Saving For Retirement In Your 60s

Retirement is around the corner in your 60s, and the times almost come to enjoy the money youve worked so hard to save. Consider shifting to capital preservation and income-generating investment strategies. These fixed income investments tend to be stable bonds or fixed annuities aimed to keep the money youve saved over the years safe.

As youll most likely be entering the last of your full-time working years, youll want to keep saving as aggressively as you can.

Emergency fund: Consider upping your cash savings to one years worth of living expenses, so you have more cash on hand for things like medical expenses.

Additional savings: Review your risk tolerance and investment strategy with an eye toward capital preservation. Financial advisors may be particularly helpful now in helping you figure out how to handle the asset allocation of your retirement funds.

Educational savings: If you have children still in college or grandchildren whose college youd like to help out with, you can continue contributions to 529 accounts.

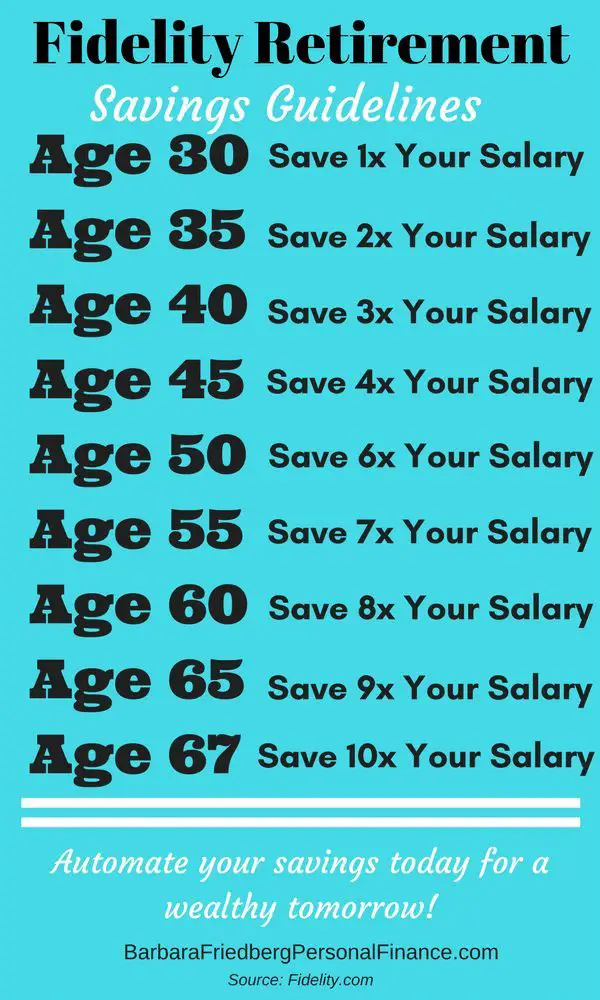

Retirement savings: Make sure youre contributing as much as you can before you retire. By the time you turn 67, you should have 10 times your annual salary in retirement savings.

Catch-up tips: Even after retirement, there are always part-time jobs that can supplement your income as you adjust to living on your savings and Social Security income.

What Age To Retire With Social Security

Choosing what retirement age to turn on your Social Security Benefits is a critical decision to make.

When choosing a target retirement age, you must consider how much Social Security income you will receive now versus later, and if the amount is dramatically different, decide later.

One should consider what expenses will arise as you get older instead of the monthly income you will receive today.

Example

Youre 66 years old, and if you turn on Social Security Benefits today, your income is $1,900 a month.

If you wait four more years at age 70, your monthly income will be roughly $3,000 a month.

Which retirement age will benefit you the most at age 80 when you may need to go into a nursing home?

What is the quality of your nursing home earning $1,900 a month versus $3,000 a month?

We didnt even consider inflation, increasing taxes, and the consistently increasing cost of care between today and 20 years from now.

The Golden Years have often been overlooked factors in .

Is it worth it to retire early and collect SSI prematurely?

