Can You Claim 401k Losses On Taxes

lossesdeductionyou canclaimyoudeductiondeductionyou candeductloss

. In this manner, can you deduct stock losses on your taxes?

Under the tax code, investors can write off any amount of losses against their gains. Thus, if you lose $50,000 on one stock and make $50,000 on another, these gains and losses will offset each other. If your losses exceed your gains, you can write off up to $3,000 of the excess losses each year against your income.

Additionally, do I report 401k contributions on my taxes? 401k contributions are made pre-tax. As such, they are not included in your taxable income. However, if a person takes distributions from their 401k, then by law that income has to be reported on their tax return in order to ensure that the correct amount of taxes will be paid.

Also, can you lose all your money in a 401k?

Your employer can remove money from your 401 after you leave the company, but only under certain circumstances, as the IRS website explains. If your balance is less than $1,000, your employer can cut you a check for the balance. Should this happen, rush to move your money into an individual retirement account .

The Child Tax Credit Was Expanded

Similar to the EITC, the child tax credit is designed to benefit working families by allowing them to claim a credit per qualifying child. The American Rescue Plan also increased the amount families could claim in 2021 to $3,600 per child under age 6 and from $3,000 for children age 6 and over . The credit was also made fully refundable, meaning the amount is refunded to the taxpayer regardless of how much the taxpayer’s liability is.

If you received advance payments during the second half of the 2021 year, you can use Letter 6419 to claim the balance you’re owed when you file your tax return this year. If you did not receive the advance payments for whatever reason , you can claim the full amount of the credit when you file.

Understanding Early Withdrawal From A 401

Withdrawing money early from your 401 can carry serious financial penalties, so the decision should not be made lightly. It really should be a last resort.

Not every employer allows early 401 withdrawals, so the first thing you need to do is check with your human resources department to see if the option is available to you.

As of 2021, if you are under the age of 59½, a withdrawal from a 401 is subject to a 10% early withdrawal penalty. You will also be required to pay regular income taxes on the withdrawn funds.

For a $10,000 withdrawal, when all taxes and penalties are paid, you will only receive approximately $6,300.

Also Check: How To Figure Out Employer Match 401k

Side Hustles And Extra Income

Earning extra cash with side hustles is an excellent way to add to your retirement funds and give yourself more time for your money to grow.

If you go this direction, its best practice to have an amount in mind, whether thats weekly, monthly, or whatever timeline you decide on. And while its great to save cash for your future self, its good to set boundaries so you dont burn out your current self in the process.

Prioritizing your time, having a clear why, and choosing the right side hustles are all important. And because time in the market is better than timing the market, the sooner you can start saving, the longer your investments will have to grow.

If youre currently employed, you might also consider asking for a raise or job hopping to increase your income. Just remember to keep lifestyle creep in check that means saving your extra money instead of splurging on unnecessary upgrades.

And one last thing. If you want to go ahead and file your tax return, you can roll your refund right into your IRA to keep the contributions flowing in thats a win-win for your current and future finances.

How To Borrow From Your 401k

If you’ve decided that borrowing from your retirement plan is right for you, here’s how to get money from a 401 loan.

Also Check: How To Calculate Employee 401k Match

Taxes Withheld From Distributions For Active Employees

When you take a distribution from your deferred compensation accounts, you will pay taxes on the distribution. The amount of tax you pay depends on several factors:

- The amount you withdraw in a calendar year, and your income in that year

- The type of Plan you have 401 or 457

- Your age and employment status

Basically, any amount you withdraw from your 401 account has taxes withheld at 20%, and if youre under age 59½, youll be taxed an additional 10% when you file your return.

Any amount you withdraw from your 457 account has taxes withheld at 20%. However, if you select a periodic distribution over 10 years, then only 10% is withheld for taxes.

Employees Retirement System of Texas

Choose Investments With Low Expense Ratios

If you are purchasing ETFs or mutual funds in your 401k, you’ll want to pick funds with low expense ratios because you’re charged a percentage of your account value. Brokerages are beginning to offer funds with zero expense ratios, so be sure to compare your investment options by cost and not just return.

