Rule : Desired Annual Retirement Income X 25

This rule follows the 4% withdrawal rate rule. They are pretty much the same, but this is easier to calculate for those who would rather not dabble in fractional math. It infers that in order to meet your income needs in retirement, you want to have at least 25 x your desired annual retirement income.

For example, say you estimate that your expenses per year in retirement are $40,000. You would be expected to save up a minimum of $1 million in retirement savings.

â $40,000 x 25 = $1,000,000

Related: The Complete Guide to Retirement Income in Canada

Is Your Balance More Or Less Than The Average

It’s imperative that you’re financially prepared for retirement. Living on Social Security alone is difficult, so you’ll want an additional source of income. For most people, that extra money must come from retirement savings.

A 401 is a popular retirement investment account used by millions of U.S. workers, in large part because this account offers generous tax advantages. Because it’s administered by employers, it’s convenient to invest in.

If you have access to a workplace 401, saving in it early and aggressively could provide a path to a secure retirement. But how have Americans done with investing in their 401 accounts? Check out the average 401 balance by age and income level to see where you stack up when it comes to your retirement savings.

How Much Could Your 401 Grow

The earlier you start investing in your 401, the easier it is to build a hefty balance thanks to compound earnings.

When you invest money, your investments earn money for you. This can be reinvested so you then have a larger pool of assets earning returns. Your money can grow exponentially. That’s why Albert Einstein was famously quoted as describing compound interest as the “eighth wonder of the world.”

The chart below shows how much $1,000 invested in your 401 could turn into by age 67, depending on when you make your $1,000 investment and assuming an 8% average annual rate of return.

| Age When You Invest Your $1,000 | Value of $1,000 Investment at Age 67 |

|---|---|

| 20 |

Table source: How America Saves, Vanguard.

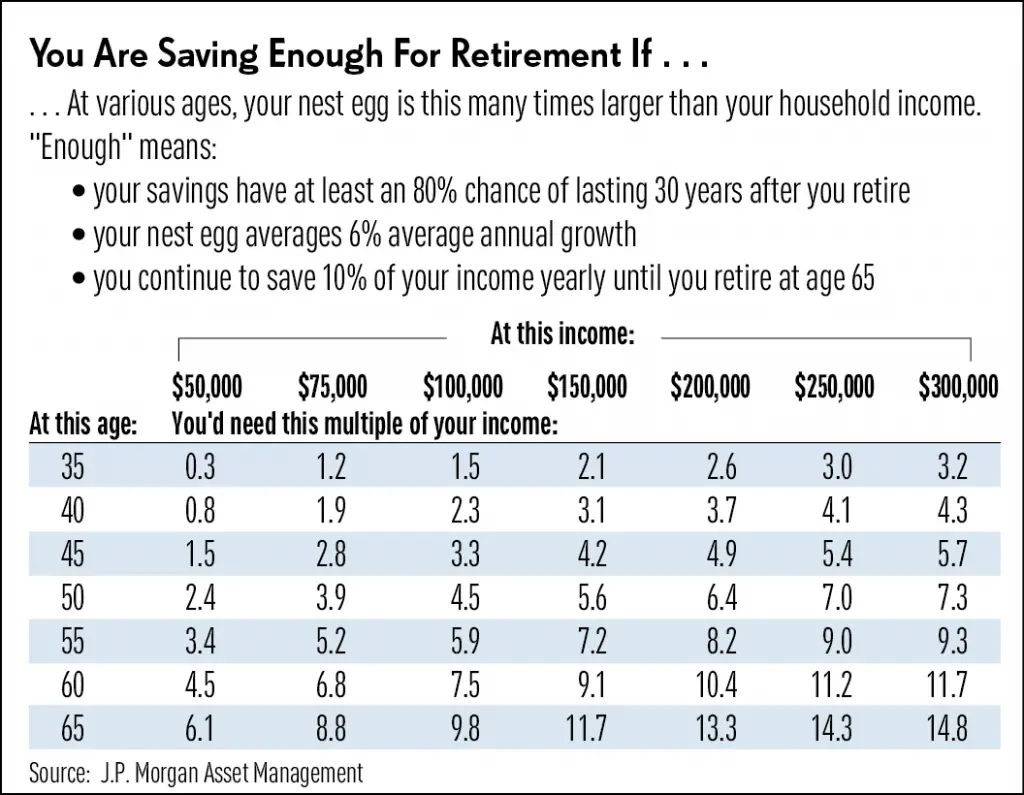

Higher earners need more money saved for retirement because, in most cases, they are used to a higher standard of living. They will need their retirement investment accounts to produce sufficient funds to maintain their lifestyle after their paychecks stop.

Many workers contribute a set percentage of income to their 401, such as 10%. With this percentage-based approach, higher earners inevitably invest more for retirement each year than their lower-earning counterparts.

