Next Steps To Consider

Keep in mind that investing involves risk. The value of your investment will fluctuate over time, and you may gain or lose money.

The change in the RMD age requirement from 70½ to 72 only applies to individuals who turn 70½ on or after January 1, 2020. Please speak with your tax advisor regarding the impact of this change on future RMDs.

Fidelity does not provide legal or tax advice. The information herein is general and educational in nature and should not be considered legal or tax advice. Tax laws and regulations are complex and subject to change, which can materially impact investment results. Fidelity cannot guarantee that the information herein is accurate, complete, or timely. Fidelity makes no warranties with regard to such information or results obtained by its use, and disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information. Consult an attorney or tax professional regarding your specific situation.

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Excess Contribution Not Withdrawn By April 15

So what happens if you dont notice that youve over-contributed to one or more 401k plans until after April 15? In this situation, the excess contribution is taxed twice, once in the year when contributed and again when distributed .

Also, the earnings from the excess contribution will be taxable income for the following year. If the mistake is not corrected, then the IRS may disqualify the entire 401k plan retroactive to the beginning of year 1. This results in the employees entire 401k account balance to become income to the employee which would have massive adverse tax consequences.

But the main reason why you want to be more conservative in your self-employed 401k contribution is not the fine. Th main reason is the stress of getting an IRS audit letter in the mail. It will also take time to amend your tax returns. This process can take hours.

Id much rather miss out on contributing an extra $1,000 in my self-employd 401k than go through the torture of dealing with the IRS.

Remember, when in doubt, round down your self-employed 401k contribution amount.

Recommended Reading: How To Make A 401k

A Deeper Look At The Limitations And Requirements

To qualify for a SEP IRA, you must meet the following:

- Be at least 21 years old,

- Have worked at the business for three of the past five years, and

- Have earned at least $600 from the job in the past year.

Your SEP IRA contribution each year cannot exceed the lesser of 25% of your compensation or $58,000 for 2021. The maximum amount of self-employment compensation that applies for 2021 is $285,000. For self-employed individuals, the amount of compensation used for these purposes is your net earnings from self-employment less the deductible portion of self-employment tax, and the amount of your own retirement plan contribution deducted on form 1040.

For a Solo 401k plan, the 2021 limit is $19,500, plus a $6,500 catch-up contribution for those individuals over age 50. That contribution amount is up to 100% of your compensation. The employer profit-sharing contribution does not count toward this limit. However, the total contribution limit of both the employer and employee in 2021 is $58,000. If you are age 50 or older, the limit is $64,500.

You May Like: How Much Can I Contribute To 401k And Roth Ira

Limits For Highly Paid Employees

If you earn a very high salary, you may be considered a highly compensated employee , subject to more stringent contribution limits. To prevent wealthier employees from benefiting unfairly from the tax benefits of 401 plans, the IRS uses the actual deferral percentage test to ensure that employees of all compensation levels participate proportionately in their companies’ plans.

If non-highly compensated employees do not participate in the company plan, the amount that HCEs can contribute may be restricted.

Contribute To Solo 401k And Day

Your wifes ability to contribute to a solo 401 depends on the self employment income that she receives from the partnership. Specifically, in order to determine how much she could contribute to the solo 401 she would take the amount reported on line 14 of her K-1 and reduce it by one half of the self-employment tax. Of that number, she could contribute for 2021: up to $26,000 as an employee contribution plan sponsored by her daytime employer) and a profit-sharing contribution to the solo 401 equal to 20% of that same number provided that her overall contribution to the solo 401 cannot exceed $64,500 for 2021. For 2022, the overall limit is $67,500.

Read Also: How Much Can I Loan From My 401k

What Are The Potential Tax Benefits Of A Solo 401

One of the potential benefits of a Solo 401 is the flexibility to choose when you want to deal with your tax obligation. In a Solo 401 plan all contributions you make as the “employer” will be tax-deductible to your business with any earnings growing tax-deferred until withdrawn. But for contributions you make as an “employee” you have more flexibility. Typically, your employee “deferral” contributions reduce your personal taxable income for the year and can grow tax-deferred, with distributions in retirement taxed as ordinary income. Or you can make some or all of your employee deferral contributions as a Roth Solo 401 plan contribution. These Roth Solo 401 employee contributions do not reduce your current taxable income, but your distributions in retirement are usually tax-free. Generally speaking, there are tax penalties for withdrawals from a Solo 401 before 59 1/2 so be sure to know the specifics of your plan.

Third Party Solo 401k Providers

If you need something a little more robust that the free prototype plans these five brokerage firms offer, then you need to find a third party service that will create the plan documentation for you.

Some of the common reasons why youd consider using a third-party service to create your solo 401k documentation:

- You want a choice in brokerage

- You want to invest in alternative assets such as real estate, startups, cryptocurrency, promissory notes, tax liens, precious metals, and more.

- You want checkbook control over your 401k

- None of the prototype providers matches exactly what youre looking for with options

Were not going to go in-depth on these providers because this section effectively becomes al-la-carte with what you can get and pay for. I just wanted to list some of the most popular third party plan providers that you can reference in your search for the best plan.

