What Is A Thrift Savings Plan

Many private employers offer their employees a 401 retirement savings plan. The government created its own retirement savings plan for its employees and military personnel and called it the Thrift Savings Plan .

The purpose of a TSP is to allow employees to build a retirement savings account over time by setting aside a percentage of their paychecks to be invested and grow until they retire and are ready to spend the money.

Like 401 plans, TSP plans come in two basic flavors, and the employee can choose which to take:

- If you have a traditional TSP, the money you pay into the account comes out of your pre-tax dollars. That is, it’s taken off the top of your gross pay, and you don’t pay income taxes on it until you retire and start withdrawing money. At that time, you will owe income taxes on both the principal and the interest your money earned. Government employers have offered the traditional TSP since 1986.

- If you have a Roth TSP, you’ll pay in post-tax dollars. The taxes owed on the income will be withheld that year. When you retire, the entire proceeds are yours tax-free. The Roth TSP has been offered only since 2012.

The Boring Glory Of Index Funds

Your best bet is to buy something called an index fund and keep it forever. Index funds buy every stock or bond in a particular category or market. The advantage is that you know youll be capturing all of the returns available in, say, big American stocks or bonds in emerging markets.

And yes, buying index funds is boring: You usually wont see enormous day-to-day swings in prices the same way you may if you owned Apple stock. But those big swings come with powerful feelings of greed, fear and regret, and those feelings may cause you to buy or sell your investments at the worst possible time. So best to avoid the emotional tumult by touching your investments

Roth Retirement Accounts Offer More Options

Why does Orman like Roth retirement accounts so much more? Because they offer more flexibility than a traditional 401. With a Roth 401, you dont ever have to take the required minimum distributions. Meanwhile, a traditional retirement account requires you to start taking money out at age 72. If you miss this deadline, or dont take enough money out, the penalty can be severe: The amount not withdrawn is taxed at 50% rate.

Meanwhile, if youre planning to leave retirement savings as an inheritance, Orman says a Roth 401 is better here, too. What if your kids are in a higher tax bracket than you ever were in, and you leave them money in a traditional 401?

Theyre going to lose a lot of that money, Orman says. But with a Roth, they get it without income taxes, she says.

More from Invest in You:

Read Also: How Do I Change My 401k Contribution Fidelity

Max Out Both To Boost Your Nest Egg

Kirsten Rohrs Schmitt is an accomplished professional editor, writer, proofreader, and fact-checker. She has expertise in finance, investing, real estate, and world history. Throughout her career, she has written and edited content for numerous consumer magazines and websites, crafted resumes and social media content for business owners, and created collateral for academia and nonprofits. Kirsten is also the founder and director of Your Best Edit find her on LinkedIn and Facebook.

Plans May Offer An Employer Match

While they might be harder to obtain, 401 plans make up for it with the potential for free money. That is, many employers will match your contributions up to some level.

401s sometimes will have a match depending on the employers generosity and financial position, says Michael Lackwood, founding principal of New York City-based Spring Delta Asset Management. If your employer does offer a match, it makes most sense to contribute to the 401 at least up to the maximum percentage match.

For example, if you contribute 4 percent of your salary, your employer may offer 2, 3 or 4 percent, as an inducement to help you save. Thats free money and an immediate return on your investment.

In contrast, youre on your own with an IRA, and your funds will consist only of what you contribute and any earnings on those contributions.

