Think Of Medical Needs Later In Life

Annette Hammortree, CLTC, RICP, and Owner of Hammortree Financial Services

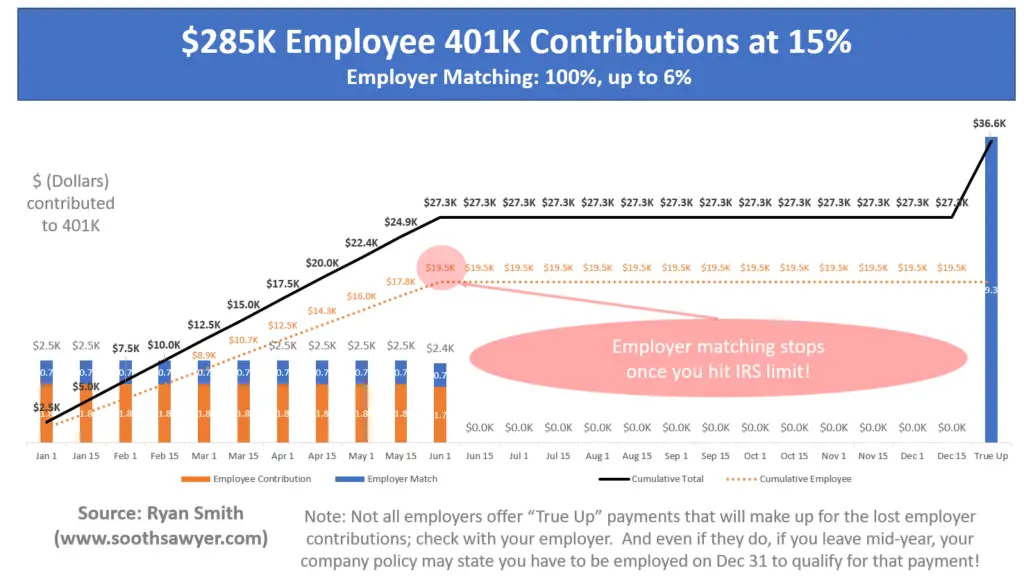

When taking a look at your employers retirement plan, I suggest that you start by contributing 15 percent of your income. The 401 specifically should be for at least the full matching contributions offered by your employer. The next step depends on your goals and objectives.

Once you have committed to matching the 401 contribution, the next step would be to utilize a Health Savings Account, since you can tap into this for medical needs during retirement, as well as starting a Roth IRA. The Roth is important since it provides another bucket to generate income during retirement. The power is in the rate of savings not the rate of return.

I also recommend taking a bucketing approach for different savings objectives, short , intermediate , long term and retirement.

What Kind Of Investments Are In A 401

401 accounts often offer a small, curated selection of mutual funds. Thats a good thing and a bad thing: On the plus side, you may have access to lower-cost versions of those specific funds, especially at very large companies that qualify for reduced pricing.

The negative is that even with discounted costs, that small selection narrows your investment options, and some of the funds offered may still have higher expense ratios than what youd pay if you could shop among a longer list of options. That can make it harder to build a low-cost, diversified portfolio.

Some plans also charge administrative fees on top of fund expenses, which can add up. If your 401 is expensive, contribute enough to earn your company match, and then direct any additional retirement savings contributions for the year into an IRA.

There Are Fees You Pay For Your 401

Unfortunately, 401 plans come with fees but many savers dont realize this. According to TDAmeritrades January 2018 Investor Pulse Survey, 37% of Americans dont know that they pay any 401 fees, 22% dont know if their plan has fees, and 14% dont know how to determine the fees. Typically larger plans will have lower fees but the number of enrollees and the plans provider can also affect the cost. Typically, fees will range from 0.5% to 2% of the plan assets.

Pay attention to each fund’s expense ratio, which is a measure of a fund’s operating expenses expressed as an annual percentage. The lower the expense ratio, the less youll pay to invest. A total expense ratio of 1% or less is reasonable. Look at your 401 plan’s website to find a fund’s expense ratio.

