How Does The Standard 401 Plan Work

It is important to note that 401 plans are designed to build wealth over time, but they are not investments in the standards sense. When you opt into a 401 plan, you set a dollar limit or a percentage of your pay to contribute to your account each pay period. This is why you might also hear it called a “defined contribution” plan. Your employer has chosen a plan provider that builds wealth by using the funds to invest in any number of assets, such as mutual funds, stocks, index funds, and real estate investment trusts . In some cases, you may be able to choose how your funds are invested, or at least how safe you’d like the account managers to be with your money.

The money that you add to your 401 account each pay period comes directly out of your paycheck , so you don’t even need to think adding it. If your job offers a match program, you may be putting away more than you even put in.

The perks are clear, but there are downsides as well. 401 plans are designed to work over the long term, and is not advisable to take money out of your account, or else you may incur fees for early withdrawal. Moreover, those those taxes that you didn’t have to pay when you put the money into your account will show up later, as you will be taxed on withdrawals.

Your Retirement Savings Plan

Its never too early to start preparing for retirement, and your 401 can play an important role in your overall strategy. Also, take advantage of any other individual and employer-sponsored retirement plans you qualify for. And dont forget more immediate savings goals. Having money put aside for emergencies and shorter-term expenses is your bet for riding out financial challenges without having to tap into your retirement funds prematurely.

Leave Your 401 With Your Old Employer

Some 401 plans let you leave your money right where it is after you leave the company. However, as you move through your career, this means you will need to keep track of multiple 401 accounts. Some employers require you to withdraw or rollover your 401 within a set period of time after youve left your job.

Read Also: When Can You Rollover A 401k Into An Ira

How Do 401 Plans Work

Now for the fun part! So with a regular 401 plan, money is deducted from your paycheck before taxes are taken out, which in turn lowers your taxable income and, therefore, lowers your taxes. The money is then placed into your 401. With the 401, you decide how your money is invested. Most plans offer a variety of mutual funds, which are made up of stocks, bonds, and money market investments. Some financial advisors recommend spreading out your money into four different investments.

Is An Ira A Retirement Plan

An IRA, or Individual Retirement Account, is indeed a retirement plan. However, it’s not a qualified plan. Instead, IRAs are described in Section 408 of the Tax Code and have their own set of rules. One significant difference between qualified plans and IRAs is that qualified plans are established by businesses, while certain types of IRAs — traditional or Roth IRAs — are established by individuals. That means you can set up a traditional or Roth IRA for yourself, whether or not your employer has established a qualified plan for you at work.

Other types of IRAs, known as SEPs and SIMPLE IRAs, are for businesses and must be established by an employer. For example, the employer might be a corporation, a sole proprietor or a partnership. SEPs and SIMPLE IRAs permit larger tax deductions than do traditional or Roth IRAs.

Recommended Reading: How To Check If You Have A 401k

Employer Matching For 401 Plans

Additionally, many employers offer a company match, which means that your company will match your contribution, up to a certain percentage or sometimes up to a certain dollar amount.

Heres a simple example of how a company may match by percentage:

Lets say your employer will match whatever percentage you put towards your 401. So you decide to contribute 5% of your salary to your 401k, meaning your employer will match that 5%. If you make $60,000 a year, thats 5% before taxes, which is $3,000. Your employer will contribute that same amount. Thats why its important to contribute at least enough to take advantage of your companys match in full. Free money is always good, right?

However, keep in mind that 401 plans also come with restrictions. In many cases, you cant tap into your companys contributions immediately after youre hired. You must wait a certain amount of time a period called vesting. The IRS also limits the amount of money you can put into your 401 savings, depending on your age and salary. There are also rules on when you can withdraw your money, and you can face penalties for pulling out funds before you reach retirement age.

