What To Look For In A Solo 401k

Going through the process of shopping around for a solo 401k provider, I’ve learned a lot about what to look for. There are a lot of options and nuances that you should look for when shopping for a 401k. Many of the “free” providers offer simple generic plans, and if those don’t work for you, you can have a third party provider create a custom 401k plan for your business, which you can then take to a brokerage.

Whoa, that sounds confusing, and it can be. So let’s look at the major options that you need to consider when selecting a solo 401k provider.

- Does the 401k provider offer both Roth and Traditional contributions?

- Does the 401k provider offer after-tax contributions to do a mega backdoor Roth IRA.

- Does the 401k provider offer loans from the plan?

- What types of investment options are allowed in the plan?

- Does the provider allow rollovers into the plan and rollovers out of the plan?

- The costs to maintain the plan

- The costs to invest within the plan

Based on your wants and needs, there are a lot of things to compare when shopping for a solo 401k provider. Let’s compare some of the main firms that offer solo 401ks. We’re going to start with the 5 major firms that provide Prototype Plans. These are the “free” plans that the companies advertise.

How To Open A Td Ameritrade Account For The Solo 401k

Each brokerage house is different in how they classify their investment-only accounts and applications can update at any time. We have made our best efforts to provide you the most up to date applications here, but please check with TD Ameritrade to ensure you have the right application to open an investment-only brokerage account under your Solo 401k plan and trust.

It’s important to remember you’re not opening a TD Ameritrade 401k. Rather, your 401k plan and trust are opening an investment-only account with TD Ameritrade.

TD Ameritrade calls these types of accounts “Trust accounts” and they are designed to work with your Solo 401k.

Do You Qualify For A Self

Are you a self-employed professional planning for your retirement? A self-employed 401 is an excellent plan to build out your retirement nest egg. Whether you are a freelancer, shop owner, or small business owner without employees, a solo 401 retirement plan can help you live your dream life when you retire. Here well discuss an overview of a self-employed 401, setting one up, how to withdraw from the account and other vital information.

Also Check: How Much Should I Put In 401k

How A Solo 401 Works

Solo 401s are available only to self-employed workers with no employees, with an exception for business owners who employ their spouses. To open one of these accounts, you must have an employer identification number , which you can get from the U.S. Internal Revenue Service .

You’re allowed to make two types of contribution to your solo 401: an employee contribution and an employer contribution. Your employee contribution limit is the same as the 401 contribution limit for any traditionally employed worker — $19,500 in 2021, or $26,000 if you’re 50 or older. These rates increase in 2022 to $20,500, or $27,000 if you’re 50 or older.

If you’d like to contribute more than this, you can make additional contributions as an employer, but this calculation is a little more complicated. You may contribute up to 25% of your net self-employment income for the year. That is all the money you’ve earned from your business minus any business expenses, half of your self-employment taxes, and the money you contributed to your solo 401 as an employee contribution.

Only the first $290,000 in net self-employment income counts for the year, and the total amount you may contribute to your solo 401 as employee and employer in 2021 is $58,000, or $64,500 if you’re 50 or older. In 2022, those increase to $61,000, or $67,500 if you’re 50 or older.

Can I Contribute To Ira If I Max Out 401k

Try to max out your 401 each year and take advantage of any match your employer offers. Contributions are tax-deductible the year you make them, which can leave you with more money to save or invest. Once you max out your 401, consider putting your leftover money into an IRA, HSA, annuity, or a taxable account.

What happens if you Overcontribute to 401k?

In many cases, individuals dont notice that theyve over-contributed to a 401 plan. Youll pay tax on the excess in the year it was contributed to the 401k . Youll also pay tax on the amount once it is withdrawn from the retirement account.

How much can a highly compensated employee contribute to 401k 2020?

401 Contribution Limit Rises to $19,500 in 2020

| Defined Contribution Plan Limits |

|---|

Don’t Miss: How Do I Get My 401k

How Late Can I Make 401k Contributions

Mark your calendars now: 401k contributions are generally due at the end of the calendar year. However, the IRS allows contributions to IRA accounts up to the tax filing deadline of the coming year. In 2021, you can contribute to your IRA accounts until May 17, 2021.

In many 401 plans, you can contribute as much as 100% of your pay . Instead of taking income from your employer, pay yourself out of that extra money.