Don’t Miss: Can Bankruptcy Take Your 401k

Distributions From A 401

When you withdraw money from your 401, this is known as taking a “distribution.” Your 401 plan will specify a date by which you are required to start receiving minimum distributions. According to the IRS guidelines, you must start taking distributions after reaching age 72 or after you retire . Some 401 plans make distributions mandatory at age 72, even if you are still working and havent retired.

Distributions are taxed. At this point, you are getting your money back, so this is considered taxable income. For this reason, some people choose to roll over distributions into another qualified retirement plan . If distributions from your 401 are, in fact, eligible for rollover , you must transfer the distribution to another qualified retirement plan within 60 days of getting it. The money you roll over into another plan will not be taxable however, you must report this activity using Form 1099-R.

If you dont roll over distributions that you receive, they will be taxed as regular income in the calendar year that you get them.

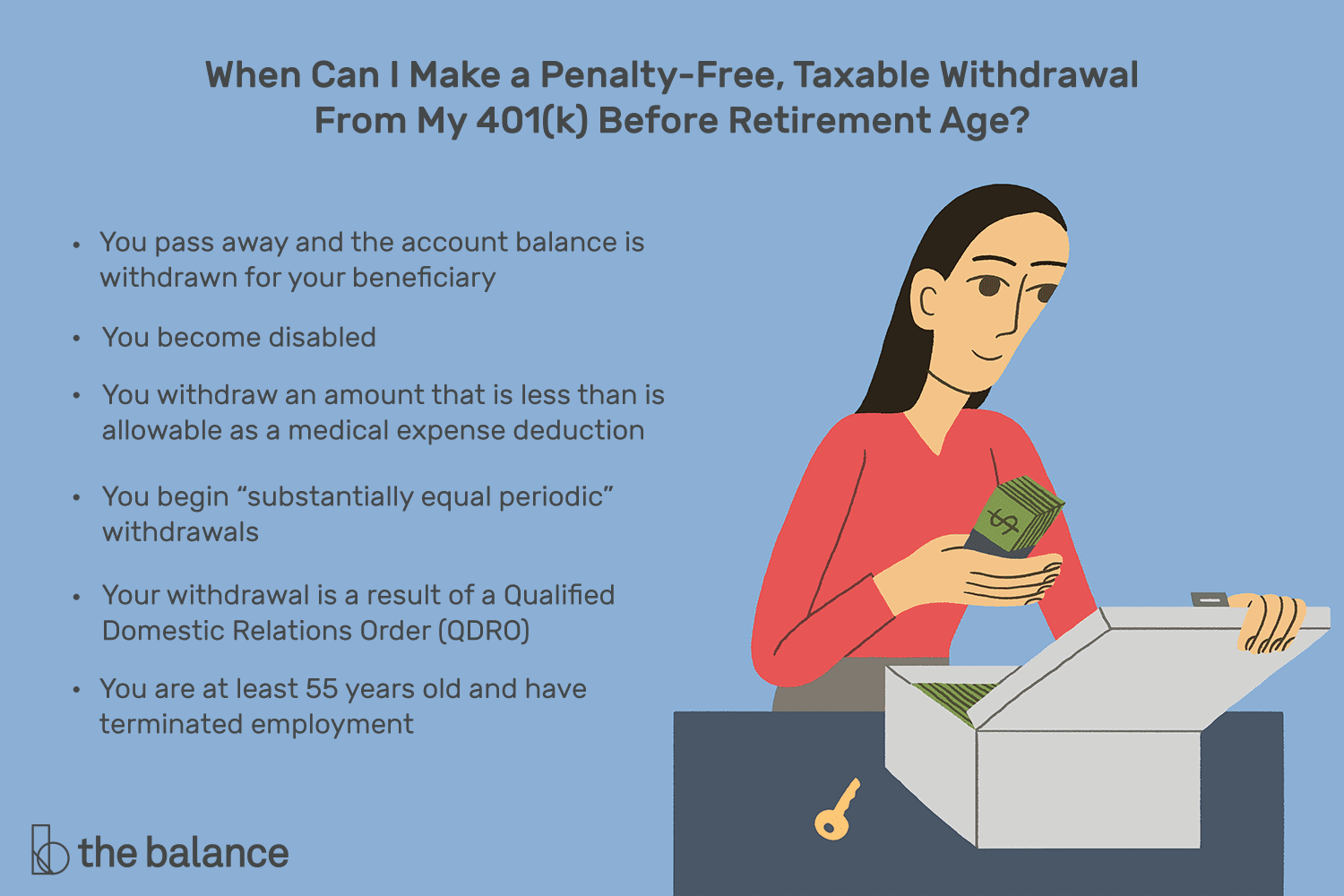

Exceptions To The Penalty

The IRS permits withdrawals without a penalty for certain specific uses. These include a down payment on a first home, qualified educational expenses, and medical bills, among other costs.

As with the hardship withdrawal, you will still owe the income taxes on that money, but you won’t owe a penalty.

Also Check: Should I Keep My 401k Or Rollover To Ira

How Do I Claim A 1099

Form 8915 -E is not yet finalized by the IRS. When it is, you can finish your distribution information.

Those who qualify as individuals directly impacted by the pandemic will be able to withdraw up to $100k from their retirement accounts without facing the 10% early withdrawal penalty.

You qualify if:

- You, your spouse, or your dependent are diagnosed with COVID-19

- You experience adverse financial consequences as a result of being quarantined, furloughed, or laid off

- You had work hours reduced to COVID-19

- Youre unable to work due to child care closure or hour reduction

The distribution would be taxed over 2020, 2021, and 2022. Youll have that time to pay back the funds you withdrew, without the amount impacting that years cap on contributions, and if you pay back the amount within that time, youll be able to claim a refund on those taxes.