How Much Do I Need To Retire

Figuring out how much savings you need to retire is not a simple calculation. You must know how long you will live andproject your expensesforward from retirement through the rest of your life. Expenses should include housing, healthcare, all household costs, what you know what youll spend and make a guess at unexpected outlays. You also need to calculate your retirement income from Social Security and other guaranteed sources. .

Any retirement expenses not covered by known retirement income will need to be taken care of with your savings. That sum is how much savings you will need for retirement . There are hundreds of numbers that go into getting a really accurate estimate of how muchretirement savings you need. The NewRetirement Planner is a comprehensive tool that can help you get to a reliable number.

You May Like: Can You Pull Out Your 401k To Buy A House

How Much Can You Withdraw From Your 401k After Retirement

How much can you withdraw from your 401k after retirement? The traditional withdrawal approach uses something called the 4% rule. This rule says that you can withdraw about 4% of your principal each year, so you could withdraw about $400 for every $10,000 youve invested.

Can I withdraw all money from 401k after retirement? Special Considerations for Withdrawals. The greatest benefit of taking a lump-sum distribution from your 401 planeither at retirement or upon leaving an employeris the ability to access all of your retirement savings at once. The money is not restricted, which means you can use it as you see fit.

Is there a limit on how much you can take out of your 401k? Theres no limit for the number of withdrawals you can make. After you become 59 ½ years old, you can take your money out without needing to pay an early withdrawal penalty.

Do I pay taxes on 401k withdrawal after age 60? The IRS defines an early withdrawal as taking cash out of your retirement plan before youre 59½ years old. In most cases, you will have to pay an additional 10 percent tax on early withdrawals unless you qualify for an exception. Thats on top of your normal tax rate.

To Retire At 60 Youll Need More Saved To Bridge The Gap Before Medicare

If your spouse is still working, you can probably get health insurance there. If not, paying for medical insurance until Medicare at age 65 may be prohibitive. In general, early retirees have five options for health insurance before Medicare:

COBRA coverage generally only lasts for 18 months if you retire early. If you retire at 60, you need five years. Obamacare exchanges are usually more affordable than private insurance, but its still really expensive. The cost also varies by state.

According to this calculator from the Kaiser Family Foundation, two 60-year-old adults in Boston, MA would pay a premium of $1,237 per month in 2021 for a silver plan, assuming theyre not eligible for subsidies. For five years, assuming no cost increases, thats nearly $75,000. In reality, medical costs tend to increase faster than inflation.

Recommended Reading: How To Make A 401k Account

Saving Outside Of Retirement Accounts May Be Key To Retiring Comfortably

Youll generally have the best opportunity to retire early if you have investment assets outside of retirement assets. Taxable investment assets offer tax planning opportunities in retirement and also increase overall savings. Especially for high earners or one-income households, maxing out your retirement accounts probably isnt enough.

As I illustrate in this analysis for Forbes, a couple both maxing out their 401s from age 35 to 65 are likely to attain a safe retirement income of $65,000 annually, increasing by inflation. Why not more? Because we ran a Monte Carlo simulation, which more accurately represents how the market moves.

If we ran the same analysis but using a static return with no deviation to account for down years, , the couple would think they could spend $100,000 per year instead. At this level of spending, theres a 50% chance they would run out of money during retirement under normal market conditions. More on stress testing a retirement plan below.

A taxable brokerage account is the most flexible type of investment account. There is no contribution limit or rules about when you can sell funds and withdraw the cash. In exchange for flexibility, you sacrifice the tax-deferred growth and tax deduction you get with 401 contributions.

How Long Does It Take To Get Money Out Of Your 401k

How long does it take to remove 401 after retiring? Depending on who manages your 401 account , it may take between three and ten working days for you to receive a check after deducting 401 .

Can I just withdraw money from my 401k?

Yes, you always have the right to deduct some or all of your contributions and their salaries, but it is not always black and white. All deductions you take will be subject to a tax deduction, and you may be liable for tax deduction as well.

How long does it take to get 401k withdrawal direct deposit?

The 401 credit system can be anywhere from the day if you do it online for a few weeks if done by hand. Once completed, it may take two to three days for the direct deposit to reach your account.

