Will Rocket Dollars Ability To Invest In Alternatives Come To The Corporate 401 Industry

We can help companies and small businesses with the

Five employees could open up SEP-IRAs at Rocket Dollar, for example, while the remaining fifteen open ones up at other custodians trading just stocks and bonds.

Self-Directed investing has been possible since ERISA Retirement plans were created in the 1970s. However, Rocket Dollar entering the corporate plan industry in todays world is very unlikely.

With the fiduciary standard, the CEO or HR helps out as the trustee of the plan and sometimes as the plan fiduciary. Even if you and some of the other employees are very knowledgeable about alternatives and some plan investments, fiduciaries and plan trustees have an obligation to take care of the investment health of the plan and the employees participating in it. As the IRS lays out, fiduciaries must

- acting solely in the interest of the participants and their beneficiaries

- acting for the exclusive purpose of providing benefits to workers participating in the plan and their beneficiaries, and defraying reasonable expenses of the plan

- carrying out duties with the care, skill, prudence, and diligence of a prudent person familiar with the matters

- following the plan documents and

- diversifying plan investments.

So, for example, letting customers roll their assets out to open an IRA, maybe at Rocket Dollar or the location of their choice, could still be in the best interests of the plan as it is in the interest of participants and their beneficiaries.

What’s The Difference Between A Rollover And An Asset Transfer

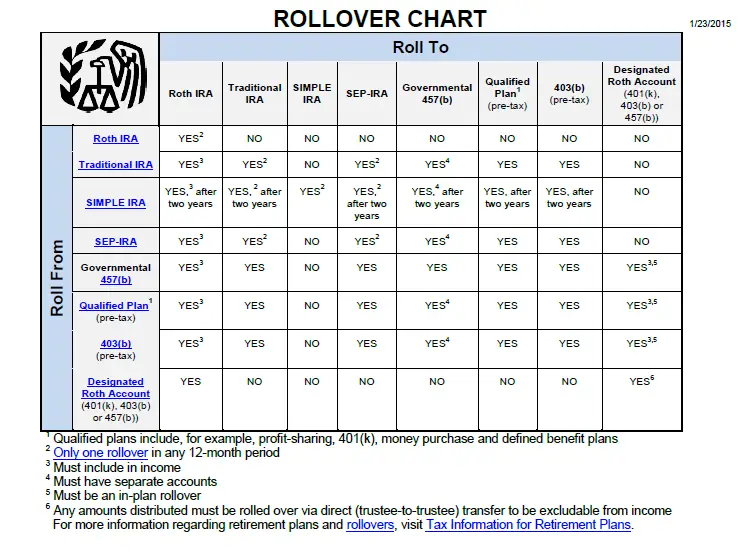

The main difference between a rollover and an asset transfer is where the money is held before it’s moved to Vanguard. If you’re moving money to Vanguard from:

- An employer-sponsored plan, such as a 401 or 403, you can initiate a rollovertypically, when you change jobs or retire. When you roll over retirement plan assets, you’re moving them from a group plan into an IRA .

- An IRA at another financial institution, you can initiate an asset transfer, tax-free. You can also transfer securities held in a brokerage IRA at another financial institution into a Vanguard Brokerage IRA.

Should I Rollover My 401 / 403 After A Job Change

Millennials are job switchers. Gallup polls have found that 21% of millennials report changing jobs within the past year.

Outside of learning the new company org chart, job switching presents another challenge: what to do with your old 401 or 403.

Currently, many millennials do nothing.

As a result, a 2017 study found that 59% of 25 34-year-olds had at least one old 401. For most individuals who are far away from retirement, this is almost certainly not the right option.

This article will lay out the disadvantages of doing nothing. It will also address some misconceptions about 401 rollovers, e.g., you should not roll over a 401 if its performing well.