Read Also: Should I Transfer 401k To New Employer

How To Figure Out How Much Youll Need In Retirement

Planning a retirement goal boils down to one task: estimate how much money youll be spending and then estimate how long you expect to need that money. Sounds easy, right? Heres a look at some numbers in action.

There are three general guidelines for calculating a retirement goal:

-

The 25 times rule of retirement: The first way to get a quick estimate of how much retirement funding you will need is to calculate your annual expenses in retirement and plan to spend that amount for about 25 years. The logic behind this method is that you can withdraw about 4 percent of your nest egg each retirement year without being in danger of losing your money.

-

The 70 percent rule of retirement: A second way to estimate your retirement needs is to plan on needing about 70 percent of your average income during your working years for as long as you live post-retirement.

-

The 15 percent rule of retirement: The 15 percent rule is simple when it comes to retirement, but its only one youll want to apply if you will be or have been saving for a long time, beginning in your twenties or early thirties. In general, saving 15 percent of your income from a young stage should give you enough to live well in retirement. The most significant benefit of this method is that it keeps you from worrying about hitting a specific mark. Just set this money aside over the years and let it grow. Of course, if you begin saving later in life, the 15 percent rule may be too low.

Plan Balances By Generation

The good news is that Americans have been making an effort to save more. According to Fidelity Investments, the financial services firm that administers more than $9.8 trillion in assets, the average 401 plan balance reached $112,300 in the fourth quarter of 2019. That’s a 17% increase from $95,600 in Q4 2018.

How does that break down by age? Here’s how Fidelity crunches the numbers.

Don’t Miss: What’s The Max You Can Put In A 401k

How Long Should I Expect My Retirement To Last

Its not a question anyone likes to address, but thinking about how long your retirement will last is another crucial factor towards hitting your goal. Did your parents, grandparents, and great-grandparents all live to be over 90 years old? Then you might want to plan on a little longer retirement if youre in good health.

Its also important to understand the role that Social Security plays as part of your post-retirement income. If youre interested in seeing what you can expect to draw when you retire, the Social Security Administration has a number of calculators to help you figure out your potential benefits.

While knowing the exact amount of years youll need to fund during your retirement is impossible, you can make a fairly good educated guess with a little research. Here is what popular investment firms and resources suggest.

How Much Should I Have In My 401k

Laurie BlankSome of the links included in this article are from our advertisers. Read our Advertiser Disclosure.

If youre wondering how much money you should have in your 401k, your wait is over. Retirement savings is much of the talk in todays personal finance world.

You want to make sure youre saving enough to meet your retirement goals. Otherwise, you may have to find ways to save more or possibly delay retiring.

While each person has a different financial situation, these insights can improve your retirement plan.

In This Article

Also Check: How Can I Find My 401k

Why Employers Offer 401s

In 1978, when the law authorizing the creation of the 401 was passed, employers commonly attracted and retained talent by offering a secure retirement through a pension . The 401 created an entirely new system, with more flexibility for both employer and employee. One of the ways it did so was by giving employers the option to match employee contributions.

Matching is a very transparent process: for every dollar you put into your 401, your employer also puts in a dollar, up to a certain amount or percentage of your income. Theres no mystery here. If your employer promises to match all 401 contributions up to 5% of your income, and you contribute that amount every month, your employer will match you dollar for dollar, every month. Its a win-win situation. You are doubling your money, and your employer is building a happy workforce.

Understanding Your Investment Account Options

Now that youve made the right choice in deciding to save for retirement, make sure you are investing that money wisely.

The lineup of retirement accounts is a giant bowl of alphabet soup: 401s, 403s, 457s, I.R.A.s, Roth I.R.A.s, Solo 401s and all the rest. They came into existence over the decades for specific reasons, designed to help people who couldnt get all the benefits of the other accounts. But the result is a system that leaves many confused.

The first thing you need to know is that your account options will depend in large part on where and how you work.

You May Like: How Do I Get My 401k

How Much Do I Need To Retire At Age 60

This husband and wife both turned 39 in 2020, and theyre saving fairly aggressively, especially for people in their age bracket. But although their contributions are moderately high, they only commit 10 percent to stocks. They could take more risks if they still have 20 years until retirement at age 60.

Here is where they stand:

- Ages: 39

- Amount added to savings each month: $2,000

- Percentage of savings in stocks: 10%

- Other debt: $45,000

While their savings arent terribly high, they contribute a healthy portion every month. So in 20 years, it will have grown substantially. Their retirement savings is projected to last until they reach the age of 81, which is past their life expectancy.

They are projected to have between $720K and $1.1M by the time they reach their early retirement age, and their projected need is between $460K and $2.4M. But they also lack a lifetime annuity or Medicare Supplemental Insurance, which could lower those figures to $310 to $960K.