If a payor is treating the payment as a coronavirus-related distribution and no other appropriate code applies, the payor is permitted to use distribution code 2 in box 7 of Form 1099-R.

- You, your spouse, or your dependent are diagnosed with COVID-19

- You experience adverse financial consequences as a result of being quarantined, furloughed, or laid off

- You had work hours reduced to COVID-19

- Youre unable to work due to child care closure or hour reduction

As employees, we received this update today,

What Is A 401 Early Withdrawal

Generally, anyone can make an early withdrawal from 401 plans at any time and for any reason. However, these distributions typically count as taxable income. If you’re under the age of 59½, you typically have to pay a 10% penalty on the amount withdrawn. The IRS does allow some exceptions to the penalty, including:

- Total and permanent disability.

- Unreimbursed medical expenses .

- Employee separated from service at age 55 or older but only from the plan at the job you are leaving.

Some 401 plans allow participants to take hardship distributions while you are still participating in the plan. Each plan sets its own criteria for what constitutes a hardship, but they usually include things like:

- Medical or funeral expenses

- Avoiding eviction or foreclosure

- The cost of repairing damage to the employee’s home

Hardship withdrawals don’t qualify for an exception to the 10% early withdrawal penalty unless the employee is age 59½ or older or qualifies for one of the exceptions listed above.

Also Check: Can I Set Up My Own 401k Plan

Continued Growth Vs Inflation

Remember that your retirement savings accounts dont grind to a halt when you begin retirement. That money still has a chance to grow, even as you withdraw it from your 401 or other accounts after retirement to help pay for your living expenses. But the rate at which it will grow naturally declines as you make withdrawals because youll have less invested. Balancing the withdrawal rate with the growth rate is part of the science of investing for income.

You also need to take inflation into account. This increase in the cost of things we purchase typically comes out to about 2% to 3% a year, and it can significantly affect your retirement moneys purchasing power.

