What Percentage Should I Contribute To My 401

Simply put, your contribution rate is the percentage of your earnings that is deducted from your paycheck and moved into your retirement plan account. In most cases, you choose the value you want to pitch in.1 And while your take-home pay will be reduced, your retirement nest egg has the potential to keep growing.

One sound strategy to implement into your savings routine is to begin contributing 10% to your retirement plan account. It can make a big difference, too. Empower insight reveals people who set their contribution rate to at least 10% are on track to replace 100% of their working income down the road.2

When should I start contributing to my 401?

The earlier, the better.

If youre eligible to participate in your employer-sponsored retirement plan, dont wait to start saving. Even if you cant afford to set your contribution rate to 10% right away, you can still boost your balance thanks to compound growth.This valuable benefit means you can earn interest on your interest because your potential earnings may be reinvested tax-free into your retirement account.

Above all, as youre climbing the ladder toward 10% as you age, your balance can continue to rise with you.

How can I grow my 401?

Little by little, you can make huge strides.

Should I max out my 401?

You dont have to stop contributing at 10%.

How else can I save?

If you dont think you can designate 10% for retirement, review your budgetto see if you can free some extra cash.

RO1877587-1021

When Determining Your Contribution Percentage Consider Automatic Boosts

In 2019, the average 401 contribution was 7 percent of pay, according to Vanguard 401 data. Meanwhile, only 21 percent of 401 participants saved more than 10 percent of their salary for retirement.

If you cant afford to contribute that much initially, many employers will allow you to increase your contribution percentage automatically each year , which may be a more comfortable and gradual way to increase your contribution amount.

A 401 can be one of your best tools for creating a secure retirement. But you may want to also consider some retirement investing alternatives.

Is Your 401k Savings On Track

Have you met your mark? If you arent there yet, dont panic. These are just rules of thumb. That means they only give you a rough estimate of what you should ideally have by the time you hit these ages. They do not take into account your individual income and experiences or other investments you might have in play.

In reality, theres no one hard answer to how much you should have in your 401k and anyone who tells you otherwise is either lying to you or just doesnt know much about finance. We could pull up a bunch of figures and show you how much someone in their 20s or 30s is saving but that would be a complete waste of time for two reasons:

1. Its impossible to compare two investors fairly. Everyone has their own unique savings situation. Thats why itd just be dumb to compare the Ph.D. student saddled with thousands in student loan debt with the trust fund baby who just snagged a cushy six-figure corporate gig the first month out of college. Theyre both going to save very differently, so its not worth comparing.

2. Most people arent financially prepared for retirement. The American Institute of CPAs recently released a study that found that nearly half of all Americans arent sure if theyll be able to afford retirement. Thats even scarier when you consider the fact that many people underestimate how much theyll need for a comfortable retirement.

Also Check: How Does A Solo 401k Plan Work

How Much Should I Have In My 401k Based On My Age

There are a few different schools of thought on how much a person should have saved in their 401k based on their age.

Every financial expert has a different opinion. When deciding what the right number is for you, I think one thing to keep in mind is that its better to have more saved than less.

Creating a potential post-retirement budget as a guideline will help you determine how much money youll spend after youre retired.

In an ideal world, you will be completely debt free by the time you retire and have minimal housing and other expenses.

Youll want to be prepare for these costs:

- Utility bills

- Travel

- Taxes

A persons income and expenses can make a difference when it comes to how much they should have saved at each interval age, but here are some general guidelines.

Use these guidelines in conjunction with your projected post-retirement budget to find out if you should have more or less saved by the time you retire than what is suggest ed here.

Do you have a 401k from an old employer that you need to rollover? Check out Capitalize which is free and will help take out the hassle of rolling over your 401k!

Get Help With Your 401

Already have a 401? While youre researching contributions, take a minute to analyze your current holdings toothere could be big savings to be found.

is a free app that creates easy-to-understand visuals of the investments you own in your 401, IRA, and other investment accounts. It then provides recommendations for how to rebalance your portfolio for maximum results and reduced expensesit can even show you how changing funds within your existing 401 might save you thousands. or read our review.

Blooom is a new tool that can automatically manage and optimize your 401 for just $10 a month. Designed especially for 401 accounts, blooom works with your available investments to find the lowest-cost and best allocation for your goals. You can get a free 401 analysis from Blooom or learn more in our review. Plus they have a special promotion where you can get $15 off your first year of Blooom with code BLMSMART

is a great all-in-one financial app that allows account holders to take control over their finances, automate saving and investing, and manage their accounts all in one place. Wealthfronts Self-Driving Money tool continuously monitors your cash flows to ensure that bills are paid and savings are instantly routed into the right investment accounts. Wealthfront account holders can also take advantage of the apps automated investment services, like daily rebalancing and tax-loss harvesting.

You May Like: What Happens To My 401k If I Leave My Job

How To Use The Contribution Calculator

This calculator is designed to show you how you could potentially increase the value of your retirement plan account by increasing the amount that you contribute from each paycheck. The Growth Chart and Estimated Future Account Totals box will update each time you select the “Calculate” or “Recalculate” button.

