Search For Unclaimed Retirement Benefits

When all else fails, search for yourself in the National Registry of Unclaimed Retirement Benefits. Not all employers participate in this service, but many do because it provides benefits that help them meet their legal requirements. It’s a free service, and it only requires your Social Security number.

Making A Fidelity 401k Withdrawal

Your 401k is your money, and making a withdrawal is as simple as contacting Fidelity to let them know you want it. The easiest way is to simply visit Fidelitys website and request a check there. However, you can also reach out via phone if you prefer: Call 800-343-3543 with any questions about the process.

From there, you can download the appropriate withdrawal request form and then mail it to the address listed on the form. Fidelity will have your check for you in five to seven business days after receiving your request. There are no fees for requesting a check, but if you liquidate any holdings, there could be commissions or mutual fund fees associated with that.

Average 401k Balance At Age 22

The average 401k balance at ages 22-24 is actually pretty impressive, and indicates that young people using the Personal Capital Dashboard are taking their retirement savings seriously. When youre in your early 20s, if youve paid down any high-interest debt, endeavor to save as much as you can into your 401k. The earlier you start, the better. As you can see from the potential savings chart, compounding interest is no joke.

Don’t Miss: Who Does Walmart Use For 401k

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Tracking Down A Lost 401

Its easy to understand why some workers might lose track of an old 401: Those born between 1957 and 1964 held an average of 12.4 jobs before the age of 54, according to the Bureau of Labor Statistics. The more accounts you acquire, the more challenging it is to keep track of them all.

Perhaps this is why there are some 24 million forgotten 401s holding assets in excess of $1.3 trillion.1 Left unattended too long, old accounts can be converted to cashand even transferred to the state as unclaimed propertyforgoing their future growth potential.

If youre among those with misplaced savings, heres how to locate and retrieve them:

Read Also: How To Calculate Employer Contribution To 401k

Banks Can Have Multiple Routing Numbers

Banks and brokers have different routing numbers depending on a variety of factors. One factor is the size. For example, a major bank such as Wells Fargo has different routing numbers in each state. Smaller banks and online-only financial institutions usually only use one routing number nationwide.

An institution might also have different routing numbers to fulfill different functions. For example, Fidelity has different routing numbers used for its brokerage and mutual fund accounts.

| Fidelity Routing Numbers |

Average 401k Balance At Age 45

When you hit your 50s, you become eligible to make larger contributions towards retirement accounts. These are called catch-up contributions. Make sure that you take advantage of them! Catch-up contributions are $6,500 in 2021. So if you contribute the annual limit of $19,500 plus your catch-up contribution of $6,500, thats a total of $26,000 tax-deferred dollars you could be saving towards your retirement.

You May Like: Can You Use 401k To Pay Off Student Loans

Changing Jobs Options For Your 401 Plan

Make the smartest decisions for your retirement plan as your career evolves.

- Employees who leave their companies have several options when it comes to their 401 plans, and each option has advantages and disadvantages.

- Options include keeping your existing plan where it is and starting a separate one at your new company, rolling it over to an IRA, or transferring it to your new companys plan.

- While its tempting to take a 401 distribution in cash to fund a dream vacation or other treat, it carries serious consequences and is not a good option for most people.

If you have a 401 plan, you are familiar with the benefits afforded by these popular retirement accounts. They are a great way to set aside pre-tax earnings and enjoy tax-deferred investments that can grow handsomely over the years, especially if your employer matches your contributions.

But what will happen to that nest egg if you leave your company to take another job? Maybe little or nothing at all, if you transfer the money to another qualified plan. Or, you might face a big tax bill and a government penalty if you prematurely withdraw funds. It depends on what you decide.

Employees who leave their companies have several options when it comes to their 401 plans, and each option has advantages and disadvantages.

Keep your old 401 where it is and start another one at your new job

Roll over existing 401 assets to an IRA and start another 401 at your new job

Take some or allof the money and run

What Are Your Options For Old Retirement Plans

You generally have four options for dealing with money thats in an employer-sponsored retirement account when youre no longer working at the company:

- Leave the money where it is: Although you might not be able to contribute to the account any longer, you may be able to leave the money in your former employers plan. Sometimes, you may need to meet a minimum account balance to qualify, such as $200 for a TSP or $5,000 for some 401s.

- Transfer funds to a new employer-sponsored plan: If you have a new job with a company that sponsors a retirement plan, you may be able to roll over the money into your new employers plan. When this is an option, compare the previous and new plans fees, terms, and investment options to see which is best.

- Roll over to an individual retirement account: You can also move the money into an individual retirement account . An IRA may give you more control as you can choose where to open the account and invest in a wider range of funds. Its also fairly easy to move from one IRA to another as the account isnt tied to your employer. However, IRAs could have more fees, especially if you dont have a lot of assets and dont qualify for lower-cost investment funds.

