Contribution Limits : How They Differ From 2020 And 2019

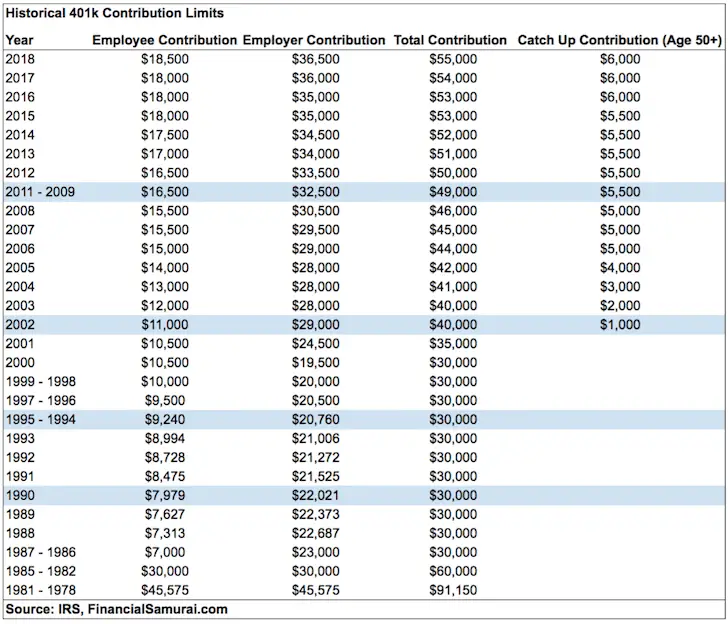

The 401 contribution limit for 2021 stays flat with 2020. The IRS lifted basic 401 contribution limits for 2020 to $19,500. And it raised the catch-up contribution cap for the first time in five years.

If youre aged 50 or older, 2020 was even more of a boon for your 401. The so-called catch-up contribution limits, for older workers, also rose to $6,500 for 2020. Before this year, catch-up contributions stayed the same, $6,000, from 2015 through 2019.

Also Check: Can I Borrow From My 401k

Investing In A Business

“An employee who has maxed out their 401 might want to consider investing in a business,” says Kirk Chisholm, wealth manager at Innovative Advisory Group in Lexington, Massachusetts. “Many businesses, such as real estate, have generous tax benefits. On top of these tax benefits, business owners can decide what type of retirement plan they want to create. If, for example, they wanted to set up a 401 plan for their company, they would be able to expand their 401 contributions beyond what they may have at their employer.”

What Is A Good 401 Contribution

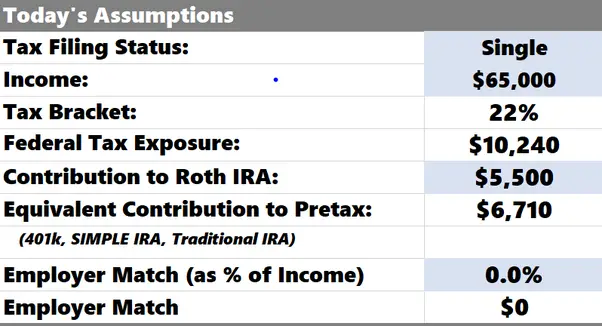

Your ideal 401 contribution depends on several factors. If your employer offers a match, your first priority should be to contribute enough to get the full match. From there, you may want to max out a tax-free retirement account such as a Roth IRA before you finish maxing out your 401. If you’re able to do all three of these, it can help you get the most out of your investments.

Recommended Reading: Should I Rollover My 401k When I Retire

What Is The Downside Of A Roth Ira

One major drawback: Roth IRA contributions are made with after-tax money, meaning there are no tax deductions in the year of the contribution. Another drawback is that the withdrawal of account income should not be made until at least five years have passed since the first deposit.

Is a Roth IRA good or bad?

Roth IRA withdrawals can help your taxes in retirement. When you decide to dive into your Roth IRA funds, withdrawals are tax-free. These tax-free withdrawals can help you defer the need to withdraw money from other accounts, which could increase your AGI, income tax or other costs.