Remember, just because you go with a third party provider also doesnt mean you cant invest at your favorite firm. For example, you can create a third party solo 401k and then have that 401k held at Fidelity. This gives you access to all of Fidelitys investment choices, but your options are created by the plan, and NOT Fidelity.

Also, you can use these plans to execute a Mega Backdoor Roth IRA. In fact, several of these companies specifically advertise that they offer it.

This isnt an exhaustive list. There are also local firms in most areas that can create 401k plan documentation as well.

Also Check: Can I Rollover My 401k To An Existing Ira

Solo 401 Contribution Deadlines: Rules Steps And Strategies

As 2021 has come to an end, it is critical that Solo 401 owners understand when and how to make their 2021 contributions. There are three important deadlines you must know if you have a Solo 401 or if you plan to set one up still for 2021. A Solo 401 is a retirement plan for small business owners or self-employed persons who have no other full-time employees other than partners or a spouse. It can be fully self-directed into real estate, LLCs, private funds, cryptocurrency, or other alternative investments, and allows the owner/participants to contribute up to $58,000 per year . For 2021 contributions, the employee maximum is $19,500, and the employers maximum is $38,500 for a total of $58,000., The limits for 2022 increase to $61,000.

Potential Benefit Of The Roth Individual : Higher Contribution Limits

In 2020 you can annually contribute up to $19,500 and up to $26,000 if youre 50 or over through salary deferral. Plus, you can contribute a profit-sharing portion of your salary. In 2020 the limit from both sources is $57,000 .

In 2021 you can annually contribute up to $19,500 and up to $26,000 if youre 50 or over through salary deferral. Plus, you can contribute a profit-sharing portion of your salary. In 2021 the limit from both sources is $58,000 .

Don’t Miss: Can I Borrow Against My 401k

How Much Can I Contribute To My Self

Updated: by Financial Samurai

A self-employed 401k plan is a great way to save for retirement if you are an entrepreneur or solopreneur. A self-employed 401k plan is also know as a Solo 401k plan. This article will discuss how much you can contribute to your self-employed 401k plan.

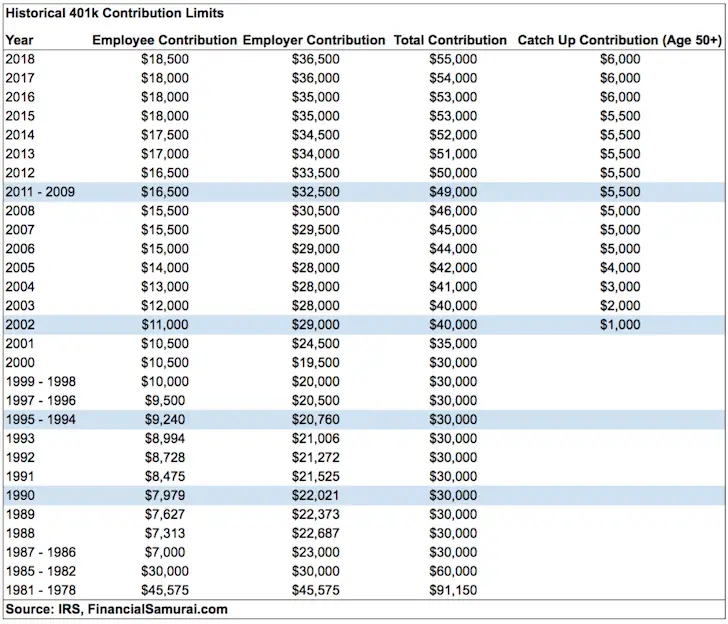

For 2021, the IRS says you can contribute up to $57,000 in your self-employed 401k plan. The amount should go up by $500 $1,000 every one or two years.

If youre at least age 50, then you can make an additional $6,000 catch-up contribution, which increases your limit to $62,000.

The $58,000 self-employed 401k plan limit consists of $19,500 from the employe and $38,500 from the employer. Therefore, to contribute the maximum to your self-employed 401k plan, you must pay yourself enough and have high enough operating profits.

In general, you can contribute up to the maximum employee amount to your Solo 401k plan + 20% of operating profits.

Here is the 401k maximum contribution limit chart for employee and employer for 2021.

What Happens If You Exceed The 401 Contribution Limit

If you go over the maximum 401 contribution for a given tax year, this is called an “excess contribution.” Excess contributions are subject to double-taxation if you do not disburse them by April 15 of the year following the tax year in question. If you discover you made an excess contribution, reach out to your plan administrator immediately to correct the issue.

Read Also: Should I Open A 401k

The Rules You Need To Knowplus A Pitfall You’ll Want To Avoid

Eric is currently a duly licensed Independent Insurance Broker licensed in Life, Health, Property, and Casualty insurance. He has worked more than 13 years in both public and private accounting jobs and more than four years licensed as an insurance producer. His background in tax accounting has served as a solid base supporting his current book of business.

