What Is 401 Matching

401 matching is when your employer makes contributions to your 401 on your behalf. It is called matching because the contributions your employer makes are based on employee contributions i.e. the contributions you make.

For example, you employer can offer a 100% match on up to 5% of your income. That means, for every dollar you contribute to your 401, up to 5% of your paycheck, your employer will also contribute one dollar.

100% Match on 4% of income at $50,000 salary.

| Your contribution | |

| $5,000 | $2,000 |

Once you contribute up to the matching limit, which in this example is 5% of your income, your employer stops contributing, but you can continue to contribute. That means that you want to contribute up to the matching limit if at all possible, to get the most value out of the match.

Employer matching plans can get complicated depending on your employer. Some employers offer graduated matching tiers, such as 100% match on the first 4% of income and a 50% match on the next 4%, giving you a 6% contribution if you make an 8% contribution.

100% Match on 3% and a 50% match on the next 3% of income at $50,000 salary.

| Your contribution |

| $2,250 |

Read the specifics of your plan to learn exactly how much your employer will contribute and how much you need to contribute to max out the benefit.

Review The Irs Limits For 2022

The IRS has announced the 2022 contribution limits for retirement savings accounts, including contribution limits for 401, 403, and most 457 plans, as well as income limits for IRA contribution deductibility. Contribution limits for Health Savings Accounts have also been announced. Please review an overview of the limits below.

Do You Think Its Possible To Contribute 100 Percent Of My Earnings To A 401 Account

The maximum amount you are allowed to contribute is the amount of money you make if your wages are less than $19,500 annually. Be aware that every 401 plan has its own set of guidelines and rules, which can limit the amount of money that you may put into your account each year. The people who earn more than $130,000 in a year or own more than 5% of the company will be affected, as will highly paid workers which will be defined as those earning more than $130,000 per year or who hold more than 5% of the company by 2021.

To ensure that highly rewarded employees do not receive an advantage that is disproportionately high when compared to other employees Business owners who sponsor major plans must comply with strict discriminatory testing criteria. High-compensated workers, despite the likelihood to to save the most, usually unable to contribute more than 2 percentage points greater than employees earning less on average. Instead of favoring any one group over another, the idea is to get everyone involved in the scheme.

