Nonqualified Deferred Compensation Plans

Unless youre a top executive in the C-suite, you can pretty much forget about being offered an NQDC plan. There are two main types: One looks like a 401 plan with salary deferrals and a company match, and the other is solely funded by the employer.

The catch is that most often the latter one is not really funded. The employer puts in writing a mere promise to pay and may make bookkeeping entries and set aside funds, but those funds are subject to claims by creditors.

Pros: The benefit is you can save money on a tax-deferred basis, but the employer cant take a tax deduction for its contribution until you start paying income tax on withdrawals.

Cons: They dont offer as much security, because the future promise to pay relies on the solvency of the company.

Theres some risk that you wont get your payments if the company has financial problems, says Littell.

What it means to you: For executives with access to an NQDC plan in addition to a 401 plan, Littells advice is to max out the 401 contributions first. Then if the company is financially secure, contribute to the NQDC plan if its set up like a 401 with a match.

Options When Employment Ends

There are a number of options an employee can take when leaving the job:

- Roll over to an IRA Rolling 401 assets to an IRA can allow participants to keep the same tax benefits, avoid penalties, choose from a wide range of investment options and, with a Roth IRA, avoid having to take distributions before theyre needed.

- Stay in the old plan Participants may be able to remain in the plan and keep the same benefits, although fees may increase and they wont be able to make contributions.

- Move to a new plan If the participants new employer accepts rollovers, participants can keep the tax benefits while consolidating their retirement plan money.

- Cash out Participants will owe applicable taxes and, if not yet age 59½ , an additional 10% early distribution tax. However, cashing out does give you cash in hand, which may make sense if you need money to take care of current needs.

To learn more about your options, contact your financial professional.

Flexible Investment Options With Ubiquity

Mutual funds and investment management services charge a fee based on the amount of money in your plan. Because we work exclusively with small businesses, we only work with partners who charge the industrys lowest asset-based fees for fund selection and investment management. Depending on the type of Ubiquity plan you have, you can choose:

- A brokerage option to make investments

- Investment options that have been carefully selected by a third-party investment expert

- To build your own custom fund list

- To work with a financial advisor to choose investments.

G and G Partners has been using Ubiquity Retirement the last 2 years. Their response has been excellent when we had questions or needed help completing forms. I give Ubiquity 5 stars.

Read Also: What Happens To Your 401k When You Switch Jobs

Meeting Your Fiduciary Responsibility To Diversify 401 Investments

Before you start picking investments for your 401 plan, we recommend you first understand your fiduciary responsibility to diversify your investment menu. These requirements are outlined in ERISA section 404. Meeting them is not difficult. You just need to pick at least three core investments with materially different risk and return characteristics. A menu of equity , fixed income , and capital preservation funds can do the trick.

In short, your diversification responsibility is nothing to fear. Selecting prudent investments is where you’re much more likely to land yourself into hot water. Thats why impartial guidance is so important. In our view, you have two clear options.

Which Retirement Plan Is Best For You

In many cases you simply wont have a choice of retirement plans. Youll have to take what your employer offers, whether thats a 401, a 403, a defined-benefit plan or something else. But you can supplement that with an IRA, which is available to anyone regardless of their employer.

Heres a comparison of the pros and cons of a few retirement plans.

Don’t Miss: How To Get My 401k Money From Walmart

What Is The Best Investment Strategy For Retirement

Many workers have both a 401 plan and an IRA at their disposal, so that gives them two tax-advantaged ways to save for retirement, and they should make the most of them. But it can make sense to use your account options strategically to really max out your benefits.

One of your biggest advantages is actually an employer who matches your retirement contributions up to some amount. The most important goal of saving in a 401 is to try and max out this employer match. Its easy money that provides you an immediate return for saving.

For example, this employer match will often give you 50 to 100 percent of your contribution each year, up to some maximum, perhaps 3 to 5 percent of your salary.

