Choose Your New Investments

Whether the money goes into your new 401k plan or an IRA, it comes in as cash, and you need to decide on the investments you want to make. Work with your new fund manager or set it up yourself by opening a brokerage window, which lets you invest in a variety of bonds, mutual funds and stocks. If thats not an option, choose an index fund. Most S& P 500 options provide an average return of five to seven percent over 25 years.

Pros And Cons Of Making A 401 Rollover

Now that you understand all of the different tax implications of doing a 401 rollover, it is important to weigh out the pros and cons to see if this is the right decision for you.

The biggest pro of doing a 401 rollover is that it allows you to keep your money in a retirement account, which can help defer taxes and allow the funds to grow tax-free until you withdraw them.

Another advantage of making a 401 rollover is the accession of more investment freedom along with higher contribution limits.

When you roll over your 401, as long as the new account is also a traditional IRAs or Roth IRA, there are no income limitations on who can contribute to it. You will now be able to make contributions from any type of employment income and earn any amount of money you want without penalty.

The biggest con of doing a 401 rollover is that it leaves you with fewer investment options than staying put in the old account. This may not seem like a big deal now, but if you end up changing jobs multiple times throughout your career then this could end up being more costly for you financially.

How Do I Complete A Rollover

Read Also: How To Find Out If I Have Any 401k

Proceed With The Rollover

Once you have chosen the type of IRA account and where to open it, you can start the process of rolling over your 401. This is usually done by filling out a form provided by the new account provider and sending it back along with a copy of your old 401 statement.

It is in this stage where you decide whether to do a direct rollover or a 60-day rollover.

Benefits Of Rolling Over Your 401

The benefits of rolling over your 401 into an IRA include:

- You choose the type and amount of investments that your IRA holds.

- You can keep your existing 401 or change to a lower-cost provider or investment options with higher returns, which may save you money in the long run.

- Youâre able to save a substantial amount of money for your retirement needs, with a variety of tax advantages including:

a) Contributing to an IRA is tax-deductible, which can help reduce your taxable income and lower your current yearâs taxes if you qualify.

b) You can set up a Simplified Employee Pension, or SEP-IRA â a traditional IRA that allows you to contribute as much as 25% of your income from self-employment for retirement purposes.

- If you have multiple 401 accounts from prior employers, then rolling them all into one IRA can simplify your financial situation and make it easier to manage all of your retirement savings in one place.

- You can always move your IRA money back into a 401 plan when you change jobs, retire, leave an employer, or switch employers â but if you stay with the same provider and put your IRA money there instead, then itâs harder to get it back out again.

Don’t Miss: Can I Start A 401k For My Child

Do I Have To Pay Taxes When Rolling Over A 401

Whether you owe taxes on a rollover depends on whether youre changing account types . Generally, if you move a traditional 401 account to a Roth IRA, you could create a tax liability. Here are a few scenarios:

- If youre rolling over money from a traditional 401 to another traditional 401 or traditional IRA, you wont create a tax liability.

- If youre rolling over a Roth 401 to another Roth 401 or Roth IRA, you wont create a tax liability.

- However, if youre rolling a traditional 401 into a Roth IRA, you could create a tax liability.

Its also important to know that if you have a Roth 401 that has any employer matching funds in it, those matching funds are categorized as a traditional 401 contribution. So if you transfer a Roth 401 with matching funds into an IRA, youll need to create two IRA accounts a traditional IRA and a Roth IRA to avoid any tax issues during the rollover.

Of course, youll still need to abide by the 60-day rule on rollovers. That is, you have 60 days from the date you receive a retirement plan distribution to roll it over into another plan, according to the IRS. Taxes generally arent withheld from the transfer amount, and this may be processed with a check made payable to your new qualified plan or IRA account.

Sign up for Bankrates myMoney today to track your finances in one place.

How Long Do I Have To Deposit The Check

You should deposit the check you get right away. Even if the check is made out to your IRA provider , you should try to do it within 60 days of receiving it.

Get a prepaid envelope sent directly to your door with a tracking number! Start a rollover with Capitalize and well send you a prepaid priority mail envelope with detailed instructions to make sure your rollover is transferred successfully. Get started

Read Also: Where Should I Put My 401k Money

How To Roll Over A 401

Perhaps you’ve left your job but still have a 401 or Roth 401 with your former employer you’re retiring and are wondering if leaving your money in a 401 is the best option or perhaps you simply want to diversifynow what? The infographic, below, explains four options to consider: leave your assets in a previous employer’s plan, cash out your 401, initiate a 401 rollover into a new employer’s plan, or rollover into an IRA .

Decide Where To Open Your New Ira

When opening an IRA, most people will look towards a brokerage, and for obvious reasons. 401 accounts are notorious for their relatively limited investment selections. But by rolling your funds into an IRA at a brokerage, youll get to choose from a significantly larger pool of potential investments. In fact, many offer some combination of stocks, bonds, exchange-traded funds , mutual funds, options and more.

