How Much Should I Have In My 401k At 60

Ok kids, youve made it! By now the hope is that you could retire in 5 years. Your income is leveling out, and you can keep contributing until you decide to officially retire.

At 60 years old, you want to have between $700k and one million dollars in your 401k.

At this point, you can move away from the riskier investments. This will help protect your retirement nest egg from stock market downturns.

What Should Your Net Worth Be At 40

Net Worth at Age 40 By age 40, your goal is to have a net worth of two times your annual salary. So, if your salary edges up to $80,000 in your 30s, then by age 40 you should strive for a net worth of $160,000. Additionally, it’s not just contributing to retirement that helps you build your net worth.

Age : The 7x Recommendation

This is also the time to make a push toward paying off debt to enter retirement owing the minimum amount possible. Live within your means and pay off bills, especially high-interest credit card debt. If you dont, those monthly payments will eat into your retirement savings later on. Doing so will also increase your credit score and lower your credit utilization rate, which will make it easier to refinance your home at a lower interest rate.

You May Like: How Much To Withdraw From 401k

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Set Limits On Helping Out Family

Many people become part of the sandwich generation in their 40s because they’re raising their own families while also trying to help their aging parents.

When you’re behind on your own savings goals, you need to set hard limits on how much you can afford to help with others’ expenses. If you want to help support your parents, then work the amount you can afford into your budget. Communicate with your parents and siblings about what they can expect from you.

You also need to prioritize your retirement savings over saving for your kids’ college education. This may be difficult, but your kids have more options for funding their education — such as financial aid, student loans, and working part-time — than you’ll have if you retire with little savings.

Read Also: Can A Small Business Owner Have A 401k

How Much To Save For Retirement

According to Fidelity, you should be saving at least 15% of your pre-tax salary for retirement. Fidelity isnt alone in this belief: Most financial advisors also recommend a similar pace for retirement savings, and this figure is backed by studies from the Center for Retirement Research at Boston College.

For many people, however, saving for retirement isnt as simple as setting aside 15% of their salary.

The 15% rule of thumb takes a couple factors for grantednamely, that you begin saving pretty early in life. To retire comfortably by following the 15% rule, youd need to get started at age 25 if you wanted to retire by 62, or at age 35 if you wanted to retire by 65.

It also assumes that you need an annual income in retirement equivalent to 55% to 80% of your pre-retirement income to live comfortably. Depending on your spending habits and medical expenses, more or less may be necessary. But 55% to 80% is a good estimate for many people.

Finally, the 15% rule wont provide you with a nest egg that supplies all of your retirement income. Youll most likely derive part of your retirement income from Social Security, for example. All in all, the 15% estimate should provide you with steady retirement income that lasts into your early 90s, at a rate of around 45% of your pre-retirement income.

How To Save More Money

If you’re feeling overwhelmed by these saving recommendations, know that it’s never too late to give your retirement or emergency fund a boost.

To save more for retirement, check whether your employer matches your 401 contributions. As an incentive to get you to save, companies may contribute up to 3% of your salary, for example, if you contribute at least that amount to your 401. Choosing not to take advantage of this incentive could mean missing out on a substantial amount of “free” money over time.

Even if your employer doesn’t provide a match, or you don’t have access to a 401 at all, you can create your own savings plan with an IRA or similar retirement investment tool. Make regular contributions to this account, and every time you get a raise, increase the amount you contribute to retirement from each paycheck. Put half of your tax refund or work bonus into your retirement account each year. Celebrate meeting saving milestones and get specific about the kind of retirement you want so you have concrete goals to work toward.

Also take a close look at your budget and see if there are expenses you can cut back to help increase the amount you’re putting into your retirement savings. If you’re feeling significantly behind, consider adding to your income by getting a second job so you can save more money every month.

Don’t Miss: How Much Can I Borrow Against My 401k

Saving For Retirement In Your 60s

Retirement is around the corner in your 60s, and the times almost come to enjoy the money youve worked so hard to save. Consider shifting to capital preservation and income-generating investment strategies. These fixed income investments tend to be stable bonds or fixed annuities aimed to keep the money youve saved over the years safe.

As youll most likely be entering the last of your full-time working years, youll want to keep saving as aggressively as you can.

Emergency fund: Consider upping your cash savings to one years worth of living expenses, so you have more cash on hand for things like medical expenses.

Additional savings: Review your risk tolerance and investment strategy with an eye toward capital preservation. Financial advisors may be particularly helpful now in helping you figure out how to handle the asset allocation of your retirement funds.

Educational savings: If you have children still in college or grandchildren whose college youd like to help out with, you can continue contributions to 529 accounts.

