Irc 401 Plans Establishing A 401 Plan

When you establish a 401 plan you must take certain basic actions. For instance, one of your decisions will be whether to set up the plan yourself or consult a professional or financial institution – such as a bank, mutual fund provider, or insurance company – to help you establish and maintain the plan.

Eligibility For Cashing Out A 401 Plan

No advice you receive on how to cash out 401 accounts will matter if your plan doesnt allow it. Yes, some employers wont let you take the money out. Even if your employer does, there could be restrictions on how the money can be withdrawn. You probably have some type of documentation with your 401 that you can check. If not, ask your HR department to provide your policy documents. You can always take money out of plans youre not participating in anymore e.g. a plan at an old employer.

If youre 59 and ½ years old, though, none of that matters. You can take money from your 401 starting at age 59 and ½ without paying a penalty. If you havent yet celebrated your 59th birthday, you may prefer instead to take a loan against your 401 if your employer allows it. This will help get you through your financial situation while still ensuring the money is there when its time to retire.

It’s important to note that the tax man may still come calling, even if you dont pay a penalty. Traditional 401 plans are taxed when you take the money out, while Roth 401 accounts hold funds that youve already paid taxes on. If you have a Traditional 401, youll need to prepare to pay taxes on the money, whether you withdraw it at age 24 or 84. If you have a Roth 401, you can take your contributions out at any time since youve already paid taxes on them, but youll pay taxes on any earnings you withdraw early if youre under 59 and ½.

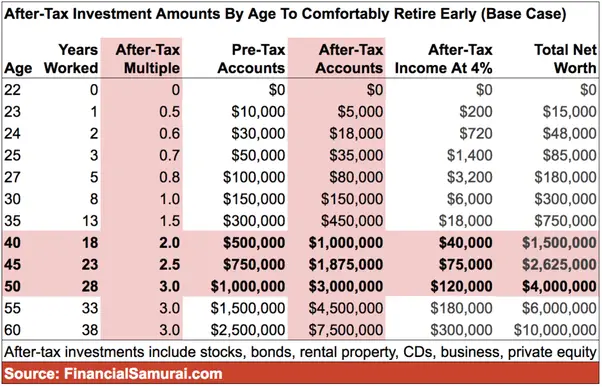

The Benchmarks For Those Closer To Retirement

The range gets wider as you get older, so we also provide more detailed estimates for people approaching retirement. This helps someone find a realistic target based on income and marital status, which affect Social Security benefits.

A Closer Look at Savings Benchmarks Later in Your Career

Savings Benchmarks Later in Your Career| 11x | 14x |

Assumptions: See Savings Benchmarks by AgeAs a Multiple of Income above. Dual income means that one spouse generates 75% of the income that the other spouse earns.

Also Check: Can I Invest My 401k In Gold

Option : Cash Out Your Old 401

Another option is cashing out your 401, which does exactly what you would expect provides cash. But there are many implications to consider. The cash you withdraw is considered income, and you may incur local, state and federal taxes by doing so. You will lose the benefit of giving your accounts investments time to grow, and you may need to work longer to make up the difference. Whats more, if you leave your employer prior to the year you turn 55 and are younger than 59 ½, you will be required to pay a 10% early withdrawal penalty on top of any taxes on the money.

How Do You Calculate A 401k Withdrawal At Age 70

Mandatory 401 withdrawals at age 70 1/2, known as required minimum distributions, are calculated by dividing the balance in the 401 account on December 31 of the previous year by the life expectancy of the account holder, reports Bankrate. Life expectancy is determined using the appropriate IRS uniform lifetime table.

401 account holders can withdraw more than the minimum distribution at any time after age 59 1/2, but required minimum distributions must begin at age 70 1/2, or account holders are subject to a 50 percent penalty tax on the amount that should have been distributed, according to the IRS. Account holders may withdraw larger amounts than the minimum, but the excess does not count towards the following years required minimum distribution. Although 401 administrators may help calculate the required minimum distribution, responsibility for calculating and withdrawing the correct amount lies with the 401 account holder.

There are three uniform lifetime tables, as reported by the IRS. The standard uniform lifetime table is used by a 401 owner whose wife is not more than 10 years younger. The Joint and Last Survivor table is used by an account holder whose only beneficiary is his wife who is more than 10 years younger. The Single Life Expectancy table is used by other beneficiaries of a 401 account.

