Rollover 401 To Roth Ira Tax Consequences

If you intend to roll over your 401 to a Roth IRA, you must first pay the taxes to progress. Rolling over your 401 to standard and Roth IRA, on the other hand, enhances your chances of tax diversification. This is particularly typical among individuals who are potentially unpredictable for the future.

If you believe your future or retirement plans will change from your current situation, you should diversify your investment portfolio so that you have two options when it comes to taxes. You retain your entire investment with a Roth IRA and may get substantial dividends. Youll also be able to gain certain tax benefits with a Traditional IRA or 401 plan.

Taxes On Roth 401k To Ira Rollover

In 2019 I rolled a long-standing Roth 401k into a new Roth IRA and withdrew the funds. I had the investment company withhold 10%, thinking that would cover or more than cover my maximum penalty. After entering the 1099-R into TurboTax, it shows I owe a very large sum in taxes still. A few questions:

– Is this in error or are these circumstances under which the funds are treated as new income that can be taxed again?

– Does the 10% penalty apply to the entirety of the funds, or just the portion which was earnings in the 401k years and in the IRA after transfer?

– Should the investment company have told me, or be able to tell me, how much is true contributions vs. earnings?

– Is there somewhere in TurboTax where I need to enter additional information to indicate the portion of the funds which has already been taxed?

How To Do A Rollover

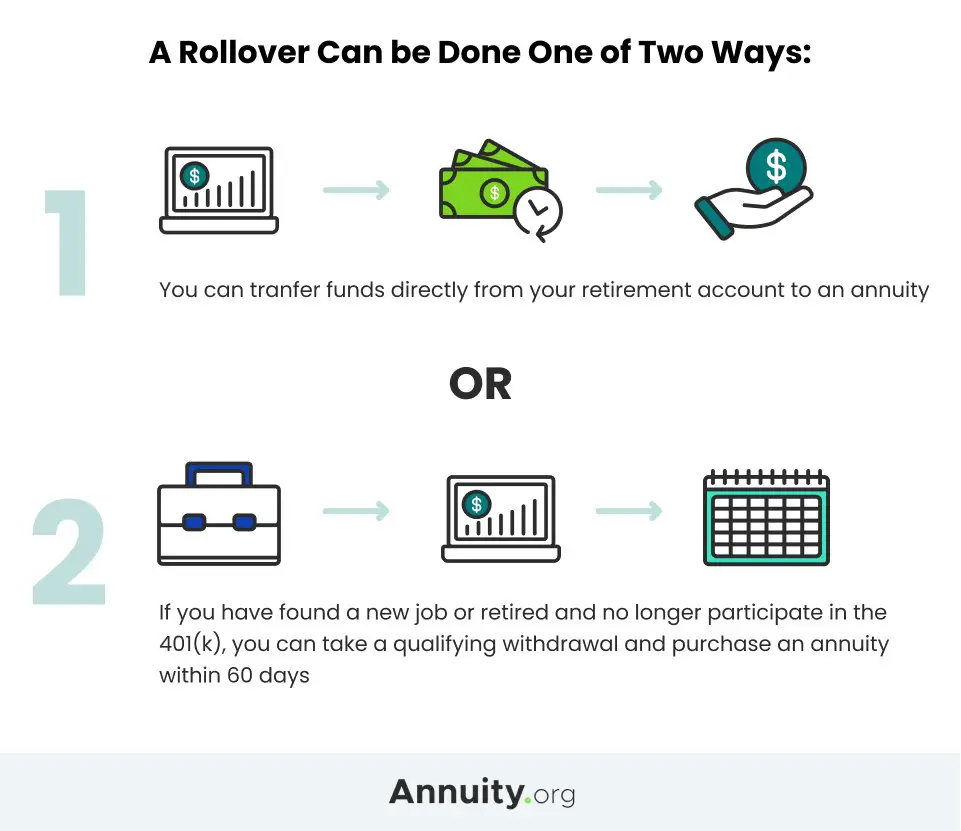

The mechanics of a rollover from a 401 plan are fairly straightforward. Your first step is to contact your companys plan administrator, explain exactly what you want to do, and get the necessary forms to do it.

Then, open the new Roth IRA through a bank, a broker, or an online discount brokerage.

Finally, use the forms supplied by your plan administrator to request a direct rollover, also known as a trustee-to-trustee rollover. Your plan administrator will send the money directly to the IRA that you opened at a bank or brokerage.

Read Also: Can I Withdraw From My 401k To Buy A House

Figure Out Which Type Of Ira You Need

Set up an IRA account if you do not already have one. You can choose between several types of IRA, though the two most common are Roth and traditional. Rolling your 401 over is easier if you move it into the same type of IRA, namely traditional into traditional, or Roth into Roth. However, that’s not the only thing to consider when moving your 401, and a different type of IRA might turn out to be best for your finances.