Save For Health Care Costs

Contributing to a health savings account can reduce out-of-pocket cost for expected and unexpected health care expenses. For 2020, eligible individuals can contribute up to $3,550 pre-tax dollars for an individual plan or up to $7,100 for a family plan.

The money in this account can be used for qualified out-of-pocket medical expenses such as copays for doctor visits and prescriptions. Another option is to leave the money in the account and let it grow for retirement. Once you reach age 65, the funds are tax-free when you use them for qualified medical expenses. If you spend the funds in other ways, they are taxed as income with no penalties.

Read Also: How To Look Up An Old 401k Account

Limitation On Elective Deferrals

The maximum amount you can defer into your 401 plan adjusts each year for inflation. As of 2012, the standard limit is $17,000. However, for people age 50 and older, the contribution limit increases by $5,500 because of what is known as a “catch-up” contribution. This extra $5,500 increases the total limit for someone older than 50 to $22,500. The catch-up contribution does not count toward the general 401 plan contribution limits.

Should I Max Out My 401k Or 457 First

Most of the time its better to max out your 401k first since your employer can contribute a company match. Taking advantage of the company match is equivalent to a 100% return!

Unfortunately, your employer cannot match your contributions to the 457 plan. Therefore, you should only contribute to the 457 plan after you have taken advantage of the full company match in your 401k.

Here is a helpful flowchart I made on How To Prioritize Your Investments:

Maxing out both 401k and 457 accounts in the right order allows you to put the most money to work for you. The money wont be going to Uncle Sam as an interest-free loan. Instead, it gets invested and flourishes through the magic of compound interest.

Let me show you an example of the difference that maxing out your 401k and 457 can have on your retirement plans.

Scenario A:

A married couple making a combined $120,000 a year, decides not to max out their 401k or 457 and just invest in a taxable account.

To make things simple I am not including other taxes and deductions. They pay $12,837 in taxes and are left with $107,163. Their expenses are $38,000/year. Therefore, they are left with .

With the $69,163 they invest it all into a taxable account where they make a return of 7% a year.

Using my Financial Independence Spreadsheet we can calculate that after 20 years their account has grown to 2.8 million.

Scenario B:

Now they have a total of $80,200 invested and each year they make a return of 7%.

A difference of $400,000!

Also Check: Can You Contribute To 401k After Leaving Job

Why Choose A Roth Ira Over A 401k

A Roth IRA is a self-directed retirement savings account. Unlike a 401, you put money into a Roth IRA after taxes. Think joyful when you hear the word Roth, because a Roth IRA allows you to grow your money tax-free. Plus, when you become 59 1/2, you can take money out of your account tax-free!

For persons who are self-employed or work for small organizations that do not provide a 401 plan, an IRA is a terrific option. If you already have a 401, you might form an IRA to save money and diversify your investments .

How Does Employer Match Count Toward 401 Limits

Some employers offer a 401 employer matching plan, which means they match the amount of pay an employee contributes toward their 401. The amount an employer matches can vary, depending on the company and IRS limits. Some employers match a portion of the employees contribution, while others match the full amount.

You can make the same contribution for all employees, or it can vary according to much each employee makes and change annually based on their earnings. For example, if an employee receives a raise at the end of the year, their employer may also increase their match amount. The most popular matching plan employers use is matching up to 6% of their employees annual income.

Also Check: Should I Roll Over 401k From Previous Employer

What Is A 401

In simple terms, a 401 plan is a retirement savings account offered by your employer, with contributions set as a consistent monthly amount, typically as a percentage of your salary.

The main advantage of a traditional 401 is that you can make contributions straight from your paycheck pre-taxsaving you 10% to 37% on your contributions, depending on your income tax rate.

Investment growth in your 401 is also tax-deferred meaning you dont need to pay annual taxes on interest earned. All of this adds up to a big upside for long-term, tax-deferred growth. However, with a traditional 401 you will need to pay income tax on all your earnings when you withdraw from the account.