Recommended Reading: Does Mcdonald’s Offer 401k

What Is A 401k

A 401k is a powerful type of retirement account that many companies offer to their employees as a perk. With each pay period, you put a portion of your paycheck into the account. It happens automatically so you dont have to do anything special and there are a ton of benefits.

A 401k is called a retirement account because it gives you huge tax advantages if you dont touch your money until you reach the minimum retirement age of 59 1/2 years. While you will have to pay a penalty if you touch your 401k savings before you reach retirement age, the benefits far outweigh the risk.

Here is a snapshot of the benefits of having a 401k:

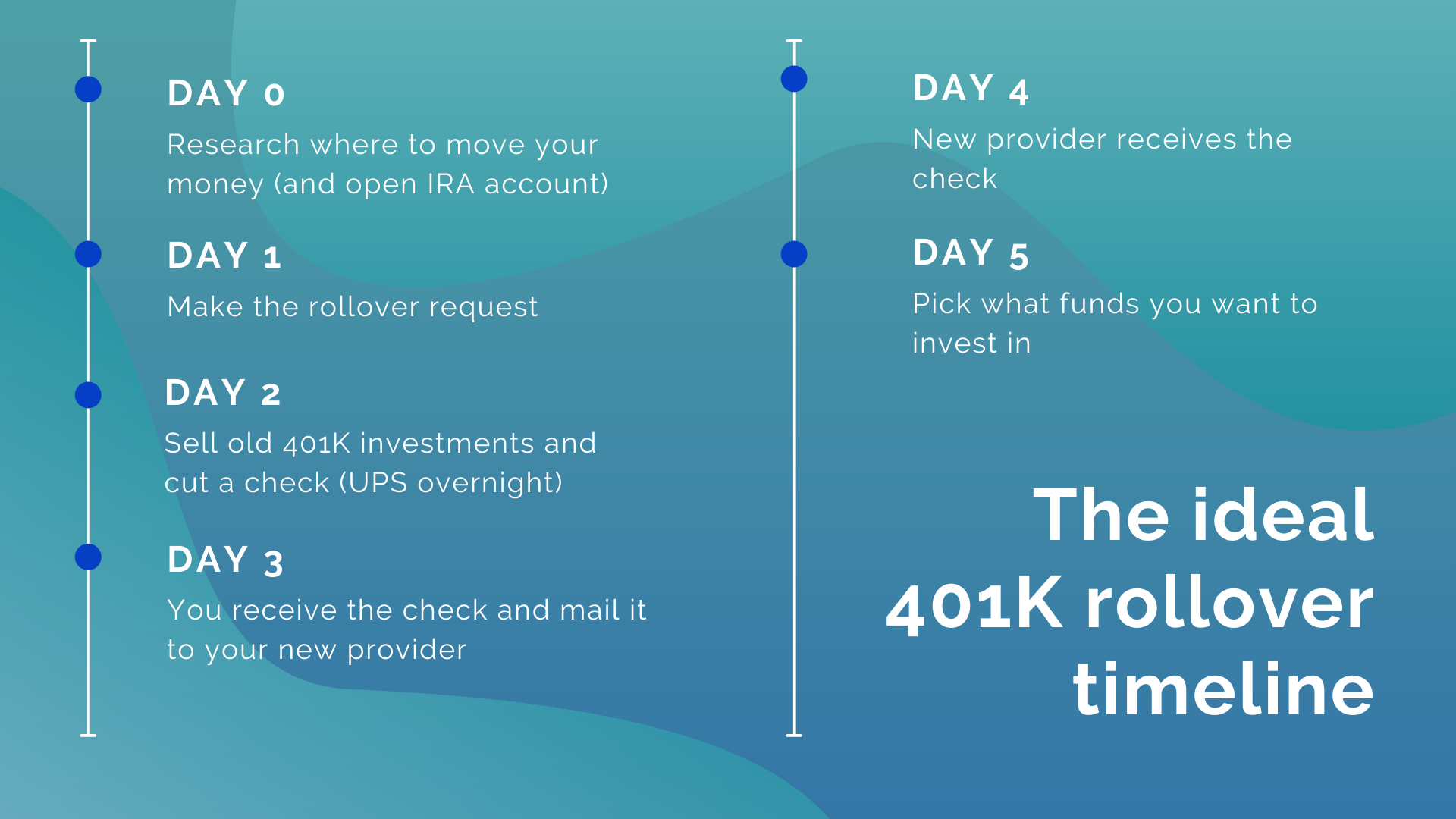

Roll It Over To An Ira Pay Taxes And Convert It To A Roth Ira

You also have the option of rolling over your old 401 to a traditional IRA then paying taxes and converting it to a ROTH IRA. This strategy could be very beneficial if you are in a low tax bracket right now and you would rather pay tax today than later in the future when taxes could be higher either because taxes go up or because you make more income and are in a higher tax bracket. This is a more complex strategy, so you should consult your tax advisor or financial advisor to see if this would be a good option for you.