Don’t Miss: How Do You Withdraw Money From A 401k

What If You Have An Existing 401 At Your Previous Employer

If you have a 401 at a previous employer, youll want to consider whether a rollover makes sense for you. You may want to consult with a tax professional to make sure that you are making a decision that is best for your unique circumstances.

As youre thinking about what to do with your old 401, here are some options to consider:

Invest Your Newly Deposited Funds

Youll have to choose investments in your new IRA so your money can grow. Make sure to maintain an appropriate asset allocation given your age, and consider your risk tolerance.

Finally, when your new IRA has been opened, be sure to read up on common IRA mistakes to avoid, such as forgetting required minimum distributions, not designating beneficiaries, and trading too often in the account.

Also Check: How Do I Find My 401k Plan

Contribution Limits For 403 And 401 Plans

The 403 and 401 plans have the same contribution limits for 2020 and 2021, which is $19,500 per year, meaning that is the maximum amount you can contribute annually. In 2022, this amount rises to $20,500. However, those aged 50 and older can contribute an additional $6,500 per year as a catch-up contribution in all three years.

Also, the total contribution limit to the plan for both the employee and employer must be the lesser of $58,000 in 2021 or 100% of the employee’s most recent yearly salary. In 2022, the amount rises to $61,000.

However, it’s important to note that a rollover from one plan to another is not a contribution but merely a transfer from one type of retirement plan to another.

Pros And Cons Of Rolling Your 403 Into A Traditional Ira

While the benefits of rolling an old 403 into a new account can vary depending on the situation, the biggest benefit youll likely receive is the gift of having more options than you had before.

Generally speaking, IRAs offer more investment options than 403 plans. The biggest advantage you get when you roll over a 403 into an IRA is the fact that IRAs offer greater flexibility when it comes to how you invest your money. Once your funds are rolled over, you can invest them into mutual funds, index funds, and even individual stocks.

If your 403 plan offered fairly limited investment options, having a traditional IRA will make you feel like you have unlimited options at your fingertips. And if you prefer a certain investment style such as investing mostly in index funds having a traditional IRA makes it much easier for you to stick to that plan for the long haul.

The biggest disadvantage that comes with rolling an old 403 into a traditional IRA is that an IRA may cost more money to maintain over time. Where you may not have paid transaction costs for your 403, you will find that running a traditional IRA can be costly.

Also Check: How Do I Withdraw Money From My 401k

Don’t Miss: Is There A Maximum You Can Contribute To A 401k

The 401 Plans And Rollover Rules

Jeff Rose, CFP® | November 30, 2021

Theres a type of retirement plan thats in the 401 family that gets little attention.

Maybe thats because only a relatively small number of employers offer it, even though the number of employees participating in the plan is probably in the millions.

Its called the 401 plan, and while its much like the 401 plan in most respects, it mostly covers government workers and school and college employees.

So lets take some time to delve into 401 plans and rollover rules that apply to them.

First Retirement Accounts Have Fees And These Fees Are Hard To Identify And Compare

If youre going to keep your money somewhere, you should know what it costs. However, its not always straightforward and simple to determine the cost.

Plans can charge a mixture of account fees, load fees, and investment fees .

You can find these fees in the plans ERISA 404a Participant notice. But figuring out how these fees impact your moneys growth is not easy.

Each time you move jobs, you will need to assess the old and new 401/403 plans fee disclosures wading through the jargon and different fee structures.

These fees might seem small and insignificant but a difference in just 0.5% in fees can have more than $100,000 impact on your retirement if youre saving even $10,000 a year.

In addition, as an ex-employee, you may be charged higher administrative fees than active employees.

Recommended Reading: How Much Tax On 401k Withdrawal

Advantages Of Using A 403

If you are offered a 403 plan by your employer, it is almost always a smart idea to begin making contributions. In fact, 403 plans offer several distinct advantages, some of which are similar to those offered through employer-based 401 plans. Here are some of the biggest benefits youll get from using a 403:

Contributions are made on a pre-tax basis, which can lower your taxable income. Just like contributions you may have made to an employer-sponsored 401 plan, the money you deposit into a 403 is pre-tax. As such, the contributions you make annually can lower your taxable income and help you save on your tax annual tax bill.