Also Check: Who Can Open An Individual 401k

How Do I Pull Money Out Of My 401k

Wait Until You Reach 59½ By age 59½ , you will be eligible to start withdrawing money from your 401 without paying the penalty tax. You just have to contact your system manager or log in to your online account and request a removal.

Can I withdraw all the money from my 401k? The main benefit of taking part in the 401 planâ can be at the time of resignation or resignation to be able to get all your retirement money at once. The money is not restricted, which means you can spend it as you see fit.

The Average 401k Balance By Age

401k plans are one of the most common investment vehicles that Americans use to save for retirement.

To help you maximize your retirement dollars, the 401k is an employer-sponsored plan that allows you to save for retirement in a tax-sheltered way. You can contribute up to $19,500 in 2021 and $20,500 in 2022.

If your employer offers a 401k and you are not utilizing it, you may be leaving money on the table especially if your employer matches your contributions.

While the 401k is one of the best available retirement saving options for many people, only 32% of Americans are investing in one, according to the U.S. Census Bureau. That is staggering given the number of employees who have access to one: 59% of employed Americans.

So how much do people actually have saved in their 401k plans? And how does this stack up against what they could have saved if they were maxing out their 401k every year?

You May Like: How To Calculate Employer Contribution To 401k

How Much Do You Need In Your 401 To Retire

Saving for retirement is one of the most important financial planning goals for most Americans. However, the question of how much youll need to retire is often quite personal and uncertain. But for many American workers, a 401 plan is the vessel used to save for retirement. Figuring out how much you should have in your 401 at any point in your career and at retirement can be challenging. Youll have to take into account a number of things, including where you want to live, what you expect your lifestyle to be and when you plan you retire. If you have in-depth questions about your retirement plans, consider working with a local financial advisor.

But Why Would I Max Out My Roth Ira Before My 401k If Its So Good

Theres a lot of nerdy debate in the personal finance sphere about this very question, but our position is based on taxes and policy.

Assuming your career goes well, youll be in a higher tax bracket when you retire, meaning that youd have to pay more taxes with a 401k. Also, tax rates will likely increase in the future.

The Ladder of Personal Finance is pretty handy when considering what to prioritize when it comes to your investments, but it is just a tool. For more about the Ladder of Personal Finance and how to make it work for you, check out THIS video where I explain it.

PRO TIP: The video is less than three minutes long. It is worth your time.

Recommended Reading: What Is The Tax Rate On 401k After 65

A Look At The Benchmarks

Considering all this, here are some savings benchmarks for people in the following age groups:

Savings Benchmarks by AgeAs a Multiple of Income

Key Assumptions: Household income grows at 5% until age 45 and 3% thereafter. Investment returns before retirement are 7% before taxes, and savings grow tax-deferred. The person retires at age 65 and begins withdrawing 4% of assets . Savings benchmark ranges are based on individuals or couples with current household income approximately between $75,000 and $250,000.

Investor’s Age and Savings Benchmarks| Investor’s Age | |

|---|---|

| 6x to 11x salary saved today | |

| 65 | 7.5x to 14x salary saved today |

We assume the household starts saving 6% at age 25 and increases the savings rate by 1% annually until reaching the necessary savings rate. Benchmark ranges reflect the higher amounts calculated using federal tax rates as of January 1, 2020, or the tax rates as scheduled to revert to pre-2018 levels after 2025. Inflation adjustments to brackets effective in 2021 do not significantly affect the analysis and, therefore, are not reflected. Approximate midpoints for age 35 and older are rounded up to a whole number within the range. Target multiples at retirement reflect estimated spending needs in retirement Social Security benefits state taxes and federal taxes.

How Many People Have $1000000 In Their 401k

Fidelity Investments reports that the number of 401 investors with a net worth of 401 accounts for $ 1 million or more has reached 233,000 by the end of the fourth quarter for 2019, up 16% from the third quarter. of 200,000 and over 1000% from the 2009 estimate of 21,000.1 Joining the ranks of

How many 401k millionaires are there in 2021?