Read Also: How To Transfer 401k Without Penalty

Vs Roth Ira: An Overview

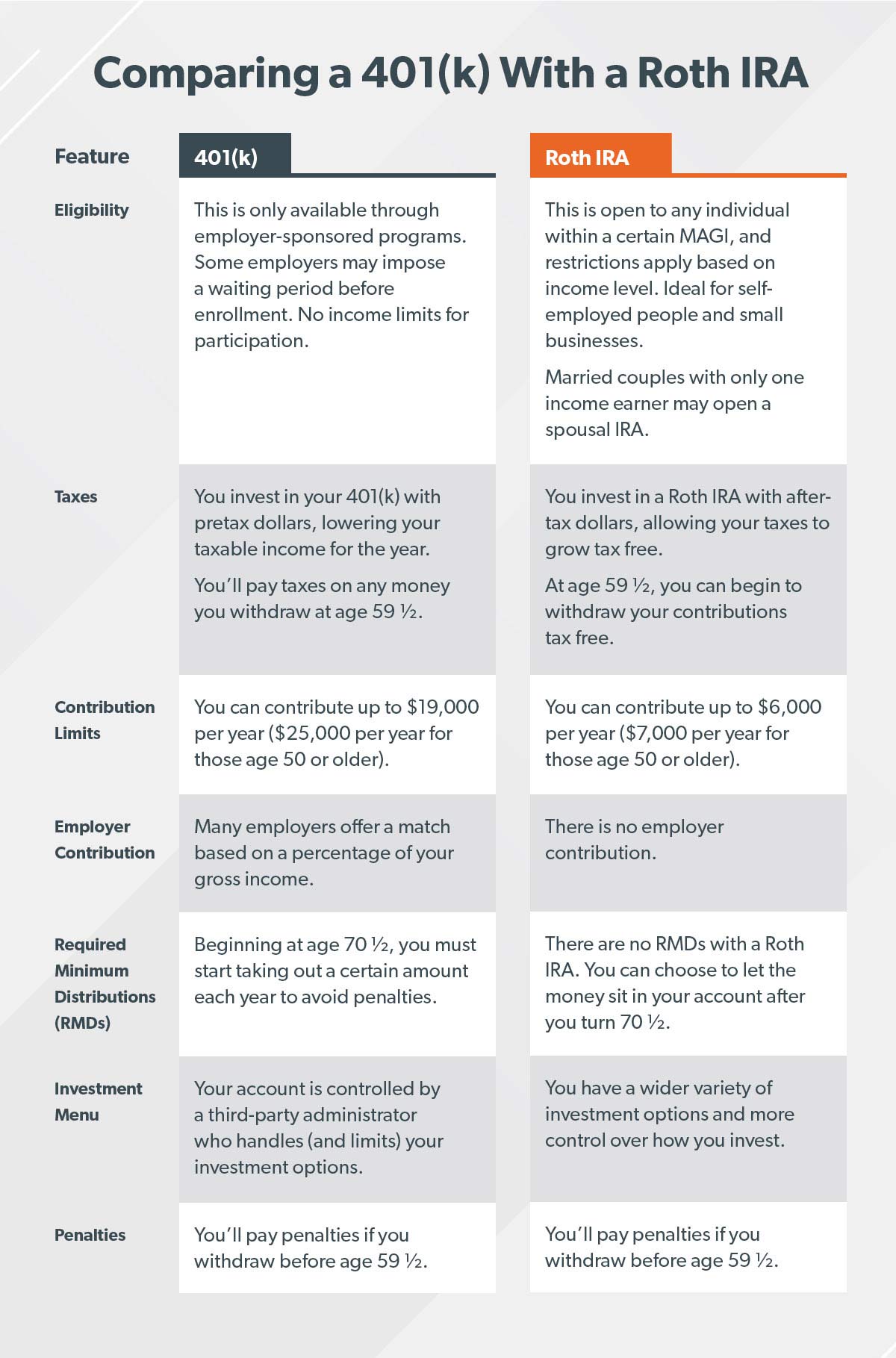

Both 401s and Roth IRAs are popular tax-advantaged retirement savings accounts that differ in tax treatment, investment options, and employer contributions. Both accounts allow your savings to grow tax-free.

Contributions to a 401 are pre-tax, meaning they are deposited before your income taxes are deducted from your paycheck. However, when in retirement, withdrawals are taxed at your then-current income tax rate. Conversely, there is no tax savings or deduction for contributions to a Roth IRA. However, the contributions can be withdrawn tax-free when in retirement.

In a perfect scenario, youd have both in which to put aside funds for retirement. However, before you decide, there are several rules, income limits, and contribution limits that investors should be aware of before deciding which retirement account works best for them.

Eligibility & Contribution Limits

Your eligibility for a 401 plan simply depends on whether your employer offers them. Generally, you have to inquire a little bit more about taking advantage of an employer match program.

