What States Do Not Tax Tsp Withdrawals

While most states tax TSP distributions, these 12 do not: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, Wyoming, Illinois, Mississippi and Pennsylvania.

What state does not impose your 401k? Some of the states that do not impose 401 include Alaska, Illinois, Nevada, New Hampshire, South Dakota, Pennsylvania and Tennessee. You can save a lot of money if you live in these states, since your retirement income will be tax-free.

What Should You Do With Your Tsp After Military Service

The first thing you will need to do is determine if your assets are eligible for distribution. The TSP has certain criteria, so contact customer service through the ThriftLine if in doubt.

Once you determine your funds are eligible for distribution, you need to decide what to do with those funds. We previously discussed options for the TSP when you leave the service in this article: what should you do with your TSP when you leave the military?

This article covers the main options, such as leaving your funds within your TSP account, rolling it into an IRA, roll your assets into a 401k plan at your new employer, withdraw your funds , and roll your funds into a qualified annuity.

Leaving The Military: Cash Out Your Tsp Or Keep It

You have been faithfully contributing to the Thrift Savings Plan since you joined the military. Now, you are counting the days until you get out and have a big chunk of money sitting in your TSP account. What should you do with it?

When you get out of the military and transition to civilian life, you will almost certainly be hit with a ton of unexpected expenses, ranging from the cost of new clothes to medical insurance. It’s really tempting to cash out your TSP account to pay for them. But that is almost always the worst thing you can do.

Most experts agree that taking money out of your TSP retirement account before you turn 59½, the normal minimum distribution age, isn’t smart.

Also Check: How Much To Withdraw From 401k

Can I Transfer My Tsp To A Roth Ira

If you belong to the TSP, you may choose to transfer or rollover some or all of your TSP balance to a Roth IRA. The rules governing this type of transaction depend on the type of TSP account that is the source of the transfer, and the method by which the money is moved.

How do I transfer my TSP to another employer?

With a direct rollover, you order the TSP to send your TSP assets directly to your new employers plan or to an IRA and you never have to handle the money. With an indirect rollover, you start by requesting a lump sum distribution from TSP and then take responsibility for completing the transfer.

What happens to my TSP if I leave federal service?

When you separate, you can leave your total account balance in the TSP if it is $ 200 or more. Your account will continue to accrue earnings and you can continue to change the way your money is invested in the five TSP investment funds by making interfund transfers. You can make an interfund transfer at any time.

Can TSP be transferred?

To make a withdrawal or transfer from your TSP account, you must apply in writing by completing a Form TSP 70 or a Form TSP 77 , and your signature must be notarized.

What Is The Earliest A Federal Employee Can Retire

Generally, an employee is eligible for retirement or an employee with at least 30 years of service and 55 years under the Civil Service Retirement System or 56 months in 2022 under Federal Employees Retirement

What is the best month for a federal employee to retire?

The best time of year for employees closed by FERS to leave a job closer or better at the end of the year of resignation. Generally, this time in late December to early January anytime between December 31 and January 13, incl.

What is the earliest I can retire under FERS?

MRAs range in age from 55 to 57 years, depending on your age. The same goes for retirement under VERA, but only if you reach your MRA. The SRS will remain 62 years old, once you qualify for Social Security benefits.

Don’t Miss: How Does 401k Work When You Quit

What Age Can I Withdraw My Tsp Without Penalty

In fact, if you retire before the age of 55 then you will have to wait until the age of 59 to avoid a 10% penalty . Note: Your traditional TSP removal code will remain taxable even if you avoid a 10 percent penalty.

Can you take money out of TSP without penalty?

You have the option to add or discard this restriction. The tax deduction for your deduction is below the corporate tax rate at your normal rate. Also, you can pay state tax. An additional IRS first waiver of the 10% penalty may apply if you are under the age of 59.

How do I avoid paying taxes on my TSP withdrawal?

If you want to avoid paying tax on the money in your TSP account for as long as you can, do not take any deductions until the IRS requires you to do so. By law, you must take minimum distribution requirements starting at the age of seventy-two.

Should I Have A Roth And Traditional Tsp

For most people, Roth TSP is the better choice because you are currently in a lower tax bracket than you will be in the future. In the traditional TSP, the money you contribute is before tax. This means that you do not pay tax at the time you deposit the money, instead you pay tax when you withdraw the money.

Can you put money in both a traditional and Roth IRA?

You can contribute to a traditional IRA and a Roth IRA in the same year. If you qualify for both types, make sure the total contribution amount does not exceed the annual limit. You can also contribute to a traditional IRA and a 401 same year. Contribution limits for each account type apply.

Is having 2 ROTH IRAs worth it?

One of the most common ways to save for retirement is with a Roth IRA. Having multiple Roth IRA accounts is perfectly legal, but the total contribution you make to both accounts can still not exceed the federally set annual contribution limits.