To optimize your retirement accounts, experts recommend investing in both a 401 and an IRA in the following order:

Differences From A Sep

If you work for yourself, you may already have opened a Simplified Employee Pension.

Here are a few of the key differences to be aware of:

- A SEP-IRA can have more than one participant.

- A SEP-IRA does not offer a catch-up contribution for those who are 50 or over.

- Employee deferral contributions are not allowed with a SEP-RA.

Don’t Miss: Can I Rollover My 401k To An Existing Ira

Investment Options: The Diy Approach

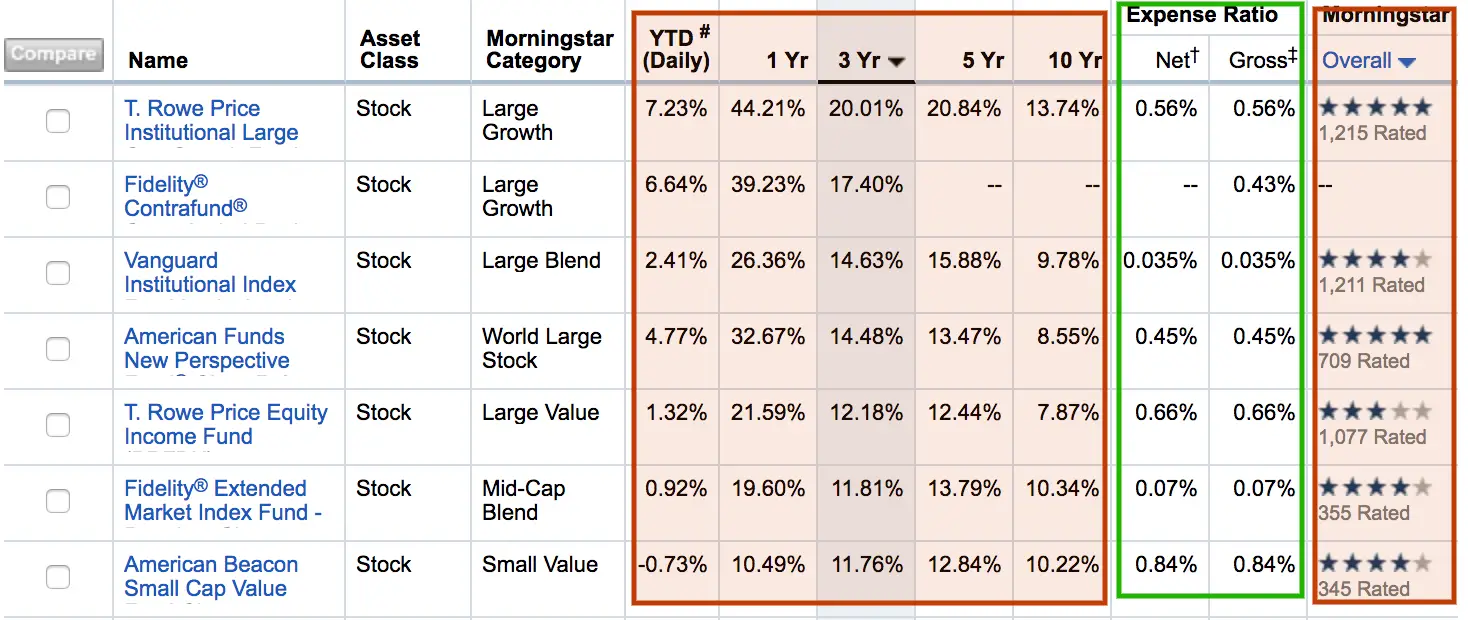

Target-date funds arent for everyone, and some prefer to adopt more of a hands-on approach. You typically cant invest in specific stocks or bonds in your 401 account. Instead, you often can choose from a list of mutual funds and exchange-traded funds . Some of these will be actively managed, while others may be index funds.

So what kinds of funds and investments can you expect to see?