Even without additional insurance, this couples savings should last through retirement. They have long-term-care insurance, which covers the risk of unexpected health care costs. If they increased their savings distribution to 25 percent stocks, they should have a well-funded retirement.

- Maximum amount needed to retire by age 60: $460K and $2.4M

You dont need a partner to live well and retire early.

So How Much Income Do You Need

With that in mind, you should expect to need about 80% of your pre-retirement income to cover your cost of living in retirement. In other words, if you make $100,000 now, you’ll need about $80,000 per year after you retire, according to this principle.

The idea is that once you retire, you’ll be able to eliminate certain expenses. You’ll no longer have to save for retirement , and you might spend less on commuting expenses and other costs related to going to work.

Now, this retirement withdrawal strategy isn’t perfect for everyone, and you might want to adjust it up or down based on the type of retirement you plan to have and if your expenses will be significantly different.

For example, if you plan to travel frequently in retirement, you may want to aim for 90% to 100% of your pre-retirement income. On the other hand, if you plan to pay off your mortgage before you retire or downsize your living situation, you may be able to live comfortably on less than 80%.

Let’s say you consider yourself the typical retiree. Between you and your spouse, you currently have an annual income of $120,000. Based on the 80% principle, you can expect to need about $96,000 in annual income after you retire, which is $8,000 per month.

You May Like: How To Open A 401k With Fidelity

How Can You Measure Your Retirement Savings Progress

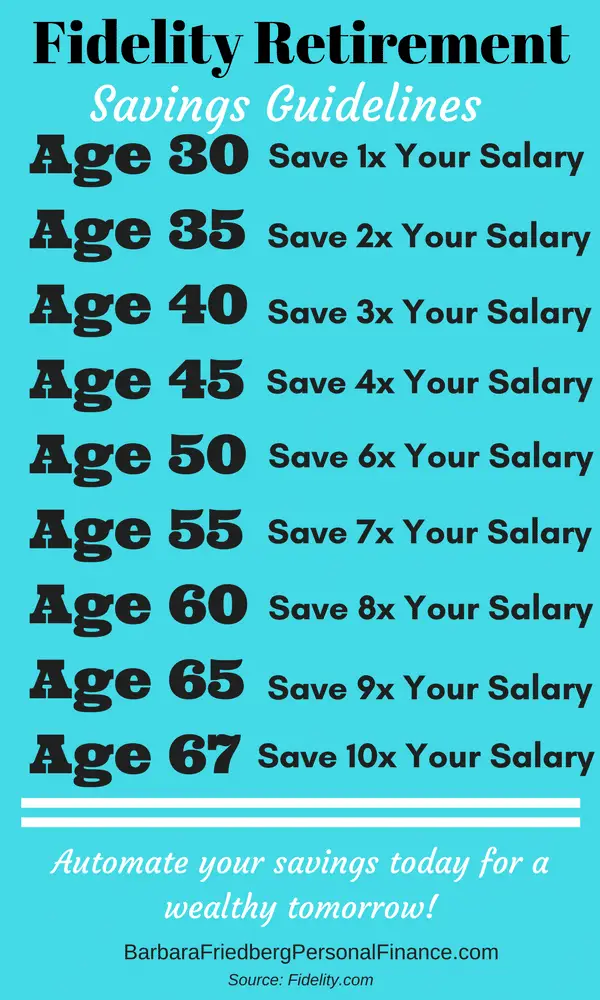

Fidelity Investments recommends saving 10 times your annual income by age 67. Of course, if youre planning an early retirement, youll need to save more. Here are some benchmarks Fidelity provides on how much you should try to have saved at different ages.

Dont have that much saved for retirement yet? Dont panic. The important thing is to continue taking steps toward progress, which will put you in a better position for the future.

How To Boost Your 401 Retirement Savings

401s come with contribution limits. For 2021, you can contribute up to $19,500. If you feel behind and want to put more muscle behind your savings efforts, the IRS allows folks who are 50 or older to kick in an additional $6,500. If itâs offered by an employer, you may be able to make after-tax contributions to help with savings. Beyond your 401, you can leverage other retirement savings vehicles outside of what your workplace offers, such as a traditional or Roth IRA, to bolster your nest egg.

There are several factors to consider here: Longevity, medical costs, your lifestyle, taxes and more. This can be rather complex for many people, but a financial advisor has the tools and expertise to build realistic financial projections to help you match your goals with your savings so you can live life with less stress. This may include delaying Social Security or exploring other financial tools, such as whole life insurance, to provide flexibility in retirement.

This publication is not intended as legal or tax advice. Consult with a tax professional for tax advice that is specific to your situation.