Your savings grow tax-free. After you make pre-tax contributions to a 403 plan, your money will continue to grow tax-free until you reach retirement and beyond. Youll only be required to pay income taxes on distributions when you take them.

Take contributions later in life when you might be in a lower tax bracket. Since you wont pay taxes on 403 funds until you are in retirement in most cases, you have the potential to pay lower taxes in the future as well. Since most people in retirement fall into a lower tax bracket, it is reasonable to assume they might pay lower taxes in the future.

The Secure Act And Annuities In 401 Plans

A possible alternative to rolling your 401 into an annuity is to see if your employer-sponsored retirement plan already includes an annuity option. The Setting Every Community Up for Retirement Enhancement Act eliminates many of the barriers that previously discouraged employers from offering annuities as part of their retirement plan options.

For example, ERISA fiduciaries are now protected from being held liable should an annuity carrier have financial problems that prevent it from meeting its obligations to its 401 participants. Additionally, annuity plans offered in a 401 are now portable. This means if the annuity plan is discontinued as an investment option, participants can transfer their annuity to another employer-sponsored retirement plan or IRA, thereby eliminating the need to liquidate the annuity and pay surrender charges and fees.

Recommended Reading: When Can I Rollover 401k To Ira

Profit Sharing Plan Rollover To 401

Profit sharing plans are often added to traditional 401 plans rather than used exclusively.

The difference is that employees can not contribute to a profit sharing plan, but by combining it with a 401, both employees and employers can contribute.

It is possible to roll over a profit sharing 401 into an individual retirement account, just as it can be done with a traditional 401.

When Leaving Your Job You Can Typically Cash Out Your 401 Or Roll It Over Into A Different Retirement Account Certain Options Can Make You Much Richer

Both a 401 and IRA are tax-advantaged retirement accounts, but they work differently. 401s are sponsored by employers and often offer limited investment options. IRAs aren’t linked to employment. They can be opened with any brokerage firm or other financial institutions and have a wider variety of investment selections, but require more hands-on management.

Because 401s are offered through employers, you’ll need to determine what to do with yours when you leave your job. Your options include:

- Leave it invested

- Rollover to a new 401

- Rollover to an IRA

There are plenty of pros and cons to these options, but let’s take a close look at when rolling your workplace 401 into an IRA may make sense for you.

You May Like: How Much Should I Withdraw From My 401k During Retirement

Should You Rollover A 401 Or 403

For most millennials, rolling over your 401 or 403 to a low-fee IRA is a smart financial decision. You can get both low fees and a lot of variety.

Reasons people do nothing can range from my current 401 is performing well to I want to look at the returns before I make a decision.

If you decide now to roll over your 401 every time you switch jobs, you wont have to make this decision each time you change employers.

While its never fun to spend time on the phone with financial services customer service, it takes less than an hour to set up an IRA and a similar time investment to rollover your old plan.

If you reduce your fees by 0.5%, you could have a $120,000 return on those two hours.2 Your future self will thank you.

Article written by, guest contributor, Eryn Schultz, the founder of Her Personal Finance. Starting with a desire to help her co-workers get their 401 match, Eryn began creating financial content using her education from Harvard Business School. She is the creator of a 10-week money bootcamp, and would love for you to join her money community.

1A 2.21% investment fee is based on a real retirement plan for a smaller employer. Larger employers may have considerably lower fees.

Direct And Indirect Rollovers

Direct rollovers, trustee to trustee, are not subject to tax withholding. A direct rollover is when the retirement plan administrator makes the payment directly to another retirement plan or an IRA. It’s important to note that the administrator may issue a check made payable to the new account, which must be deposited within 60 days. No taxes will be withheld from the transfer amount, but there could be a penalty if the money is not re-deposited into the new IRA within the 60-day period.

