Another Popular Option Is The Sep Ira Which Is Great For Self

Eweka notes that the Simplified Employee Pension IRA is “one of the easiest and simplest opportunities for someone who has self-employment income” because “it has low administrative requirements and no IRS reporting.”

Plus, if you have employees you can put aside money for them as well as yourself. The contribution limits for an SEP are surprisingly high up to 25% of each employees pay.

How Can I Save For Retirement Without One

There are lots of people who are looking for ways to save for retirement without relying on a 401, but they might be worried about their 401 losing value or they might not have it available to them at their job. One of the most common retirement vehicles that someone will use is called an IRA. An IRA is an individual retirement account. Two of the most common types of IRAs are traditional IRAs and Roth IRAs. Some people who are self-employed also use something called a SEP-IRA. One of the advantages of using an IRA is that the contributions are tax-deductible. In some cases, people claimed this deduction when they contribute to the IRA. In other cases, people claimed this deduction when they pull money out of their IRA. If people decide to make contributions to an IRA, they might be able to save money on their taxes.

On the other hand, there are some people who are simply worried that they are going to lose money if they invest in the stock market. They may not be comfortable with their knowledge base or they might not have time to track the market that closely. The good news is that there are other resources available to individuals who would like to save for retirement without having to rely on the stock market.

What Are Exceptions To 401k Early Withdrawal Penalty

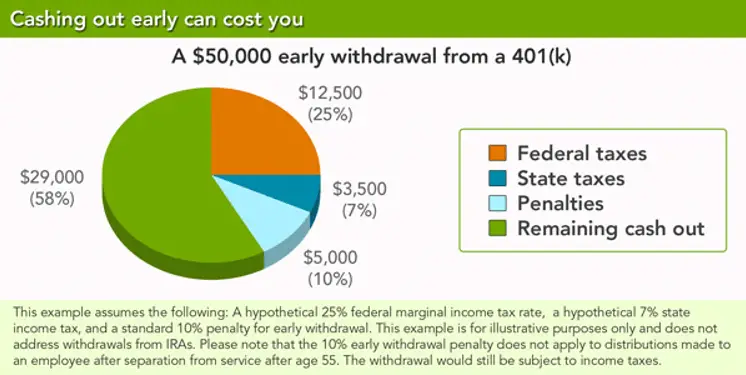

There are a few exceptions to the minimum age of 59½. The IRS offers retribution without penalty in special circumstances related to death, disability, medical expenses, child support, spousal support, and active military activity, said Bryan Stiger, CFP, a counsel. Betterments 401 financial statement.

What are the exceptions to the 10% penalty for early withdrawal?

Up to $ 10,000 for an early IRA withdrawal that is used to buy, build, or rebuild a first home for a parent, grandparent, self-employed spouse, or you or your spouses child or grandchild may be exempt from at a penalty of 10%. You have to meet the IRS definition of a home buyer for the first time.

Is the 10 early withdrawal penalty waived for 2021?

Although the initial provision for 401k withdrawals without penalty has expired at the end of 2020, the Consolidated Appropriations Act, 2021 provided a similar withdrawal exemption, allowing eligible individuals to take a qualified disaster distribution. up to $ 100,000 without being subject to the 10% penalty. what would be

Which of the following is not an exception to the 10 early withdrawal penalty for an IRA?

The following distributions are not subject to the 10% penalty tax: Death of IRA owner. Distribution to your designated beneficiaries after your death. Most non-spouse beneficiaries have settled inherited accounts in 10 years.

Read Also: How Do I Move My 401k To An Ira

What About A Traditional Ira

If your income is too high to contribute to a Roth IRA, you can go with a traditional IRA. Like a Roth IRA, you can contribute up to $6,000 a year$7,000 if youre 50 or olderand you and your spouse can both have an account.4

Thats where the similarities end. Unlike a Roth IRA, there are no annual income limits. But youre required to begin withdrawing once you turn 72, and even though contributions to a traditional IRA are tax-deductible, youll have to pay taxes on the money you take from it in retirement.5

Still with us? Now, lets look at some other options you can explore if youre self-employed.

How Can I Withdraw Money From My 401k Without Penalty

Here are the ways to get free withdrawals from your IRA or 401

- No medical payments.

- The first of the health insurance.

- Death.

- If you owe the IRS.

- Home buyers for the first time.

- Higher education costs.

- For entry purposes.

What qualifies as a hardship withdrawal for 401k?

Eligibility for Retirement Difficulty Certain medical expenses. Home purchase expenses for a main residence. Up to 12 months of schooling and expenses. Expenses to prevent them from being foreclosed on or expelled.

When can you withdraw from 401k tax free?

Stashing pre-tax cash on your 401 also allows you to grow it tax-free until you pick it up. There is no limit to the number of withdrawals you can make. After you turn 59, you can withdraw your money without having to pay an early retirement penalty.

