What Happens To Old 401s

401 administrators have different procedures for what to do with left behind accounts. Depending on the amount, they could be distributed directly to you, transferred to an IRA on your behalf, or sent to a separate holding account until you claim them.

Unwilling to bear the burden of maintaining vast amounts of accounts from former employees, 401 plans prefer to unload them any way possible. This can make it challenging to find your old 401s.

How Do I Log In To My Fidelity Account

You can get to the homepage by clicking on the Fidelity logo in the top left. Here you will be asked to enter the username and password you created. If this is the first time you are logging into your account online, you will need to click on the Register for online access button which is also in the top right hand corner of the homepage.

Option : Roll Over Your Old 401 Into An Individual Retirement Account

Still another option is to roll over your old 401 into an IRA. The primary benefit of an IRA rollover is having access to a wider range of investment options, since youll be in control of your retirement savings rather than a participant in an employers plan. Depending on what you invest in, a rollover can also save you money from management and administrative fees, costs that can eat into investment returns over time. If you decide to roll over an old 401 into an IRA, you will have several options, each of which has different tax implications.

Recommended Reading: Can I Borrow From My 401k To Start A Business

Plan For Your Retirement Over Your Career

Remember that retirement planning is not a singular event, but rather something you do over the course of your career.

Keep this mindset and continually review your retirement planning progress and account balances. If you havent started to save for retirement, its never too late.

Talk to your HR department about retirement planning options, or open up an IRA, or even basic savings account to get started putting money aside for your future.

Thursday, 21 Oct 2021 11:13 PM

Advertiser Disclosure: Many of the offers appearing on this site are from advertisers from which this website receives compensation for being listed here. This compensation may impact how and where products appear on this site . These offers do not represent all account options available.

Editorial Disclosure: This content is not provided or commissioned by the bank advertiser. Opinions expressed here are authors alone, not those of the bank advertiser, and have not been reviewed, approved or otherwise endorsed by the bank advertiser. This site may be compensated through the bank advertiser Affiliate Program.

User Generated Content Disclosure: These responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

How To Understand The Details On A 401 Statement

Now that you know how to read and understand the account summary, or cover page, of your 401 statement, its time to dive into the details.

Specifically, the activity, transactions, fees, and investment options inside your 401 statement. This information is usually found on all the additional pages of your statement.

The details inside your 401 statement can be broken down into 6 sections:

The final pages of your statement are typically the customary 401 Statement Disclosures, which may be several pages in length.

Also Check: How Much Can I Convert From 401k To Roth Ira

Us Department Of Labor

Even if your former employer abandoned its retirement plan, your money isnt lost forever. The U.S. Department of Labor maintains records for plans that have been abandoned or are in the process of being terminated. Search their database to find the Qualified Termination Administrator responsible for directing the shutdown of the plan.

Tracking Down A Lost 401

Its easy to understand why some workers might lose track of an old 401: Those born between 1957 and 1964 held an average of 12.4 jobs before the age of 54, according to the Bureau of Labor Statistics. The more accounts you acquire, the more challenging it is to keep track of them all.

Perhaps this is why there are some 24 million forgotten 401s holding assets in excess of $1.3 trillion.1 Left unattended too long, old accounts can be converted to cashand even transferred to the state as unclaimed propertyforgoing their future growth potential.

If youre among those with misplaced savings, heres how to locate and retrieve them:

Recommended Reading: Can I Contribute To A Roth Ira And A 401k

Leave Your Retirement Savings In Your Former Qrp If The Qrp Allows

While this approach requires nothing of you in the short term, managing multiple retirement accounts can be cumbersome and confusing in the long run. And, you will continue to be subject to the QRPs rules regarding investment choices, distribution options, and loan availability. If you choose to leave your savings with your former employer, remember to periodically review your investments and carefully track associated account documents and information.

Features

- Your former employer may not allow you to keep your assets in the plan.

- You must maintain a relationship with your former employer, possibly for decades.

- You generally are allowed to repay an outstanding loan within a short period of time.

- Additional contributions are generally not allowed. In addition to ordinary income tax, distributions prior to age 59½ may be subject to a 10% additional tax.

- RMDs, from your former employers plan, begin April 1 following the year you reach age 72 and continue annually thereafter, to avoid IRS penalties.

- RMDs must be taken from each QRP including designated Roth accounts aggregation is not allowed.

- Not all employer-sponsored plans have bankruptcy and creditor protection under ERISA.

If you choose this option, remember to periodically review your investments, carefully track associated paperwork and documents, and take RMDs from each of your retirement accounts.

Find 401 Plan Information Through The Labor Department

Another option is to find plan information through the Department of Labors website. By locating the companys Form 5500, an annual report required to be filed for employee benefit plans, you should be able to find contact information and who the plans administrator was during your employment.