You can still contribute to a Roth IRA and/or traditional IRA even if you participate in a 401 plan at workas long as you meet the IRA’s eligibility requirements. You might not be able to take a tax deduction for your traditional IRA contributions if you also have a 401, but that will not affect the amount you are allowed to contribute. which is up to $6,000, or $7,000 with a catch-up contribution for those 50 and over, for 2021 and 2022.

It usually makes sense to contribute enough to your 401 account to get the maximum matching contribution from your employer. But adding an IRA to your retirement mix after that can provide you with more investment options and possibly lower fees than your 401 charges. A Roth IRA will also give you a source of tax-free income in retirement. Here are the rules you’ll need to know.

Fill Out A Solo 401 Application

Before you can start a 401 account for yourself, youll need to give your brokerage some information about your business. A typical solo 401 application may ask for your:

First and last name

Plan administrators name and contact information

Social Security number

Citizenship status

Income information

Youll also need to disclose any professional associations or affiliations that might result in a conflict of interest with the brokerage. In completing the application, youll be asked to name one or more beneficiaries. You may also be asked to provide bank account information that will be used to make your initial contribution to the plan.

Read Also: How To Move Money From One 401k To Another

Who Can Open A Solo 401

As mentioned, Solo 401s provide self-employed individuals a place to save for their retirement. The term individual is vital because Solo 401s are limited to small business owners with zero employees.

Freelancers and the self-employed tend not to have any employees however, small businesses with even one other employee on the books are not eligible.

There is one caveat to this rule. If your spouse is the only other person employed by your small business, both of you can contribute and receive matching contributions from the business-but more on that in a bit.

Solo 401k Contribution Calculation For A Sole Proprietorship Partnership Or An Llc Taxed As A Sole Proprietorship

Salary Deferral ContributionAlthough the term salary deferral is used, these businesses do not provide a W-2 salary to the business owner. For businesses of this type, the salary deferral contribution is based on net adjusted business profit. Net adjusted business profit is calculated by taking gross self employment income and then subtracting business expenses and then subtracting 1/2 of the self employment tax. In 2020, 100% of net adjusted business profits income up to the maximum of $19,500 or $26,000 if age 50 or older can be contributed in salary deferrals into a Solo 401k .

Profit Sharing ContributionA profit sharing contribution can be made up to 20% of net adjusted businesses profits. Net adjusted business profit is calculated by taking gross self employment income and then subtracting business expenses and then subtracting 1/2 of the self employment tax. You will want to ask your tax professional for assistance with this calculation.

Don’t Miss: Can You Use 401k To Buy Investment Property

Where Did This Answer Come From

With a solo 401, you are allowed to make contributions in the role of employee and the role of employer. Specifically, you are allowed to make:

In this case, your net earnings from self-employment is defined as your businesss profit , minus the deduction for one half of your self-employment tax .

However, there are an assortment of limitations to the above contributions.

Important notes:

- Various amounts in this explanation may be off slightly due to rounding of cents.

- Solo 401 plans are complicated, so its likely a good idea to consult with your tax professional.

Welcome

to read more, or enter your email address in the blue form to the left to receive free updates.

My Latest Book

How Does A Solo 401 Work

As a reminder, a Solo 401 plan is nothing more than an individual retirement plan for the self-employed or small business with no employees. Also, remember that a Solo 401 is nothing more than a ship you save for retirement. You still have to choose the investments to use within your account to build wealth.

The biggest benefit of this account is the fact that people using it can contribute significantly more than with a traditional 401 plan, which in turn helps those people save more for retirement and reduce their taxable income.

As an employer, one of the key features of a Solo 401 is that you must use your actual income to determine your maximum employer contribution, which can be up to 25% of your compensation. According to the IRS, your compensation is earned income, defined as net self-employment income after deducting half your self-employment tax and contributions for yourself. However, this again depends on the business structure of your company.

Solo 401 participants can open their account with any brokerage firm they choose, although online brokers have become extremely popular due to the fact that you can start at home and on your own time and often have access to a range of helpful investment tools and Resources. Online brokerage firms also tend to come with low costs overall, which is another reason investors seek them out.

Also Check: How Can I Use 401k To Buy A House

How To Avoid The Mistake:

- Work with your plan administrator to ensure that the administrator has sufficient payroll information to verify that the deferral limitations of IRC Section 402 were satisfied.

- Establish procedures to ensure that, based on the participant election forms , participants won’t exceed the IRC Section 402 limit.

- Have checks and balances in place to alert you and your plan administrator when the limit is exceeded to take timely corrective action.

The Results Can Be Pretty Incredible

Of course, many self-employed people don’t have the ability to contribute the maximum amount allowed to a solo 401. However, even modest contributions add up over time.

For example, let’s say that you’re self-employed and that you’ll have $80,000 in net self-employment income for 2021. You decide to set aside a total of 10% of your net self-employment income in a solo 401. Not only could this reduce your taxable income by $8,000 for the year, but if you repeat the process every year, you could end up with a retirement nest egg of more than $928,000 after 30 years — and that assumes just 2% annual income increases and a historically conservative 7% annual rate of return.

Imagine if you decided to invest even more. With a solo 401, you can dramatically reduce your taxable income while building up a million-dollar nest egg.

Read Also: Can I Transfer Money From 401k To Ira