Solo 401 Versus Other Retirement Plans

If you donât think a solo 401 is a good fit for you, here are some other options you may want to consider:

- Simplified Employee Pension IRA: A is another popular option among self-employed individuals with no employees. You may contribute up to the lesser of $61,000 in 2022 or 25% of your net income. Contributions are tax-deferred, and there is no Roth option. You can use one of these accounts if you have employees, too, although youâll have to make mandatory contributions to your employeesâ accounts. This could limit how much you can afford to contribute to your own retirement.

- Traditional or Roth IRA:Traditional IRAs and Roth IRAs are open to all workers, even those who arenât self-employed. You can open them with most brokers, and youâre free to choose from many common investments. You may contribute up to $6,000 in 2022, or $7,000 if youâre 50 or older.

- Self-directed IRA:Self-directed IRAs are traditional, Roth, or SEP IRAs that allow you to invest your money in real estate and other assets you canât typically invest in with an IRA.

Each account has its pros and cons, so youâll have to decide which is best for you. A SEP IRA might be a better fit if you donât want to deal with the more complex reporting requirements of a solo 401. But solo 401s let you choose between tax-deferred and Roth accounts and take out loans, while SEP IRAs donât allow these things.

You might also like

Recommended Reading: What Is 401k In Usa

Make Contributions To Your Solo 401

Once all the paperwork is completed and the disclosures are reviewed, its time to fund your account. Most providers will accept a check, wire transfer, or automated clearing house payment to fund the Solo 401. Its up to you to decide whether you want to make monthly installments or fully fund the account in one lump-sum payment.

There are two pieces to the contribution strategy with a Solo 401. First, you are allowed to contribute up to $19,500 from your salary. If you are over 50 years old, you can contribute an additional $6,500. The second piece comes from the employer as a profit-sharing contribution of up to 25% of your net self-employment income. This earned income is your net profit minus your plan contribution to the Solo 401 and one-half of your self-employment tax.

The limit on compensation that can be used to determine your contribution is $290,000 in 2021. Consult your tax advisor to develop an optimal strategy thats IRS-compliant. Penalties for excessive contributions are applied in the year the contribution is made and when the money is distributed, so its important to get your contribution correct.

Once your account reaches $250,000 in assets, youll have new requirements, including filing Form 5500 with the IRS. If you ever hire employees who become eligible for your plan, youll need to make adjustments to accommodate these new participants.

What Is A Brokerage Firm

A brokerage firm is a company that helps buyers and sellers complete financial transactions. They earn money based on fees, or in some cases commissions, involved with the transaction. In many cases, special licensing is required to buy and sell financial products, which is where brokers are necessary and helpful. You might also find individual brokers who work independently, but typically brokers are connected to a larger team that can collaborate to help with transactions.

Read Also: How To Pull Out Of 401k

How To Lower Your Small Business Taxes With A Solo 401

Saving Solo: Keep reading to find out how you can reduce your small business taxes with a 401 Retirement Plans for the Self-Employed. Often called a Solo 401 or Individual 401 this tax saving retirement plan can help you slash your tax bill this year and into the future. Not to mention stay on track for your retirement goals. California business owners in the highest income tax brackets could save several hundred thousand dollars in taxes over the next decade when maxing out a solo 401.

