Secure Plan Administrator Registration

To register for the Manulife Group Benefits secure site for the first time, please complete the Plan Administrator Registration Form and the Electronic Administration of Policy Agreement. To obtain these forms, please contact our Customer Service Centre at 1-866-318-2727 between 8 a.m. and 8 p.m. EST Monday to Friday.

If you already have access and need to provide access to another administrator, the form can be found on the secure site under Plan Documents -> Find Forms and Brochures.

These forms are in .pdf format and require Adobe Acrobat Reader to be opened. If you do not have Adobe Acrobat’s free Reader software, you may download it now from Adobe’s Web site.

Is It Time For A New 401 Plan Administrator

Exorbitant fees are the primary reason employers change 401 plan administrators. Yet, a recent survey found only 27 percent of people knew how much they were paying in 401 fees. This information is commonly disclosed in mutual fund prospectuses and annual reports.

The plan sponsor typically retains control over hiring or firing a 401 plan administrator. Union employees may have their 401s governed by a board of trustees who oversee the plans implementation. Yet, employee lobbies can also sway companies to take another look around and reconsider how much the plan is costing workers. After all, these fees come out of employee earnings.

Learn more about affordable 401 plans for low flat monthly fees by contacting Ubiquity.

Look For Contact Information

If you dont know how to contact your former employer perhaps the company no longer exists or it was acquired or merged with another company see if you have any old 401 statements. These should have contact information to help put you in touch with the plan administrator.

If you dont have an old 401 statement handy or yours doesnt tell you what you need to know, visit the U.S. Department of Labor website and look up your employer. There you should find your old retirement accounts tax return, known as Form 5500. That will most likely have contact information for your 401s plan administrator.

Read Also: How To Convert 401k To Silver

Contributing To Your 401 Retirement Plan

Contributing to a 401 plan is traditionally done through ones employer.

Typically, the employer will automatically enroll you in a 401 that you may contribute to at your discretion.

If you are self-employed, you may enroll in a 401 plan through an online broker, such as TD Ameritrade.

If your employer offers both types of 401 accounts, then you will most likely be able to contribute to either or both at your discretion.

To reiterate, with a traditional 401, making a contribution reduces your income taxes for that year, saving you money in the short term, but the funds will be taxed when they are withdrawn.

With a Roth 401, your contributions can be made only after taxation, which costs more in the short term, but the funds will be tax free when you withdraw them.

Because of this, deciding which plan will benefit you more involves figuring out in what tax bracket you will be when you retire.

If you expect to be in a lower tax bracket upon retirement, then a traditional 401 may help you more in the long term.

You will be able to take advantage of the immediate tax break while your taxes are higher, while minimizing the portion taken out of your withdrawal once you move to a lower tax bracket.

On the other hand, a Roth 401 may be more advantageous if you expect the opposite to be true.

In that case, you can opt to bite the bullet on heavy taxation today, but avoid a higher tax burden if your tax bracket moves up.

