Federal Deposit Insurance Corporation

The FDIC is designed to protect peoples money held in banks through FDIC insurance. Bank account holders have federal protection for assets up to $250,000 in any given FDIC-insured institution.

The FDIC not only provides this insurance for account holders against potential bank failure, it also maintains records of merged or failed institutions, and the owners of those accounts. Going to the FDIC website, use the bank find tool to search institutions. If funds were unclaimed for an extended period of time, they may be held in the state controllers office. The FDIC offers links to free search tools administered by the National Association of Unclaimed Property Administrators.

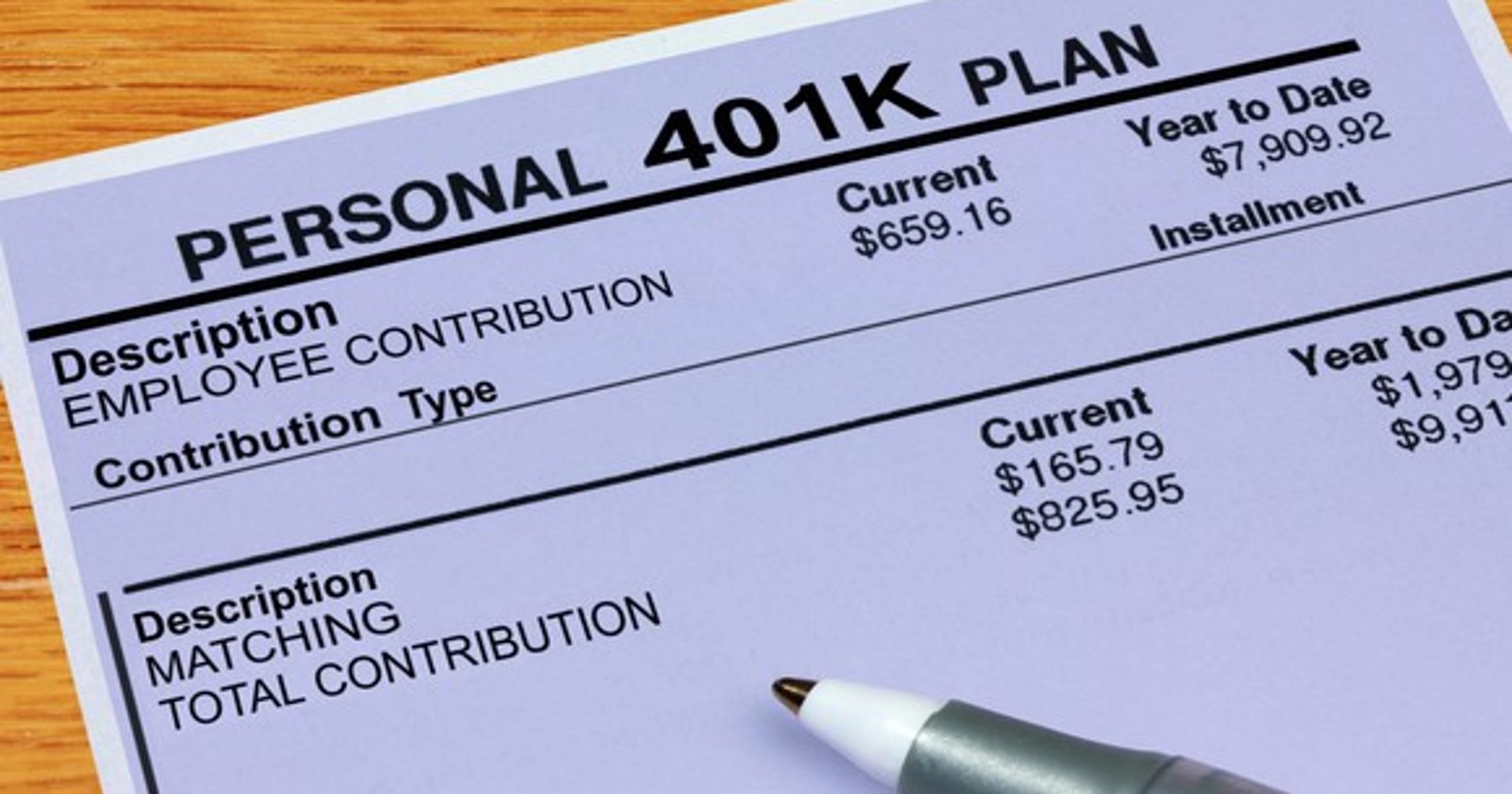

Private Sector Employees Can Invest For Retirement With A 401 Plan

A retirement plan may be one of the most valuable benefits of employment. Used effectively, it can deliver a long-term impact on your financial well-being. See how a retirement plan works and learn about the power you have to control your financial future.

