How Can I Get Money From The Government Without Paying It Back

6 Ways to Get Free Money From the Government

How To Calculate Required Minimum Distribution For An Ira

To calculate your required minimum distribution, simply divide the year-end value of your IRA or retirement account by the distribution period value that matches your age on Dec. 31st each year. Every age beginning at 72 has a corresponding distribution period, so you must calculate your RMD every year.

For example, Joe Retiree, who is age 80, a widower and whose IRA was worth $100,000 at the end of last year, would use the Uniform Lifetime Table. It indicates a distribution period of 18.7 years for an 80-year-old. Therefore, Joe must take out at least $5,348 this year .

The distribution period also decreases each year, so your RMDs will increase accordingly. The distribution table tries to match the life expectancy of someone with their remaining IRA assets. So as life expectancy declines, the percentage of your assets that must be withdrawn increases.

If you need further help calculating your RMD, you can also use Bankrates required minimum distribution calculator.

RMDs allow the government to tax money thats been protected in a retirement account, potentially for decades. After such a long period of compounding, the government wants to be sure that it eventually gets its cut in a clear timeframe. However, RMDs do not apply to Roth IRAs, because contributions are made with income that has already been taxed.

You May Like: How To Avoid Taxes On 401k

K Withdrawal Rules: How To Avoid Penalties

401k plans, IRAs and other tax-advantaged retirement savings accounts are common ways to save for retirement, and millions of Americans pour money into them every year. Its generally wise to avoid withdrawing money from your 401k, as there are often hefty penalties and taxes to consider for early withdrawals.

Sometimes, however, unplanned circumstances force people to withdraw funds from their 401k early. So if you find yourself in a place where you need to tap your retirement funds early, here are some rules to be aware of and some options to consider.

You May Like: What Happens To My 401k If I Switch Jobs

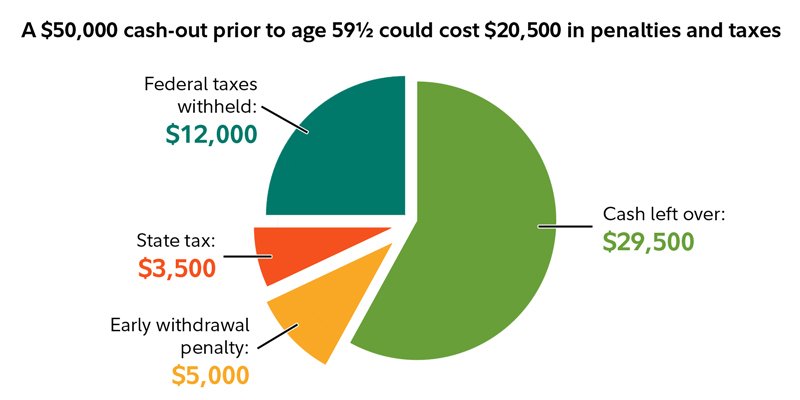

What Is The Penalty For Withdrawing From A 401

When a 401 account holder withdraws money from a 401 before age 59½, the IRS may charge a 10% penalty in addition to the ordinary income taxes assessed on the amount.

Unqualified withdrawals from a 401 are considered taxable income. Then, the 10% penalty is assessed on top of that. This could result in a hefty penalty.

Taxes If You Withdraw Money In Retirement

When you withdraw money from a 401 in retirement, you will owe taxes in the year when you take the distribution. The withdrawals will be taxed as your other sources of income at your tax bracket rate. At the minimum, you will pay federal income taxes on the distribution. If you are a resident of a state that imposes state income taxes on retirement distributions, you will pay extra taxes. However, certain states don’t tax 401 distributions, and you wonât pay additional taxes.

For Roth 401 withdrawals, you wonât pay income taxes when you withdraw money in retirement, since you had already paid income taxes at the onset. You must have reached 59 ½ and have held the account for five years or more to qualify for tax-free withdrawals from your Roth 401.

If you are already 72, you must start taking the required minimum distributions from a traditional 401 and Roth 401. If you do not take the mandatory distributions, you will incur a 10% penalty on the distribution not taken.

You May Like: Can You Take Out Your 401k

What Are The Penalties For Cashing Out A 401k

What are the penalties for cashing out a 401 before retirement? Knowing ahead of time can save you from a big mess. However, there are exceptions to help you avoid penalties.

A 401 is a tax-deferred retirement savings account. The IRS incentivizes saving for retirement by relieving the immediate tax obligations for your distributions during retirement. But what are the penalties for cashing out a 401 before youâre eligible?

The IRS issues a 10% tax penalty for cashing out funds from a 401 without meeting their criteria to do so. You can avoid the 10% penalty by qualifying for hardship withdrawals, through substantially equal periodic payments, and distributions made if youâve left your job after 55.

It may be tempting to withdraw your 401 funds when faced with a considerable expense. With no other options, itâs easy to view your retirement savings as a glorified savings account or emergency fund.

