Next Steps To Consider

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Past performance is no guarantee of future results.

Investing involves risk, including risk of loss.

Fidelity does not provide legal or tax advice. The information herein is general and educational in nature and should not be considered legal or tax advice. Tax laws and regulations are complex and subject to change, which can materially impact investment results. Fidelity cannot guarantee that the information herein is accurate, complete, or timely. Fidelity makes no warranties with regard to such information or results obtained by its use, and disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information. Consult an attorney or tax professional regarding your specific situation.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

You Live In One Of The No State Income Tax States

Federal income tax is one thing, state income tax is another. If you live in Texas, Washington, Florida, Alaska, Nevada, South Dakota, Wyoming, or New Hampshire, it is less of a sin to contribute to a Roth IRA because you arent paying any state income taxes. Everybody else should figure out a way to retire in one of the seven no income tax states and then start withdrawing pre-tax retirement funds.

Related: States With No State Tax Or Inheritance Tax

Vs Roth Ira: An Overview

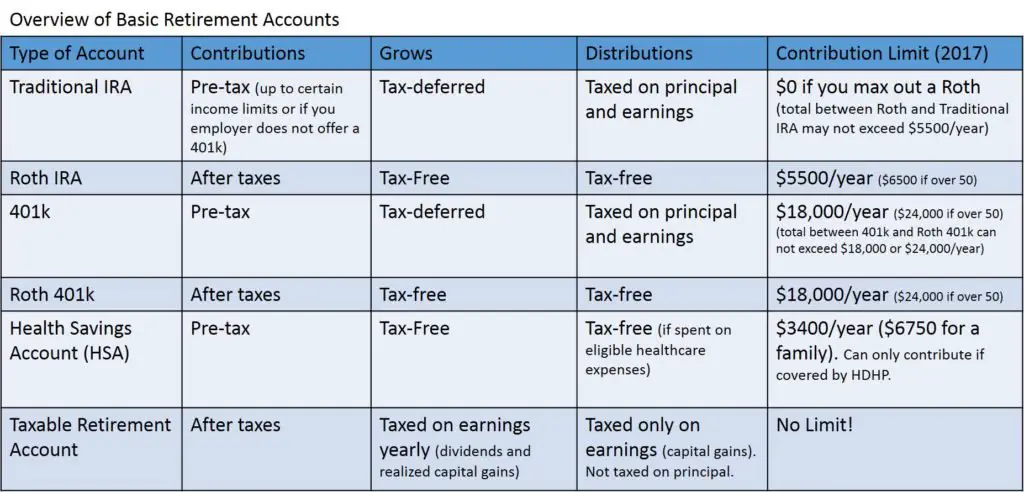

Both 401s and Roth IRAs are popular tax-advantaged retirement savings accounts that differ in tax treatment, investment options, and employer contributions. Both accounts allow your savings to grow tax-free.

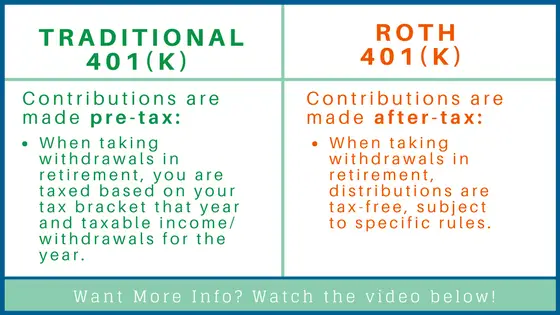

Contributions to a 401 are pre-tax, meaning they are deposited before your income taxes are deducted from your paycheck. However, when in retirement, withdrawals are taxed at your then-current income tax rate. Conversely, there is no tax savings or deduction for contributions to a Roth IRA. However, the contributions can be withdrawn tax-free when in retirement.

In a perfect scenario, youd have both in which to put aside funds for retirement. However, before you decide, there are several rules, income limits, and contribution limits that investors should be aware of before deciding which retirement account works best for them.