The good news is that your plan may give you access to lower-cost institutional shares, which are cheaper than different share classes of the same investment bought through an IRA. The average equity mutual fund expense ratio for stock funds in 401s was 0.50% in 2020, according to the Investment Company Institute. One way to cut costs: Look to see whether your plan offers index funds, which tend to be cheaper than actively managed funds.

You May Like: How Can You Get A 401k

How To Boost Your Retirement Savings

An employer match is often referred to as “free money,” but a better way to think about it is as part of your total compensation package. You want to contribute up to the match so that you’re getting all of the money your employer owes you and padding your retirement savings.

“A buy-one-get-one-free deal is how I think of it,” Monica Sipes, a certified financial planner and senior wealth advisor at Exencial Wealth Advisors, tells CNBC Make It. “The match is something that’s considered in your overall compensation, so by not taking advantage of it you’re not getting a full freight of what your employer was expecting to pay you.”

Here’s an example of the difference it can make. Let’s say you’re offered a job with a $90,000 salary and 5% 401 employer match, and a job with a $94,000 salary and no match. The $90,000 base is actually the better deal, because if you contribute up to the match, your employer will throw in $4,500, bringing your total compensation to $94,500 for the year. Over time, that will be worth even more as your investment earnings compound.

Even if they’re offering 30 cents on the dollar, that’s an automatic 30% return that you’re getting.Monica SipesSenior Wealth Advisor at Exencial Wealth Advisors

“Even if they’re offering 30 cents on the dollar, that’s an automatic 30% return that you’re getting,” says Sipes. That’s hard to beat.

The Power Of Compound Returns

The earlier you start saving for retirement, the less youll need to save each month. You can thank compounding, which is basically the returns you make on returns. Once youre making money on your earnings, your returns compound at an accelerated rate.

Suppose you want to retire at age 60 with $2 million and that you get average returns of 10%. Thats slightly less than what the S& P 500 index has delivered before inflation over the past 60 years with dividends reinvested.

Heres what youd need to invest, between your own contributions and your employers match, if you have a $50,000 annual salary.

- If you started investing at 20: Youd need to invest $316.25 per month, or 7.6% of your salary.

- If you started investing at 30: Youd need to invest $884.76 per month, or 21.2% of your salary.

- If you started investing at 40: Youd need to invest $2,633.76 per month, or 63.2% of your salary.

The examples above show not only how much more youll have to contribute to your 401 each month if you start saving later, but also how much more youll have to save overall. In the first example, youd invest just under $152,000 total by starting at 20. But if you didnt get started until 40, youd wind up investing more than $632,000 to reach your goal.

Keep in mind that 10% is an average, not the 401 rate of return you should expect every year. Your returns will vary, based on how your investments perform, along with the risk tolerance you indicate when you choose your investments.

Recommended Reading: Which Fidelity 401k Fund Is The Best

Benefits Of Having A 401k

Different 401k plans come with different perks, each with unique advantages.

Tax advantages: Traditionally, the savings in your 401k account is pre-tax. This means that the amount you contribute is exempt from current federal income tax, which also lowers your taxable income. In this case, you dont have to pay tax on the funds until you actually withdraw them. Since most people are in a lower tax bracket during their retirement years, this may lower the amount they pay in taxes on 401k withdrawals. However, depending on the type of plan you have, the tax break can come when you contribute money or withdraw funds during retirement .

Employer matching contributions: In some cases, employers will offer to match the amount you put into your 401k, which is essentially free money! Employers might offer a certain percentage of what you contribute or even dollar-to-dollar matching. Consider saving up to the maximum annual contribution amount because employer contributions dont count towards your annual limit.

Lifetime contributions: In the case of some retirement accounts and IRAs, there is often an age limit for contributions. However, 401k accounts are not subject to this stipulation so you can contribute funds as long as you are working.

Automatic investment: For many, 401k plans may be the easiest way to save for the future because they automatically deduct funds from your paycheck and place them in the account. This way you dont have to think twice about your savings.

