When To Pay The Taxes

The IRS taxes these withdrawals in the year you take them. The April 1 extension only applies to the year after which you reach age 72. You must take an RMD by April 1 of the next year after you celebrate your 72nd birthday. It helps to take the money before December 31 of the year you turn 72. You’ll more or less have to take two RMDs that year if you wait until April 1 of the year following your 72nd birthday. That could bump up your taxable income a great deal, so you’d pay more taxes in a given year. Many retirees take their first RMDs by December 31 of the year in which they reach age 72 for this reason.

How Much Are You Required To Withdrawal From Your Retirement Account

Once you reach age 72, the IRS requires you to withdraw a minimum amount of money each year from your retirement account. This amount, also known as your Required Minimum Distribution , is determined by your age and account balance so it changes each year.

Do you have multiple IRAs? Even though you must calculate each account individually, you can take your total RMD amount from one account or many.

Did you inherit a retirement account? If you are a beneficiary of a retirement account, use our Inherited IRA RMD Calculator to estimate your minimum withdrawal.

The analysis provided by this tool is based solely on the information provided by you. All examples, if any, are hypothetical and for illustrative purposes and do not represent current or future performance of any specific investment. No guarantees are made as to the accuracy of any illustration or calculation. This information does not serve, either directly or indirectly, as legal, financial or tax advice and you should always consult a qualified legal, financial and/or tax professional when making decisions relative to your individual tax situation. All investments carry a degree of risk, and past performance is not a guarantee of future results. Generally speaking, the greater the return, the greater the risk.

Required Minimum Distributionscommon Questions About Ira Accounts

Every year, around tax time, FINRA receives questions from investors about required minimum distributions, or RMDs. In a nutshell, an RMD is the amount you must take out of your traditional retirement savings plan to avoid tax penalties, once you’ve reached the mandatory age for making withdrawals.

This article provides basic information about RMDs and answers to a number of common RMD questions. We focus on RMDs from traditional IRAs because these are the type of retirement accounts where individuals are directly responsible for computing required minimum distributions.

Read Also: What Percentage Should I Be Contributing To My 401k

How Fidelity Can Help You Plan

If you are taking RMDs, we can help you:

- Use our Planning & Guidance Center to get a holistic view of your retirement income plan and see how long your money may last.

- Adjust your portfolio as your life changes. Schedule an appointment with one of our experienced advisors to create a customized path forward.

What You Do With Your Rmd Is Your Choice

The RMD for a year is determined by dividing the previous year-end’s fair market value by the applicable distribution period . The year-end value may need to be adjusted for certain events.

Your RMD changes each year, based on your balance and age. If you dont take the correct RMD amount, IRS penalties may apply. If you’re a T. Rowe Price client with an RMD eligible account, log in to manage your RMD.

If you have more than one IRA, you must calculate the appropriate RMD for each individually. However, you can take your total distribution from any one or more of the IRAs. Similar rules apply to 403 accounts. However, RMDs from other types of retirement plans, such as 401 plans, must be taken separately from each of those plan accounts.

You will have to contact your current and/or prior employer to calculate the RMD and request a distribution. If your workplace account is with T. Rowe Price, you can log in now to learn more about your RMD.

You May Like: How Do I Stop My 401k

Required Minimum Distribution Planner

When you reach the age of 72, you must begin annual withdrawals from most retirement accounts in accordance with IRS regulations. These withdrawals are known as required minimum distributions, or RMDs.

Except for your first year taking RMDs, each RMD must be taken by December 31 to avoid a hefty penalty.

Need to take an RMD but dont need the funds for retirement? Learn how your RMD can be a great way to contribute to a 529.

Use this RMD calculator to determine your projected required minimum distributions for multiple years based on a hypothetical rate of return.

What Is An Rmd

If you have a Traditional, Rollover, SEP, SAR-SEP, or SIMPLE IRA, the IRS requires you to withdraw a RMD from the account each year, beginning the calendar year in which you turn 72 or 70 ½ . You must withdraw this amount by April 1 of the following year, even if youre still working. Youre then required to take another withdrawal from your IRA by December 31 of that year and every year thereafter. If you own a Roth IRA, RMDs dont apply during your lifetime.

