Im 35 What Should I Have Saved

There is a lot of research showing that people tend to rely on approximations or rules of thumb when it comes to financial decisions.

With this in mind, many financial firms publish savings benchmarks that show the ideal levels of savings at different ages relative to an individuals income. A savings benchmark isnt a replacement for comprehensive planning, but it is a quick way to gauge whether youre on track. Its much better than the alternative some people useblindly guessing! More importantly, it can act as a catalyst to take action and start saving more.

However, for the benchmark to be useful, it needs to be realistic. Setting the target too low can lead to a false sense of confidence setting it too high can discourage people from doing anything. Articles on retirement savings goals have generated spirited discussion about the reasonableness of the targets.

What Is The Maximum 401k Contribution Amount

Starting in 2020 , you can contribute up to $19,500 each year to your 401k if you are under 50. If you are over the age of 50, you may be able to make catch-up contributions. This provision lets you invest up to an additional $6,500 in your 401k .

PRO TIP: You need to be behind in your 401k contributions to make catchup contributions.

When compared to a Roth IRA, where you can only contribute up to $6,000/year, this is an amazing opportunity especially since your pre-tax money is being compounded over time.

It’s Recommended That You Pay Off Any Bad Debt And Make Your Good Debt Manageable

Walsh explains, “Bad debt is any debt with an interest rate greater than 7% such as credit cards or personal loans. Good debt is any debt with an interest rate less than 7% such as student loans or mortgages.“

So in an ideal world , by the time you’re 35 you’d have no bad debt and anything classified as good debt would be manageable. For the latter, Walsh says, “Good debt is fine to have as long as the payments fit comfortably in your budget, allowing you to save for the future.”

Recommended Reading: Can I Roll Part Of My 401k To An Ira

How To Prepare For Your Retirement

Not everyone gets the opportunity to invest in a 401 early in life. As soon as it becomes available, its best to consider taking advantage of this benefit.

As of 2022, individuals under 49 can legally contribute $20,500 per year. Those 50 or older can save an additional $6,500 as a catch-up contribution. Starting early will allow you to have more saved by the time of retirement.

How To Calculate Your Monthly 401 Contribution

In 2021, the 401 contribution limit is $19,500 for those under age 50 this increases to $20,500 for 2022. Workers age 50 or older can make an additional catch-up contribution of $6,500 in both 2021 and 2022. You and your employers combined contributions cant exceed $58,000 in 2021 or $61,000 in 2022, excluding catch-up contributions.

However, few people actually contribute these amounts. Only 12% of plan participants made the maximum contribution in 2020, when the limit was $19,500, according to Vanguard’s 2021 How America Saves report.