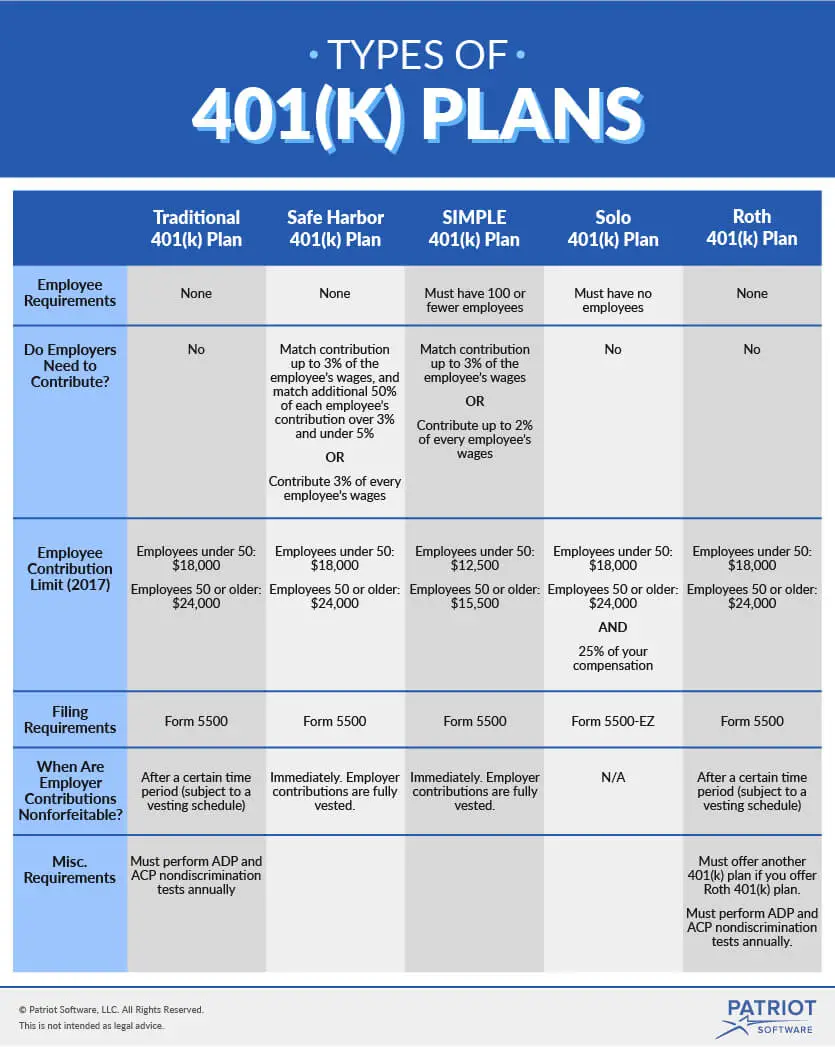

Traditional And Roth 401 Plans

Individuals who want to save for retirement may have the option to invest in a 401 or Roth 401 plan. Both plans are named for the section of the U.S. income tax code that created them. Both plans offer tax advantages, either now or in the future.

With a traditional 401, you defer income taxes on contributions and earnings. With a Roth 401, your contributions are made after taxes and the tax benefit comes later: your earnings may be withdrawn tax-free in retirement.

You May Like: How Often Can I Change My 401k Investments Fidelity

Contributions Made By Employees

The following types of contributions are made by employees and must be fully vested at all times, regardless of the employees length of service with the company.

Salary Deferrals

These are the 401 contributions that come out of employee paychecks. They may also be called elective deferrals, and they can be made as either pre-tax contributions or Roth contributions. Both pre-tax and Roth deferrals are subject to what is called the ADP Test each year, and they are generally not available for in-service distribution before age 59 ½.

Roth Contributions

The full name in the regulations is designated Roth contribution, but they are sometimes called Roth deferrals. Unlike pre-tax deferrals, employees are subject to income tax on these amounts at the time of contribution however, if left in the plan long enough, they are tax-free at the time of distribution.

Catch-Up Contributions

These are additional salary deferrals that are available to those participants who are at least age 50 and who are already making deferrals up to the limit. They are disregarded for nondiscrimination testing purposes.

After-Tax Contributions

Rollovers

Rollovers are amounts that an employee elects to move into a plan from another company-sponsored retirement plan or IRA. They can be either Roth or pre-tax and are generally not included in any nondiscrimination tests.

Benefits Of Retirement Planning With Raymond James

Our approach is different from other investment firms in that Raymond James does not have a proprietary fund package on top of its list of retirement plan alternatives and services. We utilize what we believe to be the top providers in the retirement plan market. This allows us to maintain a more consultative approach to help our clients select the package that best fits the needs of their businesses. In addition, we work with many professional plan administration firms within the industry, so we can help provide solutions to more complex plan designs or compliance needs that may arise with a customized plan.