Recommended Reading: How To Know If You Have A 401k

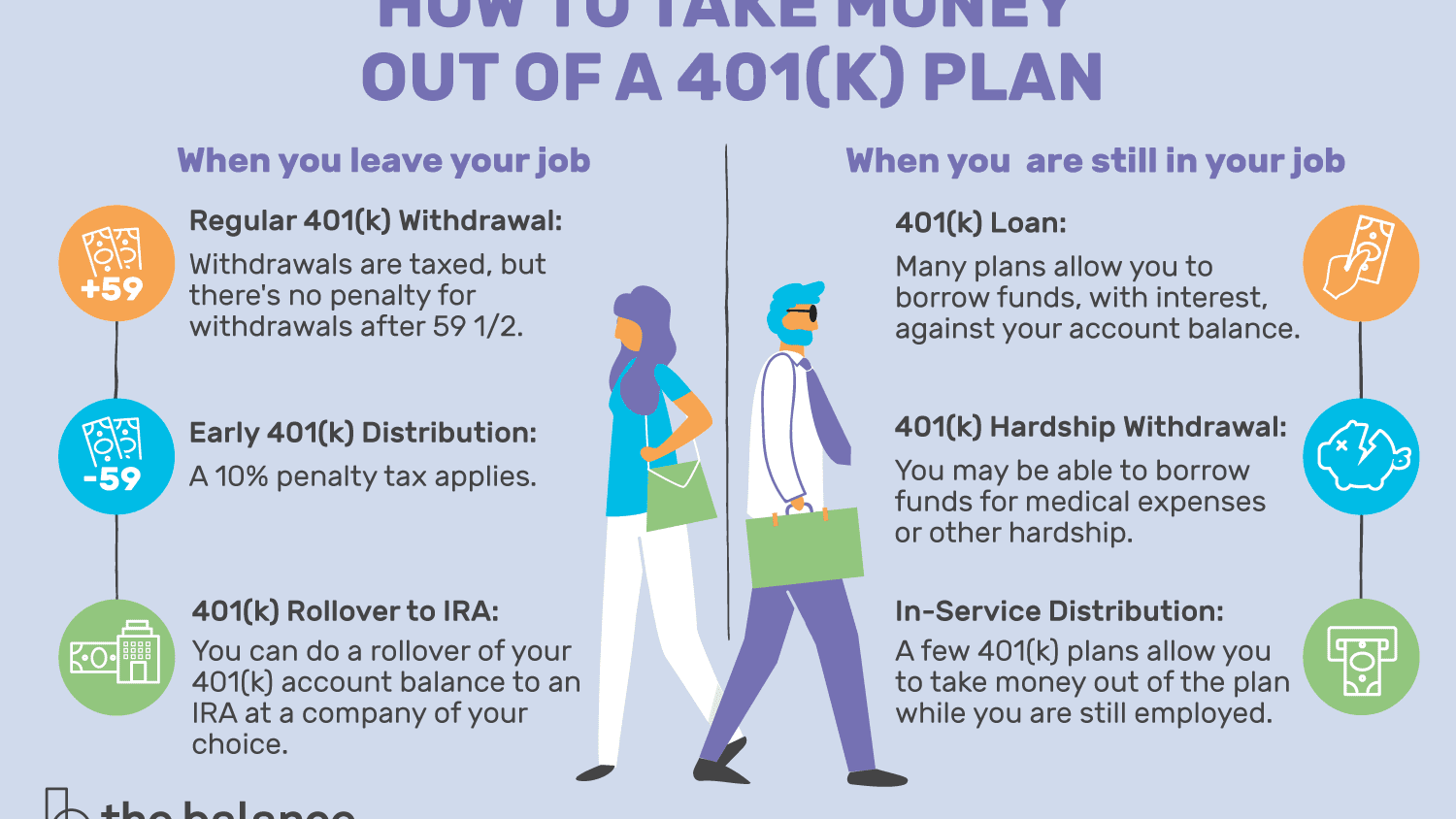

How To Take Money Out Of Your 401

There are many different ways to take money out of a 401, including:

- Withdrawing money when you retire: These are withdrawals made after age 59 1/2.

- Making an early withdrawal: These are withdrawals made prior to age 59 1/2. You may be subject to a 10% penalty unless your situation qualifies as an exception.

- Making a hardship withdrawal: These are early withdrawals made because of immediate financial need. You may be still be penalized for them.

- Taking out a 401 loan: You can borrow against your 401 and will not incur penalties as long as you repay the loan on schedule.

- Rolling over a 401: If you leave your job, you can move your 401 into another 401 or IRA without penalty as long as the funds are moved over within 60 days of your distribution.