Don’t Miss: Can You Use Your 401k As Collateral For A Loan

If Your Marginal Tax Rates Are Lower Now Than They Will Be In Retirement

Probably the most important factor in the Roth vs. Traditional 401 discussion and a key determinant in which one is right for you is if your marginal tax rate is higher or lower now than what it will be in retirement. If youre in a lower tax bracket right now, but expect yourself to be in a higher tax bracket in retirement, then it might make sense to invest in the Roth 401. By getting the taxes out of the way now on the front end, you are paying them at a discount to what your future self will have to pay when in a higher tax bracket.

For example, if you are a doctor that is currently in residency, chances are that you are in a lower tax bracket than you will be when you retire. Thus, itd probably make sense to use the Roth 401 now, while youre in a lower tax bracket and pay a lower marginal tax rate than your future self will be able to. Similarly, if you and your spouse both normally work, but one of you is currently not working for whatever reason , then it might make sense to utilize the Roth 401 while your income is temporarily diminished.

Why We Recommend The Roth 401

If youre investing consistently every monthwhether its in a Roth 401, a traditional 401 or even a Roth IRAyoure already on the right track! The most important part of wealth building is consistent saving every month, no matter what the market is doing.

But if choosing between a traditional 401 and a Roth 401, we’d go with the Roth every time! Weve already talked through the differences between these two types of accounts, so youre probably already seeing the benefits. But just to be clear, here are the biggest reasons the Roth comes out on top.

You May Like: What Should My 401k Contribution Be

About Carsonallaria Wealth Management

CarsonAllaria Wealth Management is an independent, Registered Investment Advisor , registered with the SEC. You can check our firm and our advisors at adviserinfo.sec.gov.

All material provided by CarsonAllaria Wealth Management is for informational purposes only. By accessing or otherwise using this website, you agree to be bound by the terms and conditions set forth below.

Investing involves risk of loss and investors should be prepared to bear potential losses. Past performance may not be indicative of future results and may have been impacted by events and economic conditions that will not prevail in the future. Therefore, it should not be assumed that future performance of any specific security, investment product or investment strategy referenced on the website, either directly or indirectly, will be profitable or equal to the corresponding indicated performance level.

Any reference to a market index is included for illustrative purposes only, as it is not possible to directly invest in an index. Indices are unmanaged, hypothetical vehicles that serve as market indicators and do not account for the deduction of management fees or transaction costs generally associated with investable products, which otherwise have the effect of reducing the performance of an actual investment portfolio.

Should You Contribute To Pre

For all the efforts that companies undertake to make participating in their retirement plan benefits easy, theres no simple way to help employees decide whether the money they contribute from their own paychecks should be traditional or Roth . The answer can be very nuanced depending on your situation, and for the most part, we wont know whether we chose correctly until its too late well only really know if we got the answer right when it comes time to withdraw and we actually know our taxable income, current tax brackets and lifestyle needs.

Since my crystal ball seems to be broken, Ive attempted to distill the various factors in a way that makes more sense. Keep in mind that many of the factors listed in the chart below are just different ways of saying the same thing, but the intention is to present it in the way that makes the most sense to you.

Also Check: Can I Roll A Roth Ira Into A 401k

Historically Low Tax Rates

We are in a historically low income tax environment right now. Just to give you some perspective, below are the income tax brackets for the years 2000 and 2020 respectively.

In the year 2000, a married couple filing jointly with an adjusted gross income of $200,000 would have had a marginal federal income tax rate of 36%, while a married couple filing jointly with the same income today would have a marginal tax rate of 24%. Also note that the standard deduction for a married couple filing jointly was only $7,350 in 2000, versus $24,800 in 2020. Only 20 years difference, but a 50% difference in marginal tax rates!

Now, obviously, a dollar in 2000 is worth more than a dollar in 2020, thanks to our good friend inflation. So, lets take a look at an inflation-adjusted comparison. A dollar in 2000 is roughly worth a $1.50 today, thus a family making $200,000 in 2000 would be equivalent to making $300,000 today. The family in 2000 still has a 36% marginal tax rate, and the couple today would still have a 24% marginal tax rate!