Can you contribute 5500 to both Roth and traditional IRA?

You may be able to contribute to both a Roth and a traditional IRA, up to the limits set by the IRS, which is $ 6,000 in total between all IRA accounts in 2020 and 2021. These two types of IRAs also have qualification requirements that you must meet.

Recommended Reading: Can I Rollover Old 401k To New 401k

Can You Convert A Traditional Tsp To A Roth Tsp

If you have watched my content for some time then I am sure that you know how helpful a Roth TSP or Roth IRA account can be in retirement.

After all, these accounts can help save a tremendous amount in taxes over the course of your career and retirement.

But what is the best way to get money into these accounts?

For some, it may seem like the simplest way to get money into the Roth TSP would be to simply move some of their existing traditional TSP balance over to the Roth side.

Unfortunately, it isnt that simple.

Sorry, Cant Do That

The first thing to know about getting money into the Roth TSP is that the TSP doesnt allow you to move money from an existing traditional TSP to a Roth TSP.

P.S: If you arent familiar with all the cool benefits of a Roth account, check out this article.

So the only way for most people to get money into the Roth TSP is by contributing straight into it from your paycheck.

For example, if you have 50k in your traditional TSP you cant move that into your Roth TSP but you can start putting new money directly into the Roth TSP. And this is done the same way that you put money into the traditional TSP.

You simply let the TSP know that you now would like to put a piece of paycheck into the Roth TSP instead of what you are putting into the traditional TSP.

But Theres Another Way

Now with all that being said, there is another way to get your traditional TSP money into a Roth account to benefit from the tax advantages.

Open An Ira Before You Start Any Other Paperwork

You need to open an IRA before you can transfer the funds from your TSP. You can request the Thrift Savings Plan write the check out to you, but its much faster and easier to directly transfer the funds to an IRA that has already been opened. This also reduces the likelihood of running into issues with the IRS.

You will need provide your bank or brokerage account and IRA account number when you make the funds transfer. If you already have an IRA, you can simply transfer the funds into your current account. If not, you will need to open a new IRA. Start by researching financial companies. We have a list of recommendations here, or you can go with any of the major military financial institutions or major brokerage houses .

Make sure you have both a Traditional IRA and a Roth IRA if you have funds in both the Traditional and Roth sections of the Thrift Savings Plan, or if you want to send your tax-exempt contributions to a Roth IRA .

You May Like: How To Find Out If I Have Money In 401k

Can I Use My Tsp To Pay Off My Mortgage

With lower interest rates, repayment can make more sense or you can speed up your repayment of debt with additional payments. If, in the end, you still choose to use your TSP bar to pay off your debt, make sure you know the cost of doing so.

When can I remove the TSP without penalty? With TSP, you are not exempt from the initial withdrawal penalty if you separate from the federal government in the year you reach the age of 55 or later. For IRAs, the first withdrawal penalty will apply to anything you take until you reach the age of 59 ½.

Transfer Traditional Funds To A Traditional Ira Roth To A Roth Ira

It sounds basic, but you want to get this right the first time. When you are transferring your TSP funds, make sure you transfer them to the correct type of account. This will prevent problems with the IRS. Both the TSP-70 and TSP-77 have sections for both Traditional and Roth contributions and transfers.

If you want to convert a Traditional account to a Roth account, its best to do this in two separate transactions. Complete your TSP to IRA Rollover, then perform a Traditional IRA to Roth IRA rollover.

Also Check: What Is Max Amount You Can Put In 401k

Can You Retire Early From Federal Government

It is possible to quickly retire from the government with as little as ten years of work. Among them is a special option under the Federal Employees Retirement System that allows an employee to retire at his or her minimum retirement age with as little as ten years of employment.

What is the earliest a federal employee can retire?

Generally, an employee is eligible for retirement or an employee with at least 30 years of service and 55 years under the Civil Service Retirement System or 56 months in 2022 under Federal Employees Retirement

What happens if I leave federal service before retirement age?

If you leave your Government service before you can retire: you can request that your retirement contributions be refunded to you in cash, or. If you have five years to pay off your debt, you can wait until you reach retirement age to apply for a monthly pension.

Tsp To Traditional Ira Rollover

The TSP administrators actually make closing your account a fairly easy process. When you log into your account on TSP.gov, select the Withdrawals and Changes to Installment Payments option. This then opens an online withdrawal wizard that walks you through the entire withdrawal process. When you select the Full Withdrawal option, the wizard will automatically use your answers to generate the relevant sections of TSP-70, Request for Full Withdrawal.

To complete this withdrawal wizard, youll need your traditional IRA account details . You can use an existing IRA, that is, one youve had open and contributed to for multiple years. Alternatively, you can create a new account and fund it with the rollover proceeds. Opening an IRA is extremely easy, as many institutions even let you open one online.