You May Like: How To Rollover 401k To Charles Schwab

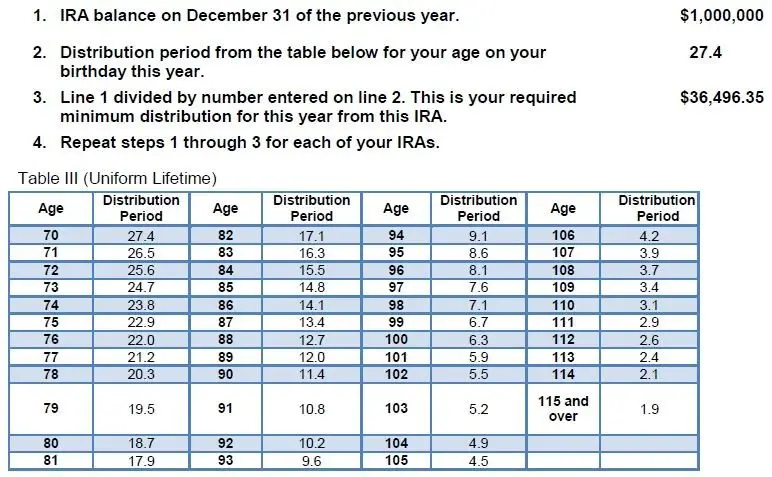

How Do I Calculate My Required Minimum Distribution

Take your prior years December 31 IRA account balance, look up your age on the appropriate table, and divide your account balance by the remaining distribution period based on your age. Let’s say Bob had $100,000 in his IRA on December 31 of the prior year. Bob decides to take his first distribution in the year in which he turns 72. His remaining distribution period is 25.6.

$100,000 / 25.6 = $3,906.25

The amount Bob must withdraw for the calendar year in which he turns 72 is $3,906.25.

It would work out like this over the first 20 years, from age 70 through age 90:

| First 20 Years of the Required Minimum Distribution Table |

|---|

| Age |

| 11.4 |

Company Sponsored Retirement Plans

The requirement to take an RMD depends on whether the individual in question is an owner of the company and whether he or she is still actively employed.

- Ownership: Any individual who owns more than 5% of the company that sponsors the plan as of the date he or she turns age 72 must begin taking RMDs regardless of their ongoing employment status.

- Employment Status: For non-owners as well as those who own 5% or less of the company, the RMD requirement kicks in as of the later of the date the participant reaches age 72 or the date he or she terminates employment. That means a non-owner who is 72 does not have to start taking RMDs as long as he or she remains actively employed by the plan sponsor.

It should also be noted that if a participant who is age 72 passes away, his or her beneficiary may be required to take RMDs even though that person might be under age 72.

Note: For active participants who reached age 70 1/2 on or before December 31, 2019, the RMD requirement kicks in on April 1st of the year following the later of the year the participant reached age 70.5 or the year he or she terminates employment.

Recommended Reading: What Percent Should You Put In 401k

Recommended Reading: Can You Pull From 401k To Buy A House

When Should You Take Rmds

There is no requirement to take an RMD as a single lump sum. If you prefer, you can take RMDs in monthly or quarterly installments or any way that suits your budget needs. Theres no tax advantage from taking out the money in staggered, smaller portions instead of a single lump sumyoull pay the same amount in taxes either way.

Taking payments earlier in the year could cost you in other ways, though. The earlier you withdraw from your accounts, the less time your money has to grow. Waiting until the end of the year to take your RMD could give you more exposure to market gains. Then again, market losses later in the year might wipe out some previous gains.

Another approach is equal quarterly or monthly withdrawals, which balance the opportunity cost of more time for growth against the chances of market losses at different points in the year. Think of it like dollar cost averaging in reverse. If youre unsure about the best RMD strategy for your needs, talk with a tax advisor or financial advisor.

Rmd Rules For Inherited Plans

If a retirement account holder passes away without having taken the necessary RMD for the year, it is up to the inheritor to take an RMD to avoid the tax penalty. After thats taken care of, you have slightly more flexibility on the timing of future withdrawals, assuming you withdraw all assets by December 31 of the 10th year following the original IRA holders death.

These withdrawals will be taxed as ordinary income unless they come from Roth accounts. In that case, they will not be taxed at all as long as the account holder first funded a Roth account at least five years before they died.

Read Also: Can I Get My Own 401k Plan

What Types Of Retirement Plans Require Minimum Distributions

The RMD rules apply to all employer sponsored retirement plans, including

profit-sharing plans, 401 plans, 403 plans, and 457 plans. The RMD rules also apply to traditional IRAs and IRA-based plans such as SEPs, SARSEPs, and SIMPLE IRAs.

The RMD rules also apply to Roth 401 accounts. However, the RMD rules do not apply to Roth IRAs while the owner is alive.

Why Do Rmds Exist

You may find yourself wondering why there is a required minimum distribution for your IRA. After all, its your money, so why cant you take it out of your account at your own pace? The answer to this question is the same as the answer to many questions when it comes to financial matters: taxes.

You dont pay taxes on the money in your IRA when you put it in. Instead, you pay taxes when you withdraw the funds in retirement. The money will be taxed according to your current tax bracket. This is beneficial if you are in a lower tax bracket in retirement than you were when you first earned the money and were probably earning a much higher total income.

If you were to leave all of your money in your IRA, it would eventually become eligible to be passed on as inheritance and perhaps end up un-taxed. The required minimum distribution forces you to take out some money while it can still be taxed.

Don’t Miss: How Much Does A 401k Cost A Small Business

Rmd Rules For Other Iras

Roth IRAs: There are no RMDs if you are the Roth account’s original owner. But if you own other IRAs as well, you will need to withdraw your RMDs on them. Withdrawals from your Roth would not fulfill the RMD rules.

Inherited IRA RMD: If you inherit an IRA , you are subject to RMD rules and may be required to begin taking RMDs by a specific date.