How Do 401 Distributions Work

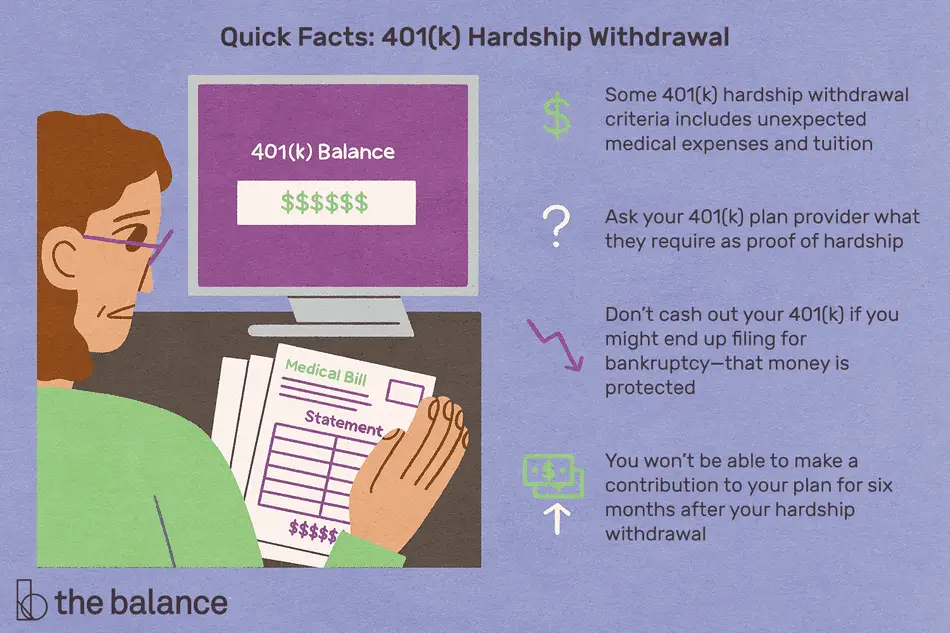

When you turn 59½, you can take distributions at any size or frequency that you like. You can even take it all out at once, but large distributions will increase your tax bill. Many people like to leave their money in their 401 and let it keep growing. However, you must start taking required minimum distributions by April 1 of the year after you turn 72. In many cases, you can delay these distributions if you are still working.

You May Like: Can I Rollover Old 401k To New 401k

Finding Old Retirement Accounts

You may want to start by contacting your former employers and the plan administrators, the companies that ran the retirement plan. Sometimes, youll find that your retirement account is still there and chugging along as is, hopefully growing in value over time. If you want, you may be able to leave it there, although update the company with your current contact information so it can let you know about any important changes.

However, its not always that easy. If your account had less than $5,000 in it when you left, the plan administrator can transfer the funds to an individual retirement account that was set up in your name. If it had less than $1,000, the company may have tried to send you a check for the amount to the address it had on file. You may also have trouble tracking down the account if the company went bankrupt or switched plan administrators, leaving it up to you to figure out who is holding onto the money now.

One thing is certainother companies dont get to keep your money. If a company cant figure out how to contact you, it has to turn unclaimed funds over to state agencies. You can start searching for your unclaimed funds in these databases:

Once you find your account or money, youll still need to decide what to do with it.

You May Like: Should I Take A 401k Loan To Pay Off Debt

Contact Your Former Employer

The first place you should look is your prior employer. Contact their human resources department. There, they should have all of the information as to the whereabouts of the 401 account you had with them.

They should send you the proper paperwork and be able to facilitate the transfer of your funds to whatever account you choose.

If they are unable to locate any information on your account, they should be able to provide you the contact information of the administrator who handled your 401 on their behalf.

Let the administrator know your situation, and just like the HR department, should be able to assist you in moving your money properly.

Recommended Reading: How To Transfer Roth 401k To Roth Ira

Fidelity Routing Number United States

Fidelity Routing Number is used for wire transfer transactions in your bank. Fidelity is not the usual brick-and-mortar bank. It focuses on brokerage accounts while functioning as a checking account too. Fidelity even has FDIC insurance for deposits, and it also offers interests with consumer-friendly policies. To boot, it yet has basic savings accounts. If you want a free cash account with little interest, this Fidelity will work for you. You can also get the routing numbers of similar banks in our complete Routing Numbers List.

Meanwhile, you can also wire money with Fidelity. Before you can do this, you need to have Fidelity direct deposit or direct debit routing numbers. Ensure that your Fidelity account is a checking account in the case of Automated Clearing House .

Ways Of Finding My Old 401ks Including Using Ssn

If youâve ever left a job and wondered âWhere is my 401?â, youâre not alone. Locating 401âs is complicated. Thus, billions of dollars are left behind each year. Beagle can help track down your money.