However, tapping into your 401 before retirement could leave you with a big mess on your hands.

Exceptions To The 401 Early Withdrawal Tax Penalty

In most cases, you can’t get out of paying taxes on the money you withdraw from a 401. But people in some situations can avoid the 10% penalty. The IRS will consider waiving the penalty if any of the following situations apply:

- You become or are permanently disabled: If you are or become disabled for life, you won’t owe the penalty.

- You are dividing assets in a divorce: Withdrawals made to satisfy a court order to divvy up the 401 with a former spouse or dependent are penalty-exempt.

- You are a qualified military reservist: You can take penalty-free withdrawals during your service period if you’re called to active duty for at least 180 days.

- You leave your job at age 55: Also known as the rule of 55, this provision allows anyone who retires, quits, or is fired at age 55 to withdraw without penalty.

- You enroll in “substantially equal periodic payments”: With , you withdraw a specific amount from your 401 every year for five years or until you turn 59½, whichever comes later. One catch: This account can’t be the one you have at your current job it has to be one you’ve kept from a previous employer. Also, if you quit the SEPP plan early, you’ll owe all the penalties, plus interest.

In addition to these events and situations, there are two other main ways to cash out early without a tax penalty: hardship withdrawals and loans.

Also Check: Can You Have A Roth Ira And A 401k

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

And Ira Withdrawals For Covid Reasons

The CARES Act had many provisions that received attention, especially the Paycheck Protection Plan loans and the individual relief checks that went to a majority of Americans. One less-noticed part of the bill, though, changes the way that pre-retirement withdrawals from retirement plans work.

Section 2022 of the CARES Act allows people to take up to $100,000 out of a retirement plan without incurring the 10% penalty. This includes both workplace plans, like a 401 or 403, and individual plans, like an IRA. This provision is contingent on the withdrawal being for COVID-related issues. The following reasons are permitted for making these special withdrawals:

- You have been diagnosed with COVID-19

- Your spouse or a dependent has been diagnosed with COVID-19

- You have financial issues because of being quarantined, furloughed or laid off due to COVID-19

- You have financial issues because you cant work due to a lack of childcare caused by COVID-19

- Youre experiencing financial hardship because the business you own or operate had to close or reduce hours

This is obviously a fairly broad set of circumstances. Essentially, if youre having a hard time financially because of circumstances caused by the pandemic, youre likely to qualify for these early withdrawals.

Recommended Reading: Can You Keep Your 401k In A Chapter 7

Is A 401 Withdrawal Without Penalty Possible

There are some exceptions to the 401 early withdrawal penalty rule. For example, an exception may be made in the event that a participant has a qualifying event such as a disability or medical expenses, and must use 401 assets to make payments under a qualified domestic relations order, has separated from service during or after the year they reached age 55, or that a distribution is made to a beneficiary after the death of the account owner.

Additionally, it may be possible to avoid the 401 withdrawal penalty through a method known as the Substantially Equal Periodic Payment rule. These are also called 72 distributions.

To do this, the account owner must agree to withdraw money according to a specific schedule as defined by the IRS. The participant must do this for at least five years or until they have reached age 59½.

Under the 72 distribution, a participant will systematically withdraw the total balance of their 401. While this is technically an option in some instances, it does mean taking money away from retirement. Consider this while making your ultimate decision.

Youll Be Assessed A 10% Penalty

First, the IRS will issue a 10% penalty immediately upon withdrawal of any funds taken out before turning 59½.

This penalty is taken out immediately from the amount you withdraw from your 401.

Say you take out $10,000 from your employer-sponsored 401. You speak to your HR department or your plan administrator and take all of the necessary steps. By the time the money reaches you, youâll only have $9,000.

The IRS implements this penalty to make you think twice about shorting your retirement too early.

Don’t Miss: Why Cant I Take Money Out Of My 401k

When Should You Make A 401 Early Withdrawal

Considering the 10% penalty, financial planners often advise taking an early withdrawal from your 401 as a last resort. Since penalty-free withdrawals are available for a number of financial hardships and situations, plan participants who take an early withdrawal with a penalty are often in serious financial straits.

Ive seen people take withdrawals for a number of reasons, Stiger says. Everything from a childs tuition to a spouses burial expenses the hope is that distributions are used for larger, more unexpected expenses like medical emergencies, keeping a home out of foreclosure or eviction, and in a down period, putting food on the table.

Taking an early withdrawal can make sense if you are able to take advantage of a penalty-free exception, use the Rule of 55 or the SEPP exemption. But might make sense to exhaust other options firstcheck out these 10 ways to get cash now. And keep in mind, contributions to a Roth IRA can always be withdrawn without penalty if youre truly in a bind.

Understanding Early Withdrawal From A 401

Withdrawing money early from your 401 can carry serious financial penalties, so the decision should not be made lightly. It really should be a last resort.

Not every employer allows early 401 withdrawals, so the first thing you need to do is check with your human resources department to see if the option is available to you.