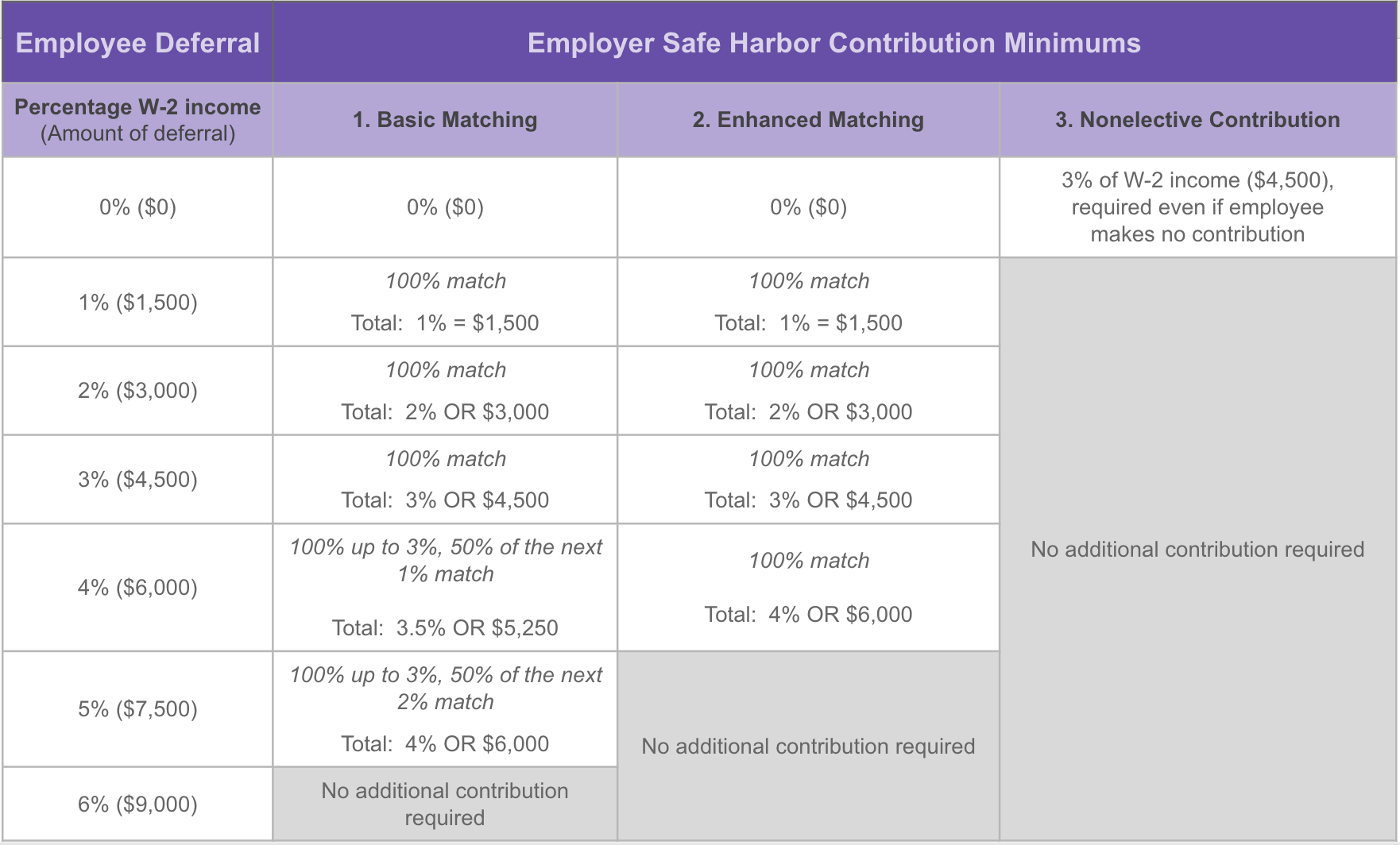

This may be avoided in the event that a company is worried about complying with anti-discrimination testing regulations. They can either provide all employees with a 3 percent match regardless of how much employees contribute or match everyones contributions with four percent match and vice versa.

Also Check: How Much Can I Add To My 401k

S To Max Out A 401 & What To Do After Maxing Out

Were here to help! First and foremost, SoFi Learn strives to be a beneficial resource to you as you navigate your financial journey.Read moreWe develop content that covers a variety of financial topics. Sometimes, that content may include information about products, features, or services that SoFi does not provide.We aim to break down complicated concepts, loop you in on the latest trends, and keep you up-to-date on the stuff you can use to help get your money right.Read less

There are a number of retirement accounts that allow you to save and invest toward your retirement goals, but one of the most common in the U.S. is the 401. As of September 2020, 401k plans in the U.S. held an approximate $6.5 trillion in retirement assets, according to the Investment Company Institute.

An employer-sponsored 401 retirement account allows both you and your employer to make contributions. When you set up a 401k, you can opt to have a certain amount of your paycheck go directly to your 401k, and sometimes an employer will match employee contributions up to a certain percentage or dollar amount.

To max out a 401 for 2021, an employee would need to contribute $19,500 in salary deferralsor $26,000 if theyre over age 50. Some investors might think about maxing out their 401 as a way of getting the most out of this retirement savings option. Heres what you need to know about the benefits of maxing out a 401, any potential drawbacks, and exactly how to do it.

Transparency Is Our Policy Learn How It Impacts Everything We Do

Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data.

Wed like to share more about how we work and what drives our day-to-day business.

Read Also: Can You Take Out Your 401k To Buy A House

Why Maxing Out Your 401k Could Mean Missing Out On Thousands

For many of us, our 401 or similar employer-sponsored retirement plan is our primary vehicle for retirement savings. A is a defined contribution plan meaning that our retirement benefit is determined primarily by the amount that we save and how we invest those savings. However, there is a maximum 401k contribution limit that we will cover.

These types of plans have primarily replaced pension plans of our parents and grandparents generation, which were funded mainly by employers.

Ideally, you got started saving for your retirement in your companys 401 plan right out of the box when you started working. If not, hopefully, by now you have gotten going and this is a regular deduction from each paycheck.

Its not easy to do when youre in your twenties. There are plenty of other things on your mind than saving money out of your paycheck. It’s a tough pill to swallow in our instant gratification society, and an even more challenging concept to teach.

However, if youre reading this today, then youre probably well on your way to contributing to your 401 and, most likely, on an annual basis. To that, I say congratulationsyou have made a great achievement.

For 2021, the new maximum contribution has increased to $19,500. If you are 50 or older, then you can contribute an additional $6,500 for a total of $26,000. Thats a lot of money on an annual basis from what the 401k maximum contribution used to be.

