How Much Can I Contribute In 2021

Solo 401ks have the highest contribution limits of any retirement plan. For 2021, you can contribute up to $58,000. Contributions are pretax or Roth. If youre age 50 or older, you can contribute up to $64,500. Contribution amounts are directly tied to your business earnings. The more you earn and pay yourself, the more you can contribute. A Nabers Group Solo 401k plan also includes the ability to make voluntary after-tax contributions. This strategy is quickly gaining popularity as a way to backdoor even more money into a Roth 401k or Roth IRA.

Its important to get your contribution calculations right. In addition to our contribution calculator tools, having a skilled tax preparer or CPA is invaluable. In essence, there are two main types of contributions:

- Employee salary deferrals: These can be up to 100% of your compensation. Employee deferral contributions max out at $19,500 per year . Salary deferral contributions and can be pre-tax or Roth, or a mix of both

- Employer profit-sharing contributions: Contribute 20-25% of net profits, depending on your business structure. Employer profit sharing contributions are pre-tax only.

Limits For Highly Paid Employees

If you earn a very high salary, you may be considered a highly compensated employee , subject to more stringent contribution limits. To prevent wealthier employees from benefiting unfairly from the tax benefits of 401 plans, the IRS uses the actual deferral percentage test to ensure that employees of all compensation levels participate proportionately in their companies’ plans.

If non-highly compensated employees do not participate in the company plan, the amount that HCEs can contribute may be restricted.

What Alternatives Are There To A Solo 401

If you’re on the fence about opening a solo 401, here are some other options you can consider:

- A Simplified Employee Pension IRA is a good option for anyone who’s self-employed. This plan comes with much higher contribution limits than a traditional IRA.

- Keogh plan: Keogh plans are retirement plans for self-employed individuals and come with high contribution limits. However, there are more administrative tasks than you’ll find with other plans.

- Traditional IRA: With a traditional IRA, you can let your money grow on a tax-deferred basis. You won’t pay taxes on the savings until you begin withdrawing the funds at retirement.

- Roth IRA: With a Roth IRA, your money will grow tax-free, and you won’t have to pay any taxes at retirement. And you’ll have the flexibility to use your contributions for certain qualified expenses.

Don’t Miss: How To Find Previous Employer’s 401k

How Much Can You Contribute To A Solo 401

In 2021, individuals with a Solo 401 can contribute a maximum amount on the employee end and the employer side of the equation.

As an employee, individuals can defer all their compensation up to the annual contribution limit of $19,500 for 2021. The only exception is, individuals ages 50 and older can contribute up to $26,000 as an employee of their company.

Note: These figures are up from 2019, when employee contributions were capped at $19,000 or $25,000 for individuals ages 50 and older.

The rest of the contribution Solo 401 participants can make is on the employer side. Here, you can contribute up to 25 percent of your compensation as defined by the plan up to an annual limit of $58,000 total , or up to $64,500 if youre 50 or older.

How does this actually work in practice? Consider this succinct example:

Ashley, age 51, earned $50,000 in W-2 wages from her small business in 2020. She deferred $19,500 in regular elective deferrals plus $6,500 in catch-up contributions to the 401 plan. Ashleys business contributed 25% of her compensation to the plan for the year, or $12,500. Total contributions to the plan for the 2021 tax season were $38,500.

This is why I strongly recommend using the services of a CPA when you have a Solo 401 plan, or are contemplating establishing one.

For reference, heres how employee and employer contributions limits have changed for Solo 401 plans over the years for retirement savers under the age of 50.

| Contribution Year |

|---|

| $49,000 |

Total Annual 401 Contribution Limits

Total contribution limits for 2021 are the following:

- $58,000 total annual 401 if you are age 49 or younger

- $64,500 total annual 401 if you are age 50 or older

The dollar amounts listed above are the total maximum amount that can be contributed. This number is a combination of both your own and your employers contributions.

In some cases, you can contribute additional amounts to other types of plans these may include a 457 plan, Roth IRA, or traditional IRA. It all depends on your income and the types of plans available to you.

Recommended Reading: How To Set Up 401k Without Employer

What Is A Solo 401 And Who Is Eligible

A solo 401 is an individual 401 designed for the self-employed and for business owners with no full-time employees.