Another benefit of a 401 is that many employers will match up to a certain contribution amount, effectively doubling your savings. Every company differs in their contribution matching limit, but a common amount is a 50 cents match for every dollar, up to 6% of an employees pay. matching here.)

However, with all the benefits come a few restrictions. The most significant is the contribution limit of $19,500 for employees in 2020. There is also a 10% early distribution penalty tax if you access your funds before age 59½, but the CARES Act may let you waive that penalty if you made an early withdrawal for reasons related to the pandemic, including financial hardship.

Traditional Vs Roth 401

Some employers offer both a traditional 401 and a Roth 401. With a traditional 401 plan, you can defer paying income tax on the amount you contribute. In other words, if you earn $80,000 a year and contribute the maximum $20,500, your taxable earnings for the 2022 tax year would be $59,500.

With a Roth 401 plan, you dont get an upfront tax break, but when its time to withdraw that money in retirement, you wont owe any tax on it. All your accumulated contributions and earnings come out tax free.

Investing in both types of plans provides you with tax diversification, which can come in handy during retirement.

If you have access to both a Roth and a traditional 401 plan, you can contribute to both, as long as your total contribution to both as an employee doesnt exceed $20,500.

In addition to the Roth and traditional 401, some employers also offer an after-tax plan, allowing you to save up to the total annual limit of $61,000. With this account you can put away money after-tax and it can grow tax-deferred in your 401 account until withdrawal, at which point any withdrawn earnings become taxable.

Don’t Miss: Can You Use 401k To Pay Off Student Loans

Does My Employers 401 Match Count Toward My Maximum Contribution

To put it simply, the answer is no. An employer matching contribution does not count towards your maximum contribution of $20,500. However, the IRS does limit total contribution to a 401 from both the employer and the employeewhich means total contributions can’t exceed either:

-

100% of an employee’s salary, or

-

The limit for defined contributions .

The limit for defined contribution plans in 2022 under section 415 is $61,000 . Workers older than 50 years are still eligible for a $6,500 catch up contribution and can have a maximum of $64,500 in employer and employee contributions. This applies to both traditional and Roth 401s.

Deferral Limits For 401 Plans

The limit on employee elective deferrals is:

- $19,500 in 2021 and 2020 , subject to cost-of-living adjustments

Generally, you aggregate all elective deferrals you made to all plans in which you participate to determine if you have exceeded these limits. If a plan participants elective deferrals are more than the annual limit, find out how you can correct this plan mistake.

Also Check: How To Transfer 401k Accounts

Can Employees Enroll In A 401 Employer Match Plan As Soon As They Are Hired

Employers are able to define their own specifications regarding when employees are eligible for 401 enrollment. Some companies choose to allow for registration immediately, while others require a certain amount of time to pass, such as the probation period, six months of employment and so on. Employers should make these regulations clear during the hiring process, so employees arent surprised if they need to wait.

How Much Should I Save For Retirement

We get that question a lot.

A good rule of thumb is to try to save 1015% of your income toward retirement, says Stanley Poorman, a financial professional with Principal®, but that also depends on when you get started. That may be fine if youre 25 if youre starting at 50, you may need to save more to retire comfortably. Theres no one-size-fits-all answer.

Another factor is whether you have a matching contribution from your employer, and if so, what percentage the company contributes. Poorman suggests deferring enough of your pay to get that match.

Get a snapshot of how much you may need to save with our Retirement Wellness Planner.

Don’t Miss: How Much Do I Need In My 401k To Retire

So How Much Should You Invest In Your 401k

Okay. So, while investing is highly personal and financial goals should be personalized, you are here so we can teach you to be rich. We have some advice to get you started.

How much you should actually be investing each month depends on a system we call the Ladder of Personal Finance. Check out this video, or read about the Ladder below:

1. Your employers 401k match. Each month you should be contributing as much as you need to in order to get the most out of your companys 401k match. That means if your company offers a 5% match, you should be contributing AT LEAST 5% of your monthly income to your 401k each month.

Weve already discussed the importance of this dont throw away free money and the returns from that free money.