What Does Your Plan Say

Although not common, a plan can specifically require that salary deferrals cease once a participants compensation reaches the annual limit.

If your plan specifies that salary deferrals be based on a participants first $280,000 of compensation, then you must stop allowing Mary to make salary deferrals when her year-to-date compensation reaches $280,000, even though she hasnt reached the annual $19,000 limit on salary deferrals, and must base the employer match on her actual deferrals.

Don’t Miss: Why Rollover Old 401k To Ira

Solo 401k Contribution Limits And Types

IRS records show that, in Tax Year 2014, an estimated 53 million taxpayers contributed almost $255 billion to tax-qualified deferred compensation plans. A popular form of deferred compensation plans, known as a solo 401 plans, permits employees to save for retirement on a tax-favored basis.

Video Slides:2020 & 2021 Solo 401k Annual Contribution Deadline

Contribution Limits For Highly Compensated Employees

Some 401 plans have extra contribution limits on employees who are highly compensated. plan and you are a high earner, these limits may not apply to you.)

Highly compensated employees can contribute no more than 2% more of their salary to their 401 than the average non-highly compensated employee contribution. That means if the average non-HCE employee is contributing 5% of their salary, an HCE can contribute a maximum of 7% of their salary. In addition to the federal limit, your company may have specific caps established to remain compliant.

The IRS determines you are a HCE if:

Either you owned 5% or more of a company last year and are participating in its 401 plan this year.

Or you earned $130,000 or more in 2020 from a company with a 401 plan youre participating in this year.

Unlike most other 401 limit guidelines, HCE classifications are based on your status from the previous year. For the 2022 plan year, the employee compensation threshold is $135,000.

If HCE contribution rates exceed non-HCE contribution rates by more than 2%, companies workplace retirement plans may lose their tax-advantaged status. As a HCE, you may be prevented from contributing to your 401 to the employee contribution max due to low 401 participation rates. You should still be able to make catch-up contributions on top of your HCE cap if you are eligible, though.

Read Also: How Do You Withdraw Money From A 401k

Roth 401 Retirement Savings Tips

Advice for maximizing your Roth 401 account:

- Max out your contributions. For each year that you’re able, aim to hit the $20,500 limit.

- Once you turn 50, add another $6,500 to that limit annually while you continue to work.

- If your employer offers to match your contributions up to a certain amount, be sure to invest at least that much in your Roth 401 each month. It’s free money, after all.

Can You Contribute More Than The Match

Its smart to contribute at least the amount your employer will match. But you can usually contribute more. In 2019, you can contribute up to $19,000. If youre turning 50 by years end, you can also make a catch-up contribution of $6,000, for a total of $25,000.1

Check with your employer about the best way to size and schedule your contributions. In some cases, contributing the max before years end can cause you to miss out on matching for the rest of the year.

Don’t Miss: Will Walmart Cash A 401k Check

Can Employees Enroll In A 401 Employer Match Plan As Soon As They Are Hired

Employers are able to define their own specifications regarding when employees are eligible for 401 enrollment. Some companies choose to allow for registration immediately, while others require a certain amount of time to pass, such as the probation period, six months of employment and so on. Employers should make these regulations clear during the hiring process, so employees arent surprised if they need to wait.

Allocating Employee Contributions Question:

In short yes. It is important to first understand the total contribution limit to a solo 401k cannot exceed $58,000 for 2021, not counting the catch-up contributions for those age 50 and over. The contributions made to the Roth solo 401k designated account will reduce the amount of contributions that you can make to the pretax solo 401k designated account. Only employee contribution may be made to the Roth solo 401k therefore, if you make the full $19,500 employee contribution to the Roth solo 401k for 2021, then you wont be able to make any employee contribution to the pretax solo 401k because you will have exhausted the full $19,500 employee contribution on the Roth solo 401k. Note that you can also split up the $19,500 employee contribution between both the pretax solo 401k and Roth solo 401k designated accounts. Lastly, you also have an additional $6,500 of catch-up contributions to work with if you are age 50 or older in 2021 since the catch-up contribution falls under the employee contribution umbrella and can thus be allocate between the Roth solo 401k and the pretax solo 401k designated account.

Don’t Miss: Should You Always Rollover Your 401k

So What Do You Need To Do

First of all, you need to check with your employer to determine how and when they match your contributions. If they do it once a year as a lump sum, then youre most likely in the clear.