- Cash out: You can also take the money out of retirement accounts completely. But unless youre 59½ or older , you may need to pay a 10 percent early withdrawal penalty in addition to income taxes on the money.

You May Like: Can You Transfer 401k To Ira While Still Employed

Can I Take All My Money Out Of My 401 When I Retire

You are free to empty your 401 as soon as you reach age 59½or 55, in some cases. Its also possible to cash out before, although doing so would normally trigger a 10% early withdrawal penalty.

If you want to cash out everything, you can opt for a lump-sum payment. Think carefully before taking this approach, though. Withdrawing your savings all at once could result in a hefty tax bill and, if not managed wisely, leave you living in severe poverty later on in retirement.

Leave It With Your Former Employer

If you have more than $5,000 invested in your 401, most plans allow you to leave it where it is after you separate from your employer. If it is under $1,000, the company can force out the money by issuing you a check, says Bonnie Yam, CFA, CFP, CLU, ChFC, RICP, EA, CVA, and CEPA for Pension Maxima Investment Advisory Inc. in White Plains, N.Y. If it is between $1,000 and $5,000, the company must help you set up an IRA to host the money if they are forcing you out.

If you have a substantial amount saved and like your plan portfolio, then leaving your 401 with a previous employer may be a good idea. If you are likely to forget about the account or are not particularly impressed with the plans investment options or fees, consider some of the other options.

When you leave your job and you have a 401 plan which is administered by your employer, you have the default option of doing nothing and continuing to manage the money as you had been doing previously, says Steven Jon Kaplan, CEO of True Contrarian Investments LLC in Kearny, N.J. However, this is usually not a good idea, because these plans have very limited choices as compared with the IRA offerings available with most brokers.

If you leave your 401 with your old employer, you will no longer be allowed to make contributions to the plan.

Also Check: Can You Rollover A 401k Into A Traditional Ira

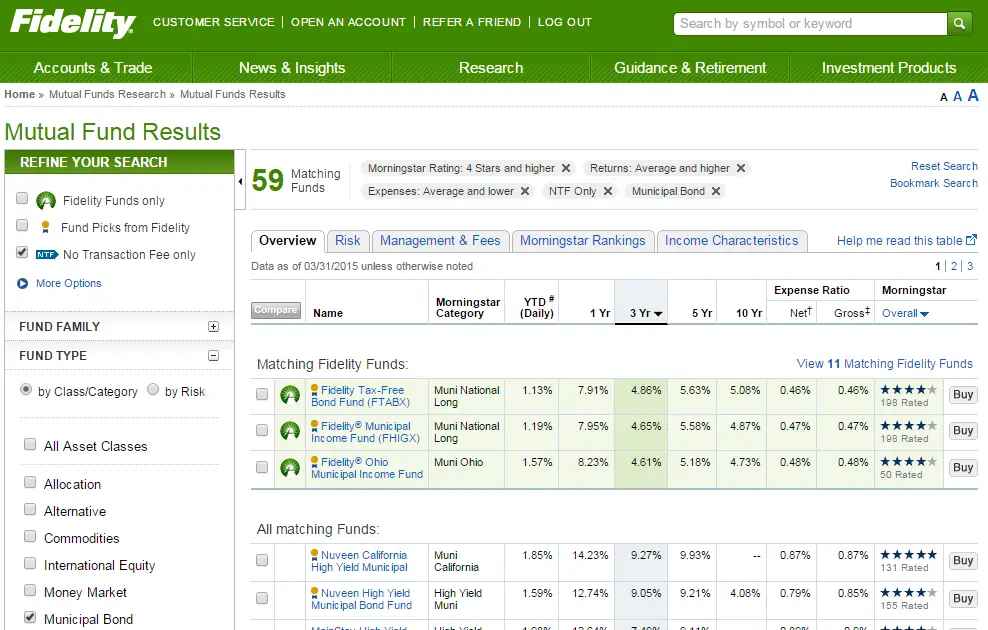

Where Can I Open A Solo 401k Account

If you are self-employed, find out where you can open a Solo 401 and the process involved when opening a self-directed retirement account.

One of the perks of being self-employed is the ability to self-direct your retirement savings. Self-employed individuals can open a Solo 401 account to access the same level of service as a company-sponsored 401 plan. A Solo 401 allows the owner-employee of the business to contribute up to $19,500 in 2021, and still make profit-sharing contributions up to $58,000 in 2021, or $64,500 if you are above 50.

You can open a Solo 401 account with different types of providers such as brokerages, banks, and self-directed custodians. You should compare the different Solo 401 providers to determine the company with the best Solo 401 account that meets your retirement needs. You should also compare the fees charged by each provider and the investment options available in each plan.