Prototype plans

We offer the small business a variety of retirement plan options. Our prototype plans are easy to adopt and maintain. Raymond James currently offers profit sharing and 401 profit sharing prototype plans. Raymond James provides automatic updates of prototype plans, making it simple and inexpensive to keep your plan up-to-date with any tax law changes.

Asset protection

This firm is a member of the Securities Investor Protection Corporation , which protects securities customers of its members up to $500,000 of net equity protection, including $250,000 for claims for cash awaiting reinvestment. Please visit sipc.org for more information about SIPC coverage.

Account protection applies when an SIPC-member firm fails financially and is unable to meet obligations to securities clients, but it does not protect against market fluctuations.

Investment flexibility

Read Also: Can I Roll An Old 401k Into A New One

When Can You Withdraw From Your 401k Without A Penalty

Wondering when can you withdraw from 401k? 59 and 1/2 is the current age when you can take money out of your 401k without incurring a penalty. However, the money you take out is still taxed as income. At the age of 70, you will be forced by the IRS to start taking distributions from your retirement accounts.

Vs : Whats The Difference

The primary difference between a 401 vs. a 401 is that the 401 is for employees of governments, educational facilities and nonprofit organizations, whereas a 401 is for employees of private-sector companies. Although both are employer-sponsored qualified benefit plans, they differ in other important ways:

Read Also: When Can I Take Out My 401k

Pension Plans And Vesting

When you start working for a new employer, you may be required to work there for a specific amount of time before you become eligible to participate in the workplace retirement plan. Earning the right to participate in these benefits is called vesting. With some employers, vesting happens immediately. With others, you may be required to work there a certain number of years before youre fully vested.

Under ERISA, employers can choose between a cliff or graduated vesting schedule. Under a cliff vesting schedule, you dont vest at all until youre with the company a certain number of years. But once you reach that tipping point, youre 100% vesting. A graduated vesting schedule is when employees become partially vested each year until they reach 100%. Employers can require a maximum of five years for cliff vesting and six years for graduated vesting.

No matter what your companys vesting schedule, you are always 100% vested in your own contributions. Suppose your employer has a five-year cliff vesting schedule. During your first five years with the company, you automatically have a right to any money you contribute to the plan. Then, once youve been there five years, you also have a right to any money your employer has contributed thus far.

If you leave the company before youre fully vested, you may receive only part of your employers promised benefit during retirement .

How Is An Ira Different From 401k

401K accounts are associated with your employment, as contributions are taken out of your wages before taxes. A traditional IRA is similar to a 401k in that contributions aren’t taxed , but the key difference is that they are independent of your employer. A Roth IRA is also independent, but contributions are made after taxes. Withdrawals from your Roth IRA are tax-free, which makes them a smart choice if you think taxes will be higher in the future.

Also Check: How To Get 401k From Old Employer

Need Help Or Have Questions

Contact MIT Benefits or see the additional contact options below.

| Vendor |

|---|

- How do I find out who I designated as my Pension Plan or Supplemental 401 beneficiary?

To find out who you designated as your Pension Plan beneficiary or to designate a new beneficiary, visit PensionConnect or call 855-464-8736 .

To find out who your Supplemental 401 beneficiary is, call Fidelity Investments at MIT-SAVE , or visit Fidelity NetBenefits to designate your beneficiary online.

- How do I update my life insurance and retirement plans to include my spouse or domestic partner?

Visit Atlas to evaluate your participation in the MIT Optional Life Insurance Plan. Spouse or partner life insurance coverage can be added within 31 days from the date of your marriage or domestic partnership or during Open Enrollment.

Review and update your beneficiaries under the MIT Optional Life Insurance Plan, the MIT Basic Retirement Plan and the MIT Supplemental 401 Plan to ensure they are current. If you are married and your most recent beneficiary designation on file for the MIT Retirement Plan does not designate your spouse as the sole primary beneficiary, and does not have spousal consent for this designation, your spouse will be beneficiary of 100% of your account balance. More on beneficiaries.