The primary purpose of permanent life insurance is to provide a death benefit. Using permanent life insurance accumulated value to supplement retirement income will reduce the death benefit and may affect other aspects of the policy.

Recommended Reading

Recommended Reading: How To Transfer 401k From Vanguard To Fidelity

Start Earning More For A Better Financial Future

The answer to How much should I have in my 401k? is an important one but its not the only way to ensure your financial future.

We are going to let you in on a little secret. It is one that has helped thousands of people live their Rich Life:

Theres a limit to how much you can save, but theres no limit to how much money you can earn.

Bonus:

Many people dont understand this and because of that, theyre content with contributing very little to their retirement accounts. When they actually retire, theyre surprised when their nest egg is a lot smaller than they thought and they have to get a job as a Walmart greeter to pay for their condo.

If you realize that your earning potential is LIMITLESS, you can truly get started working toward living a Rich Life today.

We recommend three ways to start earning more money:

1. Negotiate a salary raise. 99% of people are content with not asking for a salary raise. So if you are willing to negotiate, that puts you in the 1% and showcases to your boss that youre a Top Performer willing to work hard for more money.

2. Start a side hustle. One of my favorite money-making tactics is starting your own side hustle. We all have skills. Why not leverage those skills to start earning more money in your free time?

We want to help you get started on one of these tactics today: Starting a side hustle.

Thats why we want to offer you my Ultimate Guide to Making Money.

Stuff like:

UGH.

A How Much Income Do You Expect To Live On Per Year

You can choose to compute this amount using different strategies â for example, by using the 70% pre-retirement income rule, or by simply looking at the lifestyle you envisage living in retirement and estimating what your expenses will add up to .

Note: In your calculations, if looking at your current lifestyle and expenses, remember to eliminate expenses that may no longer be relevant in retirement such as mortgage payments, cost of commuting to work, childcare expenses RRSP, CPP, and EI payments, etc. And, remember to add new expenses that may crop up such as travel expenses, hobbies, health issues, and so on.

Don’t Miss: When Can I Set Up A Solo 401k

How To Get Retirement Ready

Open a retirement account. If you have access to a GRSP, you should at the very least contribute the amount of money your employer is willing to match. You should also open a RRSP if you don’t already have one. A RRSP is one of the most popular ways to save for retirement in Canada and it comes with nice tax benefits. Learn more about RRSPs and GRSPs.

Avoid paying high fees. Fees are like savings termites they’ll chew right through your savings. When you invest with Wealthsimple, we charge a 0.5% management fees when you invest up to $100,000 and 0.4% when you deposit more than $100,000. That’s significantly less than the 2% fees paid by traditional mutual fund investors in Canada.

Make smart moves. Begin saving for retirement as early as you can and take advantage of the power of compounding. Create a budget that includes retirement savings, learn how investing works, discover smart retirement strategies and understand what it takes to retire early.

Start Living On A Budget And Tracking Your Expenses

The fact is that until you know where your money is going each month youre going to have a hard time finding money to set aside for retirement savings.

The reason its so important to discover and track where your money is going each month is so that you can identify wasteful spending and reroute it toward causes that are more important to you.

Many people find when they start tracking expenses that they are spending money in $5, $10 and $20 increments that seems like its not a lot but adds up to hundreds or thousands of dollars each month.

When my family started tracking expenses in 2013, we were able to cut them down by nearly $1,000 a month and we were making well under $100,000 per year at the time.

By trimming grocery expenses, cutting back on entertainment costs and being more mindful of each purchase, we found a lot of waste in our spending. We were able to use what we were wasting for much more important things, such as paying off our debt.

You May Like: How To Contribute To 401k Without Employer

Why Have You Set The Default Life Expectancy Of The Calculator To 95 Years

For starters, people are living longer. Even though the average life expectancy in Canada is 82 years, many people live past this. It’s better to have more money tucked away for retirement than to run out of savings. Extra savings can always be passed down to your beneficiaries. You can change the default life expectancy if you think you’ll live a longer or shorter life.

How Much Do I Need To Retire In Canada

Retirement is usually the last thing on your mind when you are young but thats usually when you want to start planning to have the easiest path to retirement.

Its like planting a seed now to see the fully grown tree 20 or 30 years later. The sooner you plant the seed of retirement, the faster you get your retirement tree.

Wealth that is passed through generations have grown old growth trees that can be over 100 years old. So you see, time plays a major factor in wealth generation and how much you need is trying to figure out if you need a 20 years old tree or a 30 years old.

As you can imagine, there isnt one number as every city has a different cost of living. If you are willing to relocate, you can find the cheapest place to live but you will certainly need to give up something else in the process.

The key is to figure out your magic number for retiring in Canada. Mine is $1,777,777.

Recommended Reading: Can I Use 401k To Buy A Home