Contributing to an employer-sponsored 401 plan is a great way to build wealth for retirement especially if youâre receiving a match from your company. The problem is they are tied to an individual employer. We forget about them, leave that company, and one day we realize âOh yeah! Where is my 401?â

A 401 can be in a few different places. Most commonly it could be with your previous employers, an IRA they transferred your funds to after you left, or mailed to the address they had on file.

Believe it or not, Americans unknowingly abandoned $100 billion worth of unclaimed 401 accounts. According to a US Labor Department study, the average worker will have had about 12 different jobs before they turn 40. So itâs easy to see how we can lose track of so much 401 money.

To find your old 401s, you can contact your former employers, locate an old 401 statement, search unclaimed asset database in different states, query 401 providers using your social security number or better yet, get some help to find your 401 accounts from companies like Beagle.

Read Also: What Happens To Your 401k When You Die

How To Contact My 401 Plan Administrator

If you need to find out how to get hold of your plan administrator, your employers human resources officer or department will have this information.

The plan statements that you receive will also most likely show the contact information of the administrator so that you can call or email them if you need to.

It may also list the administrators website, where you can go to get further contact information if necessary.

The plan administrator will most likely have a group of employees working in a call center who are devoted to servicing the individual requests and demands of the plan participants.

Write Us Or Return Forms

You can send correspondence or completed benefits-related forms to ETF.

Wisconsin Department of Employee Trust FundsP.O. Box 7931

Wisconsin Department of Employee Trust FundsHill Farms State Office Building, 8th Floor

Note: While at ETF and the Hill Farms State Office Building, please wear a face mask if you are not fully vaccinated for COVID-19. For the latest information on ETF services and operations due to the pandemic, please go to ETF Response to COVID-19.

Don’t Miss: Should I Contribute To Roth Or Traditional 401k

Don’t Leave Your 401 Behind Here’s How To Reclaim Your Hard

Switching jobs pulls your mind in several directions at once, and it’s easy for your old 401 to get lost in the shuffle. But you can’t afford to forget about it for good. Building a nest egg to sustain you for decades is tough, so you can’t afford to leave any old retirement accounts behind. If you’ve lost track of your old 401, take these steps to find it and put that money to good use.

What Is Amazons 401 Plan

Like many major employers, Amazon offers its employees a 401 plan to help them save for retirement.

Under the plan, Amazon allows its employees to contribute between 1% and 9% of their salary to either a traditional or Roth 401, or use a combination of the two. Amazon employees can choose to invest their contributions in one or more of the following funds:

- Amazon.com Stock Fund

- American Beacon Small Cap Value Fund R6 Class

- American Funds EuroPacific Growth Fund Class R-6

- Oakmark International Fund Class Institutional

- RIMCO Total Return Fund Institutional Class

- State Street Russell Large Cap Growth Index Non-Lending Series Fund Class C

- State Street Russell Large Cap Value Index Non-Lending Series Fund Class C

- Vanguard Explorer Fund Admiral Shares

- Vanguard FTSE Social Index Fund Institutional Shares

- Vanguard Institutional 500 Index Trust

- Vanguard Institutional Total Bond Market Index Trust

- Vanguard Institutional Total International Stock Market Index Trust

- Vanguard Retirement Savings Trust III

- Vanguard Target Retirement Trust Select

- Vanguard Target Retirement Income Trust Select

Full-time and eligible reduced-time Amazon employees are automatically enrolled in the companys 401 plan 90 days after hire unless they unenroll or actively enroll themselves. Employees who are automatically enrolled will have their contributions invested into a target-date fund. Employees can also choose their own investments from the provided options.

Also Check: How Do You Get 401k

Delegating The Investing Decisions

A company or its plan sponsor often delegates the responsibilities for investing money in the funds to professional investment companies.

The retirement plan sponsor will typically hire an outside investment advisor to handle the investment of the plan’s assets. In the case of a defined contribution plan like a 401, the investment advisor will help select the plan investment menu to be offered to the plan participants. In the case of a defined benefit pension plan, the outside advisor will typically manage the investments in a fashion agreed upon with the plan sponsor.