When doing this approach, you do not want to have taxes withheld itll be subject to a 10% penalty for distribution for those under the age of 59 ½. You will want to have the cash on hand to pay the tax bill at tax time.

The great thing about ROTH IRAs is that you will never have to pay tax again on this account which makes it so powerful.

Read Also: Can I Buy Individual Stocks In My 401k

How Old Do You Have To Be To Invest In A 401

A 401 is a qualified retirement plan that allows working individuals to save for retirement in a tax-deferred manner. Employers manage their employees’ 401 accounts. Due to the preferential treatment that the IRS gives to 401 accounts, you must meet a number of prerequisites in order to have one, one such prerequisite being a minimum age requirement.

What Is The Maximum 401k Contribution Amount

Starting in 2020 , you can contribute up to $19,500 each year to your 401k if you are under 50. If you are over the age of 50, you may be able to make catch-up contributions. This provision lets you invest up to an additional $6,500 in your 401k .

PRO TIP: You need to be behind in your 401k contributions to make catchup contributions.

When compared to a Roth IRA, where you can only contribute up to $6,000/year, this is an amazing opportunity especially since your pre-tax money is being compounded over time.

Read Also: How To Pull Money From 401k

Withdrawing Funds Between Ages 55 And 59 1/2

Most 401 plans allow for penalty-free withdrawals starting at age 55. You must have left your job no earlier than the year in which you turn age 55 to use this option. You must leave your funds in the 401 plan to access them penalty-free. But there are a few exceptions to this rule. This option makes funds accessible as early as age 50 for many police officers, firefighters, and EMTs.

Make sure to understand the rules around the age requirement for penalty-free withdrawals. For example, the age 55 rule won’t apply if you retire in the year before you reach age 55, and your withdrawal would be subject to a 10% early withdrawal penalty tax in this case.

The age 55 and up retirement rule won’t apply if you roll your 401 plan over to an IRA. The earliest age to withdraw funds from a traditional IRA account without a penalty tax is 59. 1/2.

You might retire at age 54, thinking that you can access funds penalty-free in one year. It doesn’t work that way. You must wait one more year to retire for this age rule to take effect.

Leave It At Your Old Employer

You always have the option to leave your 401 at your old employer. Sometimes, if the balance is low they can tell you you have to move it, but if its above that most times they will let you keep it there.

This could be beneficial if your new 401 has very few investment options and leaving it there gives you more options. But typically, it would make sense to roll it into an IRA instead of keeping it at your old employer.

Recommended Reading: How To Rollover Vanguard 401k

What Is The Rule Of 55

Under the terms of this rule, you can withdraw funds from your current jobs 401 or 403 plan with no 10% tax penalty if you leave that job in or after the year you turn 55. It doesnt matter whether you were laid off, fired, or just quit.

The distributions are not completely tax free: Like all withdrawals from a traditional 401 or 403, you do have to pay income tax. Only the 10% tax penalty is bypassed in this scenario.

In addition, note that employers are not obliged to allow early withdrawals and, if they do allow them, they may require that the entire amount be taken out in one lump-sum withdrawal. This could expose you to a higher income tax.

This rule applies to current not former 401 or 403 plans. The government does not permit penalty-free withdrawals before 59.5 from plans you had with a previous employer. If you want access to that money under the rule of 55, you would have to transfer those funds into your current 401 or 403 plan.

Should I Roll Over My Traditional 401 To A Roth 401

There isnt a one-size-fits-all answer when it comes to rolling over your retirement savings to a Roth account. If it makes sense for your situation, a Roth conversion is a great way to take advantage of tax-free growth on your accounts. But keep in mind that rolling over a traditional 401 means paying taxes on it now. And if youre converting a large sum all at once, it could bump you into a higher tax bracket . . . which means a bigger tax bill.

For example, if youre rolling over $100,000 and youre in the 22% tax bracket, that means you have to come up with $22,000 cash to cover the taxes. Dont pull that money out of the investment itself!

If you can pay cash for the taxes without taking money out of your nest egg and youre still several years away from retirement, it may make sense to roll it over. But before you roll over accounts, make sure to sit down with an experienced investment professional. Theyll help you understand the tax impact of rolling over your 401 and how you can be prepared for it.