A solo 401 is really special because you have the option of putting aside so much money for your future, money expert Clark Howard says. Youre able to take a huge amount of what you earn, if you can afford to, and put it in a solo 401.

| Rules & Limits |

|---|

| No age/income restrictions can’t have qualifying employees |

| Employee Contribution Limit |

| $6,500 |

| Total Contribution Limits |

| Depends on whether your account is traditional, Roth or both |

#tablepress-420 from cache

Although it’s similar to a traditional 401 retirement account, a solo 401 is unique: You can contribute as an employer and as an employee. It also imposes fewer rules and requires less paperwork than a typical 401 plan.

The other brilliant thing about solo 401 plans is that, at least in theory, they offer a Roth option . Unless you’re in a high tax bracket, Clark wants you to contribute your solo 401 funds into a Roth option.

If youre a freelancer, you operate a side hustle or you own your own business, a solo 401 can be a great way to save and invest for retirement. The only requirements are:

- You must make self-employment income.

- You cannot have any “qualified” employees.

In this case, a qualified employee is someone who has worked for your company for at least one year and has worked at least 1,000 hours per year.

Who Qualifies For A Solo 401k

In the digital era, the number of entrepreneurs and business owners who qualify for a Solo 401k grows every day. Fortunately, qualifying for a plan is simple. You need two things:

Presence of self-employment business activity means you are running your own small business. You can have a Solo 401k even if you havent yet made money with your small business. But, the power of the Solo 401k really kicks in when your business is earning revenue. This allows you to put away the maximum amount in contributions and save big on taxes.

Almost any business structure qualifies, including sole proprietorship, 1099 contractors, LLC, S-corp, or C-corp.

Recommended Reading: How Much Can You Contribute 401k

Withdrawing Funds From A Self

As with traditional 401 plans, the self-employed 401 is intended to help you save money for retirement, and there are regulations in place to encourage you to do so. For example:

- Withdrawals prior to age 59½ may be subject to a 10% early withdrawal penalty, along with any applicable income taxes1

- You must take required minimum distributions from self-employed 401s beginning at age 722

- Plans can be structured to allow loans or hardship distributions3

- Plans can be structured to accept rollovers from other retirement accounts, including SEP IRAs and traditional 401s, into your self-employed 401

- You can roll your self-employed 401 assets into another 401 or an IRA

Because of its high contribution levels, flexible investment options, and relatively easy administration, the self-employed 401 is an attractive option for small-business owners or sole proprietors who want to be able to save aggressively for the future.

If there is the potential that your business might add employees at a later date, however, know that you will either have to convert your self-employed 401 plan to a traditional 401, or else terminate it. But if you’re confident that you will remain a one-person operation, and you want the high savings options that these plans offer, this type of account may be a good fit.