These service providers, regardless of whether they are employees of the administrator or third parties, are subject to the same duty of care as the administrator.

Where Can I Find Out More Information On Qrp Distribution Options

Are you considering the various options for the savings you have accumulated in your qualified employer sponsored retirement plans , such as a 401, 403, or governmental 457? Know that what you choose to do with your current retirement savings can have a substantial impact on your future.

You generally have four options for your QRP distribution:

- Roll over your assets into an Individual Retirement Account

- Leave your assets in your former employers QRP, if allowed by the plan

- Move your assets directly to your current/new employers QRP, if allowed by the plan

- Take your money out and pay the associated taxes

The option that is best depends on your individual circumstances. You should consider features such as fees and expenses, services offered, investment choices, when distributions are no longer subject to the 10% additional tax, treatment of employer stock, when required minimum distributions begin and protection of assets from creditors and bankruptcy. Investing and maintaining assets in an IRA will generally involve higher costs than those associated with QRPs. You should consult with the QRP administrator and a professional tax advisor before making any decisions regarding your retirement assets.

Roll your money over to an IRA,

Asset allocation and diversification are investment methods used to help manage risk. They do not guarantee investment returns or eliminate risk of loss including in a declining market.

Past performance is not a guarantee of future results.

Also Check: How To Self Manage Your 401k

How Much Should I Contribute To My 401

Most financial experts say you should contribute around 10%-15% of your monthly gross income to a retirement savings account, including but not limited to a 401.

There are limits on how much you can contribute to it that are outlined in detail below.

There are two methods of contributing funds to your 401.

The main way of adding new funds to your account is to contribute a portion of your own income directly.

This is usually done through automatic payroll withholding ).

The system mandates that the majority of direct financial contributions will come from your own pocket.

It is essential that, when making contributions, you consider the trajectory of the specific investments you are making to increase the likelihood of a positive return.

The second method comes from deposits that an employer matches.

Usually employers will match a deposit based on a set formula, such as 50 cents per dollar contributed by the employee.

However, employers are only able to contribute to a traditional 401, not a Roth 401 plan.

This is especially important to keep in mind if you want to utilize both types of plans.

A key variable to keep in mind is that there are set limits for how much you can add to a 401 in a single year.

For employees under 50 years of age, this amount is $19,500, as of 2020. For employees over 50 years of age, the amount is $25,000.

If you have a traditional 401, you can also elect to make non-deductible after-tax contributions.

Plan in Advance

What Happens To You 401 If You Quit

If you leave your job at Amazon, you have a few different options for what to do with the money in your 401 plan. First, you can simply decide to leave the money where it is. You might go this route if you arent moving to a company that offers a 401 or if the plan at your new company isnt as good as the Amazon plan.

Next, you can to a 401 plan at your new company. The benefit of this option is the simplicity You only have to keep track of one retirement account, rather than keeping track of one at each of your former jobs. To roll money from a former 401 to your Amazon 401 plan, contact your plan administrator, Fidelity.

Next, you can decide to roll the money into your 401 over into an IRA. You can choose between a traditional IRA or a Roth IRA, but keep in mind that if you roll the money over from a traditional 401 to a Roth IRA, youll have to pay income taxes on the entire amount.

Finally, you can take a lump-sum distribution from your Amazon 401 plan . While this option might seem the most attractive at the moment, it should be saved as a last resort.

First, cashing out your 401 is robbing your future self of retirement funds. And since time in the market is one of the most important factors for how your investments grow, cashing out what youve saved could result in a huge cut to your retirement savings. Another downside of cashing out your 401 is that in addition to paying income taxes on the amount you withdraw, youll also pay a 10% penalty.

Don’t Miss: When You Leave A Company What Happens To Your 401k

Use Resources To Discover Unclaimed Assets

Once you use these resources to locate your funds, you can use the following resources to get access to your unclaimed assets.

You May Like: Can I Use My Fidelity 401k To Buy A House