What Happens If I Stop Contributing To My 401k

If you are considering stopping contributions to a 401k, you would be better served to merely suspend those contributions. A short-term suspension will slow the performance of your retirement fund, but it wont keep it from growing. It also will lessen the temptation to simply withdraw all the funds and wipe out retirement savings in the process.

Build An Emergency Fund

This should be the foundation of your financial plan and experts recommend having about six months worth of expenses saved. You can park this money in a high-yield savings account to earn more interest than you would in a traditional checking account. An emergency fund should help you manage most of lifes curveballs.

What Are The Pros And Cons Of Withdrawal Vs A 401k Loan

| Pros and Cons of 401k Withdrawal vs. 401k Loan | ||

|---|---|---|

| 401k Withdrawal | ||

|

|

|

| Cons |

|

|

Read Also: How Can I Find Out If I Have 401k Money

Special Rules Resulting From The Coronavirus Pandemic

It should be noted that the CARES Act of 2020 gave employers the option to amend their 401 plans only if they so choose to allow investors who are impacted by the coronavirus to gain access to of their retirement savings without being subject to early withdrawal penalties and with an expanded window for paying the income tax they owe on the amounts they withdraw per The Security and Exchange Commissions Office of Investor Education and Advocacy .

An employer could amend their plan by allowing coronavirus-related distributions but not increasing the 401 loan limit, according to Porretta.

The SECs OIEA guidance on the CARES Act allowed qualified individuals impacted by the coronavirus pandemic to pay back funds withdrawn over a three-year period , and without having the amount recognized as income for tax purposes.

For income taxes already filed for 2020, an amended return can be filed. The 10 percent early withdrawal penalty was also waived for withdrawals made between Jan. 1 and Dec. 31, 2020. It also waived the mandatory 20 percent withholding that typically applied.

The Act also allowed plan participants with outstanding loans taken before the Act was passed but with repayment due dates between March 27 and Dec. 31, 2020 to delay loan repayments for up to one year. .

Dividing Your 401 Assets

If you divorce, your former spouse may be entitled to some of the assets in your 401 account or to a portion of the actual account. That depends on where you live, as the laws governing marital property differ from state to state.

In community property states, you and your former spouse generally divide the value of your accounts equally. In the other states, assets are typically divided equitably rather than equally. That means that the division of your assets might not necessarily be a 50/50 split. In some cases, the partner who has the larger income will receive a larger share.

For your former spouse to get a share of your 401, his or her attorney will ask the court to issue a Qualified Domestic Relations Order . It instructs your plan administrator to create two subaccounts, one that you control and the other that your former spouse controls. In effect, that makes you both participants in the plan. Though your spouse cant make additional contributions, he or she may be able to change the way the assets are allocated.

Your plan administrator has 18 months to rule on the validity of the QDRO, and your spouses attorney may ask that you not be allowed to borrow from your plan, withdraw the assets or roll them into an IRA before that ruling is final. Once the division is final, your former spouse may choose to take the money in cash, roll it into an IRA or leave the assets in the plan.

You May Like: Should I Put My 401k Into An Ira

Congress Passes Secure 20 Act Making Important Changes To 401s

Enter your email address to instantly generate a PDF of this article.

The last act of the 117th Congress was to pass the Consolidated Appropriations Act, 2023. Tucked not-so-deep into the CAA is the SECURE 2.0 Act of 202290+ provisions focused on 401 and other retirement plans. SECURE 2.0 builds on what we can now call SECURE 1.0, which was enacted in 2019.

SECURE 2.0 is an expensive piece of legislation. Congress has chosen to pay for it by mandating that plans offering certain 401 features, like catch-up contributions, be made on an after-tax, Roth basis.

Every mention of the word Roth will require significant adjustments to your payroll system to accommodate after-tax withholding. At a minimum, Payroll, HR and Benefits will need to work together to ensure the following:

- All eligible participants are timely enrolled into an auto-enrollment plan, and the proper amount is withheld and invested prudently, if employees dont indicate their investment choices

- All qualified part-time employees are enrolled in the plan and pretax deductions are made from their pay

- Determining employees wages for catch-up contribution purposes.