Don’t Miss: How To Get 401k Money After Quitting

Option : Keep Your Savings With Your Previous Employers Plan

If your previous employers 401 allows you to maintain your account and you are happy with the plans investment options, you can leave it. This might be the most convenient choice, but you should still evaluate your options. Each year, American workers manage to lose track of billions of dollars in old retirement savings accounts, so you should make sure to track your account regularly, review your investments as part of your overall portfolio and keep the beneficiaries up to date.

Some things to think about if youre considering keeping your money in your previous employers plan:

In Case Of Emergency Please Dial

An emergency fund isnt just a repository of cash you can dip into when the tires wear out or the dishwasher breaks down. Those emergency dollars may actually be critical to your overall investing strategy, whether or not you have access to a 401 plan.

The last thing you want is to invest in the markets and have to dip into your investment portfolio at a loss. If your investment portfolio drops and you dont have an emergency fund, you might panic, capitulate, and sell at the worst possible time.

What about other important priorities, like paying off college debt, saving for a down payment on a house, and building education and retirement savings? Again, all that is important, but having emergency cash is a key short-term priority because without it, longer-term goals could get dinged.

Consider putting your goals into short-term, intermediate-term, and long-term buckets. The short-term budget includes emergency savings. Intermediate goals may include buying a house and paying for college.

A critical long-term goal is retirement. But if you have no 401 plan and need to dip into those IRAs and HSAs to pay for something thats in the shorter-term bucket, like a surprise car repair bill, youre potentially damaging long-term savings. Any retirement plan needs to rest on a solid foundation, which is why an emergency fund is so important.

Inclusion of specific security names in this commentary does not constitute a recommendation from TD Ameritrade to buy, sell, or hold.

Recommended Reading: Which 401k Fund To Choose

How To Fund A Retirement Account

So you know how much you need to save for retirement and which accounts you can open. Now you have to fund those accounts without your employers help. The first step you can take is to set up direct deposit. You can set it so that a portion of your paycheck automatically deposits into your IRA or other account. You may also set up automatic transfers from a bank account to your retirement savings account. That way, you can set it and forget it.

You may also want to set aside any tax refunds, windfalls or bonuses you get. Its easy to deposit those funds into an account right away. That way, you can pretend that you never had access to that money anyways.

Its important to know that putting money into your IRAs or solo 401 isnt all you need to do. Youll also need to choose your investments. Luckily, you wont be limited to the funds your employer has selected to provide. A good place to start is with an S& P 500 index ETF and an intermediate term bond index fund. Youll need to make sure your investments are well-diversified and optimized. You dont need to do this all on your own, though. If you need help, there are a ton of financial advisors or robo-advisors out there who can help you manage your accounts.

What If I Run A Small Business With Employees

Once you have employees, the rules of the road change a bit. A great choice is a SIMPLE IRA, which requires you to offer up to a 3% match for your employees every yearand contributions are tax-deductible. SIMPLE IRAs come with an individual limit of $13,500 a year.8

|

Retirement Option |

|

25% of earned income |

Don’t Miss: Can You Leave Money In 401k At Your Old Job

Saving Tip #: Cut Down Your Cost Of Living

Our study found that, across all demographic groups, cost of living is the top reason people dont save for retirement.6 And, while household incomes have finally bounced back to where they were before the 2008 financial crisis hit, the cost of living has increased by 18% during the last decade.7

That doesnt leave much wiggle room for families to tackle everyday expenses. But that doesnt have to spell disaster for your retirement! Here are two tips to help you stay on track:

- Dont spend your raises. A lot of people increase their lifestyle to match that income increase. A fancier car. A new kitchen. A nicer wardrobe. But remember: Investing 15% of your income also means investing 15% of any pay increases. As your income grows over time, those bumps in pay can add some serious cash to your nest egg!

- Stick to a monthly budget. If you havent been budgeting, nows the time to start! A budget helps you take control of your money and make a plan for every dollar. Tell your money where to go instead of wondering where it all went.

Open A Traditional Ira Or A Roth Ira

If you want to defer income tax on your retirement savings the same way you can defer it when you contribute to a 401, open a traditional individual retirement account, or IRA. You can contribute up to $5,500 per year to this account .

The money you contribute is tax-deferred, meaning youll get a tax break today but will pay taxes on your withdrawals in the future.

Or, if youre interested in letting that money grow tax-free, consider a Roth IRA instead. Many of the same rules apply to Roths as apply to traditional IRAs . The biggest difference is your contributions are made with after-tax dollars.

The advantage? If you follow the rules, your withdrawals in the future can be made tax-free.

Recommended Reading: How To Get Money Out Of 401k Without Paying Taxes

Launch A Profitable Side Hustle And Open A Solo 401 Or Sep Ira

If you really don’t want to save for retirement without a 401, then you could open your own. You’d have to start a side hustle and establish a solo 401 orSimplified Employee Pension IRA. What’s nice about these accounts is that they have very high contribution limits. In 2021, you can contribute up to $58,000 to a SEP IRA or solo 401. If you’re 50 or older, then you can add an additional $6,500 to the solo 401 limit. There are caveats, though:

- contributions cannot exceed 25% of your income from the business.