Retirement savings: Make sure youre contributing as much as you can before you retire. By the time you turn 67, you should have 10 times your annual salary in retirement savings.

Catch-up tips: Even after retirement, there are always part-time jobs that can supplement your income as you adjust to living on your savings and Social Security income.

What Is The Average 401k Balance For A 40 Year Old

Ages 40-49 Average 401 balance: $ 102,700. On the same subject : How does retirement annuity work. Median 401 balance: $ 36,000.

What has an average 40-year-old accumulated for retirement? Saving for Retirement at 40 Although the recommended amount for saving for a retirement plan is up to four times your annual salary, this is not a reality for many Americans. The average income of people over the age of 40 is just over $ 50,000, but the average retirement savings for this age group are $ 63,000.

Read Also: What Is The Phone Number For Fidelity 401k

Retirement Savings In Your 60s

You are close to retirement. At age 60, plan to have 8 times your annual income, and at age 65, a 9-10 Ã multiple or more would be excellent.

At age 65, the Old Age Security pensionstarts. Combined with the CPP, these benefits may account for up to an average of $15,654.48 per year based on the current average numbers for 2021.

Your retirement savings fill the gaps in your retirement income needs since CPP and OAS alone wonât be enough.

You can learn about how these pension benefits work in this retirement guide.

Your investment portfolio continues to require attention. While it is advisable to lower your risk exposure in retirement, some level of risk is required if you want your returns to exceed the inflation rate.

Keep your cash holdings in a high interest account that pays a reasonable interest rate TFSA Savings, RRSP Savings, or General Savings.

If you are in doubt about your plan, consult a certified financial advisor or planner. For a retirement calculation that takes your CPP, RRSP, workplace pension, and more into consideration, .

Other Benefits Of A 401

Even for employers who do not offer any matching program, every employer with a 401 plan is responsible for administering the plan. That may seem like its no big deal, but it actually saves quite a bit of trouble for the employees. As an employee in a 401 plan, you dont have to worry about the complicated rules and regulations that need to be followed, or about making arrangements with the funds in which you invest your moneyyour employer takes care of all of that for you. Thats quite a bit of saved paperwork.

At the same time, employees who participate in a 401 maintain control over their money. While employers provide a list of possible investment choices, most commonly different sorts of mutual funds, employees have quite a bit of freedom to decide their own strategy. Whether you are willing to take on a little more risk with your investments, or if you would rather play it safe, theres probably an option for you.

Read Also: How Old Do You Have To Be To Get 401k

Retirement Savings In Your 30s

Based on Fidelityâs rule of thumb, you should have at least your annual salary saved by age 30, and two times by age 35.

The reality is that your 30s are probably going to be one of the most challenging times in your life to save for retirement.

You may be thinking about buying a home, getting married, paying off debt, having children, and more. While you are busy catching up with life, beginning to invest for retirement is crucial at this stage.

The retirement clock is ticking and you cannot afford to squander the time you still have on your side. Max out employer pension plans and pay attention to TFSA and RRSP contributions.

If you donât have funds to contribute to both registered accounts, there may be merit to choosing one over the other.

Accelerate debt repayment and find ways to increase your income.

This is also a good time to get life insurance and create a Will if you have dependents.

Depend On Nobody But Yourself

Contribute the maximum pre-tax income you can to your 401 for as long as you work. This is the absolute MINIMUM you can do to by on the right 401k savings by age path.

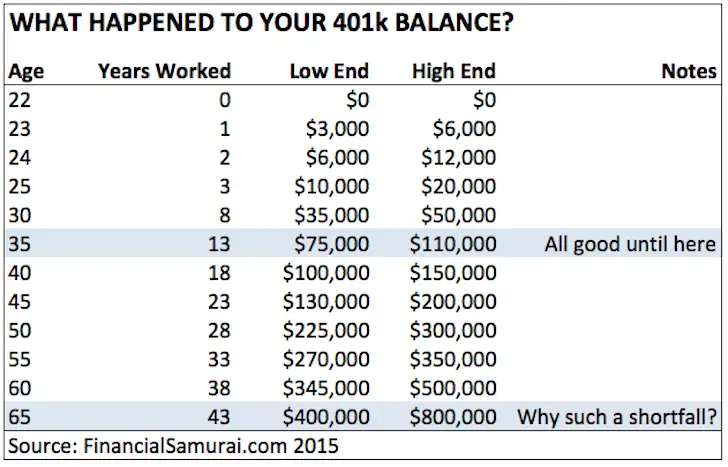

Below is a chart that shows what you could have in your 401 if you max it out each year starting in 2022. The right hand column shows what you would have in your 401 with 8% compound annual returns.

