 million. If he were to roll the $1 million over to his IRA, the money would grow tax-deferred until he took distributions. At that time, the distributions would be taxed as ordinary income.

Also, if Mike didn’t sell the stock before he dies, the beneficiaries of his IRA will pay ordinary income tax on all of the money they receive, including the current value of the stock.

If, on the other hand, Mike withdraws the stock from the plan rather than rolling it into his IRA, his tax situation would be different, as would that of his heirs. He would have to pay ordinary income tax on the original cost of $200,000. However, the remaining $800,000 would not be subject to his ordinary income tax because of the NUA tax break.

If Mike immediately sold the stock, he would have to pay only the lower capital gains tax on that $800,000 NUA. Let’s say that Mike instead holds the stock for a few months before selling it. When he sells, he pays capital gains tax, rather than income tax, on the NUA before he transferred the stock to his brokerage account, and on any additional appreciation since then. And because the stock is not a part of an IRA, he does not have to worry about RMDs from the account, based on the stock’s value.

Here is the comparison if Mike immediately sells the stock:

Recommended Reading: Does My Employer 401k Match Count Towards Limit

Decide Where You Want The Money To Go

If youre making a rollover from your old 401 account to your current one, you know exactly where your money is going. If youre rolling it over to an IRA, however, youll have to set up an IRA at a bank or brokerage if you havent already done so.

Bankrate has reviewed the best places to roll over your 401, including brokerage options for those who want to do it themselves and robo-advisor options for those who want a professional to design a portfolio for them.

Bankrate has comprehensive brokerage reviews that can help you compare key areas at each provider. Youll find information on minimum balance requirements, investment offerings, customer service options and ratings in multiple categories.

If you already have an IRA, you may be able to consolidate your 401 into this IRA, or you can create a new IRA for the money.

Defining Terms: What’s A 401

A 401 plan is a tax-advantaged retirement account typically sponsored by an employer.

The traditional form of the 401 works much like a traditional IRA: Your contributions in a given year reduce taxable income for that year. In a simplified example, if you earn $75,000 and contribute $10,000, your earnings fall to $65,000, saving you tax dollars up front. Your withdrawals will eventually be taxed, though.

401s differ in a few meaningful ways from IRAs:

- Contribution limits: 401s have much higher contribution limits. These typically change annually, but generally you can contribute about three times as much money to a 401 as an IRA.

- Investment options: 401s typically provide limited investment options, with most offering a dozen or fewer mutual funds. In IRAs opened at brokerages, you can invest in virtually any stock exchange-traded fund , or mutual funds.

- Matching funds: Many employers match employee 401 contributions up to a certain percentage of pay.

Read Also: What Are The Best Investments For My 401k

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

Traditional Vs Roth: Which Type Of Ira Should I Roll My 401 Into

Now, the type of rollover IRA you transfer your money into depends on what type of 401 youre rolling over.

If you had a traditional 401, you can transfer the money into a traditional IRA without having to pay any taxes on it . Likewise, if you had a Roth 401, you could roll the money into a Roth IRA completely tax-free. Easy, right? Traditional to traditional, tax-free. Roth to Roth, also tax-free.

Dont Miss: How To Do Your Own 401k

Read Also: How To Use Your 401k

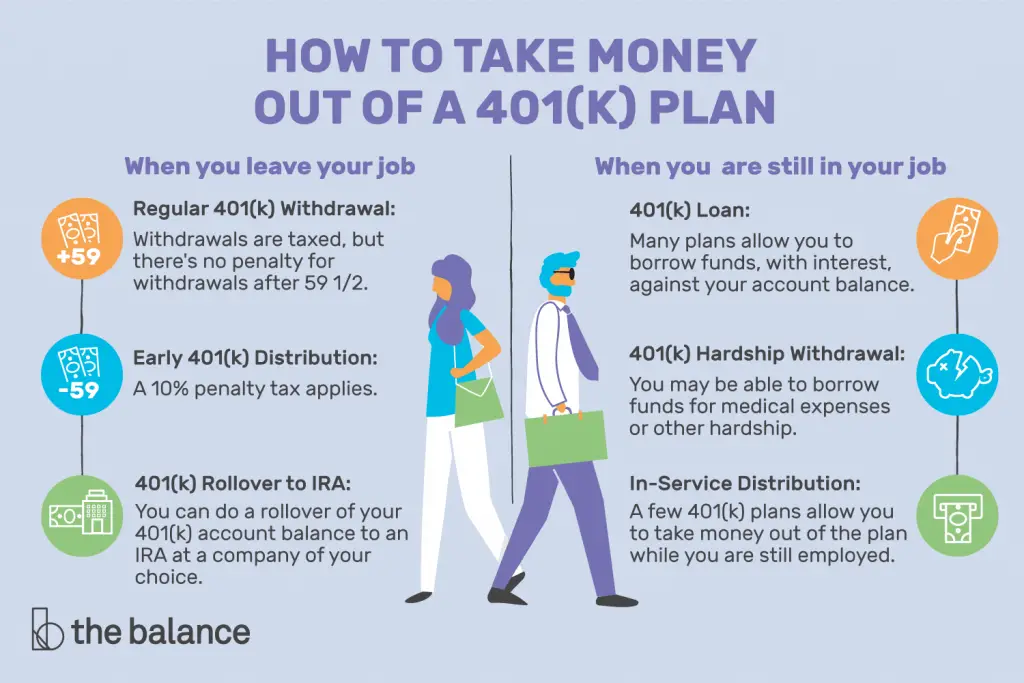

When To Roll Over Your 401 To An Ira

Rolling over your 401 to an IRA is possible only if you’re leaving your current employer or your employer is discontinuing your 401 plan. It is an alternative to:

- Leave your money invested in your existing 401

- Rollover to your new employer’s 401

- Withdrawal from your 401, which would trigger a 10% penalty if you aren’t 59 1/2 or older

A rollover or IRA) does not have tax consequences. This would not be the case if you do a rollover to a Roth IRA.

Rolling over a 401 to an IRA provides you with the opportunity to choose which brokerage you want to hold your retirement funds. It may be the right choice if:

- Your new employer doesn’t offer a 401 plan

- You cannot keep your money invested in your current workplace plan because your plan is being discontinued or your 401 administration won’t allow you to stay invested for some other reason

- Your new employer’s 401 plan charges high fees, offers limited investments, or has other drawbacks

- You’d prefer a wider choice of investment options

However, there are some downsides to consider:

- While 401 loans allow you to borrow against your retirement funds, no such option exists with an IRA.

- Transferring company stock can be complicated account, read up on an “NUA strategy” that could save you a lot of money.)

If these downsides aren’t deal breakers for you, the next step is figuring out how to roll over your 401 to an IRA.

How 401 Rollovers Work

If you decide to roll over an old account, contact the 401 administrator at your new company for a new account address, such as ABC 401 Plan FBO Your Name, provide this to your old employer, and the money will be transferred directly from your old plan to the new or sent by check to you , which you will give to your new companys 401 administrator. This is called a direct rollover. Its simple and transfers the entire balance without taxes or penalty. Another, even simpler option is to perform a direct trustee-to-trustee transfer. The majority of the process is completed electronically between plan administrators, taking much of the burden off of your shoulders.

A somewhat riskier method, Ford says, is the indirect or 60-day rollover in which you request from your old employer that a check be sent to you made out to your name. This manual method has the drawback of a mandatory tax withholdingthe company assumes you are cashing out the account and is required to withhold 20% of the funds for federal taxes. This means that a $100,000 401 nest egg becomes a check for just $80,000 even if your clear intent is to move the money into another plan.

Also Check: What Happens To My 401k After I Quit

Why Choose Irar For Your Self

The answer is clear and simple!

Your account will be serviced by an experienced team of Certified IRA Services Professionals with expertise in self-directed IRAs. Our knowledge and experience in self-directed IRA rules, regulations, and recent trends, will assist you in making smart educated decisions.

Youll also be able to save over 50% compared to fees charged by other industry providers. We believe in maintaining lower fees because were committed to helping you build long-lasting retirement wealth.

At IRAR we see many cases in which IRA owners transfer their existing self-directed IRA to IRAR because theyve grown unhappy with their current provider account fees were too high, poor service, or the provider has gone out of business or changed in management.

Regardless of the reason, we want to help.

Can A 401k Loan Be Transferred

If you quit your job with an outstanding 401 loan, you may consider transferring the loan to another retirement account. Find out if this is possible.

If you are paying a 401 loan and you lose your job, you could be wondering what to do with the loan. Do you leave it with the soon-to-be former employer or do you transfer it to your new retirement account? Usually, when you quit or leave your job, you will have to pay off the loan before the tax deadline. If you are unable to pay the 401 loan, any outstanding balance will be considered an early distribution, which triggers income taxes and a 10% penalty tax.

Normally, a 401 loan cannot be transferred to another retirement account. If a plan allows partial rollovers, you may be able to rollover the 401 balance minus any outstanding 401 loan balance. Some employers do not allow partial rollovers, and you may be required to pay off the 401 loan fully before you can rollover the 401 balance. However, if the company is acquired or sold, you may be allowed to rollover the 401 account, including the outstanding 401 loan, to a new employerâs 401 plan.

Recommended Reading: How To Borrow From 401k For Down Payment

What If You Have An Existing 401 At Your Previous Employer

If you have a 401 at a previous employer, youll want to consider whether a rollover makes sense for you. You may want to consult with a tax professional to make sure that you are making a decision that is best for your unique circumstances.

As youre thinking about what to do with your old 401, here are some options to consider:

Do I Have To Take My Retirement Plan Assets When I Change Jobs

Company retirement plan rules can vary, but most follow the same basic guidelines. If your account balance is less than or equal to $1,000, your plan might cash you out. If your balance is greater than $1,000 and less than or equal to $5,000, your plan might roll over your balance into an IRA selected by your former employer. If your balance is greater than $5,000, you will generally be permitted to leave your balance in the plan however, you will not be able to contribute to the account and will be subject to any restrictions and rules of the plan.

You May Like: What Happens To My Roth 401k When I Quit