The RMD rules are summarized as follows:

-

If the original IRA owner dies in a year they were supposed to begin RMD withdrawals: The beneficiary must take an RMD in that year.

-

If the original IRA owner dies after December 31, 2019: The beneficiary must withdraw all of the money from the account by December 31 of the death’s 10th anniversary.

-

A beneficiary can be exempt from the 10-year rule if they are not more than ten years younger than the original IRA owner, or they’re a spouse, minor child, disabled individual, or chronically ill.

-

If the original IRA owner dies before they began taking RMDs, and before January 1, 2020: The beneficiary can choose between:

- A lifetime distribution of the IRA funds based on their life expectancy factor by December 31 of the year after the original IRA owner’s death, or

- A 5-year distribution completed on December 31, the 5th anniversary of the owner’s death.

Non-individual beneficiaries, such as an estate, trust, or charity, must follow the 5-year rule.

Rmds And Inherited Iras

If youve inherited an IRA, the RMD rules you must follow depend on your relationship to the original deceased owner. There are three general types of inheritors: a spouse, a non-spouse and an entity such as a trust or non-profit organization. Its important to know the RMD rules behind these accounts in order to avoid the top mistakes people make when inheriting retirement accounts.

Lets start with the rules for a spousal inheritor, who has rights not granted to all other types of beneficiaries.

Recommended Reading: Where To Move 401k Money

The Irs Updated The Uniform Lifetime Table Which Is Used To Determine Your Mandatory Withdrawals This Year This Tool Can Calculate Your Rmds From A Traditional Ira

This calculator makes it easy to determine your required minimum distributions from a traditional IRA. The SECURE Act of 2019 raised the age for taking RMDs. If you were born before July 1, 1949, then you should have started taking a distribution when you hit 70 ½. However, if you were born on or after July 1, 1949, then you are required to start making withdrawals beginning at age 72.

To use the calculator, all you need is what your age will be at the end of 2022 and the total balance of your traditional IRA accounts as of December 31, 2021. Do not include balances from Roth IRAs. Those accounts do not have required minimum distributions.

Please note that the IRS updated the uniform lifetime table, which is used to calculate RMDs, at the beginning of 2022. The change is meant to account for longer life expectancies, and as a result, RMDs should be slightly smaller each year.

If you’re married and your spouse is more than 10 years younger than you are and is named as the sole beneficiary on at least one of your IRAs the RMD will be less than what this calculator shows. Consult a financial planner for more details.

Taking two RMDs in one year can have important tax implications. This could push you into a higher tax bracket, meaning a larger portion of your Social Security income could be subject to taxes, or you could also end up paying more for Medicare Part B or Part D.

Whats The Required Age To Start Taking Rmd

Prior to the Setting Every Community Up for Retirement Enhancement Act, the starting age for RMDs was 70 1/2 years old. But after the SECURE Act was signed into law on December 20, 2019, the age requirement was raised. If youre born on or after July 1, 1949 and your 70th birthday fell on or after July 1, 2019, you are not obligated to take RMDs until you reach the age of 72. However, if you were born before July 1, 1949, the required age will still be 70 1/2. You must withdraw your RMD by December 31 each year after your required beginning date.

What happens if you dont withdraw your RMD? If you fail to take your RMD, or dont take the required amount, youll face penalty charges. You must pay 50% of the RMD that was not withdrawn.

Since RMD is only the floor amount, you are allowed to take more. Note that your RMD distributions are considered taxable income during the year you withdraw them. This is the time the IRS starts collecting taxes you were able to defer from your retirement account. And once you fall under a lower tax bracket by the time you retire, it means youll pay lower taxes.

RMD rules come with certain exceptions:

RMD was Waived in 2020

Read Also: Is There A Limit For 401k Contributions

What Life Expectancy Table Is Used To Calculate The Solo 401k Rmd

If the participant dies before his or her required beginning date, and if the beneficiary elects to receive distributions over his or her life, the beneficiarys life expectancy is determined using the Single-Life Table. Each year thereafter, the life expectancy is reduced by one. If more than one beneficiary shares in each RMD, the life expectancy of the oldest beneficiary is used. If the participant dies on/after his or her required beginning date, the beneficiary must continue to receive annual RMDs. The life expectancy of the participant is compared to the life expectancy of the beneficiary, and the longer life expectancy is used. Each year thereafter, the life expectancy is reduced by one.

Required Minimum Distributions: How To Calculate Rules

Once you turn 72, the IRS expects you to take Required Minimum Distributions from your retirement accounts each year.

But how do you calculate your RMDs? And when is the deadline to withdraw the funds?

In this article, Ill explain how RMDs work, the deadlines you need to meet to avoid stiff tax penalties and what happens if you inherit a retirement account.

Read Also: Does Fidelity Offer A Solo 401k

How To Take Rmds From Multiple Accounts

You must figure out the RMD for each account if you own more than one IRA. You can then combine these amounts.

You can take combined RMDs from one or more accounts. You can take $5,000 from Account A and $5,000 from Account B if you have to take a total of $10,000 in RMDs across your IRAs, but RMDs must be calculated on, and taken individually from, any 401 or 457 plans that you have.