The safest way to process a direct rollover is to have the administrator process a trustee-to-trustee transfer, which electronically transfers the funds from the old plan to the new one. The IRA owner does not receive a check, and there are no taxes withheld nor any penalties.

Indirect rollovers are when the check is made out to and sent directly to the plan participant. An indirect rollover is subject to 20% withholding. For an indirect rollover to remain completely untaxed, the participant has to make up the withheld amount.

Also Check: How Can I Find All Of My 401k Accounts

Can You Rollover A 403b Into A Traditional Ira Absolutely

Jeff Rose, CFP® | August 20, 2021

With most people transitioning through several employers during their career, it is fairly common for them to leave a trail of employer-sponsored retirement accounts behind.

While its possible to let each of these accounts continue growing on their own, this is rarely the best option for your finances. In fact, you would almost always be much better off taking your old retirement accounts, including 403 plans, with you.

Fortunately, its not that difficult or time-consuming to roll your 403 into a new account you can monitor yourself. Once you have left an employer, you have several options for rolling over your 403 funds into another type of retirement account such as a traditional IRA or a Roth IRA.

What Is A 401

Most for-profit companies offer 401s, which help their employees build tax-advantaged retirement savings. Depending on whether you choose a traditional or Roth 401, plan contributions are withheld from your paycheck pre-tax or after-tax.

With a traditional 401, your plan contributions are deducted from your pay before income taxes, which decreases your taxable income today. You pay taxes on withdrawals from your 401 account when you are in retirement. If you choose a Roth 401, you pay income taxes on your plan contributions today, and you owe no income tax on withdrawals in retirement.

In either type of plan, your money grows tax free, and investment gains are not subject to capital gains taxes. If you need to withdraw funds before retirement agecurrently 59 ½you generally owe a 10% penalty, plus income taxes on any money that hasnt been taxed yet.

To help your money grow, 401s let you invest primarily in mutual funds. You can choose a mix of stock and bond funds, depending on how aggressively youd like to invest. You may also select a target date fund, which invests you in a range of other funds that adjusts from aggressive to conservative until you enter retirement.

Don’t Miss: Can You Move A 401k Into A Roth Ira

How To Rollover Assets Out Of A U

Contact TIAA or Fidelity Investments. Certain rollovers may be done via telephone on a recorded line or online at the vendor website.

If you are using a rollover form return it to TIAA or Fidelity. The form will ask which U-M plan you want to rollover assets from. Refer to the Plan Names and Numbers for the plan types and their record keeping number with TIAA and Fidelity.

Yes You Can Move Your Ira Or 401k To An Annuity Tax

Q. Is it possible to roll over my retirement savings, such as my 401k, IRA, or 403 accounts into an annuity without paying taxes?

A. You can roll over your IRA, 401, 403, or lump sum pension payment into an annuity tax-free. Annuities funded with an IRA or 401 rollover are “qualified” plans, enabling an insurance company to create an “IRA annuity”, into which you can deposit your retirement funds directly.

Additionally, you can have your employer roll over your 401 funds into an annuity without withholding any taxes since no mandatory withholding requirements pertain to funds directly transferred into an annuity by an employer.

Q. If I decide to roll over my IRA, 401, or lump sum pension payment into an annuity, will I be hit with a distribution tax?

A. NO. The reason you’re permitted to roll over these payments into an annuity tax-free is because when you buy an annuity with IRA or 401k money the first thing the insurance company does is create an IRA holding account to receive your transferred funds.

So really buying an annuity with IRA money is the same as moving your money from its current IRA or 401k trustee to another IRA trustee. This kind of transaction is considered a “direct transfer” or a “direct rollover” which is tax-free. You will owe taxes on the monthly income you receive but not on the transfer.

Q. How can I find and purchase an IRA annuity?

Q. Can I “lock in” an IRA annuity rate before the insurance company receives my distribution?

You May Like: Do I Need Life Insurance If I Have A 401k