Types Of Retirement Living Insurance Plans

There are several good purchase a old age insurance plan. If youre a dynamic worker or a retiree, there are many types of coverage you can purchase. Whole life insurance is an effective option for those who want a one-time payment. Expereince of living policies will be flexible, meaning you can replace the coverage as your health and living scenarios change. These types of plans can also provide a incapacity payout or death profit. They typically remain in force for the entire insureds lifetime. Not like term insurance, whole life insurance plans will eliminate when the covered dies.

Traditional Annuity programs are one of the popular options for retirement insurance. This sort of plan requires a one-time top quality, and several regular payments for a pre-set period of time. The payout period is generally around 30 years, but you can pick a longer payment period in case you desire. Also you can choose to acquire a Pension Income Insurance plan. Both types of plans will provide you with frequent payments. If you choose a term or perhaps whole life policy, you can be guaranteed that there is an idea that fits your requirements and price range.

Recommended Reading: Can I Rollover 401k To Ira While Still Employed

Why Save In A 401

Contributing to a 401 plan can help participants prepare for retirement. By participating in their companys 401 plan, employees can take advantage of matching contributions from their employer, enjoy preferential tax treatment on both pretax and post-tax contributions, harness the power of compounding, and gain access to a wide range of investment options. Check out this article for even more reasons to get started today.

1 Limits are for 2019 and can be subject to change annually. 2 Ordinary income taxes are due on withdrawal. Withdrawals before the age of 59½ may be subject to an early distribution penalty of 10%. 3 This is a hypothetical illustration used for informational purposes only. The marginal tax bracket used is 25%. This lump-sum, after-tax figure doesnt account for the possible change in tax bracket that might occur due to a lump-sum distribution of the taxable amount, nor does it take into effect any applicable tax penalties. There is no guarantee that the results shown will be achieved, and the assumptions provided may not be reflective of your situation. 4 Only applies to qualified distributions, which means the money is withdrawn when you are at least 59½ years old, or on death or disability, and youve held Roth contributions in your account for at least five years .

What Is A Pension Plan

Pension plans provide a continuous, fixed income after retirement. The amount of income is typically based both on your total years of employment and the wages earned during your final year of employment. Because you will know in advance the amount of your monthly benefit at retirement, pensions are referred to as defined benefit plans. Private and union pension plans typically do not require an employee contribution to the pension fund, while government pension plans usually do.

Also Check: How Do I Know If I Have A 401k

Choosing Investments In Your 401

You will usually have several investment options in your 401 plan. The plan administrator provides participants with a selection of different mutual funds, index funds and sometimes even exchange traded funds to choose from.

You get to decide how much of your 401 balance to invest in different funds. You could opt to invest 70 percent of your contributions in an equity index fund, 20 percent in a bond index fund and 10 percent in a money market mutual fund, for example.

Plans that automatically enroll workers almost always invest their contributions in what is known as a target-date fund. Thats a fund that holds a mix of stocks and bonds, with the mix determined by your current age and your target date for retirement. Generally, the younger you are, the higher the percentage of stocks. Even if you are automatically enrolled in a target-date fund, you are always free to change your investments.

Investing options available in 401 plans vary widely. You should consider consulting with a financial adviser to help you figure out the best investing strategy for you, based on your risk tolerance and long-term goals.

Rules For Withdrawing Money

The distribution rules for 401 plans differ from those that apply to individual retirement accounts . In either case, an early withdrawal of assets from either type of plan will mean income taxes are due, and, with few exceptions, a 10% tax penalty will be levied on those younger than 59½.

But while an IRA withdrawal doesn’t require a rationale, a triggering event must be satisfied to receive a payout from a 401 plan. The following are the usual triggering events:

- The employee retires from or leaves the job.

- The employee dies or is disabled.

- The employee reaches age 59½.

- The employee experiences a specific hardship as defined under the plan.

- The plan is terminated.

Also Check: How To Make A 401k Account

What Is A Roth Ira

A Roth IRA is a type of individual retirement account similar to traditional IRAs in many ways, but with some significant differences. One of the main differences is how the tax breaks are different: with a traditional IRA, the money you put in isn’t taxed with a Roth IRA the money you take out isn’t taxed. Roth IRA’s also have no requirements on when the money must be taken t, so they can be a good tool to pass along wealth to your beneficiaries if you find you don’t need the money in retirement.