Managing your own retirement funds takes a lot of time and energy, but a financial advisor can do it for you. Many financial advisors specialize in retirement planning and investing, which is exactly the combination youll need. If you go this route, your advisor will manage your investments in an IRA according to your needs and current savings situation.

If you prefer an even more hands-off approach to investing, a robo-advisor could be a good option. When you open an IRA with a robo-advisor, an asset allocation profile will be created for you based on your age, risk tolerance and proximity to retirement. The robo-advisor will then invest and manage your assets for you according to this plan.

Regardless of which way you go, make sure you understand any account, investment or advisory fees you may incur. An overbearing fee structure can have an extremely negative effect on your portfolio, so keep an eye out for this.

Don’t Miss: Can You Roll Over 401k To New Employer

What Happens To My Retirement Money When I Reach Age 72

The IRS says you must begin withdrawing money from your employer plan account by April 1 following the year you turn 72 or retire, whichever is later . Withdrawals from traditional IRAs must begin by April 1 following the year you turn 72. If you dont withdraw the minimum required amount, the IRS will penalize you with a 50% tax on any amount that should have been withdrawn but wasnt. Roth IRAs are not subject to required minimum distributions.

The SECURE Act increased the age when required minimum distributions must begin from 70½ to 72, effective for individuals turning 70½ on or after January 1, 2020. If you reached age 70½ before this date, you are still required to take RMDs.

Move Money To New Employer’s 401

Although there’s no penalty for keeping your plan with your old employer, you do lose some perks. Money left in the former companys plan cannot be used as the basis for loans. More importantly, investors may easily lose track of investments left in previous plans. I have counseled employees who have two, three, or even four 401 accounts accumulated at jobs going back 20 years or longer, Ford said. These folks have little or no idea how well their investments are doing.

For accounts between $1,000 and $5,000, your company is required to roll the money into an IRA on your behalf if it forces you out of the plan.

If you have at least $5,000 in your account, most companies allow you to roll it over. But accounts of less than $5,000 can be rolled out of the plan by the company if a former employee does not respond to a notification letter within 30 days.

For amounts under $1,000, federal regulations now allow companies to send you a check, triggering federal taxes and state taxes if applicable, and a 10% early withdrawal penalty if you are under age 59½. In either scenario, taxes and a potential penalty can be avoided if you roll over the funds into another retirement plan within 60 days.

Don’t Miss: How To Transfer My 401k From Previous Employer

What Is A Direct Rollover

A direct rollover is a qualified distribution of eligible assets from a qualified plan, 403 plan, or a governmental 457 plan into a traditional IRA, qualified plan, 403 plan, or a governmental 457 plan.

A direct rollover can also be a distribution from an IRA to a qualified plan, 403 plan or a governmental 457 plan. A direct rollover effectively allows a retirement saver to transfer funds from one retirement account to another without penalty and without creating a taxable event.

Make The Best Decision For You

When it comes to deciding what to do with an old 401, there may be factors that could be unique to your situation. That means the best choice will be different for everyone. One thing to remember is that the rules among retirement plans vary so it’s important to find out the rules your former employer has as well as the rules at your new employer.

Do also compare the fees and expenses associated with the accounts you’re considering. If you find it confusing or overwhelming, speak with a financial professional to help with the decision.

You May Like: Where Can I Cash A 401k Check

When Changing Jobs Is This Your Best Option

When an employee leaves a job due to retirement or termination, the question about whether to roll over a 401 or other employer-sponsored plan quickly follows. A 401 plan can be left with the original plan sponsor, rolled over into a traditional or Roth IRA, distributed as a lump-sum cash payment, or transferred to the new employers 401 plan.

Each option for an old 401 has advantages and disadvantages, and there is not a single selection that works best for all employees. However, if an employee is considering the option of transferring an old 401 plan into a new employer’s 401, certain steps are necessary.

Will You Pay Taxes When You Rollover From 401

If you rollover a 401 to another 401 or IRA, there are situations when you may owe taxes on the transaction. Usually, you must pay taxes when you rollover funds from a traditional 401 to a Roth 401 or Roth IRA, since funds are moved from a pre-tax account to an after-tax account.

For example, if you rollover from a traditional 401 to a Roth 401 or Roth IRA, you must pay taxes on the rollover, since a Roth 401 and Roth IRA are funded with after-tax dollars. In contrast, if you rollover from a traditional 401 to a traditional 401, you wonât pay tax on the rollover since both retirement accounts are pretax.