You may also be able to find information on lost accounts through FreeERISA. You must register to use the site, but it is free to search once youve set up your account.

Read Also: How Much 401k Should I Have At 40

You Are Viewing This Page As An Investor

Advisors, switch views to see more relevant content.

TFSA basics

Regardless of what youre saving for, a TFSA is a great way to reach any financial goal.

RRSPs 101

You can reduce tax on your current income when you save for the future. Here are six RRSP tips.

For you and your goals

Over 1.5 million

To business leaders around the world

Over 25,000

* Source: More on the Value of Financial Advisors, by Claude Montmarquette and Alexandre PrudHomme, CIRANO, 2020. The average household with a financial advisor for 15 years or more had asset values 2.3x higher than an average comparable household without a financial advisor.

Commissions, fees and expenses may be associated with investment funds. Read a funds prospectus or offering memorandum and speak to an advisor before investing. Funds are not guaranteed, their values change frequently and investors may experience a gain or loss. Past performance may not be repeated.

Read our privacy policy. By using or logging in to this website, you consent to the use of cookies as described in our privacy policy.

This site is for persons in Canada only. Mutual funds and ETFs sponsored by Fidelity Investments Canada ULC are only qualified for sale in the provinces and territories of Canada.

88747-v202076

Recommended Reading: How To Recover 401k From Old Job

Contribute The Max For The Match

If your company is matching your contributions up to a certain point, contribute as much as you can until they stop matching the funds. Regardless of the quality of your 401 investment options, your company is giving you free money to participate in the program. Never say no to free money.

Once you reach the maximum contribution for the match, you might consider contributing to an IRA to diversify your savings and have more investment choices. Just don’t miss out on the match.

Don’t Miss: How To Open A Self Directed 401k

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Start Your Transfer Online

Youll get useful tips along the way, but you can call us if you have a question.

Youll need to:

- Enter the account information requested. Your instructions from that point will depend on the company holding your account and your account information. Not all transfers follow the same process, so well ask only for the information needed to complete your particular type of transfer.

- Enter your personal information, such as your birth date and Social Security number, or if youre already a Vanguard client, confirm the information that weve been able to prefill for you.

- Review your information and click Submit.

Want an idea of how long a transfer could take?

Don’t Miss: How Do I Transfer 401k To New Employer

What Is An Ira

While there are a number of benefits to 401ks, they’re not the only retirement plan in the game. An IRA is an individual retirement account. Where a 401k can only be offered through an employer, an IRA account can be opened up by an individual whether they’re associated with an employer or not. That means they’re the best option for independent contractors without an employer or anyone who wants to do some extra retirement planning on top of their 401k.

Reference An Old Statement

Because companies reorganize, merge, get acquired, or go out of business every day, its possible that your former employer is no longer around. In that case, try to locate a lost 401k plan statement and look for contact information for the plan administrator. If you dont have an old statement, reach out to former coworkers and ask if they have an old statement.

Don’t Miss: What To Do With 401k At Retirement

Standard Deposits To Individual And Ira Accounts

- For most check deposits to individual brokerage accounts as well as to most IRA accounts , checks must be made payable to one of these:

- Fidelity Investments.

- National Financial Services, LLC.

- Account holder exactly as it appears on the Brokerage Account Registration. Checks payable to the account holder must be endorsed by the account holder to prevent paying bank from returning the check to Fidelity.