On the other hand, without an employers help, a Roth IRA may not prove available to everyone. For one, you have to find an institution with which to open your account. Some institutions may only accept applicants with high deposit amounts, limiting their products to more wealthy clients.

Its important to note, however, that Roth IRAs offer a solid savings option for those with lower income. This is because you fund a Roth IRA with after-tax money, making your withdrawals tax-free. This structure comes in handy for people who see themselves in a higher tax bracket in retirement.

Plus, Roth IRA rules and limitations tend to phase out higher earners. For 2021, total contributions to Roth IRAs cannot exceed $6,000, or $7,000 for those over 50. To the opposite, 401 plans have much higher contribution limits.

For 2018, you can contribute up to $19,500 to your 401. Dont forget that if your employer matches your 401 contribution, their match does not count towards that limit. Instead, you have to ensure your total annual 401 contributions do not exceed the lesser of 100% of your salary or $58,000 .

Also Check: When Can I Move My 401k To An Ira

Roth Ira Vs : Which Is Better For You

10 Minute Read | November 09, 2021

The Roth IRA and 401 are like cousins: They come from the same family of retirement investment accounts, so they have a lot in common. But look close enough, and youll see how different they are!

Once you understand how they work, you can choose the plan that will help you maximize your savings. And thats not just fancy investing talk. Your choice today could result in thousandsif not millionsof dollars down the road! You need to understand your options so you can be 100% prepared for retirement.

So, what are the major differences between a Roth IRA vs. a 401? And even more importantly: How do you know which one is better for you?

First, lets discuss the main features of each account.

Taxes With 401k Or Traditional Iras

No matter the type of retirement account you choose to open, there will likely be associated tax questions. At H& R Block, were here to help. With many ways to file your taxes with H& R Block, you can opt for in-office or virtual tax preparation, keeping all tax laws related to retirement savings accounts in mind, we can make sure youre producing an accurate tax return that maximizes allowable tax deductions.

Not in need of tax preparation at the moment? Read more about taxes on retirement income, pensions and annuities.

Related Topics

If youve contributed too much to your IRA for a given year, youll need to contact your bank or investment company to request the withdrawal of the excess IRA contributions. Depending on when you discover the excess, you may be able to remove the excess IRA contributions and avoid penalty taxes.

Did you sell property over the past tax year? Find out from the experts at H& R Block how to calculate cost basis for your real estate.

Don’t Miss: How To Split 401k In Divorce

Eligibility And Contribution Limits

There are no modified adjusted gross income limits for saving to a 401, so you can make use of this type of account, no matter how much or how little money you earn. You might not be able to save the full amount allowed each year to a Roth IRA, or you may not be able to contribute at all if you earn above certain MAGI limits.

The amount of your contribution also depends on your income tax filing status.

| 2022 Roth IRA Income Limits | ||

|---|---|---|

| If Your Filing Status Is: | And Your MAGI Is: | |

| $10,000 | Zero | |

| Single, head of household, or married filing separately, and you didn’t live with your spouse at any time during the year | < $129,000 | Up to the limit |

| Single, head of household, or married filing separately, and you didn’t live with your spouse at any time during the year | $129,000 but < $144,000 | A reduced amount |

| Single, head of household, or married filing separately, and you didn’t live with your spouse at any time during the year | $144,000 | Zero |

The IRA contribution limit for 2021 is $6,000. It’s $7,000 if you’re 50 or older. These limits will remain the same in 2022. Subtract from your MAGI one of three amounts to figure out the amount of your permitted reduced contribution in 2022:

- $204,000 if you’re married and filing a joint return or are a qualifying widow or widower

- $0 if you’re married and filing a separate return, and you lived with your spouse at any time during the year

- $129,000 if you have any other filing status

What Is The Downside Of A Roth Ira

- Roth IRAs provide a number of advantages, such as tax-free growth, tax-free withdrawals in retirement, and no required minimum distributions, but they also have disadvantages.

- One significant disadvantage is that Roth IRA contributions are made after-tax dollars, so there is no tax deduction in the year of the contribution.

- Another disadvantage is that account earnings cannot be withdrawn until at least five years have passed since the initial contribution.