Basics Of 401 Allocation

When you allocate your 401, you can decide where the money you contribute to the account will go by directing it into investments of your choice.

At a minimum, consider investments for your 401 that contain the mix of assets you want to hold in your portfolio in the percentages that meet your retirement goals and suit your tolerance for risk.

Read Also: Should You Convert 401k To Roth Ira

Investing In A Business

“An employee who has maxed out their 401 might want to consider investing in a business,” says Kirk Chisholm, wealth manager at Innovative Advisory Group in Lexington, Massachusetts. “Many businesses, such as real estate, have generous tax benefits. On top of these tax benefits, business owners can decide what type of retirement plan they want to create. If, for example, they wanted to set up a 401 plan for their company, they would be able to expand their 401 contributions beyond what they may have at their employer.”

Too Complicated Get Some Help

If this process seems like a lot of work, youâre not alone. Locating your old 401 accounts and finding the proper place to transfer them to can get confusing.

Fortunately, Beagle can do all of the difficult work for you. The tasks of finding your accounts and facilitating their transfers are all done for you. Getting started is easy.

Don’t Miss: How To Set Up 401k In Quickbooks

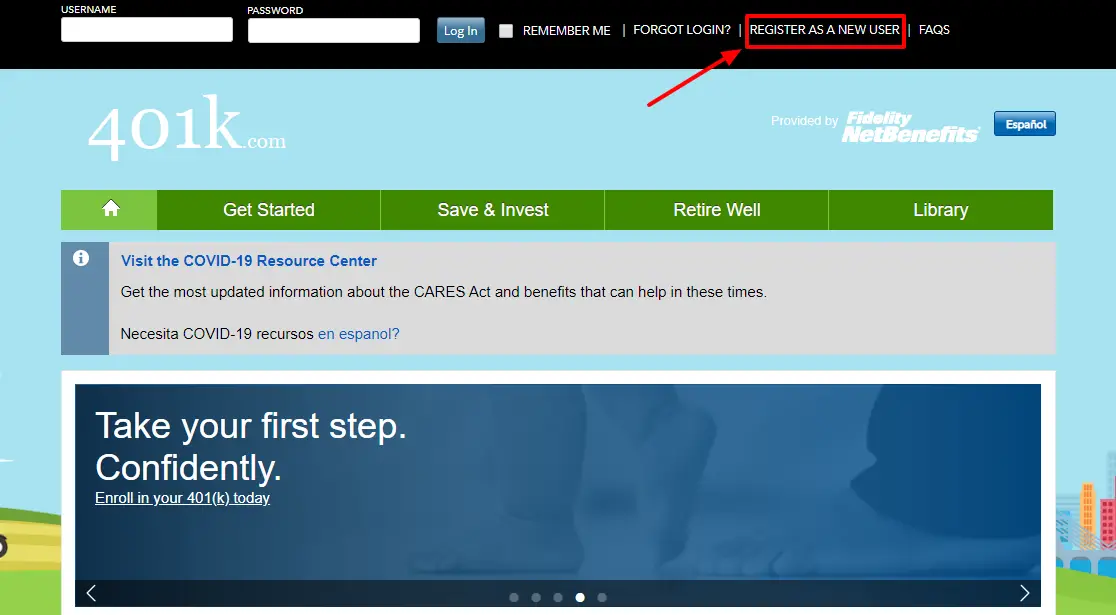

Start Your Transfer Online

Youll get useful tips along the way, but you can call us if you have a question.

Youll need to:

- Enter the account information requested. Your instructions from that point will depend on the company holding your account and your account information. Not all transfers follow the same process, so well ask only for the information needed to complete your particular type of transfer.

- Enter your personal information, such as your birth date and Social Security number, or if youre already a Vanguard client, confirm the information that weve been able to prefill for you.

- Review your information and click Submit.

Want an idea of how long a transfer could take?

Ways To Dig Up An Old 401 Account

Before we play “lost and found” with your old 401 plan, know that even though you can’t find your 401 account , your plan money is federally protected.

That’s right. By law, nobody can access, steal or otherwise make off with your 401 funds while they’ve gone missing.

With Uncle Sam at your back, use these tips and strategies to find a lost 401 account.

Also Check: Is An Ira Better Than 401k

Look Through Unclaimed Property Databases

You can also search the National Registry of Unclaimed Retirement Benefits Opens in new window to find plans under your name.

Once you find one account, you can potentially spot a few more, as theres a possibility you have multiple plans hosted by the same company. The other accounts should come up as you log into the management companys website.

Reference An Old Statement

Because companies reorganize, merge, get acquired, or go out of business every day, its possible that your former employer is no longer around. In that case, try to locate a lost 401k plan statement and look for contact information for the plan administrator. If you dont have an old statement, reach out to former coworkers and ask if they have an old statement.