In other words, everybody who consistently maxes out their 401 each year will likely be a 401 millionaire by the time they turn 60.

After you contribut a maximum to your 401k every year, try and contribute at least 20% of your after-tax income after 401k contribution to your savings or retirement portfolio accounts.

This way, you will have potentially DOUBLE the amount in total retirement saving if your household income is $100,000 or more. If your household income is closer to $50,000, you should still see a nice 30% boost to your retirement savings if you consistently save 20% of your after tax income.

Treat your 401k just like Social Security and write it off completely from your mind. Do not expect either accounts to be there for you when you retire. Its just like how you should never expect the government to ever help you when youre in need.

Also Check: How To Withdraw My 401k Money

How Much Should You Have In Your 401k By Age

Now that we have established that you need a 401k in your life and explained how much you can contribute, lets talk cash. Aside from investing enough to meet your employer match, how much should you have in your 401k, really?

One way to answer that question is to look at your age.

While there is no one-size-fits-all answer to the question, How much should I have in my 401k? there are some best practices you can keep in mind to guide your efforts. Yes, while you should start investing in a 401k as soon as possible, some people might not get that opportunity right away and thats okay. The point is to do it when you can.

When you do finally start investing, there are a few good rules of thumb to help you make a sound decision on how much you should have in your 401k.

How To Save For Retirement

Fidelity’s saving recommendations assume that an individual has saved 15% of their annual income every year since age 25 and that they invest 50% of their retirement savings in stocks.

Starting to save for retirement as early as possible will allow you to take greater advantage of compounding. Compounding allows you to earn investment returns on not only your contributions but on your previous returns as well. Investing in stocks rather than only in low-risk, low-reward investments like cash and bonds allows for investment returns that, historically, average about 10% per year .

The type of investment account you can use to save for retirement often depends on whether you’re employed by a company that offers a workplace retirement plan. But anyone can, and should, save for retirement, no matter their employment arrangement. Here are your options:

- Individual retirement account : If you don’t have access to a 401, or you want to save extra for retirement, you can open an IRA. These also come in traditional and Roth versions, and the income qualifications and tax treatment differ between the plan types. Like with the different types of 401, Roth IRAs are funded with post-tax income and traditional IRAs are taxed upon withdrawal. A Self-Employed Pension IRA is available to freelancers, the self-employed and sole proprietors, and a SIMPLE IRA is available to small businesses.

Recommended Reading: Can You Cash Out 401k To Buy A House

How Much Should I Have In My 401 By Age 60

Retirement is a big milestone but getting there doesnât happen overnight. Financially preparing yourself to leave the workforce requires some forward thinking. If youâre asking yourself, âHow much should I have in my 401 by age 60?â youâre not alone.

A general rule is to have six to eight times your salary saved by that point, though more conservative estimates may skew higher. The truth is that your retirement savings plan hinges on your individual goals and financial situation, not some magic number. Here are a few ways to measure whether youâre on the right track.

What Is The Maximum 401k Contribution Amount

Starting in 2020 , you can contribute up to $19,500 each year to your 401k if you are under 50. If you are over the age of 50, you may be able to make catch-up contributions. This provision lets you invest up to an additional $6,500 in your 401k .

PRO TIP: You need to be behind in your 401k contributions to make catchup contributions.

When compared to a Roth IRA, where you can only contribute up to $6,000/year, this is an amazing opportunity especially since your pre-tax money is being compounded over time.

Read Also: Can I Roll My Wife’s 401k Into My Ira

How Much Should You Have Saved For Retirement

How much you should save for retirement largely depends on the kind of lifestyle you want for you and your family.

That being said, experts at Fidelity recommend that you consistently save 15% of your salary over the course of your career in order to be prepared for retirement.

This is how much Fidelity recommends Americans have saved at every age:

- By 30, you should have the equivalent of your salary saved

- By 40, you should have three times your salary saved

- By 50, you should have six times your salary saved

- By 60, you should have eight times your salary saved

- By 67, you should have 10 times your salary saved

Saving And Investing Money By 40

If you already have a 401, there are a number of strategies to max out your 401 that are worth looking into. For example, it might make sense to contribute at least enough to qualify for any employer matching your company offers. Why lose out on the free money that your employer is willing to contribute to your retirement savings?

Try setting monthly or weekly savings targets to help you stay on track for retirement. You can even set up automatic transfers or deposits, so you dont have to think about it.

As youre rethinking how much money you need to save for retirement, it also makes sense to look at your lifestyle goals. That includes figuring out when you might want to retire, what kind of lifestyle you want in retirement, and how much money you might have coming in during retirement.

Don’t Miss: What Happens To 401k In Divorce