- If youre in your late forties or fifties, this five-year rule may make Roths less appealing.

- Tax-free distributions from Roth IRAs may not be beneficial if you are in a lower income tax bracket when you retire.

Also Check: How To Increase 401k Contribution Fidelity

Who Should Use A Roth Ira Roth 401

So, experts concur that if you’re a young worker in the early part of your career, you’re almost certainly better of with a Roth IRA or Roth 401.

How young? How many years until retirement?

Most future retirees should use Roths because tax rates are bound to climb, says Ed Slott, founder of IRAHelp.com.

“That said, If I had to put an age on it, I would say anyone under age 50 should be going all Roth,” Slott added. “The younger you are the more years away from retirement the more likely it is that your tax rates will be raised when you begin withdrawing in your retirement years.”

Roth Ira Pros And Cons

|

Pros |

|

|

|

Read Also: How To Borrow From 401k To Buy A House

Summary Of Roth Tsp And Traditional Tsp Rules

Whichever you choose, the rules are similar to those for private-sector employees, with some consideration for the needs of federal employees and military personnel:

- You can contribute up to a maximum annual limit, which may be adjusted annually. For the 2021 tax years, the maximum is $19,500, plus $6,500 if you’re age 50 or older. In 2022, it goes up by $1,000 to $20,500. That’s for a Roth TSP or a traditional TSP, or even a combination of accounts if you have more than one.

- Your federal employer makes a contribution of a minimum of 1% and as much as 5% to your account.

- Your money will be invested in your choice of several investment funds and “lifestyle cycle” funds. The latter are funds that gradually reduce risk to your principal as you approach retirement age.

Which Retirement Account Is The Best Home For Your Money

You have a lot of choices to make when it comes to your retirement savings. One of the most important is where you’re going to keep your money until you’re ready to start withdrawing it.

There are many options out there, but two of the most popular are the Roth IRA and the 401. Here’s a closer look at 12 key differences between them to help you decide which one is best for you.

5 Stocks Under $49Presented by Motley Fool Stock AdvisorWe hear it over and over from investors, I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. Id be sitting on a gold mine!” It’s true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share!