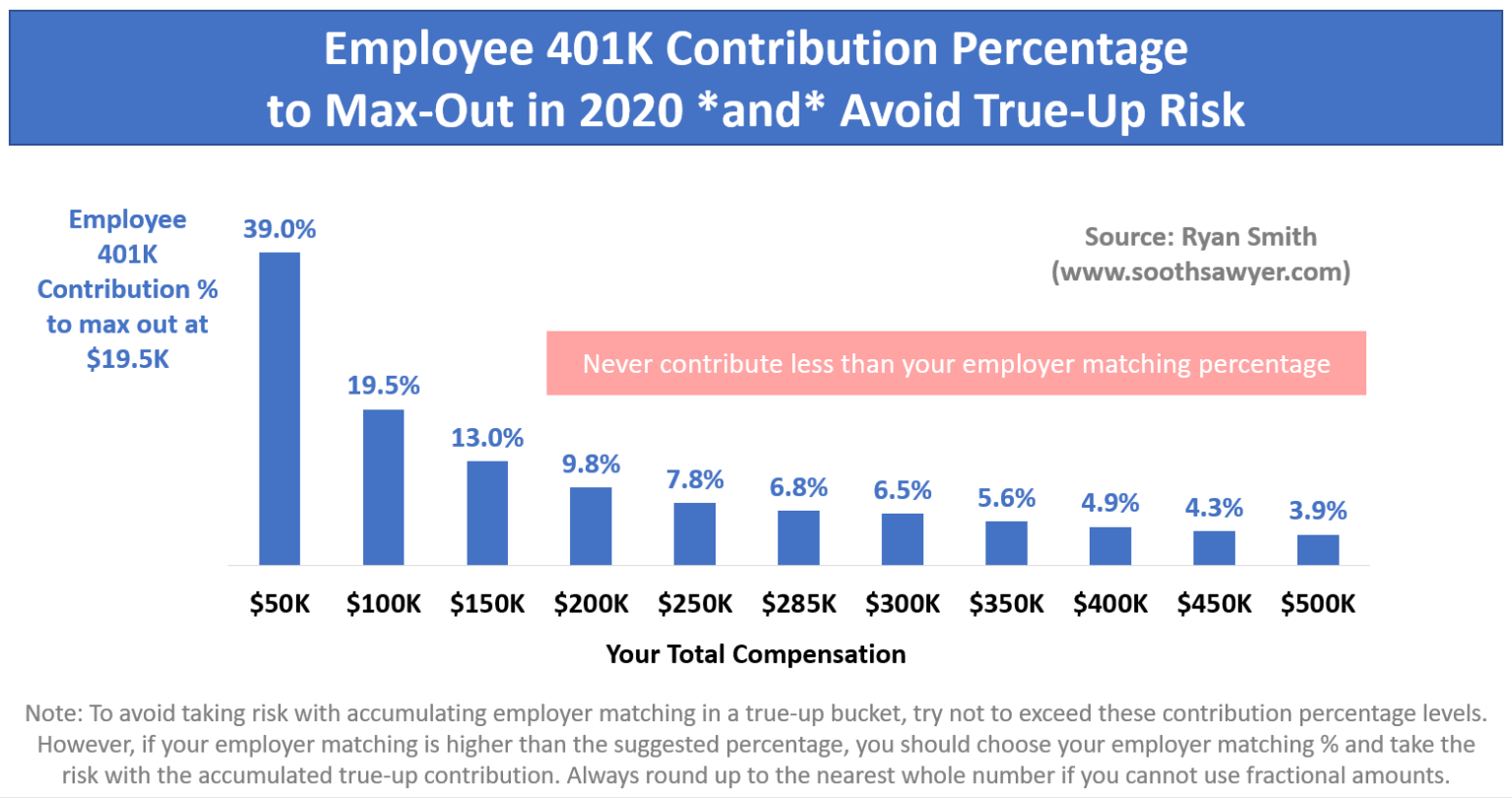

If they do it on a paycheck-to-paycheck basis, you just need to do a little math to find the ideal contribution to get the full or close to the full company match.

Lets go back to my original example and run some numbers. We need to divide $19,500, the max, by your annual income of $360,000. This comes to about 5.4%. This would be the amount you would want to change it to in order to spread out your contributions over the entire year, ensuring yourself of getting the full $14,400 match may not allow you to contribute a tenth of a percent so I would simply round up to ensure you get the full match…in other words, go with 5% the entire year and then bump it to 9% in December before moving it back down to 5% in January and bumping it to 9% again in December, etc).