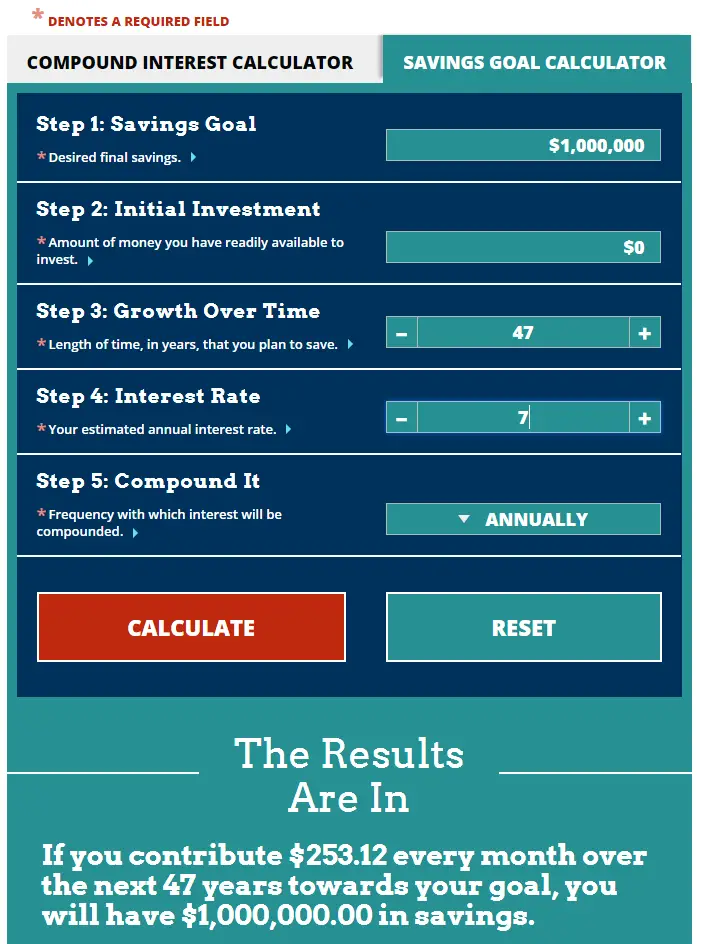

To determine how much you should be saving, you can use Social Securitys retirement estimator and see what monthly benefit you can expect from that fund. You also can use a retirement calculator to estimate how much youll need each month on top of Social Security. Choose a calculator that allows you to personalize as many factors as possible, including your current age and account balance, anticipated contributions, other sources of income, and expected rates of return.

Also Check: Can I Invest My 401k In Gold

Never Quit Your Monthly Payments

As you begin to pay down your debts, continue to allocate the same amount to other debts.

For a rough example

- Lets say you were paying $50 per month on a credit card and $100 per month on a loan.

- Once you pay off the $50 per month credit card, add that $50 per month to the loan.

- Now youll be paying $150 per month on the loan, and its paid that much faster.

When the debts are completely paid off, continue paying that $150 per month that you already have allocated into your retirement fund.