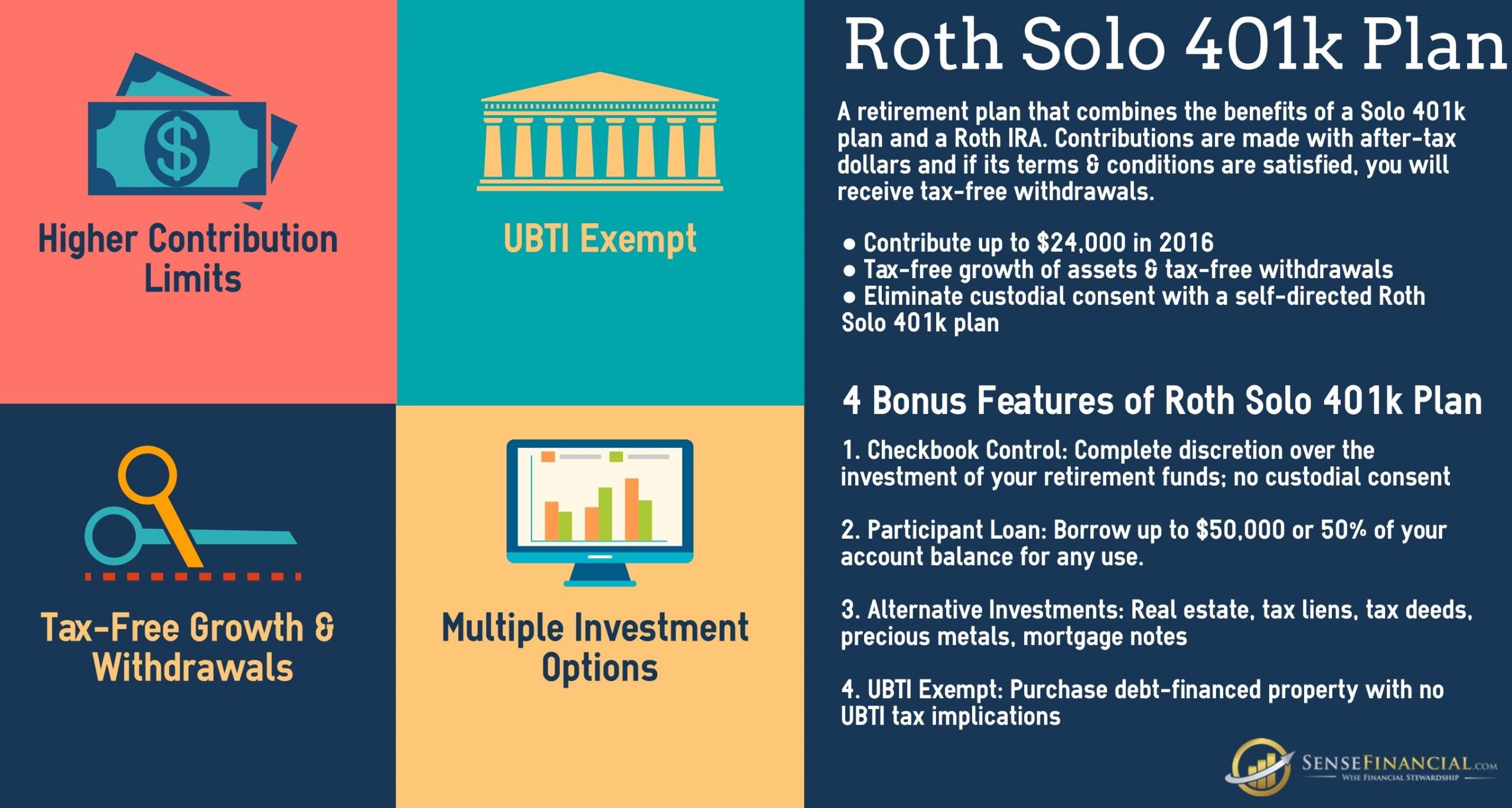

What solopreneurs, freelancers, and small business owners need to know and need to do to fund their retirements utilizing a solo 401 Plan. You wont get a current tax deduction but a Roth Solo 401 can help lower your taxes in retirement.

Update: Contributions limits have increased for 2022 to a total of $61,000. Plus an additional $6500 catch-up contribution if you 50 or older. The TCJA Tax Plan makes these plans even more valuable for many small business owners. Defined Benefit Contribution Limits have also increased for 2022. Talk to your Fabulous Financial Planner and CPA about the 20% pass-through tax break.

If nothing else these retirement plans can help you minimize your current tax bill. Do you really want to write a check to the IRS?

Stocks Bonds Mutual Funds Cds

In addition to non-traditional investments such as real estate, a Solo 401k may purchase stock, bonds, mutual funds, and CDs. The advantage of using a self-directed Plan is that you are not limited to just making these types of investments. With a Solo 401k Plan with checkbook control you can open a stock trading account with any financial institution as well as purchase real estate, buy tax liens, or lend money to a third-party. Your investment opportunities are endless! When purchasing stocks or securities with the Plan, all income and gains, including dividends, would flow back to the plan without tax. With a Roth Solo 401 Plan, all gains are tax-free. Whereas, if you purchased stocks with personal funds, all income and gains would be subject to federal and in most cases state income tax.

Solo 401k Tips:

For more information, checkout our founder Adam Bergmans Book, email us at [email protected] or call 1-800-472-0646 to speak with one of our customer service representatives today!

Read Also: How Do You Split A 401k In A Divorce

What Are The Benefits Of A Solo 401

Unlike other options, a Solo 401 account holder can choose between a traditional option and a Roth option. The traditional option allows you to deduct the amount you pay in from your income for that year, giving you an immediate tax break. With the Roth option, the income taxes on that money is paid immediately and you owe no taxes when you withdraw the funds.

The Solo 401 has far higher annual contribution limits than a plain-vanilla IRA, although that is also true for the SEP IRA and the Keogh plan.