- With a solo 401, you can contribute as both the employee and employer. This distinction is important because the contribution rules for each role are different. As an employee of the business, you can contribute up to $19,500 of your compensation. As the employer, you can contribute up to 25% of earned income. Earned income equals your net earnings from self-employment less one-half of the sum of your self-employment tax and contributions to yourself. The contribution cap for a solo 401 applies to the total of the combined employee and employer contributions.

The broader takeaway is that your business must be profitable to make contributions to these accounts. You can’t, for example, get a business license for a hobby, open a solo 401, and then contribute money from your day job.

Understanding Your Investment Account Options

Now that youve made the right choice in deciding to save for retirement, make sure you are investing that money wisely.

The lineup of retirement accounts is a giant bowl of alphabet soup: 401s, 403s, 457s, I.R.A.s, Roth I.R.A.s, Solo 401s and all the rest. They came into existence over the decades for specific reasons, designed to help people who couldnt get all the benefits of the other accounts. But the result is a system that leaves many confused.

The first thing you need to know is that your account options will depend in large part on where and how you work.

Recommended Reading: How Much In 401k To Retire

How A Tiaa 401k Can Help Academics Save For Retirement

If you are an academic or are a member of a college, a TIAA 401k can help you save for retirement. TIAA, or the Teachers Insurance and Annuity Association of America, is a Fortune 100 financial services company that offers a diversified portfolio of retirement products. The companys financial services focus on academic, research, medical, cultural, and governmental fields.

This retirement plan has a long history of incorporating new strategies before they became mainstream. In the late 1970s, TIAA was one of the first institutions to offer international stocks and added a CREF Social Choice Account as an option for socially responsible investing. The next decade saw TIAA enter the 529 market, offering both fixed and variable annuities to fund the accounts.

Another TIAA 401k plan is the TIAA CREF plan, which is also a defined contribution plan, though it differs from the TIAA 401k in many ways. Unlike a 401, a TIAA CREF plan is funded entirely by fixed and variable annuities. This means that the funds are invested in securities that will pay higher returns over time.

The TIAA 401k plan has two main types of funds. The TIAA Traditional fund focuses on longer-term, illiquid assets that pay a higher interest rate. The TIAA RC plan is the bond side of the portfolio. The TIAA 401k can serve as the bond side of your retirement investment portfolio. There are nine versions of the TIAA CREF.

More Options If Youre A Freelancer Or Entrepreneur

If youre the boss of you, then you might have a few more choices available to you when it comes to saving for retirement.

One is a , which is like a regular IRA above, except the employer makes all the contributions. You just have to be 21 years old, earn at least $600 a year, and have worked for your company in three out of the last five years. The great part about SEP IRAs is that they have high contribution limits up to 25% of earnings or $58,000, whichever is lower.

Theres also a solo 401, aka a one-participant 401. With this kind of account, think about it like youve split yourself into two people: the employer and the employee. The employer side of you can contribute up to 25% of earnings, while the employee side of you can contribute up to $19,500 . The total limit is still $58,000, but depending on your income, this weird split might actually let you contribute more with a solo 401 than a SEP IRA.

So, no need to let a lack of a 401 get you down. You can still take care of Future You and build that dream retirement starting today.

The information provided should not be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice.

The information provided does not take into account the specific objectives, financial situation or particular needs of any specific person.

Also Check: How To Start My 401k

Saving Tip #: Stop Overspending On Non

Going out for lunch with your coworkers every day or signing up for that cable package with all those premium channels you never watch can leave your nest egg riding on empty.

A recent study found that the average American spends almost $1,500 on non-essential items every month.8 Thats almost $18,000 a year on things like eating out, impulse purchases and magazine subscriptions! We want you to enjoy life and have some fun! But dont go overboard and let your fun hijack your future.

What if you just cut your non-essential spending by $150 per month and put that money into retirement savings for 15 years? By ditching your cable and canceling that gym membership you barely use, you could potentially add almost $70,000 to your retirement account. Thats nothing to sneeze at.

Are you already thinking about some things in your budget you might be able to slash? Here are a couple of my suggestions:

Open A Taxable Brokerage Account

You can put your money in a regular investment account where you’ll accumulate stocks, mutual funds, and bonds after youve reached the annual maximum contribution for your IRA and after you’ve fully funded an HSA. These accounts aren’t tax-deferred, but there are ways to minimize these taxes. Tax loss harvesting allows you to sell off losing stocks to offset capital gains in your portfolio.

Pay attention to the minimum amount required to invest when you’re opening a taxable brokerage account, and make sure you understand the various fees associated with keeping your investments there. Fees can take a big bite out of your investment earnings over time, so it may be helpful to look for cost-efficient investment options, such as exchange-traded funds .

Also Check: How To Check My 401k Balance