Previous

3 of 14

Recommended Reading: How Do I Close Out My 401k Account

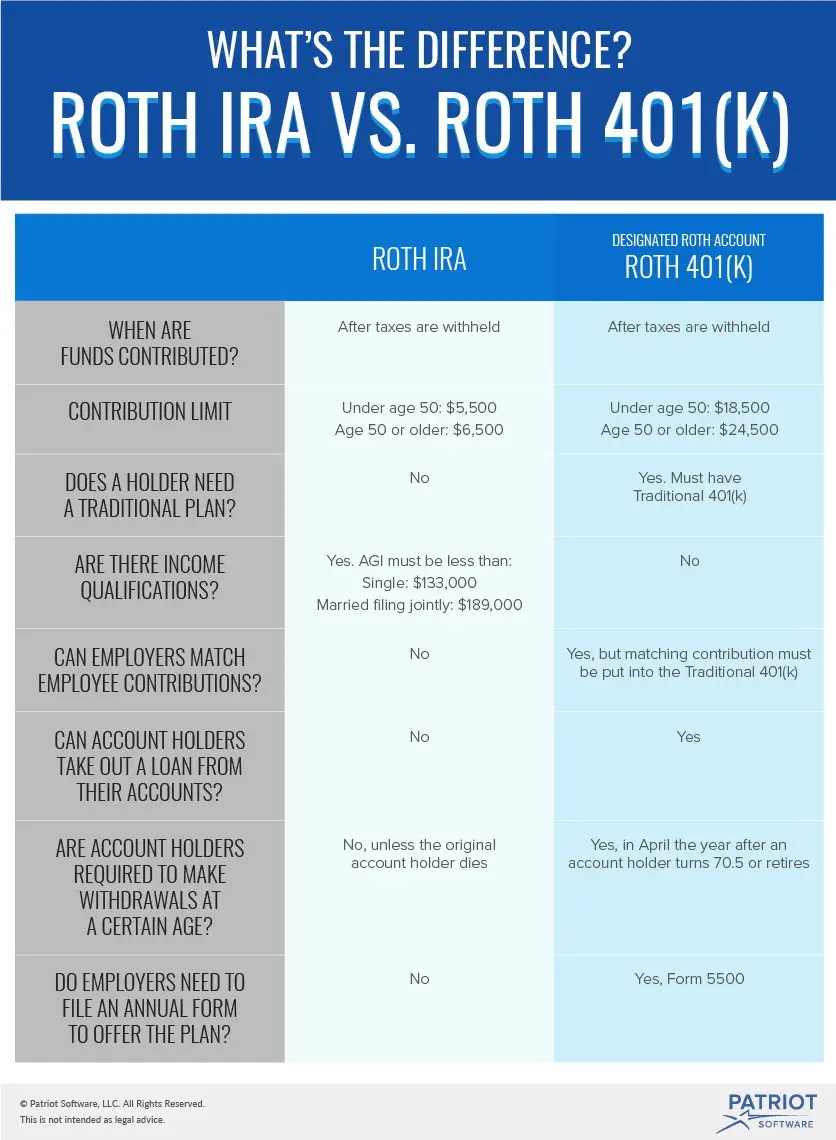

Roth 401 Vs Roth Ira: An Overview

There is no one-size-fits-all answer as to which is better, a Roth 401 or a Roth IRA. It all depends on your unique financial profile: how old you are, how much money you make, when you want to start withdrawing your nest egg, and so on. There are advantages and disadvantages to both. Here are the key differences you should consider when comparing the two types of Roths.

What Are The Similarities Between A Traditional 401 And A Roth 401

Lets start with what a traditional 401 and a Roth 401 have in common.

First, these are both workplace retirement savings options. With either type of 401 plan, you can enjoy the convenience of having the contribution drafted out of your paycheck.

Second, both can include a company match. About 86% of companies that offer a 401 or similar product provide a match on employee contributions.3 If you work at a place that offers a match, take it. Your employer is giving you free money!

Third, both types of 401s have the same contribution limit. In 2022, the contribution limit is $20,500 per year or $27,000 if youre over 50.4 The opportunity to invest that much every year is a huge perk of either type of 401, especially when compared to the Roth IRAs contribution limit of $6,000 per year.5

The Roth 401 includes some of the best features of a 401convenient contribution methods and the possibility of a company match if your employer offers one. But thats where their similarities end. Lets dig into the distinct differences between these two retirement savings options.

You May Like: How Do I Know If I Have Money In 401k

Roth Vs Traditional Iras: Comparing The Features

Here Is How the two IRA Types Are the Same

- Contribution Limit: Your contribution is limited for both types of IRA by the lower of an IRS-imposed limits and your earned income for the year. However, note that the Roth IRA has an additional limit .

- Contribution Deadline: You can send your contributions to both types of plan until Tax Day of the following year.

Here Are the Many More Aspects where the Two Differ

Required Minimum Distributions :

There are no RMDs for Roth IRAs during your lifetime. Traditional IRAs are subject to RMDs, so you must start withdrawing by April 1 of the year following when you turn 70½, and by December 31 of each subsequent year. The RMD amount is determined by the IRS and is intended to approximately deplete the IRA by your death. Failure to withdraw your RMD can subject you to confiscatory penalties of 50% of the amount you should have withdrawn and didnt. The IRS may waive this penalty if your under-withdrawal was made due to a reasonable error and you file the proper paperwork.

What Is The 5 Year Rule For Roth Ira

The Roth IRA is a special form of investment account that allows future retirees to earn tax-free income after they reach retirement age.

There are rules that govern who can contribute, how much money can be sheltered, and when those tax-free payouts can begin, just like there are laws that govern any retirement account and really, everything that has to do with the Internal Revenue Service . To simplify it, consider the following:

- The Roth IRA five-year rule states that you cannot withdraw earnings tax-free until you have contributed to a Roth IRA account for at least five years.

- Everyone who contributes to a Roth IRA, whether theyre 59 1/2 or 105 years old, is subject to this restriction.

Also Check: How Does A 401k Loan Work