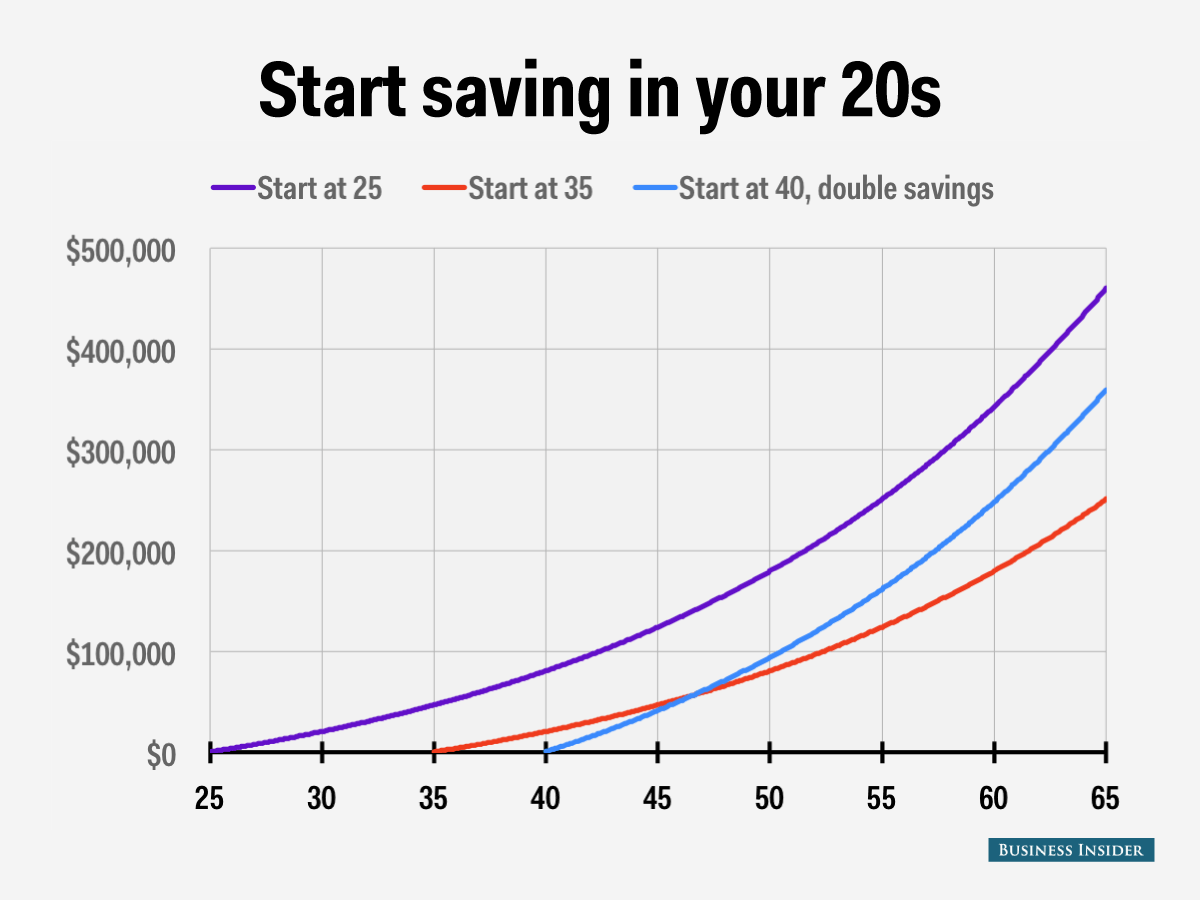

Keep your money working for you. You still have a good 30 years to earn some compound interest if you get focused and put your money to work.

Related: Keep Investing Simple: The Secret to Wealth

When Your Retirement Is In A Good Place It May Be Time To Start Saving For Your Short

Exactly how much money you should have in your retirement account by age 35 varies depending on who you talk to. Some advisors suggest that by the time you’re 35, you should have double your current salary in retirement, while others say having the amount of your salary in savings is sufficient. Meanwhile, the Transamerica Center for Retirement Studies released a 2020 report that found that the median retirement savings for millennials was $23,000 .

There are a lot of intimidating “benchmarks” floating around, but the important thing is that you just start saving. And keep in mind that the amount of money you’ll actually need for retirement is completely dependent on what sort of retirement lifestyle you envision for yourself.

Once you commit to a plan that will get your retirement savings to a place you’re comfortable with, then you can focus on other big financial goals. “The key is not to sacrifice retirement savings to fund other goals such as paying for college or buying a vacation property,” says Walsh.

You May Like: How To Transfer 401k From Old Job

Prioritize Your Retirement Savings

Whether you started saving late or are frugal with your finances, there are several things you can do to increase the amount of money you put toward your 401.

Its advisable to add one year of gross salary saved every five years. So when youre 30, youll want to have saved one years worth of your salary at age 35, youll want to have saved two years worth of your salary and at 40, youll want to have saved three years worth of your salary.

Make compound interest work for you: Compound interest is a simple concept that can rapidly cause wealth to snowball. It happens when the interest that accrues on an amount of money, in turn, accrues interest itself. Do your research to see which 401 plans have the best interest-bearing options.

Average 401k Balance At Age 65+ $471915 Median $138436

The most common age to retire in the U.S. is 62, so its not surprising to see the average and median 401k balance figures start to decline after age 65. Once you reach age 65, there are still several considerations for your retirement, even if you are no longer working and accumulating wealth. Some of these include making decisions about Medicare, creating a plan around withdrawing money from your retirement accounts, and evaluating any additional insurance needs.

Read Also: Can I Take A Loan Out Of My 401k

When Should I Contribute To A Roth Ira Instead

Your retirement plan should always focus on leveraging tax deferment and a high savings.

Your retirement age is not set at 65, it is simply a function of your personal burn rate and the passive income you can generate from your savings.

That low cost of living, tax deferment, those matching contributions from your employer, that consistent annual contribution to your 401k, your healthy savings account, and the power of compound interest can bring your retirement age down exponentially

With that said, which retirement accounts should you be contributing to in order to maximize your tax advantage?

The tax advantages of contributing to a 401k can differ from those of a Roth IRA, depending on your annual salary. A Roth IRA also offers more flexibility for accessing funds penalty-free, compared to a 401.