Also Check: Should I Manage My Own 401k

Plan For Your Retirement Over Your Career

Remember that retirement planning is not a singular event, but rather something you do over the course of your career.

Keep this mindset and continually review your retirement planning progress and account balances. If you havent started to save for retirement, its never too late.

Talk to your HR department about retirement planning options, or open up an IRA, or even basic savings account to get started putting money aside for your future.

Thursday, 21 Oct 2021 11:13 PM

Advertiser Disclosure: Many of the offers appearing on this site are from advertisers from which this website receives compensation for being listed here. This compensation may impact how and where products appear on this site . These offers do not represent all account options available.

Editorial Disclosure: This content is not provided or commissioned by the bank advertiser. Opinions expressed here are authors alone, not those of the bank advertiser, and have not been reviewed, approved or otherwise endorsed by the bank advertiser. This site may be compensated through the bank advertiser Affiliate Program.

User Generated Content Disclosure: These responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

Where Is My 401

When you leave your employer you have three options for the money youâve accumulated in your old 401 account. You can either:

- Leave it alone and keep it in the same account

- Roll over the funds to your new employerâs 401 plan or

- Roll over the funds to an IRA.

Most people leave their 401âs alone, either from neglect or they donât bother with facilitating the transfer.

You can rollover your old 401 funds to an IRA as soon as youâd like. If your IRA is already set up then it can accept the funds immediately.

However, if your new employer implements a waiting period before you can participate in their 401 program, then you have no choice but to leave it alone until youâre eligible.

This is where things fall through the cracks. Unattended 401âs can end up in a few different places: the old account you have with your former employers, an automatic safe harbor rollover account set up by your plan, the unclaimed property department in the state, or your old 401s could have been cashed out already if the balance was less than $5,000 when you left the job.

Recommended Reading: How To Get Money From My 401k Plan

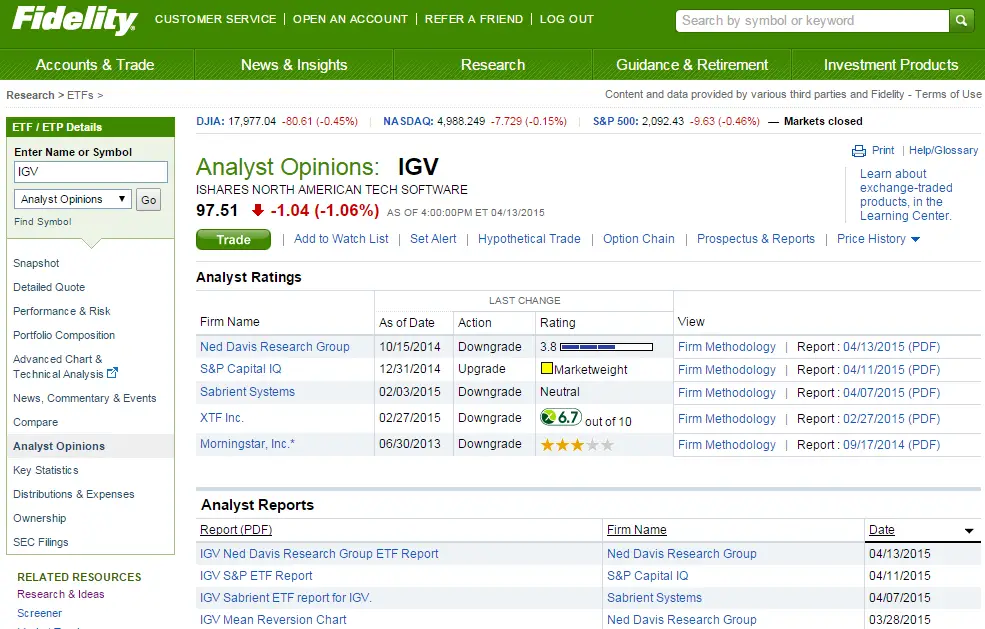

How Much Does It Cost To Have An Advisor Manage Your 401

Compensation methods vary between advisors and retirement plans. At one of the larger 401 plan providers , you may have access to a group to ask questions. Support may be narrow in scope, but that might be ok depending on your needs. Plan fees may cover these services. Alternatively, plan providers could charge an asset-based fee or earn commissions based on recommendations. Consider the cost-benefit along with the depth and quality of the personal advice you require.

Another option is to work with an independent, fee-only financial advisor. The fee-only model helps reduce conflicts of interest as the advisor doesn’t double as a salesperson. A truly independent advisor isn’t employed by/affiliated with a fund company, which can mean more objective advice. Also ask financial advisors if they are a full-time fiduciary, always acting in your best interest.

How much it costs to work with an advisor depends on the advisory firm, your financial situation, and the services you receive. While cost is an important component, the cheapest option today might be the most expensive in the long run.