Pre-filled amountsBased on our records, the following information may be pre-filled:

Salary

- Pay period. If the information is not available, the default pay period is weekly.

Contribution

- Your contribution rate. Note that we will use 8% as a default value if your contribution rate is not available or if your contribution is a dollar amount rather than a percentage.

Investment

- Years invested

- Your initial balance

You may change any of these values.

Using the calculator

In the following boxes, you’ll need to enter:

Salary

- Your expected annual pay increases, if any.

- How frequently you are paid by your employer.

Contribution

- The amount of your current contribution rate .

- The proposed new amount of your contribution rate. Be sure to verify the maximum contribution rate allowable under your plan. Also, pre-tax contributions are subject to the annual IRS dollar limit.

Pre-tax Contribution Limits 401, 403 and 457 plans |

|

|---|---|

| 2020 | |

| After 2020 | May be indexed annually in $500 increments |

Employer Match

Investment

- The length of time that you anticipate you will invest this money.

- The amount of your current account balance.

- Your hypothetical assumed annual rate of return.

Why Should I Use One

Matching dollars, for one thing. Over 90% of employers that offer a 401 plan also kick in a company match, which means as you contribute, your employer will, too. Commonly, that match will be worth 50% to 100% of your contributions, up to a limit that typically falls between 3% and 6% of your annual salary. If your employer offers up this free money, a good rule of thumb is to do everything you can to contribute enough to take advantage of it.

The other huge benefit of the 401 is that it allows you to put a lot of money away for retirement in a tax-advantaged way. The annual 401k contribution limit is $20,500 for tax year 2022, with an extra $6,500 allowed as a catch-up contribution every year for participants age 50 or older.

Read Also: Can You Roll A 401k Into A Roth

Increase Your Income If Need Be

Sometimes a lack of retirement savings is caused by mismanaged income. Its common to get caught up in everyday frivolous spending that seems harmless but causes major savings deficits over the years.

Other times there is a real lack of income that has caused a persons inability to save for retirement.

If youre managing your money well and minimizing waste but dont make enough to save what you need to save for retirement you may need to increase your income.

Luckily, there are several options for boosting your income:

- Get a part-time job

- Sell unwanted items

Then take that cash and use it to fund your 401k or other retirement accounts.

However, its important to remember that as you increase your income, you need to be sure to take that extra money and target it all toward retirement savings.

It might be tempting to use it for fun stuff like vacations and new and shiny things especially if youve been living on a tight budget for a long period of time.

Dont make that mistake. Instead, commit to funneling all extra income into your 401k or other retirement accounts, even if its only for a specified period like five years or ten years.

After that time is up, youll likely see a significant increase in your retirement savings. That increase will help ensure you wont be struggling to live in your later years.

Average 401k Balance At Age 65+ $471915 Median $138436

The most common age to retire in the U.S. is 62, so its not surprising to see the average and median 401k balance figures start to decline after age 65. Once you reach age 65, there are still several considerations for your retirement, even if you are no longer working and accumulating wealth. Some of these include making decisions about Medicare, creating a plan around withdrawing money from your retirement accounts, and evaluating any additional insurance needs.

Read Also: Can Bankruptcy Take Your 401k

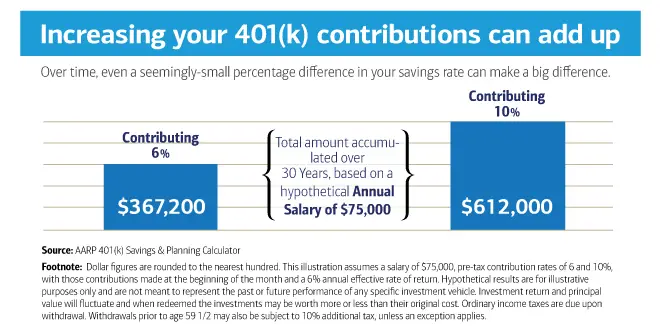

The Effect Of A Few Percentage Points Over Time

When determining what to contribute, dont set your sights too low: A couple of percentage points can make a big difference.

Even if you start small, its important to start saving as early as you can and let time do the work of accumulating interest for you. Make a goal to increase your contribution each year and stick to it.

For example, this graph shows how much someone earning $60,000 annually would save after 30 years, investing at different levels. In this example, a couple of percentage points can be worth more than $150,000 in the end.

Potential value after 30 years

$ thousands

Example is for illustration purposes only. Assumes $60,000 salary, bi-weekly contributions, 3% annual pay increase, and a 7% rate of return. Investments will fluctuate and when redeemed, may be worth more or less than originally invested. Balances shown are pre-tax and are subject to income taxes upon distribution. Values do not account for fees and expenses.