2. Whether youre in debt. Once youve committed yourself to contributing at least the employer match for your 401k, you need to make sure you dont have any debt. Remember, if you have employee matching, you are effectively earning a 100% return on every penny you invest in your 401k that is significantly more than the interest you would save by paying down your debt.

If you dont, great! If you do, thats okay. You can check out my system on eliminating debt fast to help you.

Key Employee Contribution Limits That Remain Unchanged

The limit on annual contributions to an IRA remains unchanged at $6,000. The IRA catch-up contribution limit for individuals aged 50 and over is not subject to an annual cost-of-living adjustment and remains $1,000.

The catch-up contribution limit for employees aged 50 and over who participate in 401, 403, most 457 plans, and the federal governments Thrift Savings Plan remains unchanged at $6,500. Therefore, participants in 401, 403, most 457 plans, and the federal governments Thrift Savings Plan who are 50 and older can contribute up to $27,000, starting in 2022. The catch-up contribution limit for employees aged 50 and over who participate in SIMPLE plans remains unchanged at $3,000.

Details on these and other retirement-related cost-of-living adjustments for 2022 are in Notice 2021-61 PDF, available on IRS.gov.

Don’t Miss: How To Transfer 401k When Changing Jobs

Benefits Of Contributing To Your 401 Plan

401 account contributions provide a double tax advantage for taxpayers. Individuals are able to direct pre-tax funds from their paycheck into their 401, reducing the amount of their income subject to income taxes the following year. In addition, any earnings from 401 account contributions are also tax-exempt.

Individuals will need to pay income taxes on funds taken out of 401 accounts during retirement. However, many find their income is lower during retirement than it was while working, placing them in a lower tax bracket.

Contribution Limits In 2021

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandheres how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks or securities.

401 plans are an excellent way to save for retirement, but because 401s are tax-advantaged, the IRS sets a contribution limit on how much you and your employer can put into your 401 per year.

Read Also: How To Get Money Out Of 401k Without Penalty

Read Also: How To Invest In A 401k For Dummies

Employers Have A Higher Contribution Ceiling

The employers 401 maximum contribution limit is much more liberal. Altogether, the most that can be contributed to your 401 plan between both you and your employer is $61,000 in 2022, up from $58,000 in 2021. That means an employer can potentially contribute much more than you do to your plan, though this is not the norm.

The salary cap for determining employer and employee contributions for all tax-qualified plans is $305,000. Even at that level, the employer would have to contribute a hefty amount to reach the $61,000 limit.

Contributions And Market Volatility

During a market downturn, its important to take a step back, and recognize that when saving in your 401, you are investing for the long-term. Even though you might be afraid of investing in a volatile market, its actually a very good idea to continue to contribute to your 401.

Putting money into your 401 each pay period is a natural way to dollar cost average, which is a strategy where you invest a fixed dollar amount of money at regular intervals, over a long period of time.

This means you wont invest all your money into the market when it is either at a low or a high. With dollar-cost averaging, there is no wrong decision about when to invest in the market. In fact, while the market is at a low you could actually receive a better deal on buying investments.

Of course, when the market stumbles, it can mean the economy isnt doing well, so its important to reassess the personal impact on your budget and expenses too. You should take a look at your whole financial picture to strategize how you can continue to save, and continue your regular 401 contributions to smooth out your returns over time.

You May Like: What Is The Maximum Amount To Put In A 401k

Are Roth Iras Still A Good Idea

If you have earned an income and meet income limits, a Roth IRA can be an excellent tool to save for retirement. But remember, its only part of an overall retirement strategy. If possible, its a good idea to contribute to other retirement accounts as well.

Is a Roth IRA a good idea right now?

Roth IRAs are ideal retirement savings accounts if youre in a lower tax bracket now than you expect to be in retirement. Millennials are well positioned to make the most of the tax benefits of a Roth IRA and decades of tax-free growth.

Are ROTH IRAs high risk?

But they should follow Thiels example in one respect: Roths accounts are a great place for high-risk, high-return investments. Unlike a traditional individual retirement account or 401, Roths are funded with after-tax dollars.

Read Also: Do I Have To Pay Taxes On 401k Rollover