Anyone can set up a traditional IRA. A Roth IRA, however, has an income restriction. Individuals who make more than a certain amount may not contribute to a Roth IRA. Both types of IRA have tax benefits, but the timing of the tax benefits depends on the type of IRA.

The breakdown is, essentially, that you won’t pay taxes on a traditional IRA until you withdraw the money, whereas your Roth IRA contributions are after tax, so you won’t pay any taxes later when you take the money out. Depending on what tax bracket you’re in when you contribute and what tax bracket you anticipate being in when you retire, one IRA option will make more sense than the other. You can also withdraw your Roth contributions without penalty even before you’ve reached retirement age.

Are The Income Eligibility Limits Still In Place To Make An Annual Contribution To A Roth Ira

Yes. The income limits for annual contributions are still in effect, so its possible to take advantage of a Roth conversion but not be eligible to make an annual contribution. Since there are no income eligibility limits for conversions, however, one common strategy is to make a non-deductible contribution to a Traditional IRA then convert it to a Roth IRA. This may not be an appropriate strategy if you have other Traditional, SEP, or SIMPLE IRA balances, as the pro-rata rule would apply. Please consult a tax advisor to see if this strategy would work for you.

You May Like: Can You Use Your 401k As Collateral For A Loan

No Retirement Minimum Distribution

When you are willing to withdraw your money or contribution, you can do so. However, when you reach the age of 70.5, you must withdraw funds from both a standard IRA and a 401. This is done so that the IRA investor may begin paying taxes.

There are no such restrictions with a Roth IRA. When you reach the age of 70, you must withdraw a portion of your RMDs. RMDs are needed in most 401 accounts but not in Roth IRA. However, if your Roth IRA was inherited, you may be obligated to pay the RMDs on time. Withholding RMDs on time might lead to serious consequences. If someone fails to meet the April 1st deadline, they will face a 50% penalty.

If someone fails the April 1st date for their first withdrawal, they will face a 50% penalty rate. The RMDs will be considered part of your annual income, and you will be required to pay taxes on them as usual. The main disadvantage of RMDs is that they add extra earnings to your account, which may result in a high tax rate.

Rolling Over To A Roth Ira

Rolling over a Roth 401 to a Roth IRA is often the best option when you leave your job. This can be the right choice because:

- Roth 401 accounts aren’t as common as traditional accounts, and your new employer may not offer a Roth 401 you can move your money into.

- You’ll have your choice of brokerage firms, so you can open your Roth IRA wherever you’re comfortable investing.

- You’ll almost always have more investment options in a Roth IRA. Most Roth 401 accounts offer a limited choice of investments, but a Roth IRA allows you to invest in virtually any stocks, bonds, or other assets.

- You do not have to take required minimum distributions from a Roth IRA, but you do have to take RMDs from a Roth 401. RMDs start after age 72.

Rolling over a Roth 401 to a Roth IRA enables you to retain the tax benefit these accounts provide, which is the ability to withdraw money tax-free as a retiree as long as you’ve followed certain rules. You also avoid any tax penalties that could result if you withdraw but don’t roll over money from your Roth IRA when leaving your job before you are 59 1/2.

Fortunately, rolling over funds from a Roth 401 to a Roth IRA can be very simple. You’ll need to open a Roth IRA with a brokerage of your choosing and contact your 401 plan administrator to arrange a transfer of funds to your new account. This is called a trustee-to-trustee transfer, and it reduces the potential for tax consequences.

Read Also: How To Open A 401k Plan

Check Your Employer Contribution

If you haven’t already left your job, check whether your employer’s contribution to your 401 has vested. If it hasn’t, determine the time period you need to wait for it to vest. If it’s only a small amount of time and you have the option of remaining in your job for a few more months, waiting for the employer contribution to vest is valuable to your retirement finances.

Why Roll Your 401 Into A Roth Ira

We assure you that we agree with your rationale if youve opted to rollover your current 401 plan to a Roth IRA. With Roth IRA funds, you must pay taxes now rather than at the withdrawal time. If youre not sure why a 401 rollover is beneficial, it will depend on your present situation and future intentions.

If you will be taxed at a high rate when you retire, it is critical that you pay the taxes now rather than whenever you retire. You must pay taxes on withdrawals from a Roth IRA, which appears to be a pretty honest positive point. Here are some of the most compelling reasons to choose a 401 rollover.

Don’t Miss: Can I Use 401k Money To Start A Business

Benefits Of Converting A 401 To A Roth Ira

- Youll lock in a zero future tax liability. By voluntarily converting your 401 to a Roth IRA now, youll pay taxes now, but youll also give your money an opportunity to grow completely unrestrained by taxes for the rest of your life.