Also Check: What Is The Penalty For Taking Money Out Of 401k

How Contributions Affect Rmds

When you calculate an employee’s RMD, consider any contributions that you make for that employee. For defined contribution plans, calculate the RMD for an employee by dividing his or her prior December 31 account balance by a life expectancy factor in the applicable table in Appendix B of Pub. 590-B. A defined benefit plan generally must make RMDs by distributing the participant’s entire interest as calculated by the plan’s formula in periodic annuity payments for:

- the participant’s life,

Does Everyone Who Turns 72 Need To Take An Rmd

Turning 72 in a given year doesnt mean that you have to take an RMD. Only those who turn 72 in a given year AND meet any of the following criteria must take an RMD:

You have taken an RMD in previous years. If so, then you must take an RMD by December 31 of every year.You own more than 5% of the company sponsoring the 401 plan. If so, then you must take an RMD by December 31 every year.You have left the company in the year you turned 72. If so, then the first RMD does not need to occur until April 1 of the following year but must occur consecutively by December 31 for every year.> Example: John turned 72 on June 1, 2021. John also decided to leave his company on August 1, 2021. He has been continuously contributing to his 401 account for the past 5 years. The first RMD must occur by April 1, 2022. The next RMD must occur by December 31, 2022 and every year thereafter.> NOTE: that this criteria means that you do NOT need to take an RMD if you meet the RMD age and are still working.You are a beneficiary or alternate payee of an account holder who meets the above criteria.

Recommended Reading: Can I Rollover 401k To Ira While Still Employed

Planning Out The Timing Of Your Withdrawals

The timing of your early withdrawals is important, says Dave Lowell, certified financial planner and founder of Up Your Money Game.

If you were employed for most of the year and had a relatively high income, then it makes sense to not withdraw money under the rule of 55 in that calendar year, since it will add to your total income for the year and possibly result in you moving to a higher marginal tax bracket, Lowell says.

The better strategy in that scenario may be to use other savings or take withdrawals from after-tax investments until the next calendar rolls around. This may result in your taxable income being much lower.

Series Of Substantially Equal Payments

If none of the above exceptions fit your individual circumstances, you can begin taking distributions from your IRA or 401k without penalty at any age before 59 ½ by taking a 72t early distribution. It is named for the tax code which describes it and allows you to take a series of specified payments every year. The amount of these payments is based on a calculation involving your current age and the size of your retirement account. Visit the IRS website for more details.

The catch is that once you start, you have to continue taking the periodic payments for five years, or until you reach age 59 ½, whichever is longer. Also, you will not be allowed to take more or less than the calculated distribution, even if you no longer need the money. So be careful with this one!