But What If You Dont Stay At The Same Job Heres How To Factor In Irregular Income And Raises

Today, many twentysomethings will work several jobs before turning 30. If this is you, it means your income will fluctuate considerably.

Its also possible that your salary could double between the time you start working and your 30th birthday. In these cases, set an absolute 401 savings goal for the time you turn 30 rather than using your annual earnings as a guide. .

Rollover 401s into IRAs when you leave jobs and stay on top of your investments. Keep them simple, like index funds and target-date funds, but make sure theyre aggressive.

Finally, consider opening a Roth IRA and contributing as much as you can to supplement your 401. Unlike your 401, contributions to a Roth IRA are made with post-tax dollars, but once you retire the withdrawals are tax-free.

Related: Where To Invest: 401k, IRA Or Both?

My rule of thumb is that your contributions should be just large enough to feel uncomfortable. Think about what you could contribute. If you say, I wouldnt miss another $100 a month, then consider going higher until you say that might get a little tight. Pull back 5% or 10% from that discomfort zone, and invest away!

Read Also: Where Can I Get 401k Plan

You May Like: When To Withdraw From 401k

Be Sure To Layout A Retirement Budget

Deacon Hayes, Owner & Founder of WellKeptWallet

Everyone’s life and circumstances are unique. Therefore, what works for one person is not going to be a magic formula that works for all. That being said, it’s always better to save more than you need rather than less.

Start by determining the age you would like to retire. Then, create a post-retirement budget to help you determine how much money you will need to save up ahead of time. Don’t forget to include vehicles, insurance, taxes, and other expenses that are not always monthly.