Always take full advantage of employer offers and contribute enough to your 401k to take full advantage of your employer matching, but read our article on saving in a Roth IRA vs a 401k to craft a plan that works for you. There are lots of ins-and outs and subtleties to retirement planning, and the better you understand those ins and outs, the better you can tailor plans that match your personal situation.

What Net Worth Is Rich

Most Americans say that to be considered wealthy in the U.S. in 2021, you need to have a net worth of nearly $2 million $1.9 million to be exact. Thats less than the net worth of $2.6 million Americans cited as the threshold to be considered wealthy in 2020, according to Schwabs 2021 Modern Wealth Survey.

Don’t Miss: How To Find Out How Much Is In My 401k

How Much Should I Have Retirement At 35

So to answer that question, we believe that having a 35-year retirement income saved once and a half times is a reasonable goal. This is an achievable goal for anyone who starts saving at the age of 25. See the article : How retirement works. For example, if a 35-year-old earns $ 60,000, he saves about $ 60,000 and about $ 90,000.

What Is A Good 401k Match

Anyone who has worked multiple jobs will realize that employer 401K matching policies can be wildly inconsistent.

According to the Bureau of Labor Statistics, the average 401k match is 3.5%. a 2015 National Compensation Survey by the BLS found that sadly, of the 56% of employers offered 401k plans :

- 49% match 0%

- 41% match contributions between 0-6% of an employees salary.

- 10% match contributions at 6% or more of salary.

The lesson is, if youre one of the fortunate 10% whose employer matches 6% or more of their salary, get that maximum match every year!

Recommended Reading: How To Roll Roth 401k To Roth Ira

Once You Have The Basics Covered Try To Put 15%20% Of Your Income Toward Retirement

Saving for retirement is important, but Walsh notes that you should first check those foundational finance to-dos off your list clearing up bad debt, setting up an emergency fund, and getting insured.

If you’re there, he says, “A 35-year-old should strive to put away between 15% and 20% of their income toward retirement. This is a good starting point, but if you are a high earner, started saving later, or want to retire early, then it will need to be higher.”

That being said, if you look at the numbers and can tell that putting aside 15%20% would be too restrictive, it might be a sign to look for ways to earn more. Maybe that means finally asking for that raise, picking up a side hustle, or keeping your eye out for a new job.

Is It Possible To Live The Dream In Retirement

Just 22% of boomers are living the dream compared with 27% of Gen Y and 18% of Gen X When youre retired what does living the dream look like? Whatever financial goals you have for your retirement years, a CERTIFIED FINANCIAL PLANNER® professional can offer valuable advice on securing your financial future and living your dreams. Yes!

You May Like: How To Get Money Out Of 401k Without Penalty

Average Current Retirement Savings Balance

Unfortunately, many people are woefully under-prepared for retirement from a financial standpoint.

Here are some statistics on the median current retirement savings balances of Americans based on their age.

| Families Between |

|---|

| 70+ | 12.3% |

Workers save more for retirement as they get older and pay off other debts like student loans and a home mortgage.

At a minimum, many experts recommend saving at least 10% of your income for retirement. Dave Ramseys Baby Steps recommend saving at least 15% into retirement accounts after getting out of debt and building an emergency fund.

You can use a retirement calculator like NewRetirement to review your personal progress and project how long your nest egg will last. This tool is free but paid plans are available too.

Read our NewRetirement review to learn more about this interactive retirement planner.

Can You Become A Millionaire From 401k

If you increase your contribution each year to meet the new annual limits, or if you get a 401 game from your employee, you could become a millionaire even faster. But for most people, setting aside $ 20,000 each year for retirement is unrealistic. That doesnt mean you cant save a million, though.

You May Like: How To Check My 401k Plan

K Savings By Age: How Much You Should Have

To determine how much you should have saved in your 401k by age, Ive come with some assumptions that have encapsulated in a chart below.

The assumptions for the below chart are as follows:

- Low End column accounts for lower maximum contribution amounts available to savers above 45.