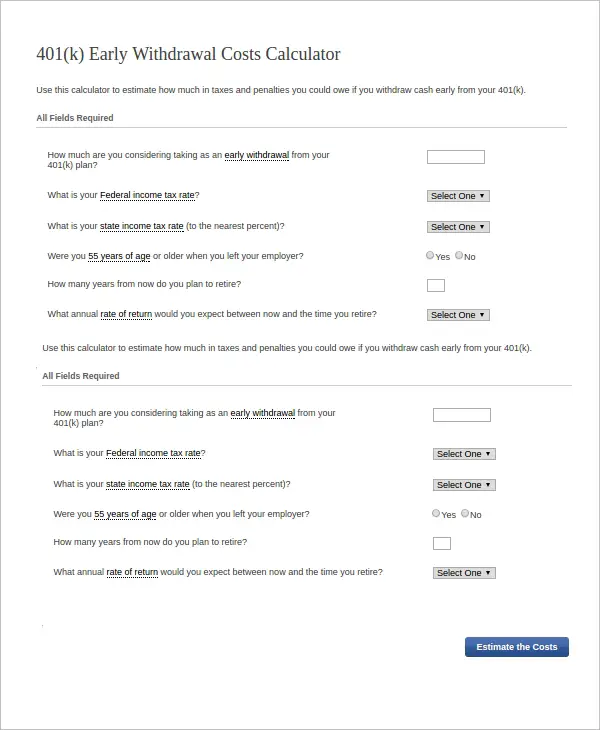

How To Calculate Your Mandatory Withdrawal Amount

Once you turn 72, you are required to withdraw a specific amount from your 401 each year. You must take out this amount by December 31 of each year to avoid penalties. Take out too little, and the remaining amount will still be penalized.

To make sure you are withdrawing the correct amount from your 401, the IRS provides a calculation so you can zero in on the exact amount you need to withdraw.

To get your annual amount, divide your 401 balance as of December 31 of the previous year by your life expectancy factor.

An exception to this requirement is if your spouse is the only primary beneficiary and they are 10 years younger than you, use the IRS Joint Life Expectancy Table instead.

You May Like: How To Pull Out Your 401k Early

Withdrawing After Age 595

Hardship Withdrawals Hit A Record High

The share of retirement savers who withdrew money from a 401 plan to cover a financial hardship hit a record high in October, according to data from Vanguard Group.

That dynamic when coupled with other factors like fast-rising credit card balances and a declining personal savings rate suggests households are having a tougher time making ends meet amid persistently high inflation and need ready cash, according to financial experts.

Nearly 0.5% of workers participating in a 401 plan took a new “hardship distribution” in October, according to Vanguard, which tracks 5 million savers. That’s the largest share since Vanguard began tracking the data in 2004.

Put another way, roughly 25,000 workers took one of these distributions.

Meanwhile, savers have been dipping into their nest eggs via other means loans and “non-hardship” distributions in higher numbers throughout 2022, according to Vanguard data.

“We are starting to see signs of financial distress at the household level,” Fiona Greig, global head of investor research and policy at Vanguard, previously told CNBC.

That said, the overall monthly share of people taking a hardship withdrawal is relatively small and not indicative of the “typical” 401 saver, she added.

Read Also: How Much Tax On 401k Withdrawal

Beware 401 Balance Minimums

If your account balance is less than $5,000 and youve left the company, your former employer may require you to move it. In this case, consider rolling it over to your new employers plan or to an IRA.

If your previous 401 has a balance of less than $1,000, your employer has the option to cash out your accounts, according to FINRA.

Always keep track of your hard-earned 401 money and make sure that it is invested or maintained in an account that makes sense for you.

Recommended Reading: How Does Company Match Work For 401k

When You Leave A Job

When you leave a job, you generally have the option to:

- Leave your 401 with your current employer

- Roll over the funds to an IRA

- Roll over the funds to your new employer’s 401.

If you choose any of those options, you will not owe taxes or a 10% penalty. You can also take this money as a distribution, but this will trigger early withdrawal penalties if you are under 59 1/2 .

Don’t Miss: Can You Move Money From Ira To 401k

You Want An Extra Place To Stash Retirement Savings

Roth IRAs enable you to save up to $6,500 in 2023 if you’re under 50 or $7,500 if you’re 50 or older. These limits aren’t as high as 401 limits, but they are up slightly from 2022. Roth IRAs make great homes for your savings if you don’t have access to a workplace retirement plan or if you don’t like the investments or fees your current workplace plan has.

Image source: Getty Images.

High earners will need to be mindful of the Roth IRA income limits to avoid penalties. Some may still be eligible to contribute some money directly to a Roth IRA, though their annual contribution limit may be lower than the figures above. Others may not be able to contribute any money to a Roth IRA directly. But they can still do a backdoor Roth IRA where they put money in a traditional IRA first and then do a Roth IRA conversion in the same year.