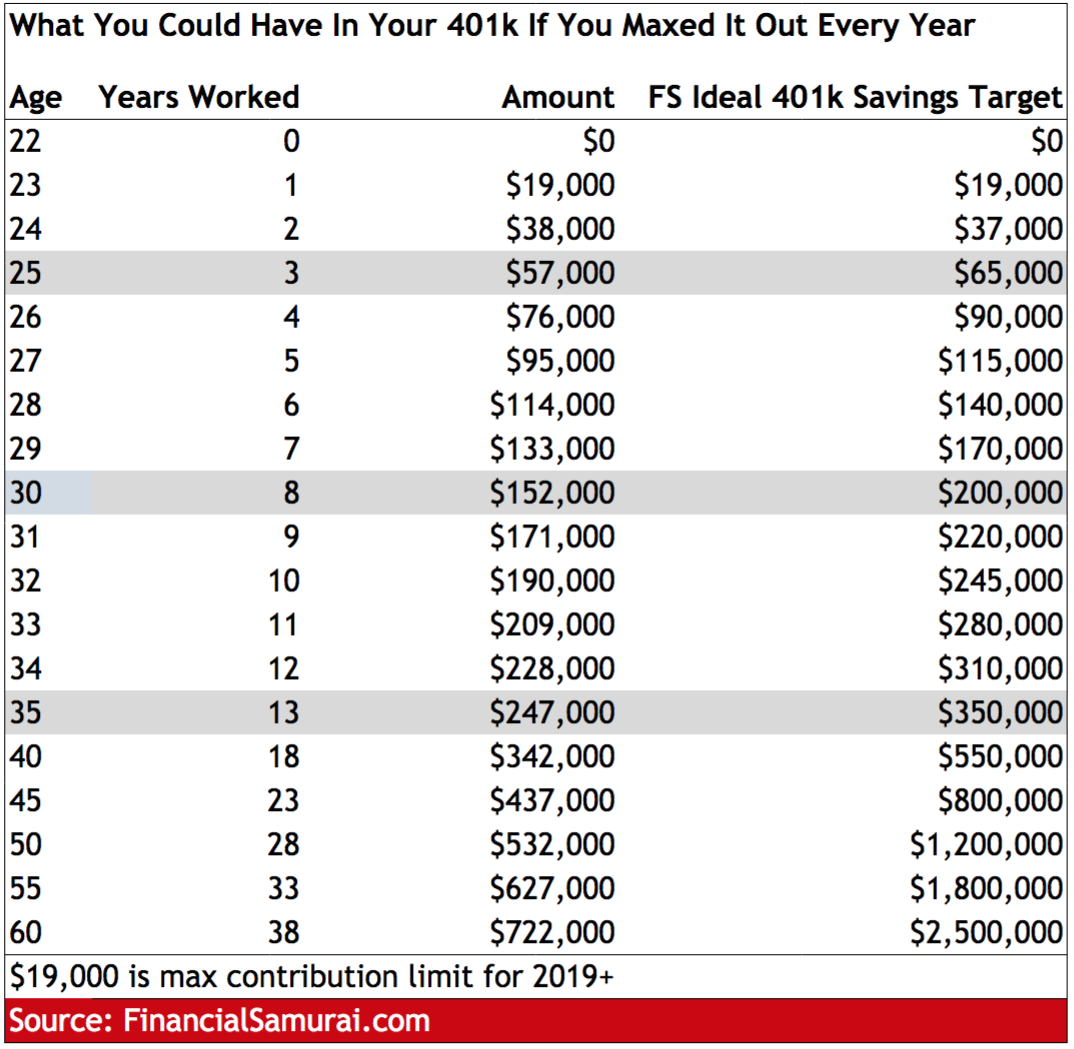

You can use a 401 calculator to assist you in determining how much money you should be investing at any age. However, here is a general guideline :

- At age 30 a minimum of one year’s salary

- At age 35 at least two years salary

- At age 40 three years salary or more

- At age 45 four years salary at minimum

- At age 50 at least five years salary

- At age 55 six years salary if not more

- At age 60 seven times your annual salary

- At age 65 at least eight times your yearly salary

What Is A 401

A 401 is a retirement plan offered by some employers. These plans allow you to contribute directly from your paycheck, so theyre an easy and effective way to save and invest for retirement. There are two main types of 401s:

-

A traditional 401: This is the most common type of 401. Your contributions are made pre-tax, and they and your investment earnings grow tax-deferred. Youll be taxed on distributions in retirement.

-

A Roth 401: About half of employers who offer a 401 offer this variation. Your contributions are made after taxes, but distributions in retirement are not taxed as income. That means your investment earnings grow federally tax-free.

Recommended Reading: Can I Roll My 401k Into A Brokerage Account

Pay Tax Now Or Later When Contributing To Your 401

When you sign up with your employers 401, you will need to decide if your contributions will be pre-tax or after-tax, that is, whether they go into a traditional 401 or a Roth 401, if your employer offers a Roth option.

Saving on a pre-tax basis means you are deferring the tax liability on your contribution until after you retire. As an example, a worker aged 50-plus in the 12 percent tax bracket with $80,000 in taxable income who defers the maximum for 2021 $26,000 will reduce their tax bill by $3,120.

Saving for retirement on an after-tax basis in a Roth 401 means you pay taxes on your contributions now, at your current tax rate, so that when you access the money during retirement, the withdrawals will be tax-free as long as funds have been in the account for a minimum of five tax years.

If your employer plan allows, you can take advantage of both types of contributions to diversify your tax position at retirement.

Could You Increase Your 401 Contribution

How often you can adjust your 401 or 403 contribution is generally determined by your employer and your retirement planit may be once a year or as often as youd like.

If youre able, reducing non-essentials or allocating new income could allow you to bump up the amount youre saving.

A 1% increase only makes a small difference in your paycheckbut may make a big difference down the road. Consider the example below for a $35,000 annual income:1

| Additional contribution |

|---|

1 This example is for illustrative purposes only. It assumes $35,000 in annual income, 3.5% annual wage growth, 30 years to retirement, 7% annual rate of return and a 25% tax bracket. Estimated monthly retirement income calculations assume a 4.5% annual withdrawal in retirement. The assumed rate of return is hypothetical and does not guarantee any future returns nor represent the return of any particular investment option. Reduced take-home pay is accurate for the initial year and would change based on participants annual pay. Estimated savings amounts shown do not reflect the impact of taxes on pre-tax distributions. Individual taxpayer circumstances may vary.