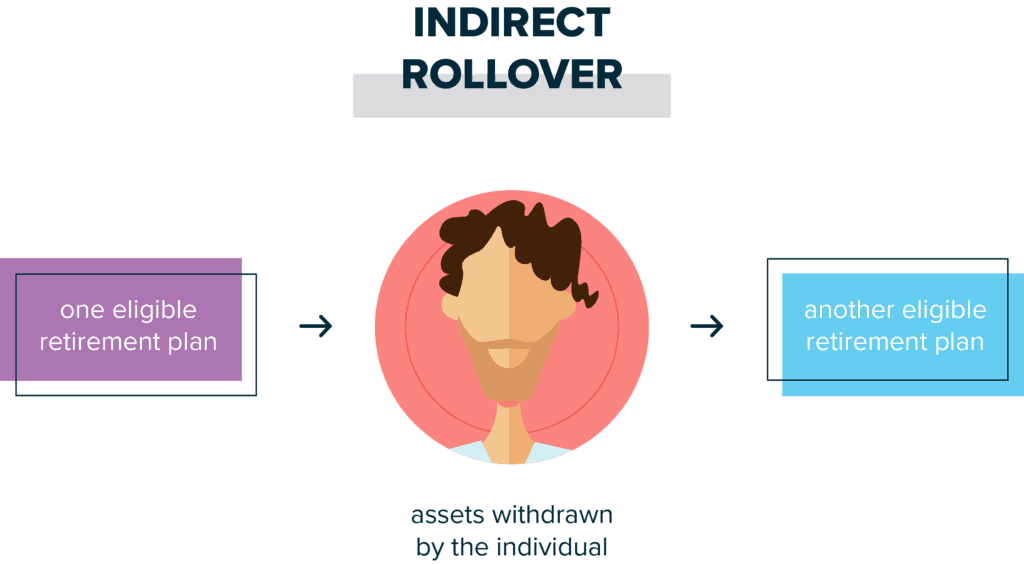

Taxes may also arise if you donât complete the rollover within the 60-day period. Generally, when you opt for an indirect rollover, the 401 plan will send you a check with your 401 money, and you must deposit the check to a qualified retirement plan. If you donât rollover the funds within 60 days, the money will be considered a taxable distribution subject to income taxes and a potential 10% early distribution penalty.

Read Also: When Can You Use Your 401k

Reasons To Transfer Your 401 To A New Job

There are three main reasons to rollover a 401:

1. To reduce fees. If the fees are too high with your previous employers 401, rolling over a 401 can be advantageous.2. To maximize your money. If you arent happy with the investment options in your old 401 and your new employer accepts rollover 401s, you might be able to save money while investing in a broader range of investment vehicles.3. To streamline your investments. If you leave your 401 where it is, you may not think about it very often. Its important to keep tabs on all of your investments so you can make sure they are on track and appropriate for your time horizon and goals.

You May Like: What Is 401a Vs 401k

You May Have Accumulated

There are many factors to keep in mind when considering a 401 rollover, including where you’re at in your career, your current financial status, and your tax and investment preferences. You should consider all of your options before making a decision, and can use the information provided here to help. If you decide a rollover is right for you, contact a Schwab Rollover Consultant at .

Also Check: How To Use 401k To Start A Business

What Happens If You Cash Out Your 401

If you withdraw 401 money before age 59 ½, you could face a 10% penalty from the IRS on top of paying applicable income taxes. There are some exceptions, such as if you leave your job at age 55 or later or if you make a hardship or other eligible withdrawal, but its a good idea to consult a tax professional before cashing out your 401.

No matter when you cash out your 401, though, you may owe income tax on what you withdraw if its a traditional account or investment earnings in a Roth account that you didnt start contributing to at least five years before.

Contact Your Current Plan Administrator And New Plan Administrator

The easiest 401 rollover option is to get your old plan administrator to transfer your balance directly to your new account. This is called a direct 401 rollover, and it frees you from having to worry about tax consequences or early withdrawal penalties.

Speak with your new plan provider about getting an account number, then provide the information to your current 401 administrator. Theyll take care of the rest.

Be aware that not every plan administrator will perform a direct 401 rollover. In this case, the plan administrator cuts you a check for the balance, and its up to you to send the funds to your new 401 plan provider. You have just 60 days to redeposit the balance in your new plan. Otherwise its treated as an early withdrawal that incurs a penalty and income tax liabilities.

Read Also: Who Is Eligible For Solo 401k

How 401 Rollovers Work

If you decide to roll over an old account, contact the 401 administrator at your new company for a new account address, such as ABC 401 Plan FBO Your Name, provide this to your old employer, and the money will be transferred directly from your old plan to the new or sent by check to you , which you will give to your new companys 401 administrator. This is called a direct rollover. Its simple and transfers the entire balance without taxes or penalty. Another, even simpler option is to perform a direct trustee-to-trustee transfer. The majority of the process is completed electronically between plan administrators, taking much of the burden off of your shoulders.

A somewhat riskier method, Ford says, is the indirect or 60-day rollover in which you request from your old employer that a check be sent to you made out to your name. This manual method has the drawback of a mandatory tax withholdingthe company assumes you are cashing out the account and is required to withhold 20% of the funds for federal taxes. This means that a $100,000 401 nest egg becomes a check for just $80,000 even if your clear intent is to move the money into another plan.