As of 2021, if you are under the age of 59½, a withdrawal from a 401 is subject to a 10% early withdrawal penalty. You will also be required to pay regular income taxes on the withdrawn funds.

For a $10,000 withdrawal, when all taxes and penalties are paid, you will only receive approximately $6,300.

Recommended Reading: How To Direct Rollover 401k

The Costs Of Early 401k Withdrawals

Early withdrawals from an IRA or 401k account can be an expensive proposition because of the hefty penalties they carry under many circumstances.

The IRS allows penalty-free withdrawals from retirement accounts after age 59 ½ and requires withdrawals after age 72 . There are some exceptions to these rules for 401ks and other qualified plans.

Try to think of your retirement savings accounts like a pension. People working towards a pension tend to forget about it until they retire. There is no way they can access it before retirement. While that money is locked up until later in life, it becomes a hugely powerful resource in retirement. The 401k can be a boon to your retirement plan. It gives you flexibility to change jobs without losing your savings. But that all starts to fall apart if you use it like a bank account in the years preceding retirement. Your best bet is usually to consciously avoid tapping any retirement money until youve at least reached the age of 59 ½.

If youre not sure you should take a withdrawal, you can use this calculator to determine how much other people your age have saved.

Can I Leave My Money In My 401 Plan After I Terminate Employment

It depends upon your account balance and the terms of your 401 plan. The IRS allows 401 plans to automatically cash-out small account balances defined as less than $5,000 without the owners consent upon their termination of employment. Under these rules, account balances between $1,000 and $5,000 must be rolled over into a personal IRA for the benefit of the employee. Amounts below $1,000 can be paid out by check.

To find the cash-out limit applicable to your 401 plan, check your plans Summary Plan Description . If your account exceeds this limit, you can postpone withdrawals until the date you must start taking Required Minimum Distributions.

Don’t Miss: How To Find A Deceased Person’s 401k

Can I Take A Withdrawal Before I Terminate Employment

In general, you cant take a withdrawal from your 401 account until one of the following events occurs:

- You die, become disabled, or otherwise terminate employment

However, a 401 plan can also permit withdrawals while you are still employed. These in-service withdrawals are subject to the following conditions:

- 401 deferrals , safe harbor contributions, QNECs and QMACs cant be distributed until age 59.5

- Non-safe harbor employer match and profit sharing contributions can be distributed at any age.

- Employee rollover and voluntary contributions can be distributed at any time.

- 401 deferrals , non-safe harbor contributions, rollovers and voluntary contributions can be withdrawn in a hardship distribution at any time.

To find the in-service withdrawal rules applicable to our 401 plan, check your plans Summary Plan Description .

How Do You Take A Withdrawal Or Loan From Your Fidelity 401

If you’ve explored all the alternatives and decided that taking money from your retirement savings is the best option, you’ll need to submit a request for a 401 loan or withdrawal. If your retirement plan is with Fidelity, log in to NetBenefits®Log In Required to review your balances, available loan amounts, and withdrawal options. We can help guide you through the process online.

Read Also: Can I Buy 401k Myself

Considering An Early Retirement Withdrawal Cares Act Rules And What You Should Know

This blog was originally posted on May 27, 2020 and was updated on June 30, 2020.

If youre out of work and need income, you might be considering withdrawing from your retirement savings. Normally, if you withdraw money from traditional Individual Retirement Accounts and employer-provided accounts before reaching age 59 ½, you have to pay a 10 percent early withdrawal penalty.

Furthermore, emergency withdrawals from your current employer-provided plans are limited to an amount needed to meet a limited set of approved hardships, like avoiding foreclosure, home repairs after a disaster, or medical expenses.

If the pandemic has had negative effects on your finances, temporary changes to the rules under the CARES Act may give you more flexibility to make an emergency withdrawal from tax-deferred retirement accounts during 2020.

Among other things, the CARES Act eliminates the 10 percent early withdrawal penalty if you are under the age of 59 ½. One third of the money you withdraw will be included as income in your taxes for each of the next three years unless you elect otherwise. The CARES Act also allows you to pay back what you withdrew from your accounts if youre able to do so.

Please note that this blog discusses withdrawals from retirement plans not retirement plan loans. You may want to spend some time weighing the risks and benefits to withdrawing money versus taking a loan. Learn more about taking a loan from your retirement accounts.

Do I Have To Pay The 10 Penalty For Early 401k Withdrawal

If you take money out of your 401 account before reaching the age of 59 1/2, youll have to pay a 10% early withdrawal penalty on top of income tax. A $5,000 early 401 withdrawal will cost $1,700 in taxes and penalties for someone in the 24 percent tax bracket. The 401 early withdrawal penalty has a handful of exceptions. You wont have to pay the 10% penalty on withdrawals from the 401 connected with the employment you most recently left if you lose or quit your job at age 55 or later.

Read Also: How Do You Transfer 401k