And, thats it. THIS ONE SIMPLE CHANGE OF SPREADING OUT YOUR 401 CONTRIBUTIONS OVER THE ENTIRE YEAR COULD SAVE YOU AND BRING YOU HUNDREDS OF THOUSANDS OF DOLLARS IN THE LONG-TERM.

It seems so simple, yet not many of us really think about it because, again, it feels like were going above and beyond if we max out our 401 as early as we can in the year .

Good luck, and go get your full match!

What Are 401 Matching Contributions

If your employer offers 401 matching contributions, that means they deposit money in your 401 account to match the contributions you make, up to a certain threshold. Depending on the terms of the 401 plan, an employer may choose to match your contributions dollar-for-dollar or offer a partial match. Some employers may also make non-matching 401 contributions.

Matching contributions arent required by law, and not all employers offer them as part of their 401 plans. But according to Katie Taylor, vice president of thought leadership at Fidelity Investments, a 401 match can be a core employee benefit that helps an organization retain talent and build strong teams.

About 85% of the employers we work with offer some sort of matching contribution, said Taylor. The average employer contribution dollar amount into 401s in 2019 was $4,100, which equates to a little bit more than $1,000 per quarter.

Some 401 plans vest employer contributions over the course of several years. This means you must remain at the company for a set period of time before you fully take ownership of your employers matching contributions. Employers use vesting to incentivize employees to remain at the company. When you complete the schedule, you are said to be fully vested.

Don’t Miss: Should I Borrow From My 401k

Getting The Most From Your Employer 401 Match

Getting the most from your 401 plan is one of the best things you can do when planning your retirement. That’s because your employer may match the money you put into your account. If you work at a place that offers a 401 match benefit, when you put money from your paycheck into your 401, your employer puts money into the account, too.

If your company offers a match, you may have gotten a notice about it when you started your job. You can ask the 401 plan manager at work whether a 401 match is offered if you haven’t already heard about it. Companies want employees to contribute to their 401, so they match the funds as a way to spur on workers to save for their futures.

Think of matching funds as free money you receive from your job after you make pre-tax contributions to your 401 plan from your paycheck. If you fail to put money into your 401, you give up the chance to receive your employer’s matching amount.

What About Employer Contributions

Employers are not obligated to match your Roth contributions, but if they do, the match is a pre-tax contribution. The funds will go into a separate pre-tax account, and funds from it will be subject to tax when distributions are made at retirement.

Your employers contribution does not count towards your individual maximum permitted contribution, but they do count towards the overall limit. Currently, the maximum amount that you can put into all your 401 plans, Roth or traditional and including employer contribution, is $57,000 for individuals under 50 or $63,500 for those aged 50 and over.

Also Check: How Do You Transfer 401k

K Contribution Limits 2022

- The contribution maximum for workers 401 plans has been raised to $20,500, from $19,500 before.

- Single taxpayers now have a tax bracket of $68,000 to $78,000, up from $66,000 to $76,000 before.

- The threshold for married couples filing jointly has been raised from $105,000 to $125,000 to $109,000 to $129,000, an increase from $105,000 to $125,000.

- The maximum contribution amount for an IRA donor has been raised from $198,000 to $208,000, a $204,000 to $214,000 increase.

- Separate returns filed by a married person are not subject to an annual cost of living adjustment and stay between $0 and $10,000.

- The catch-up deposits for savers over the age of 50 will remain at $6,500.

You can find further information about 401k Contribution Limits 2022 on the IRS website, which you may access here: https://www.irs.gov/newsroom/irs-announces-401k-limit-increases-to-20500

Employer Match Does Not Count Toward The 401 Limit

There are two sides to your contribution: what you provide as the employee and the match from your employer . You can only contribute a certain amount to your 401 each year. For tax year 2022 that limit stands at $20,500, which is up $1,000 from the 2021 level. This contribution limit includes deferrals that you elect to be withheld from your paycheck and invested in your 401 on a pre-tax basis.

The good news is that this limit does not include employer match contributions. If you contribute, say, $20,500 toward your 401 and your employer adds an additional $5,000, youre still within the IRS limits.

However, there is another limit which applies to overall contributions your employer match contributions are taken into account for this overall contribution limit. For tax year 2022, that limit stands at $61,000 or $67,500 when you include catch-up contributions for workers 50 or older. This means that together, you and your employer can contribute up to $61,000 for your 401. Note, though, that most employers are not this generous with their contributions, so youre likely in little danger of exceeding this limit.

Don’t Miss: How To Rollover Fidelity 401k To Vanguard