You can bet that almost every plan will have large-cap stock funds. These are funds made up entirely of large-cap stocks, of stocks with a market capitalization of over $10 million. Large-cap stocks make up the vast majority of the U.S. equity market, so your 401 will almost certainly have multiple funds to choose from that invest in them. Notable large-cap funds include the Fidelity Large-Cap Stock Fund and the Vanguard Mega Cap Value ETF .

Another type of mutual fund youll likely find in your 401s catalog of option is a bond fund. A bond fund is a mutual fund that invests solely in bonds. Within this category exists several categories like corporate bond funds, government bond funds, short-term bond funds, intermediate-term bond funds and long-term bond funds. Bond funds are popular because, as a general rule, they provide the safety of investing in bonds, but theyre much easier to buy and sell than individual bonds. Still, bonds arent risk-free: Longer term bonds can be hurt by rising interest rates, and so-called junk bonds are at risk of default.

How To Invest Your 401

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks or securities.

Nothing is more central to your retirement plan than your 401. It represents the largest chunk of most retirement nest eggs.

Finding the money to save in the account is just step one. Step two is investing it, and thats one place where people get tripped up: According to a 2014 Charles Schwab survey, more than half of 401 plan owners wish it were easier to choose the right investments.

Heres what you need to know about investing your 401.

Don’t Miss: How Does 401k Work At Retirement

Solo Or Individual 401

If you run a small business and are self-employed, you can still take advantage of 401 benefits. You can do so by establishing a solo or individual 401 plan.

This is a 401 thats designed for business owners who have no other employees, other than their spouses. You can make contributions to a solo 401 as both an employer and an employee, though there are annual limits on how much you can contribute.

Setting up this type of retirement plan involves some paperwork and it may be more complicated than other self-employed retirement plan options. But if you dont have employees and dont plan to hire any, it could be a good fit if you want to save for retirement while enjoying tax benefits

After Establishing The Plan

Once your portfolio is in place, monitor its performance. Keep in mind that various sectors of the stock market do not always move in lockstep. For example, if your portfolio contains both large-cap and small-cap stocks, it is very likely that the small-cap portion of the portfolio will grow more quickly than the large-cap portion. If this occurs, it may be time to rebalance your portfolio by selling some of your small-cap holdings and reinvesting the proceeds in large-cap stocks.

While it may seem counter-intuitive to sell the best-performing asset in your portfolio and replace it with an asset that has not performed as well, keep in mind that your goal is to maintain your chosen asset allocation. When one portion of your portfolio grows more rapidly than another, your asset allocation is skewed toward the best performing asset. If nothing about your financial goals has changed, rebalancing to maintain your desired asset allocation is a sound investment strategy.

And keep your hands off it. Borrowing against 401 assets can be tempting if times get tight. However, doing this effectively nullifies the tax benefits of investing in a defined-benefit plan since you’ll have to repay the loan in after-tax dollars. On top of that, you will be assessed interest and possibly fees on the loan

Read Also: How To Do A 401k Rollover

Q: Can I Open A 401 And Another Retirement Account

A: Yes! You can contribute to a 401, Roth IRA, traditional IRA, and as many other accounts a you wantin fact, we encourage you to.

But, you should understand the different tax rules associated with each. Tax-deferred accounts include: 401s, 403bs, traditional IRAs, solo 401s, and SEPs. Post-tax accounts include: Roth 401s and Roth IRAs.

Why A Solo 401k

You might be asking why I’m considering a solo 401k versus a SEP IRA or other self employed retirement savings options. Well, it all comes down to circumstance and how much you can save.

Let’s look at two scenarios that are similar to mine. First, in the past, I only saved in a because my income was lower and I was still maxing out my 401k at work, so I didn’t need any additional employee contributions.

With both a SEP and Solo 401k, on $30,000 of income, the employer contribution is $5,576.11. Since I was already doing the $18,000 at my primary employer, that amount didn’t make a difference.