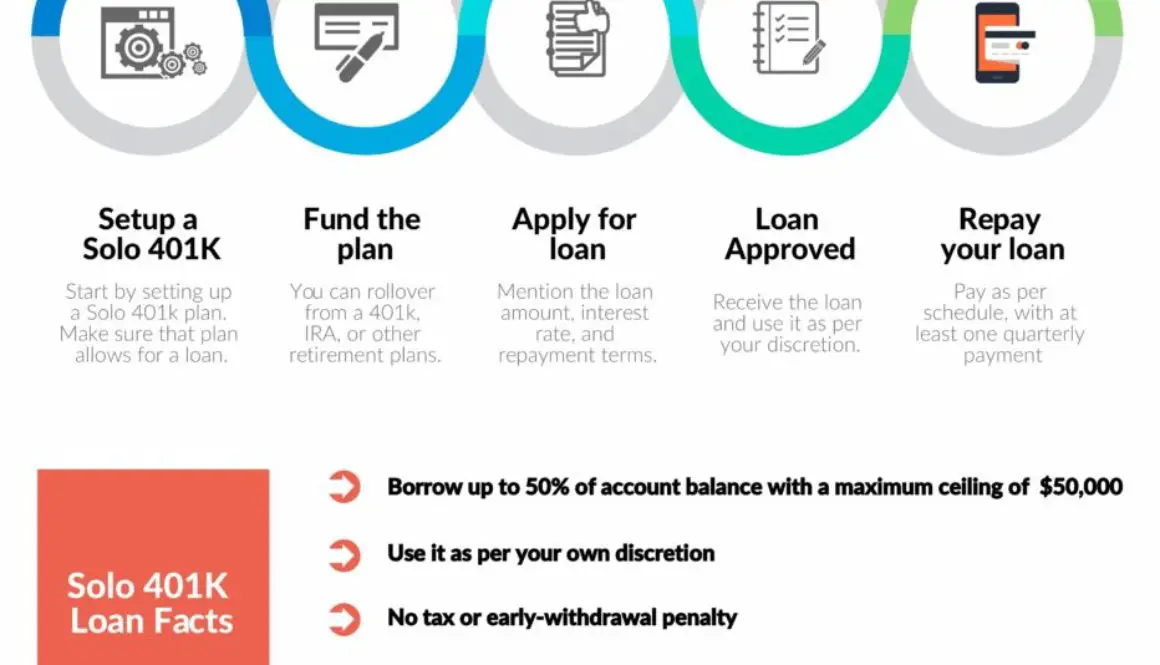

S To Set Up A Solo 401

There are specific steps that must be taken to properly open a solo 401 plan, according to the Internal Revenue Service .

First, you have to adopt a plan in writing, making a written declaration of the type of plan you intend to fund. The choices are the same as are given to an employee opening a 401 plan: you can choose a traditional 401 or a Roth 401. Each has distinct tax benefits.

A solo 401 must be set up by December 31st in the tax year for which you are making contributions.

Also Check: How Old Do You Have To Be To Start 401k

Start Side Hustling Already

I hope everyone now knows how to calculate what they can contribute to their self-employed 401k plan. Go over the example a couple more times if you are still confused. And check with an accountant if you want to be extra sure. Make sure you dont contribute too much to your self-employed 401k plan. If you do, it can be a pain to unwind the contribution.

Given the benefits of being able to contribute to a self-employed 401k plan, I highly recommend you start your own online business. Not only can you contribute your operating profits to a tax-deferred self-employed 401k plan, you can also deduct business expenses.

If you dont want to start an online business that cant be shut down during the coronavirus pandemic, be a rockstar freelancer. Being one allows you to contribute to a solo 401 as well.

If you are only a W-2 employee, your 401k contribution is capped at the maximum a a year + any 401k employer match . Unfortunately, very few employers are generous enough to contribute ~20% of their operating profits to you.

For those who work at startups or money-losing organizations, you are SOL in terms of receiving any profit sharing. Youll get paid below market rate, have options likely not worth what you hope, and get minimal retirement benefits.

Implementing & Maintaining A Solo 401 Plan

Implementing a solo 401 plan is pretty straight forward, and most brokerage firms offer them at very low annual costs. If youre establishing a brand new plan, it must be done by December 31st of the tax year youd like to contribute for. Fortunately, as long as you establish the plan by that date, you have some flexibility over when your contributions are actually deposited.

Elective deferrals may be deposited any time before your tax filing deadline. This is usually April 15th for sole props, single member LLCs, and C-Corps, and March 15th for multi-member LLCs, partnerships, and S-Corps. This deadline includes extensions too, which could push your deadline out another six months to September 15th or October 15th.

Although your contributions may be deposited any time before your tax filing deadline, they need to be reported on your W-2 by January 31st. Since your employee deferrals will show up as a deduction from your wages in box 12, this notifies the IRS that youre electing to defer a portion of your comp, and will have the deposit made by your tax filing deadline. Logistically, best practice is to let your bookkeeper or accountant know that youd like to make a contribution. They can then handle the reporting for you on your books and payroll files.

As for profit sharing contributions, they may be made any time before your tax filing deadline, plus extensions. Youll claim the deduction for the contribution on either your business or personal return.

Recommended Reading: What Is The Maximum I Can Contribute To My 401k

Solo 401 Early Withdrawal Rules

Early withdrawal rules for Solo 401s depend on which type of account you have. With a few exceptions, you must pay a 10% penalty tax on withdrawals from a traditional Solo 401 account made before you turn 59 ½, plus income taxes on the amount withdrawn.

With a Solo Roth 401, early withdrawals of contributions are free of the 10% tax penalty and income tax payments, but you pay the penalty and income tax on earnings. You cannot withdraw contributions exclusively from a Roth Solo 401, meaning you will have to pay taxes and a penalty on at least part of your early withdrawal.

Administering A Solo 401 Plan

Once your Solo 401 plan exceeds $250,000 in assets at the end of the year, the IRS requires you file an annual Form 5500 EZ. Or if you ever terminate the plan, you must also file a Form 5500 EZ.

Unlike Traditional 401 plans, there are no compliance testing requirements to ensure Solo 401 plans do not favor highly compensated employees and are non-discriminatory, as long as you have no employees participating in the plan.