This information is a general discussion of the relevant federal tax laws provided to promote ideas that may benefit a taxpayer. It is not intended for, nor can it be used by any taxpayer for the purpose of avoiding federal tax penalties. Taxpayers should seek the advice of their own advisors regarding any tax and legal issues specific to their situation.

Like what youre reading?

Get articles like this delivered directly to your inbox.

Breaking It Down: Where Do You Fit In

There are many reasons you might think this chart seems totally reasonable, or, conversely, totally unreasonable. And thats understandable. Life presents us all with different challenges. We have unexpected medical expenses, decide to go back to school, or have kids and want to pay their college tuitions. These are all perfectly valid excuses as to why you might be falling behind where this chart says you should, or could, be.

Based on this chart, you would think that most Americans should be retiring as multi-millionaires at age 65. This probably seems way off-base, and in reality, it is most people retire with very little in the way of savings and investments. The point is that this chart shows what is possible if you are disciplined and strategic about your 401k savings.

If you are on the younger end of the ages shown on the chart, you may be daunted at the prospect of contributing $8,000 per year to your 401k, not to mention $19,500. Where you live, what your first-year salary is, or what loans you may be paying can make it difficult for this contribution to seem realistic. Its crucial, however, to recognize the importance of saving as much as you can for retirement as early as you can.

So, lets determine, based on the two scenarios in the potential savings chart, whether these figures would be sufficient to support your lifestyle for the rest of your retirement.The average life expectancy for men is around 84 years old, and 86.5 years old for women.

You May Like: How To Calculate Rate Of Return On 401k

Proper Asset Allocation And Risk Tolerance

Your asset allocation between stocks and bonds first depends on your risk tolerance. Are you risk averse, moderate, or risk loving? Are young and full of energy? Or are you old and tired as hell?

Im personally extremely tired due to raising too kids during a pandemic. Therefore, Im relatively conservative. Besides, after such a huge run in the stock market, Id like to keep most of the gains during the next correction.

Your asset allocation also depends on the importance of your specific market portfolio. For example, most would probably treat their 401K or IRA as a vital part of their retirement strategy. For most, these retirement accounts will become their largest investment portfolios.

However, those who have taxable investment accounts, rental properties, and alternative assets may not find their stock and bond portfolio as important.

For example, I have roughly 40% of my net worth in real estate because I prefer owning a hard asset that is less volatile, provides shelter, and produces rental income. I then have roughly 30% of my net worth in equities. Volatility is something I do not like.

Finally, the proper asset allocation of stocks and bonds depends on your overall net worth composition. The smaller your stocks and bonds portfolio as a percentage of your overall net worth, the more aggressive your portfolio can be in stocks.

The Retirement Savings Plan Is Offered By Many Employers Conferring Tax Benefits To Those Who Invest

The IRS announced the changes to 401 payments back at the start of November. The employee contribution limit for the plans has increased to $20,500 this year, up from $19,500 in 2021, and catch-up deposits for savers 50 and older will still be $6,500.

This change will also apply to people who use the 403, most 457 plans, as well asthe federal government’s Thrift Savings Plan.

There are a number of options when it comes to new jobs and your 401k. Let’s talk about it. Follow us on Youtube

CNET

The limit on annual contributions to an Individual Retirement Arrangements remains unchanged at $6,000. The IRA catch-up contribution limit for individuals aged 50 and over is not subject to an annual cost-of-living adjustment and remains $1,000. However, those over 50 do have an advantage and catch-up deposits will still be $6,500, meaning they can contribute a maximum of $27,000 over a single year.

Although many have savings shortfalls, only 8.5% of workers maxed out company retirement plans in 2018, according to a report from the Congressional Research Service.

You May Like: Should I Roll My Old 401k Into My New 401k

Contribute To A Roth Ira

The Roth IRA is the peanut butter to the 401s jellythey just go better together! The beautiful thing about the Roth IRA, which stands for individual retirement account, is that it lets you enjoy tax-free growth and tax-free withdrawals in retirement. There it is again! Tax-free . . . dont you just love the sound of that?

In 2021, you can put up to $6,000 into a Roth IRA .8 Sticking with our example above, maxing out your Roth IRA and investing $6,000 into your account brings your total retirement savings for the year to $9,750 . . . just a little bit short of your retirement savings goal.

So what are we going to do with the remaining $1,500? Its time to send you back . . . back to the 401!

But Why Would I Max Out My Roth Ira Before My 401k If Its So Good

Theres a lot of nerdy debate in the personal finance sphere about this very question, but our position is based on taxes and policy.

Assuming your career goes well, youll be in a higher tax bracket when you retire, meaning that youd have to pay more taxes with a 401k. Also, tax rates will likely increase in the future.

The Ladder of Personal Finance is pretty handy when considering what to prioritize when it comes to your investments, but it is just a tool. For more about the Ladder of Personal Finance and how to make it work for you, check out THIS video where I explain it.

PRO TIP: The video is less than three minutes long. It is worth your time.

Read Also: How Much Money Can You Put In 401k Per Year