Whats even crazier is that even a family only making $50,000 in 2000 would be in the 28% federal marginal tax rate, a 4% higher marginal tax rate than a family making $300,000 today!

Thus, I think that it could make a lot of sense to contribute to a Roth 401k versus a traditional 401 and take advantage of these low tax rates while you can.

Five Questions To Ask Yourself Before Switching To A Roth 401

Roth 401k vs traditional. Comparison of retirement plans.

getty

If you have a 401 at work, youre probably familiar with the standard advice about such plans: make sure to contribute enough to receive any employer match and make the maximum contribution if youre able. But some employers offer both a traditional 401 and a Roth 401, and it can be difficult to determine if it makes sense to switch. It is worth understanding how the two types of retirement accounts work along with five questions to ask yourself to select which one is best for you.

Traditional vs. Roth 401s

Regardless of the kind of 401 account you use, you still have the same contribution limit: in 2021, you can save a total of up to $19,500, plus an additional $6,500 if youre over age 50. When you reach retirement, both kinds of 401s have required minimum distributions for account holders over the age of 72. This is a significant difference from a Roth IRA, which has no distribution requirements. The owner of a Roth 401 could eliminate their distribution requirement by rolling it into a Roth IRA, though he or she would want to compare the particulars of both accounts before doing so.

The Roth 401 essentially works the opposite way: contributions are made with post-tax dollars, providing no tax benefit in the year of the contribution, but withdrawals are tax-free as long as youre over age 59 ½ and have held the account for at least five years.

Recommended Reading: When Do You Need A 401k Audit

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

When The Traditional 401 Is Better

Heres when the traditional 401 plan is probably the better option:

Youre in a high tax bracket and save money

Because the traditional 401 gives you a tax break on contributions today, it can make sense to use that break today when your tax costs are high.

If someone is in the highest tax bracket , and they think they will be earning less as they approach retirement, then it may make sense to contribute on a pre-tax basis, says Ma.

Thats the course of action recommended by Marianela Collado, CFP, at Tobias Financial Advisors in Fort Lauderdale, Florida, but she adds an important stipulation.

Having said that, even this only makes sense if you are disciplined enough to take the savings associated with making that traditional 401 contribution and you save that, too, says Collado.

Collado says that if youre not disciplined enough to invest that tax savings from the traditional 401, then the tax-free growth will far outweigh what you couldve accumulated in a traditional plan on an after-tax basis.

You cant get matching contributions on a Roth 401

Some employers dont offer matching contributions for 401 plans at all. However, some subset of employers provide this perk for traditional 401 plans only but not Roth 401 plans, because of how tax laws benefit these traditional plans.

Using Schindlers strategy you can still capture the full employer matching which advisers universally agree is the thing you must do with early-year contributions to a traditional plan.

Read Also: How Do I Sign Up For 401k

What Should I Do With An Old 401

You might have an old 401or severallying around from previous employers. Transferring the money from a 401 to your new employers Roth 401 might seem like an appealing option. But just remember, youll get smacked with a tax bill if you go that route.

Rolling your old 401 into a traditional IRA is another way to go. Youll have more control over your investments and will be able to choose from thousands of funds with the help of your financial advisor. Plus, you wont face any tax consequences since youre moving from one pretax account to another.

If you arent able to transfer your money into your new employers plan but think a Roth is for you, you could go with a Roth IRA. But just like with a 401 conversion, youll pay taxes on the amount youre putting in. If you have the cash available to cover it, then the Roth IRA might be a good option because of the tax-free growth and retirement withdrawals.

Should I Contribute To A Roth 401 Or A Traditional 401

Though retirement may seem a long way off, you may need to decide now whether you should contribute to your employer’s traditional 401 or Roth 401 plan. It’ll take some information and some prophecy.