However, fast forward to today, the business makes much more income, and my wife is now working for the business. As such, it can make a huge difference in savings and lowering our taxes. Let’s assume that the business is going to make $100,000 this year. That means that the business can contribute $18,587.05 to both my 401k and my wife’s 401k. Plus, my wife can contribute $18,000 of her salary to the 401k as well .

As such, the solo 401k provides much more savings options, and lower taxes today as a result.

Recommended Reading: What Does It Mean To Roll Over Your 401k

More Financial Advising Help

Seeking professional help to manage your 401 is a smart move. In 2014, Financial Engines Inc. published a report that concluded professionally managed assets perform an average of 3.2% better than nonprofessionally-managed assets. However, many professional investment managers could charge up to 3%.

SmartAsset can help you find a profitable solution to finding a safe and affordable way to get professional 401 management.

Pricing

Understand What A 401 Is

While you sign up for your 401 through the company you work for, it is typically managed by a separate financial firm, such as Vanguard, Fidelity, Principal, Schwab, etc. This is the company you will receive important information and disclosures from about your account and investments.

If you leave your employer, in most cases your account will remain at the financial firm that originally managed it, unless you roll it over to a new company .

You can begin withdrawing money penalty-free at 59 ½ in most cases. If you withdraw money before that age, you will be hit with a 10% early withdrawal penalty and pay income taxes on the distributions. You can also take a 401 loan, which needs to be repaid, including interest. Learn more about that here.

Not every employer offers employees a 401. If that’s the case, you can open an IRA, which also offers tax advantages for those investing for retirement, on your own through a brokerage firm.

Recommended Reading: How To Withdraw 401k From Previous Employer

Target Date Retirement Funds

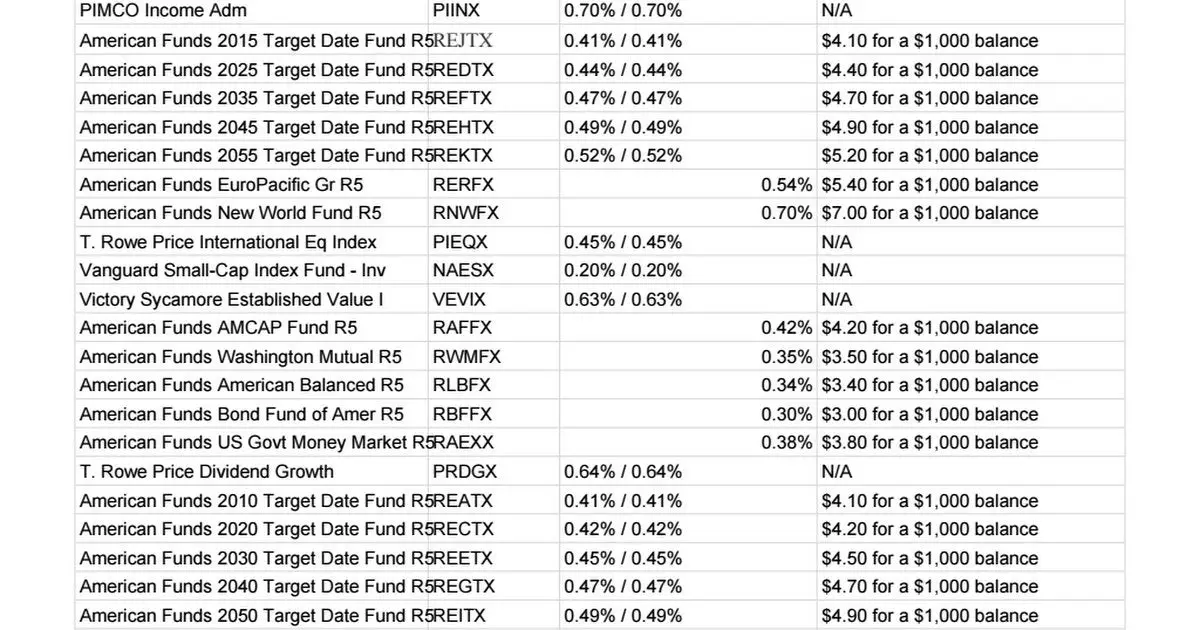

Target-date retirement funds have become staples of 401 plans. As the name implies, these funds allow investors to choose a targetcalendar yeartiming that is nearest their desired retirement date. The employee then allocates 100% of their 401 dollars to the target-date fund.