Don’t Miss: Can You Get 401k If You Quit

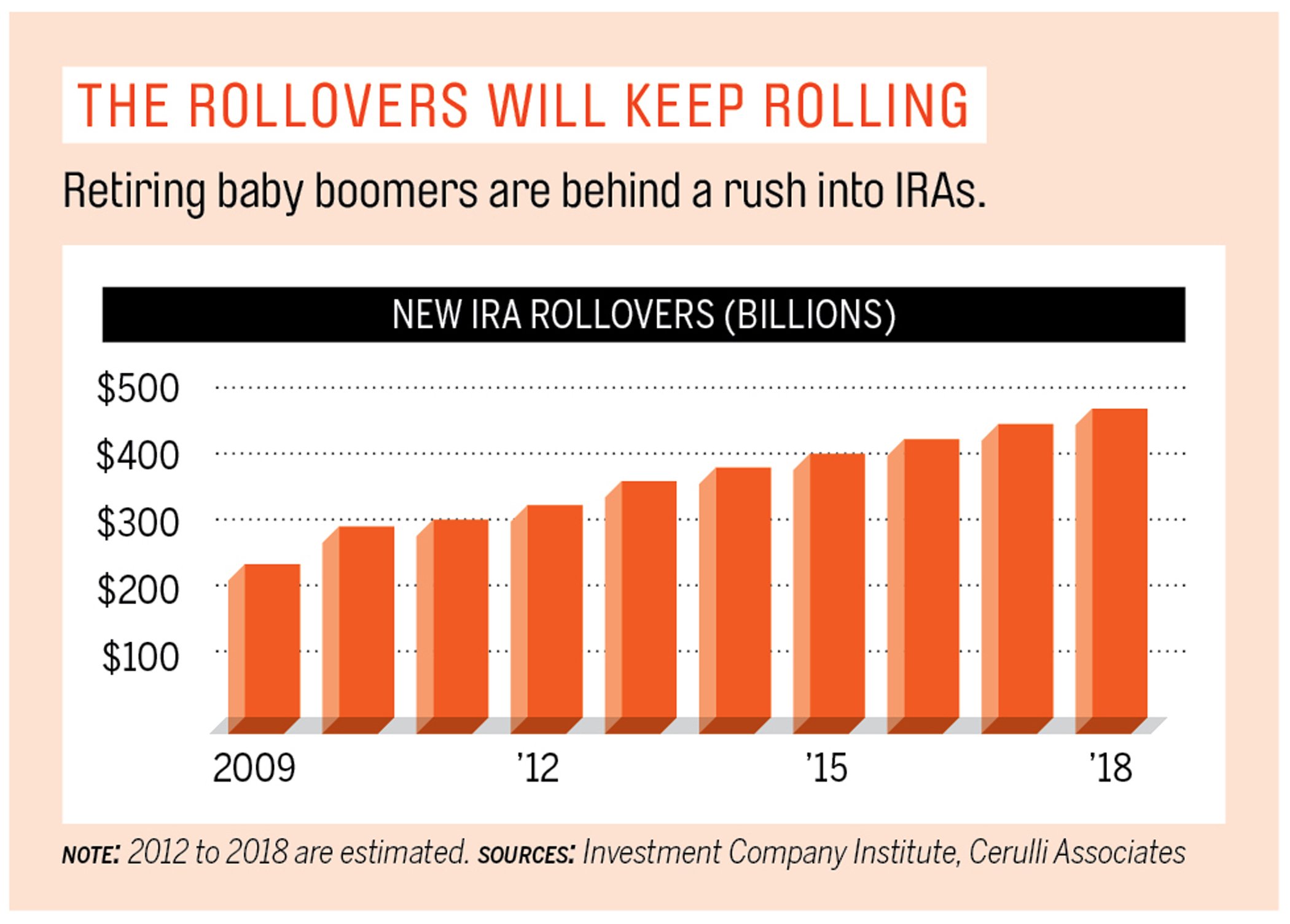

What Are The Advantages Of Rolling Over A 401 To An Ira

Doing a 401 rollover to an IRA offers perks that can include more diverse investment selections than a typical 401 plan, perhaps cheaper investments and lower account fees. It’s also a way to keep your retirement funds organized and ensure you have easy access to them. And while some 401 plans pass account management fees along to the employees, many IRAs charge no account fees.

In summary, it’s a good way to save money, stay organized and make your money work harder.

What Is A 401 And How Do They Work

A 401 is a retirement savings plan sponsored by employers. You fund the account with money from your paycheck, you can invest that money in the stock market, and you earn some tax perks for participating.

That’s the basic definition of a 401. The more interesting angle is what a 401 can do for you. The 401 is a powerful resource for achieving financial independence, especially when you start using it early in your career. Said another way, if you like money and wish to have more of it in the future, you can use a 401 to make that happen.

Read on for a closer look at how the 401 works, when you can withdraw funds from a 401, and what happens to your 401 if you change jobs.

Recommended Reading: How Do You Transfer 401k

What Is A 401

A 401 is a type of retirement plan offered by employers. It allows you to save for retirement using pre-tax dollars from your paycheck. Frequently employers will match contributions up to a certain percentage, allowing you to save even more. Then you pay taxes when you withdrawal from the account in retirement.

So How Much Should You Invest In Your 401k

Okay. So, while investing is highly personal and financial goals should be personalized, you are here so we can teach you to be rich. We have some advice to get you started.

How much you should actually be investing each month depends on a system we call the Ladder of Personal Finance. Check out this video, or read about the Ladder below:

1. Your employers 401k match. Each month you should be contributing as much as you need to in order to get the most out of your companys 401k match. That means if your company offers a 5% match, you should be contributing AT LEAST 5% of your monthly income to your 401k each month.

Weve already discussed the importance of this dont throw away free money and the returns from that free money.

2. Whether youre in debt. Once youve committed yourself to contributing at least the employer match for your 401k, you need to make sure you dont have any debt. Remember, if you have employee matching, you are effectively earning a 100% return on every penny you invest in your 401k that is significantly more than the interest you would save by paying down your debt.

If you dont, great! If you do, thats okay. You can check out my system on eliminating debt fast to help you.

Recommended Reading: Can First Time Home Buyers Use 401k