- IRAs tend to be more flexible. Since an IRA is an independent retirement account, you dont necessarily have to be in any sort of formal employment relationship to open one Money in an IRA is free of the common restraints that typically come with the standard 401 plan youll find at your employer.

- Youll be free to invest in what you want. Most 401 plans have set investment menus that youll need to choose from with IRAs, youll have significantly more choice in terms of how you can invest your money.

There are also some major costs involved with converting your 401 to a Roth IRA.

Do I Have To Pay Taxes When I Rollover A 401k To A Roth Ira

A taxable event is rolling over your 401 plan to a Roth IRA. Your contributions, employer-match contributions, and all earnings will be subject to income tax. This could put you in a considerably higher tax bracket, depending on the size of your account, so dont do it unless youve done the arithmetic. You should also speak with a financial expert to ensure that this is the correct decision for you.

Recommended Reading: What Is Better For Retirement 401k Or Ira

Smart Steps To Converting A 401 To An Ira

The world of retirement investment and planning is full of options. If you have a 401 account, you might encounter one of multiple reasons to instead convert it to an IRA. Whether you’re leaving a current job or simply want more control over your investments, here are some things to consider and some steps to take when making the conversion.

Leaving Money To Others

If you’re planning to leave retirement savings to heirs, consider how it may affect their taxes. Due to the SECURE Act, heirs will be required to withdraw the full account balance of an inherited IRA by the 10th anniversary of the original owner’s passing. Inherited traditional IRA withdrawals generate taxable income, and heirs may be forced to take these withdrawals during their peak earning years. These distributions could incur taxes when they’d rather avoid them, or unintentionally push them into a higher tax bracket. Inheriting Roth IRA assets, which generally don’t incur any income taxes, can be a benefit to your heirs. In addition, the income taxes paid on a Roth IRA conversion may also help reduce the size of a taxable estate.

But there are many details to consider. For example, if your heirs are likely to be in a much lower tax bracket than you are, it may be advantageous to leave them a traditional IRA. That’s because it may be better for them to pay lower taxes in the future than for you to pay higher taxes now.

Also, Roth IRA conversions may be disadvantageous to those who intend to leave at least some of their assets to charitable institutions. Traditional IRAs can typically be left to charity without any tax bill at all for either party. So, in that case, conversion will mean that the tax was paid needlessly.6

Read Viewpoints on Fidelity.com: An all-in-one wealth transfer checklist

Recommended Reading: Can Business Owners Have A 401k

Higher Pay And Taxes In The Future

With a Roth IRA, you pay taxes on your current income and invest the money in your retirement accounts. However, you will not be required to pay any taxes on your pay-outs. Thats a bonus in this case. In any case, you must pay the taxes.

However, if you believe you will earn more money in retirement, rolling over to a Roth IRA may be better. Because there is no tax on future distributions, you will get all of your dividends and profits at once. And if you wish to start a business or start-up after retirement, you will be able to do so without sustaining any losses.

Annuitization Calculator To Determine Taxes

But paying taxes now isnt always a bad thing. In fact, some would argue that you can better afford the taxes now, while youre still working. Claiming the rollover on your taxes when you have a decent salary coming in will likely be easier than paying taxes on the money youre taking out when youre in your 60s or 70s and no longer have a steady paycheck coming.

Another argument for paying the taxes now is that youll probably pay less than you will down the road, assuming tax rates increase over time. This, of course, may be a bigger difference if youre younger rather than just a few years away from retirement. You can find annuitization calculators online that can help you determine just how much youll get each month from your various investments to determine what youll need to live on.

Recommended Reading: Do I Have To Split My 401k In A Divorce

How Do You Convert To A Roth Ira

The actual process for converting a 401 or traditional IRA to a Roth IRA is simple. In fact, its so straightforward that you can create problems before youre aware that youve done so.

Here are the three basic steps to convert your retirement account to a Roth IRA:

If you manage your own funds, you should be able to find steps to do a Roth conversion on your investment platforms site, says Kerry Keihn, financial advisor at Earth Equity Advisors in the Asheville area, noting that each institution has a slightly different process or forms.

Within a couple weeks and often sooner the conversion to the Roth IRA will be made.

When it comes time to file taxes for the year you made the conversion, youll need to submit Form 8606 to notify the IRS that youve converted an account to a Roth IRA.

How To Roll Your Roth 401 To A Roth Ira

The process might seem complicated, but its typically straightforward if you know what to expect. In the case of Roth accounts, taxes are no longer part of the equation which makes a rollover even easier. This process wont work if youre still with your employer, but if youve found a new role and are looking to move an old Roth 401, read on.

Also Check: Should I Roll Over 401k To Ira

Should You Convert To A Roth 401

If your company allows conversions to a Roth 401, youll want to consider two factors before making a decision:

Read Also: How Much Can You Put Into A Solo 401k

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

You May Like: Do I Have A 401k From A Previous Employer