In general, a 401 is a retirement account that your employer sets up for you. When you enroll, you decide to put a percentage of each paycheck into the account. These contributions are placed into investments that youve selected based on your retirement goals and risk tolerance. When you retire, the money you have in the account is available to support your living expenses.

What Is A 401 Beneficiary

When you enroll in a 401 plan at work, youll often complete a form naming your beneficiaries. Youll be asked to name at least two people: a primary beneficiary and a contingent beneficiary:

- Primary beneficiary. Your primary 401 beneficiary is your first choice to receive your retirement assets in the event of your death.

- Contingent beneficiary. Your contingent, or secondary, beneficiary is the person who will receive benefits if your primary beneficiary isnt alive when you die, or declines to accept the benefits.

You may name more than one person in both the primary and contingent beneficiary categories. If you do, though, youll need to specify the percentage each primary beneficiary will receive. The shares dont have to be equal, but the total must equal 100%. For example, you could name a sibling as a primary beneficiary receiving 80% of the account balance, and two charities receiving 10% each.

Recommended Reading: How To Transfer My 401k To My Bank Account

Don’t Miss: How Much Should I Have In My 401k At 55

What Happens If You Cash Out Your 401

If you withdraw 401 money before age 59 ½, you could face a 10% penalty from the IRS on top of paying applicable income taxes. There are some exceptions, such as if you leave your job at age 55 or later or if you make a hardship or other eligible withdrawal, but its a good idea to consult a tax professional before cashing out your 401.

No matter when you cash out your 401, though, you may owe income tax on what you withdraw if its a traditional account or investment earnings in a Roth account that you didnt start contributing to at least five years before.

Understanding How To Build Your Financial Toolkit

This is NOT the financial toolkit but think about being a mechanic and how having the right tools will get the job done.

It wasnt easy, although once we paid our mortgage in full, everything else fell into place like a game of Tetris.

Although financial literacy began as papercarriers, we werent money experts.

Related: 5 Financial Resources That Helped Usalong our debt repayment journey.

We laughed when we found out that we were paper carriers and had the same financial mentality.

Of course, we spoke about how the money was around $25 a week, but better than nothing.

Note, Better than nothing, and this state of mind is not something everyone believes in.

Often we feel we are worth more to a company than they pay us,

Don’t Miss: Can You Cash Out 401k To Buy A House

What Are Average Adp 401 Fees

In our most recent Small Business 401 Fee Study, we found that ADP plans cost small businesses an average of 1.47% of plan assets each year, with their admin fees totaling about $314.08 per participant.

|

Average ADP 401 Fees |

|

|

All-In Fees |

1.47% |

While their per-capita admin fee is below the study average of $422.30, that number can easily grow much higher due to the way these fees are charged.

In our experience, about 60% of admin fees charged by ADP are paid by revenue sharing hidden 401 fees that lower the investment returns of plan participants. Not only are plan sponsors or participants often unaware that theyre paying them, but theyre always charged as a percentage of plan assets. That means plan participants will automatically pay ADP higher and higher administration fees for the same level of service as their account grows. Thats not fair!

When you factor in compound interest, these growing fees can make a huge dent in your retirement savings. As such, you want to do everything in your power to avoid paying them.

If youre currently using ADP for your 401, your first step to avoiding these fees is to find out whether or not youre paying them. Well show you how to do that later.

Do I Have A 401k I Don’t Know About

If you think that you may have enrolled in a 401K plan with a previous employer, but youre not quite sure, there are a few ways to find out if you did.

The easiest way is to contact the HR department of your former employer and ask them whether you ever contributed to a 401K while in their employment. Youll need to give them your personal details along with the dates that you worked for them, so keep this information to hand.

If your old employer has since gone bust or you cant remember which companies youve worked for in the past, check the National Registry of Unclaimed Retirement Benefits website. Youll be able to see whether youve been listed on their database by your old employer as someone with unclaimed retirement plan funds.

If you havent been listed on the National Registry of Unclaimed Retirement Benefits database, there are a couple more options to explore. Visit NAUPA or missingmoney.comwhere you can search by state based on where youve lived or worked to find out whether any unclaimed assets belong to you.

Recommended Reading: How Much Do You Need In Your 401k To Retire

Roll The Account Over Into His Or Her Own Retirement Account

Some retirement plans require that a deceased employees account be distributed in a lump sum. In order to avert an immediate tax obligation, a surviving spouse could roll over the account into his or her own IRA or other retirement plan. Required minimum distributions would begin when the surviving spouse turns 70 ½.

Insights Delivered To Your Inbox

The Financial Planning 5

Terms and Conditions for the CFP Board Find a CFP® Professional Search

These terms and conditions govern your use of the Find a CFP® Professional Search feature on Certified Financial Planner Board of Standards, Inc.s Lets Make a Plan website . Before using Find a CFP® Professional, you must read and agree to be bound by these terms and conditions and CFP Boards Terms of Use, which also apply to your use of Find a CFP® Professional.