These plans can be called Self-Directed 401, Individual 401, Individual Roth 401, Self-Employed 401, Personal 401 or One-Participant 401 depending upon the vendor offering the plan services.

You May Like: Can You Get A Loan Using Your 401k As Collateral

Don’t Miss: How To Move Your 401k To An Ira

See Our Complete Guide To The Best Retirement Plan For Independent Workers

- Individual 401 plans allow you to start taking deductions after you turn 59.5 years old.

- You cannot employ any full-time employees and have a solo 401.

- In 2021, an employee can contribute up to $19,500 in one year, assuming you’re under 50 years old.

- Annual or maintenance fees for solo 401 plans usually run between $20 and $200, and they are tax deductible.

The number of people who run their own business continues to trend up. The most recent data from the Bureau of Labor Statistics found that 9.6 million people worked for themselves in 2016. That is projected to increase to 10.3 million by 2026.

Working for yourself may give you the ability to make more money than you would working for someone else, but it also means you need to have your own retirement plan in place. One of the most popular retirement plans for independent workers is a self-employed 401. We spoke to two financial experts to find out how these retirement plans work.

Logan Allec, CPA and owner of the personal finance site Money Done Right, and Adam Bergman, a trained tax attorney and president of IRA Financial Trust and IRA Financial Group, offered their insights about these plans, including the maximum contributions, taxes, investments and fees.

Editor’s note: Looking for the right employee retirement plan for your business? Fill out the below questionnaire to have our vendor partners contact you about your needs.

Looking To Reduce Excessive 401k Fees

Sign up for Personal Capital for free and use their Portfolio Fee Analyzer tool. The tool will show you how much in fees youre paying. I had no idea I was paying $1,700 in 401 fees four years ago until I ran the tool.

Now Im only paying about $300 a year in fees. Excessive fees is one of the biggest drags on making more money and retiring earlier.

You can also use Personal Capital to track your net worth, track your cash flow, and optimize your investments.

For more nuanced personal finance content, join 100,000+ others and sign up for the free Financial Samurai newsletter. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009.

Filed Under: Entrepreneurship

I started Financial Samurai in 2009 to help people achieve financial freedom sooner, rather than later. Financial Samurai is now one of the largest independently run personal finance sites with 1 million visitors a month.

I spent 13 years working at Goldman Sachs and Credit Suisse. In 1999, I earned my BA from William & Mary and in 2006, I received my MBA from UC Berkeley.

In 2012, I left banking after negotiating a severance package worth over five years of living expenses. Today, I enjoy being a stay-at-home dad to two young children and writing online.

Current recommendations:

Recommended Reading: Can You Withdraw Your 401k If You Quit Your Job

Recommended Reading: How To Transfer 401k From Old Job

Can You Have Employees And Open A Single

You can’t have any full-time employees, but you can contract with freelancers or employ part-time employees who don’t work more than 1,000 hours a year in your business. Note that not all individual 401 plans allow for part-time employees, so be sure to check with your provider before hiring employees.

Solo 401k Contribution Deadline 2021

The 2020 contribution deadline has passed for almost all businesses. The final 2020 tax returns were due October 15, 2020, unless you are in a FEMA identified disaster area and your tax filing deadline has been extended. The good news is that you have plenty of time to contribute for 2021. You can set up and fund your new Solo 401k plan all the way until you file your taxes in 2022. Depending on your business structure this could be either March 15 or April 15, 2022. If you have an S Corp or Partnership your deadline is March 15. With a Sole Proprietorship or C Corp your deadline is April 15th. If you file an extension, you could set up and fund your Solo 401k all the way until either September 15 or October 15 .

Read Also: How Much To Max Out 401k

What Is The Maximum Contribution To A Solo 401k

Contribution limits to a Solo 401k are very high. For 2021, the max is $58,000 and $64,500 if you are 50 years old or older. This is up from $57,000 and $63,500 in 2020. This limit is per participant. So if your spouse is earning money from your small business that means they can also contribute up to the same amount into the Solo 401k. If you are both 50 years old or older, this means that combined contributions could be up to $129,000 per year!

Solo 401k contributions are much higher than all other retirement plans. Traditional and Roth IRA limits are just $6,000. The catch up contribution is $1,000 more if you are 50 years old or older. The IRS typically increases contribution limits every couple years as a cost of living increase to keep up with inflation. Therefore, its a fair bet to expect contribution limits to continue going up over time.