For example, if a 401 participant expected to retire around the year 2035, they could allocate 100% of their 401 contributions to a target-date retirement 2035 fund and not worry about any further portfolio management. These funds can also make for good “default” funds for 401 participants who do not want to select their investment options.

To provide a range of target datesand depending upon the employees’ age demographicsmost 401 plans should offer a range of target retirement dates through 2050 and the decades in between.

Use Retirement Income Funds

Retirement income funds are a unique type of mutual fund. You place capital in the fund, and it is managed for you. In this case, the managers allocate your money across a diversified portfolio of stocks and bonds for you. You place a minimum amount of capital into the account, and the fund managers will do the rest, letting it grow in value. Retirement income funds are great if you prefer to have someone else manage your money and you have a few decades to let it grow.

Don’t Miss: How Much Can You Take Out Of Your 401k

Scale Up Contributions Over Time

Once you’ve picked your investments, the best thing you can do is leave your account alone and let the contributions build.

In addition to low costs and diversity, consistently investing over time i.e., every paycheck will make the biggest difference in the size of your savings. Low-cost funds are only effective if you continuously invest in them and don’t try to time the market, or pull money out when it starts to drop, a recent report from Morningstar says.

Experts also advise increasing your contributions each time you get a raise or bonus by a percentage point or two, helping you reach your goals faster.

Finally, remember that while the stock market has historically increased around 10% per year, that’s not guaranteed, and there will be periods when it falls. Experts also expect returns to be lower, around 4%, over the next decade than they have been the previous 10 years.

Still, no one knows what will happen, except that the best course of action is typically to invest in low-cost index funds consistently, over many decades. Do that, and you’ll be on the path to building real wealth.

Should I Pay To Have Someone Manage My 401k

Proper 401k management is a critical piece to your retirement plan. Gone are the days where you could just allocate a specific percentage of your paycheck each pay period to your 401k, and by the time you retire, youll have enough money to sustain your quality of life.

401K management is becoming increasingly more important considering inflation, the rising cost of health care, and the number of years we stay retired. Not only is 401k management becoming increasingly more important, its also becoming increasingly more challenging.

Hiring a 401k management company can help ensure youre on the right path at all times. If you dont know where to start dont worry, weve done the hard work and isolated the best 401k management companies below.

You May Like: Why Choose A Roth Ira Over A 401k

Invest Based On The Time Until You’ll Need The Money

Remember that a 401 is a retirement account, so you should plan not to withdraw money until you are at least 59 1/2. If you’re fairly young now, that means you have a long investing horizon ahead of you. If you’re nearing retirement age, however, your investing horizon is much shorter you will need to start withdrawing that money soon to fund your retirement.

Keep this timeline in mind when determining your risk tolerance. If you’re investing in your 401 throughout your career, your willingness to take risks should change over time. When you’re younger, more of your 401 funds should be invested in the stock market to maximize potential returns. You have time to wait out any downturns. However, as you age, you have less flexibility around market volatility and should shift your funds toward safer investments.

Lower-risk investments such as cash, CDs, money market funds, and bonds present far less risk of loss but also lower rates of return. If you overinvest your 401 funds in safe investments like these, you risk missing out on the wealth-building returns of the stock market.

To make sure you aren’t taking on too much — or too little — risk with your 401, consider this simple formula: Subtract your age from 110 and invest the resulting percentage of your 401 money in the market. A 20-year-old would have 90% of their money in stocks while an 80-year-old would have just 30% of their assets in the market.