The Solo 401 allows you to take loans from your account before you retire. This is not an option with many other retirement plans.

Finally, the Solo 401 is relatively straightforward in terms of paperwork, as it is designed for one-person shops, not corporations.

Vanguard Solo 401k Plan Document

Starting a Solo 401K at Vanguard is easy. If you are already a Vanguard client, you can set the account up online by logging into your account and choosing Individual 401K. If you dont have an account with Vanguard right now, you must call 1-800-992-1788 and a representative will walk you through the process.

Before you can apply for a Solo 401K, youll need an Employee Identification Number. You get this number directly from the IRS and it only takes a matter of minutes as they provide it to you instantly. Head to the IRS website and complete the required information to get your EIN.

Beyond the EIN, youll need to sign a few Vanguard documents, which they will send to you. Youll need to sign them and send back the originals, but make sure you keep a copy for yourself.

As a part of the process, youll also need to choose a plan administrator. Many business owners choose to handle it themselves, but if you dont want the responsibility, you can assign it to your spouse or your accountant .

Read Also: Who Is The Plan Administrator For 401k

Comparing The 5 Most Popular Solo 401k Providers

Now that we’ve covered the five major “free” solo 401k providers, let’s compare them in a chart side-by-side to see how their offerings compare to each other.

Sorry, the chart doesn’t display on mobile.

|

Comparing The Most Popular Solo 401k Providers |

|

|---|---|

|

Fidelity |

|

|

$0/trade |

$0/trade |

Some notes: Vanguard’s annual fees can be waived over $50,000 in assets. Also, all of these companies offer commission-free ETFs, so you could potentially invest for free within your Solo 401k. Vanguard also have a very odd pricing schedule. While they do offer their own products commission free, if you want to buy other stocks or ETFs, you’ll pay anywhere from $2-$7 depending on how much in assets you have.

Now you can see why the choice of solo 401k providers is so difficult. Each firm has strengths and weaknesses, and the selection depends really on what matters to you.

And if none of these really excite you, you can always create your own solo 401k with a third party provider.

What To Do With Your Distributions

With potentially thousands of dollars coming your way in the years ahead, you may need a strategy to get the most from your distributions.

Before you decide on any course of action in allocating your distributions, you should consult with a tax professional to make sure youre making the best decisions based on your specific tax situation. If you expect to spend the money to cover retirement expenses, thats probably an easy choice. Take the distribution, pay the taxes you owe, and use the money as needed. But if you are already receiving enough income to cover your bills through a job, Social Security, or any pension or investment income, it may help to develop a strategy for making the most of your distributions. Here are some options for doing just that:

Donate it. If you donate your distribution or a portion of it to a qualified charity, the amount of the distribution you donate is taxable, but may qualify as a tax deduction.

Make a qualified charitable distribution . When you reach 70½, you can request up to $100,000 be sent directly to a qualified charity as a non-taxable distribution from your IRA. The QCD also counts towards your RMD for the year once you reach age 72. But if you make deductible traditional IRA contributions and also request a QCD, the QCD amount will be reduced by the amount of the traditional IRA deductions.

Start early and move some money to a Roth IRA. Even if youre years away from turning 70, it may be helpful to plan ahead.

You May Like: Can I Invest My 401k In Gold

What Is A Solo 401 And Who Is Eligible

A solo 401 is an individual 401 designed for the self-employed and for business owners with no full-time employees.

A solo 401 is really special because you have the option of putting aside so much money for your future, money expert Clark Howard says. Youre able to take a huge amount of what you earn, if you can afford to, and put it in a solo 401.

| Rules & Limits |

|---|

| No age/income restrictions can’t have qualifying employees |

| Employee Contribution Limit |

| $6,500 |

| Total Contribution Limits |

| Depends on whether your account is traditional, Roth or both |

#tablepress-420 from cache

Although it’s similar to a traditional 401 retirement account, a solo 401 is unique: You can contribute as an employer and as an employee. It also imposes fewer rules and requires less paperwork than a typical 401 plan.

The other brilliant thing about solo 401 plans is that, at least in theory, they offer a Roth option . Unless you’re in a high tax bracket, Clark wants you to contribute your solo 401 funds into a Roth option.

If youre a freelancer, you operate a side hustle or you own your own business, a solo 401 can be a great way to save and invest for retirement. The only requirements are:

- You must make self-employment income.

- You cannot have any “qualified” employees.

In this case, a qualified employee is someone who has worked for your company for at least one year and has worked at least 1,000 hours per year.