2 Contributions are limited to the lesser of the annual plan or the IRS limit as indexed annually.

3 Some plans may not allow catch-up contributions to the plan.

This document is intended to be educational in nature and is not intended to be taken as a recommendation.

Also Check: Can You Contribute To 401k After Leaving Job

Read Also: How Much Can I Invest In 401k And Roth Ira

Why Should I Use One

Matching dollars, for one thing. Over 90% of employers that offer a 401 plan also kick in a company match, which means as you contribute, your employer will, too. Commonly, that match will be worth 50% to 100% of your contributions, up to a limit that typically falls between 3% and 6% of your annual salary. If your employer offers up this free money, a good rule of thumb is to do everything you can to contribute enough to take advantage of it.

The other huge benefit of the 401 is that it allows you to put a lot of money away for retirement in a tax-advantaged way. The annual 401k contribution limit is $20,500 for tax year 2022, with an extra $6,500 allowed as a catch-up contribution every year for participants age 50 or older.

What Is The Average And Median 401 Balance By Age

401 balances can average roughly $6,000 at the age of 24 to more than $255,000 at the age of 65. Both average and median 401 balances can vary greatly depending on a few factors. This can include how long you have been saving for retirement or whether your company provides 401 matching, which is when your employer contributes to your retirement savings based on the amount of your contribution.

While savings are personal, the idea of a nest egg will likely make you contemplate what your financial future holds. Retirement might seem like a long way down the road, but time flies faster than we realize. And the earlier you start saving for retirement, the better off youll be later in life.

Knowing the average and median 401 by age can help you figure out where you stand and how you can be better prepared for the future. Heres what you can learn about the average 401 balance by age from Vanguards research on How America Saves in 2021:

| Age |

|---|

Read Also: How To Manage 401k Investments

Top Contribution Method: Max Your 401k Percentage

If you want maximum funding for your 401k plan, then determining the contribution percentage is straightforward, even without a 401k max contribution calculator. The maximum contribution per year is age based and changes depending on whether you’re age 50 and over, or whether you’re under the age of 50, as set forth below. To calculate the correct percentage to contribute, divide the annual limit by the number of total yearly paychecks. The result should then be divided by your gross salary per paycheck to learn the contribution percentage.

Cap Out Employer Match

One of the best ways to pad your retirement fund is to take advantage of the opportunities available. Your employer matching program is one of them. Contributing up to the limit of the match ensures that you receive the maximum amount your employer can give you.

Since the match is part of your plan, its essentially money owed to you. Going without it means you do not receive the full benefit of what your employer promised.

Choosing a lower-salary job with an employer match may even be a better option in some cases. The contributions boost your savings and can grow over time while your earnings compound.

Read Also: Can You Roll Over 401k From One Company To Another

Resist The Temptation To Tap Your 401

When youre contributing funds to your 401 account month after month, there will be times when the market flags and you see the value of your investments steadily decline. You may face the urge to withdraw money from the market during downturns, its essential that you resist the temptation.

Especially for young investors, its important to remind people to stay the course even when the market is volatile, said Taylor. People who are younger have time to ride out market swings.

There Are Contribution Limits For 401s

The IRS sets an annual limit on how much money you can set aside in a 401. That limit can change because it is adjusted for inflation. For 2021, you can put away $19,500. Those 50 or older by year-end can contribute an extra $6,500. Check out the Financial Industry Regulatory Authority’s 401 Save the Max Calculator, which will tell you how much you need to save each pay period to max out your annual contribution to your 401. If you cannot afford to contribute the maximum, try to contribute at least enough to take full advantage of an employer match .

Also Check: How Do I Know Where My 401k Is