Permitted Uses

Find a CFP® Professional is compiled and published by CFP Board as a reference source about CFP® professionals in the United States. It does not include all CFP® professionals — only those who chose to be included. It may be used only by members of the public to locate CFP® professionals and obtain information about them, and individual CFP® professionals or their staff to view their own listings or those of colleagues. CFP Board reserves the right to block your use of this search tool indefinitely should CFP Board determine, in its sole discretion, that you are using it for a different purpose. Except as expressly provided herein, neither Find a CFP® Professional nor any of its data, listings, or other constituent elements may be modified, downloaded, republished, sold, licensed, duplicated, “scraped,” or otherwise exploited, in whole or in part. CFP Board expressly prohibits use of this information by individuals or business organizations to offer products or services to CFP® professionals.

Read Also: How To Borrow Money From Your 401k Plan

Financial Toolkit Tip Get Your Information Together

Stop feeling sad for yourself, start working your way up, and turn around to say goodbye to the depressed, money-stressed person you used to be.

If you find it challenging to get started to become a money boss, its essential to find out whats stopping you?

- Are you short on cash?

- Why are you short on cash?

- How can you increase cash flow?

Taking money matters into your own hands takes a big commitment but is well worth the effort.

Find Your 401s With Your Social Security Number

If you don’t have any of the information mentioned above, you’re not out of luck just yet. You can use your social security number to search for and find old 401s.

When you join a 401 at work, you’ll provide your social security number. This ties your 401 to any tax responsibilities you may have but also permanently stamps your 401 to your identity.

There are a couple of places to search for your old 401s using your social security number.

You May Like: How To Transfer Your 401k From One Company To Another

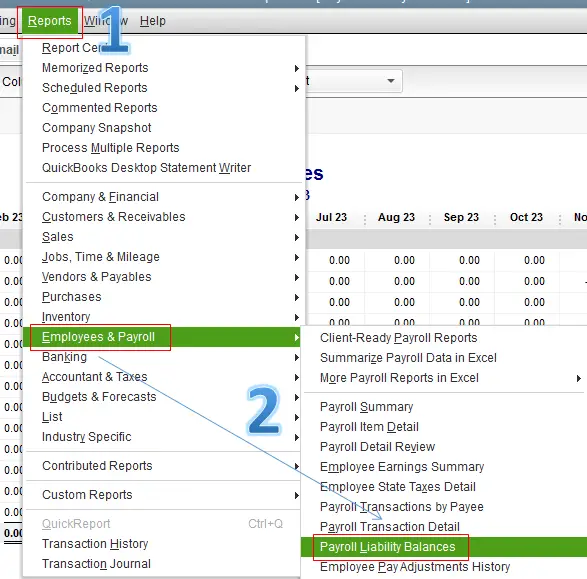

How To Check Your 401 Account

07.21.2019

No matter how much your investments are on auto-pilot, it is always beneficial to check your 401 account once or twice a year online. In your online account you can check your 401 balance, how your investments are performing, yearly rate of return and more. With this information, decide if any changes need to be made such as contribution amounts and investment choices. Summertime is the perfect time to check your 401 and see how youre doing against your retirement and 401 contribution goals.

If youre still new to retirement savings, check out John Olivers segment on retirement savings. He does the best job at making 401 plans entertaining.

How Much Should I Contribute To My 401

Most financial experts say you should contribute around 10%-15% of your monthly gross income to a retirement savings account, including but not limited to a 401.

There are limits on how much you can contribute to it that are outlined in detail below.

There are two methods of contributing funds to your 401.

The main way of adding new funds to your account is to contribute a portion of your own income directly.

This is usually done through automatic payroll withholding ).

The system mandates that the majority of direct financial contributions will come from your own pocket.

It is essential that, when making contributions, you consider the trajectory of the specific investments you are making to increase the likelihood of a positive return.

The second method comes from deposits that an employer matches.

Usually employers will match a deposit based on a set formula, such as 50 cents per dollar contributed by the employee.

However, employers are only able to contribute to a traditional 401, not a Roth 401 plan.

This is especially important to keep in mind if you want to utilize both types of plans.

A key variable to keep in mind is that there are set limits for how much you can add to a 401 in a single year.

For employees under 50 years of age, this amount is $19,500, as of 2020. For employees over 50 years of age, the amount is $25,000.

If you have a traditional 401, you can also elect to make non-deductible after-tax contributions.

Plan in Advance

You May Like: How To Get My 401k Early

If Youre Thinking Of Quitting Your Job

Timing is important here. If your company offers matching contributions, dont walk away and leave that money on the table. Check your plans vesting schedule to see whether working longer will let you vest more in your employer contributions. Also, find out when matching contributions are deposited into your account. Some companies make the deposit every pay period some only once a year. If you leave before that years contribution is made, youll lose it. *

Life Affordability When Interest Rates Increase

When The Bank of Canadas interest rates rises, borrowing money from the bank is harder.