What Are The Advantages Of Borrowing Money From Your 401

- You won’t pay taxes and penalties on the amount you borrow, as long as the loan is repaid on time.

- Interest rates on 401 plan loans must be consistent with the rates charged by banks and other commercial institutions for similar loans.

- In most cases, the interest you pay on borrowed funds is credited to your own plan account you pay interest to yourself, not to a bank or other lender.

You May Like: How To Contact My 401k

Exceptions To The Penalty

The IRS permits withdrawals without a penalty for certain specific uses. These include a down payment on a first home, qualified educational expenses, and medical bills, among other costs.

As with the hardship withdrawal, you will still owe the income taxes on that money, but you wont owe a penalty.

Read Also: How To Invest Money From 401k

Wait To Withdraw Until Youre At Least 595 Years Old

If all goes according to plan, you wont need your retirement savings until you leave the workforce. By age 59.5 , you will be eligible to begin withdrawing money from your 401 without having to pay a penalty tax.

Youll simply need to contact your plan administrator or log into your account online and request a withdrawal. However, you will owe income taxes on the money , so a portion of each distribution should be designated to cover your tax liability. 401 withdrawals arent mandatory until April 1 of the year after you turn 72 , at which point you must take a required minimum distribution every year.

Recommended Reading: How Much Can I Convert From 401k To Roth Ira

Common 401 Loan Questions

Can I borrow against my 401? Check with your plan administrator to find out if 401 loans are allowed under your employers plan rules. Keep in mind that even though youre borrowing your own retirement money, there are certain rules you must follow to avoid penalties and taxes.

How much can I borrow against my 401? You can borrow up to 50% of the vested value of your account, up to a maximum of $50,000 for individuals with $100,000 or more vested. If your account balance is less than $10,000, you will only be allowed to borrow up to $10,000.

How often can I borrow from my 401? Most employer 401 plans will only allow one loan at a time, and you must repay that loan before you can take out another one. Even if your 401 plan does allow multiple loans, the maximum loan allowances, noted above, still apply.

What are the rules for repaying my 401 loan? In order to be compliant with the 401 loan repayment rules, youll need to make regularly scheduled payments that include both principal and interest, and you must repay the loan within five years. If youre using your 401 loanto buy a primary residence for yourself, you may be able to extend the repayment period. What if I lose my job before I finish repaying the loan? If you leave or are terminated from your job before youve finished repaying the loan, you typically have 60 days to repay the outstanding loan amount.

Summary of loan allowances

Tips On 401 Withdrawals

- Talk with a financial advisor about your needs and how you can best meet them. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- If youre considering withdrawing money from your 401 early, think about a personal loan instead. SmartAsset has a personal loan calculator to help you figure out payment methods.

Also Check: How To Take My Money Out Of 401k

Series Of Substantially Equal Periodic Payments

This is the classic Section 72t ) method for early withdrawal exceptions to the penalty. Essentially you agree to continue taking the same amount from your plan for the greater of five years or until you reach age 59½. There are three methods of SOSEPP:

7. Required Minimum Distribution method uses the IRS RMD table to determine your Equal Payments.

8. Fixed Amortization method in this method, you calculate your Equal Payment based on one of three life expectancy tables published by the IRS.

9. Fixed Annuitization method this method uses an annuitization factor published by the IRS to determine your Equal Payments.

Section 72 provides additional methods for premature distribution exceptions which can occur before leaving employment :

10. High Unreimbursed Medical Expenses for yourself, your spouse, or your qualified dependent. If you face these expenses, you may be allowed to withdraw a limited amount without penalty.

11. Corrective Distributions of Excess Contributions under certain conditions, when excess contributions are made to an account these can be returned without penalty.

12. IRS Levy when the IRS levies an account for unpaid taxes and/or penalties, this distribution is generally not subject to penalty.

And lastly, here are a few additional ways that you can withdraw your 401k funds without penalty:

Originally by Financial Ducks In A Row, 1/20/20

POPULAR ARTICLES AND RESOURCES FROM ETFTRENDS.COM

How Do You Withdraw Money From Your 401 After Retirement

There are a few different ways that you can withdraw money from your 401 after retirement. The most common way is to take out a loan from the account. This is usually the easiest and quickest way to access your funds. Another option is to roll over the account into an IRA. This can be a good choice if you want to keep the money invested for growth. Finally, you can cash out the account entirely. This is usually not recommended, as you will be subject to taxes and penalties on the withdrawal.

Recommended Reading: How To Find How Much Is In My 401k