According to Fidelity Investments, one of the largest 401k providers in the United States today, the 401k million figure reached nearly 180,000 in 2021 thanks to the expansion of the bull market.

You May Like: How Much Can You Put Into A 401k Per Year

Depend On Nobody But Yourself

Contribute the maximum pre-tax income you can to your 401 for as long as you work. This is the absolute MINIMUM you can do to by on the right 401k savings by age path.

Below is a chart that shows what you could have in your 401 if you max it out each year starting in 2022. The right hand column shows what you would have in your 401 with 8% compound annual returns.

In other words, everybody who consistently maxes out their 401 each year will likely be a 401 millionaire by the time they turn 60.

After you contribut a maximum to your 401k every year, try and contribute at least 20% of your after-tax income after 401k contribution to your savings or retirement portfolio accounts.

This way, you will have potentially DOUBLE the amount in total retirement saving if your household income is $100,000 or more. If your household income is closer to $50,000, you should still see a nice 30% boost to your retirement savings if you consistently save 20% of your after tax income.

Treat your 401k just like Social Security and write it off completely from your mind. Do not expect either accounts to be there for you when you retire. Its just like how you should never expect the government to ever help you when youre in need.

How To Figure Out If You Can Retire Comfortably

Stress testing retirement projections can help investors feel more confident they wont run out of money under different conditions in the financial markets. Again, basic online calculators dont account for the variability in investment returns or the timing of down years. The only factor is a static average annual return. Put another way, simple compounded return calculators only assume your investments grow, ignoring the downside produces the average.

For guidance that takes your entire situation into account, consider working with a CERTIFIED FINANCIAL PLANNER professional to develop a financial plan and help ensure you stay on track throughout retirement with ongoing investment management and advisory support.

To feel confident that 60 isnt too early to retire, your plan should include a Monte Carlo simulation to stress-test a retirement plan for market volatility.

Putting everything together in a comprehensive financial plan is often the best way to determine how much you need to retire. Running the numbers will help you understand what trade-offs exist and what options best suit your needs and goals.

About Darrow Wealth Management

Darrow Wealth Management is an independent fee-only financial advisor and full-time fiduciary. The Darrow Money Management Program provides ongoing investment management and financial planning services for individuals and families.

You May Like: How To Allocate Your 401k

New Year New 401 Limit Increases What You Need To Know About Your Retirement Savings In 2022

Looking ahead to a strong financial plan in 2022.

getty

Starting the new year off with a strong, strategic financial plan to kickstart your financial goals for the next 12 months can have a lasting impact on your future beyond 2022. This, of course, includes the ever-important consideration of retirement planning. Luckily, recent legislative changes have increased contribution limits for the 401, as well as altered some other retirement investment vehicles to enable increased savings for those who are eligible. Here’s what you need to know about retirement investing as you conduct financial planning for 2022.

New Legislative Changes To Retirement Investments

As of early November, the IRS announced a number of new legislative changes to retirement accounts that take effect this year, much of which can be attributed to the country’s record-high inflation. This includes changes to contribution limits for 401 plans, as well as changes in salary eligibility for IRAs, Roth IRAs and Saver’s Credits, all up from the 2021 plan. Certain contribution limits for IRAs and their associated catch-up values have not changed.

Understanding Investment Limits

How To Max Out Your 401 In 2022

As previously mentioned, one of the most important things you can do to max out your 401 contribution is to make the most of your own income and employer inputs.

Securities and Advisory services offered through LPL Financial, a registered investment advisor. Member FINRA/SIPC.

Tips For Getting Retirement Ready

- If youre unsure of what your retirement plans should look like, a financial advisor can help you get things in order. Luckily finding a financial advisor doesnt have to be hard. SmartAssets free matching tool can pair you with up to three advisors in your area. Get started now.

- Dont forget about Social Security. Youll get a check from the government each month, which can help you get to your desired retirement income level. Find out how much youll get with our free Social Security calculator.

Don’t Miss: How To Check If You Have A 401k