Anyone buying a house today far above the asking price or those with debt must think ahead about how this will affect them.

Can you afford to pay for your debts if the interest rates increase?

If the answer is no, call a family meeting or talk to your spouse about ways to increase cash flow and decrease expenses.

You May Like: Should I Roll My 401k Into An Annuity

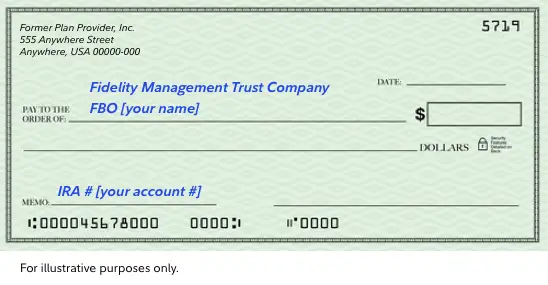

Contact Your Current Plan Administrator And New Plan Administrator

The easiest 401 rollover option is to get your old plan administrator to transfer your balance directly to your new account. This is called a direct 401 rollover, and it frees you from having to worry about tax consequences or early withdrawal penalties.

Speak with your new plan provider about getting an account number, then provide the information to your current 401 administrator. Theyll take care of the rest.

Be aware that not every plan administrator will perform a direct 401 rollover. In this case, the plan administrator cuts you a check for the balance, and its up to you to send the funds to your new 401 plan provider. You have just 60 days to redeposit the balance in your new plan. Otherwise its treated as an early withdrawal that incurs a penalty and income tax liabilities.

Make Sure You Actually Contributed

Before you go through the hassle and process of calling the HR department at your old employer, or searching through databases, its a good idea to verify that you contributed to the plan.

If you are unsure if you contributed to a 401 plan, you can check your previous year tax return and old W-2. Any contribution will be in Box 12 of the W-2.

ERISA, or the Employee Retirement Income Security Act of 1974, sets minimum standards for retirement plans, and protects retirement savings from abuse or mismanagement.

Among other things, employees are required to make annual reports

Read Also: How To Open A 401k Plan

Is There Lost Loot Out There With Your Name On It Well Tell You How To Search

Do you look for your name in newspaper ads that list owners of unclaimed property? Thats a start, but youve also got to broaden your search if you expect to find forgotten funds. Many types of lost assets, including pensions and U.S. Savings Bonds, arent safeguarded by the state agencies that place those newspaper ads.

Its easier than ever to find forgotten property thanks to the increasing number of databases. In most cases, it makes sense to do the sleuthing yourself rather than pay a finder firm to do it for you. If you locate funds that are yours, the fiduciary that holds them will provide specific instructions on how to claim them. Youll need proof of your identity. If the property belonged to a deceased relative or friend, youll also have to prove that you are the executor of the estate or the rightful heir.

You May Like: Can I Move My 401k To A Different Company

Most Of Your 401 Money Is Yours

Your 401 account usually holds several different types of contributions. The contributions you put in are called “salary deferral contributions.” These always belong to you, as they represent your earned wages paid into the 401 account. The company cannot take this money, and it is yours by law.

Often, companies have a separate, independent firm acting as a 401 administrator to provide service for the plan. Whether your company had an internal or external plan administrator, that entity is bound by a fiduciary duty to put your needs first as the account holder. This acts as a safeguard, because it protects an unscrupulous employer from taking your money.

If your company made contributions for you, they were either matching your contribution or making a profit-sharing contribution. Some of this money may belong to you, and some may not.

This type of contribution can be subject to a vesting schedule, which means that the longer you stay employed with the company, the more of that money belongs to you. The portion of your employer contributions in which you are 100% vested belong to you, so that part of your money also stays secure.

Recommended Reading: Where Is My 401k Money Invested

How To Check Your 401

First things first, how do you even check your 401 account online? Start by going to the website of your 401 provider. If youre not sure who your 401 provider is, go onto your employer intranet and it should be listed under a HR resources section. Once youre on their website, if you get stuck hit forgot username. If youve never set up an online profile this process will alert you to that pretty quickly. Itll take a couple of steps to get your username and password retrieved / set up. Once you have this bookmark the page and save your username / password either through a password manager or somewhere you can reference later.

Contact Your Hr Department

If you don’t know where to check your 401 balance, your HR department can at least direct you to the entity that manages your company’s 401 plan. Then, you can contact the 401 plan administer by phone or over the internet to check the balance of your 401 plan. You can also check how the money is invested and whether it’s time for you to rebalance your portfolio.

Video of the Day

Don’t Miss: Can I Use 401k To Invest In Real Estate