First, understand the differences between the plans. Next, take an honest look at your current financial state. Finally, peer into the future to predict what your assets will be when you’re ready to start withdrawing retirement funds.

With a traditional 401 retirement plan, you deposit nontaxed funds, and the earnings are also not taxed while you’re building your nest egg. You pay taxes only when you take out money from your account. At that point, both contributions and interest are hit. If your employer also contributes, taxes are also postponed on those amounts. In a Roth 401, any contributions you make have already been taxed, though additional income –such as interest — is not. When you start pulling money out, you can celebrate, because you pay no taxes on your savings.

To choose between a traditional or Roth 401, consider your present tax rate. If you’re currently in a high tax bracket, having a traditional 401 avoids having to pay significant taxes on your contributions right now. Then consider: What’s your economic forecast for retirement? If you think you’ll be in a lower tax bracket, you’ll end up with more total money, even after paying taxes on withdrawn funds.

Recommended Reading: How Does A 401k Work When You Change Jobs

Do I Make Too Much Money For A Roth Ira

So you have too much money to qualify for a Roth individual retirement account. If your adjusted gross income exceeds $ 131,000 or $ 193,000 , you cannot contribute to a Roth IRA directly. To get around this, you finance a traditional IRA, and then convert the money into a Roth.

How much income is too much for Roth IRA?

To contribute to the Roth IRA in 2022, single tax filers must have a modified adjusted gross income of $ 144,000 or less, up from $ 140,000 in 2021. If married and filing jointly, your combined MAGI must be under $ 214,000 . in 2021).

Does Roth IRA make sense for high income?

A Roth IRA can be a good option for those hoping in a higher tax bracket once the withdrawal begins. However, unlike traditional IRAs, there is a limit to contributing to Roth IRAs based on income. For married couples, the phase-out is $ 198,000- $ 208,000.

Do I make too much money to open a Roth IRA?

You can contribute to a traditional IRA no matter how much money you earn. But you dont have the right to open or contribute to a Roth IRA if you make too much money. There are still ways around the Roth IRA contribution limit.

The Biggest Factor Affecting This Decision: Taxes

If we all could just know what tax rates will be when we retire and start withdrawing from our retirement savings, along with what our own income will be at that point, this would be a simple choice if you knew your tax rate would be lower when withdrawing from your retirement account, youd choose pre-tax and avoid paying taxes on the money today so that you could pay at a lower rate in the future.

On the flip side, if you knew that tax rates would be higher when youre withdrawing and that youd be paying more in taxes, then youd choose Roth so that you can pay todays lower rates, then enjoy your savings without tax consequences in the future.

Don’t Miss: How Much Can You Contribute To 401k Per Year

Recent Graduate With New Job: Choose Roth 401 Or Traditional 401

I just graduated, and I’m starting a new job soon. My employer has pretty good policy for matching 401 contributions, so I want to invest as much as possible, especially during this first year.

My question is: should I invest in a traditional 401, a Roth 401, or some combination of the two? On the one hand, tax rates may be much higher when I retire, and I might be in a higher tax bracket, so a Roth 401 would be good. On the other hand, I might be in a lower tax bracket when I retire, so a traditional 401 might be better. It’s hard to know where I will stand in 30 years.

Is this the same trade-off as with a traditional / Roth IRA, or is there any other tax difference I should know about?

I would go for the Roth for the reasons already described by JoeTaxpayer and JohnFx. Furthermore, there are two additional things I’d like to point out:

First, income tax rates in the U.S. may, in general, rise in the future. If tax rates are expected to rise, then it makes sense to pay the tax now and not later, even if your own income level were otherwise unchanged. While guessing what tax rates might be in retirement does amount to speculation, I suggest there’s little chance of income tax rates remaining low in the U.S., with continuing large budget deficits each year.

Below is a supporting reference for that second point, from IRS Publication 4530 , a pamphlet called “Designated Roth Accounts under a 401 or 403 Plan”. Here’s the relevant excerpt:

- 2