Recommended Reading: What To Ask 401k Advisor

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

Taxes On Roth 401 Plans

Some employers offer another type of 401 plan called a Roth 401. These savings plans take the opposite approach when it comes to taxation: Theyre funded by post-tax income. This means your contributions wont lower your AGI ahead of tax-filing season.

The biggest benefit of a Roth 401 is that because youre paying taxes on your contributions now, you can withdraw the money tax-free later. A few other important notes:

-

You can begin withdrawing money from your Roth 401 without penalty once youve held the account for at least five years and youre at least 59½.

-

You can withdraw money from a Roth 401 early if youve held the account for at least five years and need the money due to disability or death.

-

Roth 401s also require taking RMDs.

Also Check: How To Save For Retirement Without A 401k

A Troubled Retirement System

That theres trouble brewing in the U.S. retirement system, which requires most workers to supplement Social Security with personal savings, has been widely acknowledged.

According to data from the U.S. Bureau of Labor Statistics published in 2020, only 55% of the civilian adult population participates in a workplace retirement plan. And even those who do are often woefully behind when it comes to investing part of their paycheck.

The wealth management giant Vanguard, for instance, revealed early in 2019 that the median 401 balance for those ages 65 and older is just $58,035. The SECURE Act aims to encourage employers who have previously shied away from these plans, which can be expensive and difficult to administer, to start offering them.

Hardship Distributions From 401k Plan

If you are younger than 59 ½, youre going to have to demonstrate that you have an approved financial hardship to get money from your 401k account. And thats only if your employers retirement plan allows it. They are not required to offer hardship distributions, so the first step is to ask the Human Resources department if this is even possible.

If it is, the employer can choose which of the following IRS approved categories it will allow to qualify for hardship distribution:

- Certain medical expenses

- Certain expenses for repairs to a principal residence

The only other way to get access to your funds is to leave your employer.

You May Like: How To Invest In 401k Without Employer

What Is A 401 Loan

Most 401 plans allow participants to borrow their own money from the plan and repay the loan through automatic payroll deductions.

Unlike personal loans and home equity loans, 401 loans are usually easy to get. There’s no credit check, and applications are typically short. However, they’re like other types of debt in that you must pay interest on the amount you borrow. Your plan’s administrator determines the interest rate, but it must be similar to the rate you’d receive when borrowing money from a bank. The good news though is that you are paying interest to your own 401 account.

Typically, 401 loans must be repaid within five years. That repayment period can be extended if you use the loan to purchase a home.

Taking Money Out Of A 401 Once You Leave Your Job

If you no longer work for the company that sponsored your 401 plan, first contact your 401 plan administrator or call the number on your 401 plan statement. Ask them how to take money out of the plan.

Since you no longer work there, you cannot borrow your money in the form of a 401 loan or take a hardship withdrawal. You must either take a distribution or roll your 401 over to an IRA.

Any money you take out of your 401 plan will fall into one of the following three categories, each with different tax rules.

You May Like: What To Do With 401k When You Quit Your Job

Making The Numbers Add Up

Put simply, to cash out all or part of a 401 retirement fund without being subject to penalties, you must reach the age of 59½, pass away, become disabled, or undergo some sort of financial hardship . Whatever the circumstance though, if you choose to withdraw funds early, you should prepare yourself for the possibility of funds becoming subject to income tax, and early distributions being subjected to additional fees or penalties. Be aware as well: Any funds in a 401 plan are protected in the event of bankruptcy, and creditors cannot seize them. Once removed, your money will no longer receive these protections, which may expose you to hidden expenses at a later date.

Adjust Your Return Expectations

The Federal Reserve is poised to raise interest rates in an effort to curb inflation.

But if inflation still continues to climb, it may drive nominal profits higher. However, your real profits may stay the same or even be less, Reddy said.

Consequently, returns may be more muted for the foreseeable future than they have been in the past 10 years. Still, they will be higher than zero and higher than what you can get by investing in bonds.

“Over the long-term, you’re probably still better off in equities as your best source of investable assets,” Reddy said. “But it will probably make a lot of people queasy along the way.”

Don’t Miss: How To Transfer 401k To Bank Account