Once youve completed the withdrawal wizard online, you need to print and sign the form. If you have a spouse as a beneficiary, youll also need to notarize his or her signature. Once completed, you then have a couple options for submitting the form:

We recommend Option 1. Its always better to have a professional IRA custodian handle these rollovers, as it limits the potential for mistakes that could cause issues with the IRS.

Read Also: Is It Good To Have A 401k

View Important Information About Our Fees And Commissions

-

3. Standard online $0 commission does not apply to over-the-counter equities, transaction-fee mutual funds, futures, fixed-income investments, or trades placed directly on a foreign exchange or in the Canadian market. Options trades will be subject to the standard $0.65 per-contract fee. Service charges apply for trades placed through a broker or by automated phone . Exchange process, ADR, and Stock Borrow fees still apply. See the Charles Schwab Pricing Guide for Individual Investors for full fee and commission schedules.

Investors should consider carefully information contained in the prospectus, including investment objectives, risks, charges, and expenses. You can request a prospectus by calling 800-435-4000. Please read the prospectus carefully before investing.

Schwab ETFs are distributed by SEI Investments Distribution Co. . SIDCO is not affiliated with Charles Schwab & Co., Inc.

This tax information is not intended to be a substitute for specific individualized tax, legal, or investment planning advice. Where specific advice is necessary or appropriate, Schwab recommends that you consult with a qualified tax advisor, CPA, financial planner, or investment manager. Depending on the type of account you have, there are different rules for withdrawals, penalties, and distributions. Please understand these before opening your account.

Withdraw Your Tsp Assets In A Lump Sum

Withdrawing your Thrift Savings Plan assets in a lump sum is not usually recommended because you will be assessed with taxes and early withdrawal penalties . Together, these can eat up nearly a third of your total TSP assets.

Possible Advantages: Your assets will be available for immediate use. This can help during periods of unemployment after separating form the military or civil service.

Disadvantages: The huge tax payment and the 10% early withdrawal penalty reduces the amount you receive by almost a third. In addition you also all lose tax deferral benefits, potential future earnings, and lock in any market losses. Most importantly, you reduce the amount of money you have for your retirement.

You can change your mind within 60 days. The law requires your old fund manager to deduct 20% of your withdrawal for taxes at the time of withdrawal. If you change your mind, there is a 60-day rollover rule which allows you to roll the money into an IRA within 60 days. However, you will be required to come up with the 20% difference to reinvest the entire amount and avoid paying income taxes. You will get the 20% back when you file taxes the following year as long as you complete the rollover within 60 days.

Verdict: Consider this option only if you need the funds immediately and you cannot meet those expenses through other means. But I strongly advise you to speak with a financial planner to look at other options before doing this.

Don’t Miss: How To Find 401k Account Number

Where To Transfer Your 401

posted on

When you leave a job, you typically get to choose what happens with your retirement savings. Thats the case with most 401, 403, and other retirement plans. You often have the opportunity to take control of your savings, but you might also have the option to leave assets with your former employer.

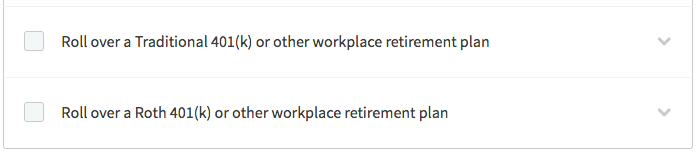

If you decide to move the money, where should you transfer your 401 savings? On this page, well cover the most common options available when you retire or change jobs:

- Transfer to an IRA that you control

- Move to your new jobs retirement plan

- Transfer to a bank account

- Buy an annuity if you want income guarantees

- Leave the money where it is

Advantages To Rolling Tsp Funds Into An Ira

As outlined above, a couple benefits exist for keeping retirement savings in a TSP once you separate from the military. However, there are also some major advantages to rolling those funds into an IRA. If any of the below advantages resonate with your unique situation, moving your TSP funds into an IRA may make sense.

Advantage 1: Investment Options

While the TSP offers extremely low expense ratios, it also has very limited investment options. Within your TSP account, you can only choose from five individual funds or several life-cycle funds . This means that investors looking to purchase individual stocks, exchange-traded funds, or other common investment options cannot do so in a TSP.

Alternatively, IRAs typically offer a wide variety of investment options, limited only by the account custodian. For more sophisticated investors who prefer building a personalized retirement portfolio, IRAs simply offer far more flexibility. Additionally, some investors eventually choose to use retirement funds to invest in alternative assets . While you cannot do this with a TSP or normal IRA, you can with a self-directed IRA.

Advantage 2: Simplicity

As people approach retirement age, many try to simplify their financial situation. This may mean limiting the number of open retirement accounts you have. If you served in the military, worked in a civilian job, and started an IRA, you could potentially have three retirement accounts and that doesnt even include your spouses accounts.

Don’t Miss: Can A Small Business Set Up A 401k