Dont Miss: How Do I Transfer 401k To New Employer

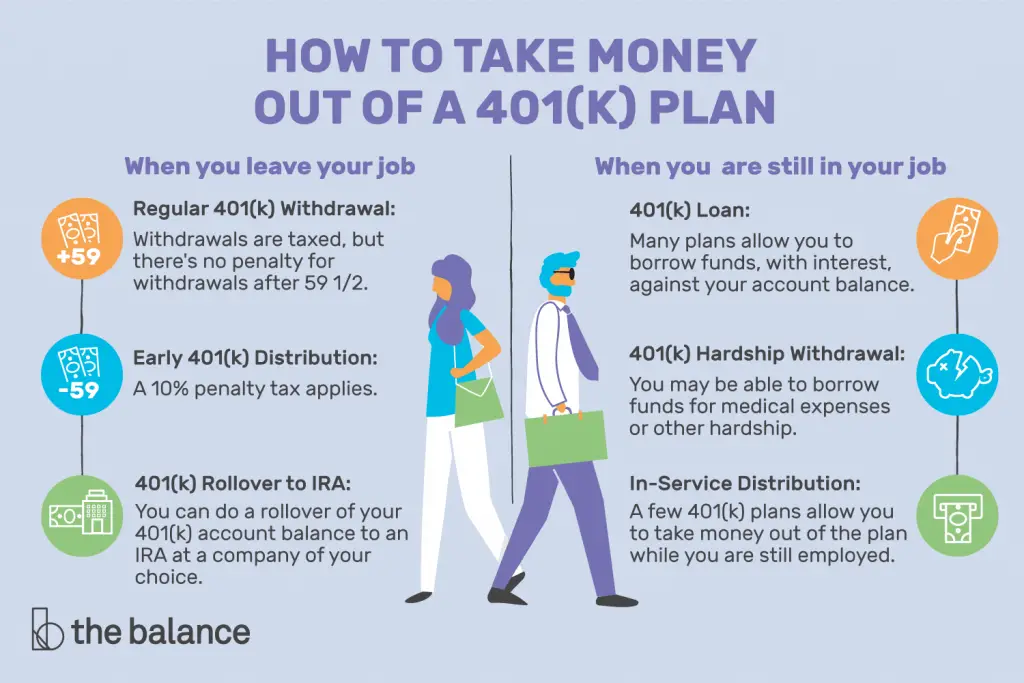

Taking Withdrawals From A 401

Once money goes into a 401, it is difficult to withdraw it without paying taxes on the withdrawal amounts.

“Make sure that you still save enough on the outside for emergencies and expenses you may have before retirement,” says Dan Stewart, CFA®, president of Revere Asset Management Inc., in Dallas. “Do not put all of your savings into your 401 where you cannot easily access it, if necessary.”

The earnings in a 401 account are tax-deferred in the case of traditional 401s and tax-free in the case of Roths. When the traditional 401 owner makes withdrawals, that money will be taxed as ordinary income. Roth account owners have already paid income tax on the money they contributed to the plan and will owe no tax on their withdrawals as long as they satisfy certain requirements.

Both traditional and Roth 401 owners must be at least age 59½or meet other criteria spelled out by the IRS, such as being totally and permanently disabledwhen they start to make withdrawals.

Otherwise, they usually will face an additional 10% early-distribution penalty tax on top of any other tax they owe.

Some employers allow employees to take out a loan against their contributions to a 401 plan. The employee is essentially borrowing from themselves. If you take out a 401 loan, please consider that if you leave the job before the loan is repaid, you’ll have to repay it in a lump sum or face the 10% penalty for an early withdrawal.

Also Check: How To Transfer 401k To Charles Schwab

Pros And Cons: 401 Vs Ira

401 Pros |

|

|---|---|

|

|

|

|

You’ve Found Your Old 401s Now What

Once you’ve located your old 401s, you have a few options. Some come with penalties, some require taxes to be paid, and some don’t require either.

You have the option to cash out all of the funds in your old 401s. However, the IRS will charge you a 10% early withdrawal penalty. In very few cases, can this penalty be waived, so it’s best to leave it saved until you’re at least 59½.

Secondly, you can rollover your old 401s into your current employer-sponsored plan. This comes with no penalty or taxes. Because you are rolling it over into another retirement account, you won’t incur any additional costs in doing so.

Lastly, you can consolidate your 401s into an IRA. Like a 401, an IRA is a retirement account, so it’s free from any penalties and taxes. These are held outside of your employer’s 401 plan, but they’re easy to set up and come with many more investment options.

Recommended Reading: Can I Use 401k To Pay Off Credit Card Debt

Usei Releases An Interview On Its Metaverse Plans

Your best bet is to visit FreeERISA.com, which can help you track down your old 401 using the following website tools:

- Code search: Find employee benefit and retirement plan filings by location.

- Dynamic name search: Find 5500s even if the plan sponsor’s name changed.

- Instant View: See benefit filings right in your browser instantly.

What Is A 401 Plan And How Does It Work

A 401 Plan is a retirement savings vehicle that allows employees to have a portion of each paycheck directly paid into a long-term investment account. The employer may contribute some money as well.

There are immediate tax advantages for the employee if the account is a traditional 401 and tax advantages after retiring if it is a Roth 401.

In either case, the money earned in the account will not be taxed until it is withdrawn during retirement if it is a traditional 401. If it is a Roth 401, no taxes will be due when the money is withdrawn.

Also Check: When Can I Move My 401k To An Ira

Taking Money Out Of A 401 Once You Leave Your Job

If you no longer work for the company that sponsored your 401 plan, first contact your 401 plan administrator or call the number on your 401 plan statement. Ask them how to take money out of the plan.

Since you no longer work there, you cannot borrow your money in the form of a 401 loan or take a hardship withdrawal. You must either take a distribution or roll your 401 over to an IRA.

Any money you take out of your 401 plan will fall into one of the following three categories, each with different tax rules.