- Mid End column accounts for lower maximum contribution amounts available to savers below 45.

- High End column accounts for savers who are under the age of 25. After the first year, one maximizes their contribution every year to their 401k plan without failure.

- Average starting working age is 22. But you can follow the number of years working as a different guideline if you graduate later or earlier.

- $18,000 is used as the conservative base case maximum contribution amount for ones entire working life.

- No after-tax income contribution, although more power to you if you have the disposable income to do so.

- The rate of return assumptions are between 0% 10%.

- Company match assumption is between 0% 100% of employee contribution. $61,000 is the total 401k contribution for 2022. Employees can contribute a maximum of $20,500.

- The Low, Mid, and High columns should successfully encapsulate about 80% of all 401K contributors who max out their contributions each year. There will be those with less, and those which much greater balances thanks to higher returns.

Invest In Real Assets To Boost Wealth

What we do know is that housing prices have outpaced wage inflation by more than 3.5X since 2000. Therefore, not only should you invest heavily in your 401k, you should also invest in real estate.

In a rising interest rate environment, investing in real estate can be beneficial. Not only will rent prices increase, but so will property prices. Further, the real cost of debt gets whittled down.

At least be neutral real estate by owning your own primary residence. To get long real estate, I would buy rental properties and invest passively in real estate crowdfunding.

My favorite two real estate crowdfunding platforms are:

Fundrise: A way for accredited and non-accredited investors to diversify into real estate through private eREITs. Fundrise has been around since 2012 and has consistently generated steady returns, no matter what the stock market is doing. For most people, investing in a diversified real estate portfolio is the best bet.

CrowdStreet: A way for accredited investors to invest in individual real estate opportunities mostly in 18-hour cities. 18-hour cities are secondary cities with lower valuations, higher rental yields, and potentially higher growth due to job growth and demographic trends. If you have a lot of capital, then you can build your own select real estate portfolio with CrowdStreet.

Don’t Miss: How To Move Your 401k To A New Job

Why Employers Offer 401s

In 1978, when the law authorizing the creation of the 401 was passed, employers commonly attracted and retained talent by offering a secure retirement through a pension . The 401 created an entirely new system, with more flexibility for both employer and employee. One of the ways it did so was by giving employers the option to match employee contributions.

Matching is a very transparent process: for every dollar you put into your 401, your employer also puts in a dollar, up to a certain amount or percentage of your income. Theres no mystery here. If your employer promises to match all 401 contributions up to 5% of your income, and you contribute that amount every month, your employer will match you dollar for dollar, every month. Its a win-win situation. You are doubling your money, and your employer is building a happy workforce.

Less Than 25 Years Old

- Average 401 balance: $6,718

- Median 401 balance: $2,240

- Contribution rate: 8.1%

Although many people younger than 25 years old are new to the workforce or are not in a job where a 401 plan is offered, their average 401 balance increased 23 percent in 2020 compared to 2019, and 49 percent of those who are eligible for a 401 plan are participating in it. This indicates that this generation is indeed planning for retirement early on.

You May Like: How To Check 401k Balance Adp

Depend On Nobody But Yourself

Contribute the maximum pre-tax income you can to your 401 for as long as you work. This is the absolute MINIMUM you can do to by on the right 401k savings by age path.

Below is a chart that shows what you could have in your 401 if you max it out each year starting in 2022. The right hand column shows what you would have in your 401 with 8% compound annual returns.

In other words, everybody who consistently maxes out their 401 each year will likely be a 401 millionaire by the time they turn 60.

After you contribut a maximum to your 401k every year, try and contribute at least 20% of your after-tax income after 401k contribution to your savings or retirement portfolio accounts.

This way, you will have potentially DOUBLE the amount in total retirement saving if your household income is $100,000 or more. If your household income is closer to $50,000, you should still see a nice 30% boost to your retirement savings if you consistently save 20% of your after tax income.

Treat your 401k just like Social Security and write it off completely from your mind. Do not expect either accounts to be there for you when you retire. Its just like how you should never expect the government to ever help you when youre in need.