Way #: Initiate Transfer/distribution From Ira Custodian

Read Also: When Leaving A Company What To Do With 401k

When To Roll Over Your 401 To An Ira

Rolling over your 401 to an IRA is possible only if you’re leaving your current employer or your employer is discontinuing your 401 plan. It is an alternative to:

- Leave your money invested in your existing 401

- Rollover to your new employer’s 401

- Withdrawal from your 401, which would trigger a 10% penalty if you aren’t 59 1/2 or older

A rollover or IRA) does not have tax consequences. This would not be the case if you do a rollover to a Roth IRA.

Rolling over a 401 to an IRA provides you with the opportunity to choose which brokerage you want to hold your retirement funds. It may be the right choice if:

- Your new employer doesn’t offer a 401 plan

- You cannot keep your money invested in your current workplace plan because your plan is being discontinued or your 401 administration won’t allow you to stay invested for some other reason

- Your new employer’s 401 plan charges high fees, offers limited investments, or has other drawbacks

- You’d prefer a wider choice of investment options

However, there are some downsides to consider:

- While 401 loans allow you to borrow against your retirement funds, no such option exists with an IRA.

- Transferring company stock can be complicated account, read up on an “NUA strategy” that could save you a lot of money.)

If these downsides aren’t deal breakers for you, the next step is figuring out how to roll over your 401 to an IRA.

Can I Convert 401 To Ira Without Leaving Job

You can transfer or roll over your 401 funds to a self-directed IRA if you separate from your employer due to retirement, termination, or simply quitting your job. You can transfer the funds just like you would to another 401 or a traditional IRA. The difference is, you use a specialized IRA, which allows you to invest in instruments other than stocks, bonds and mutual funds.

Recommended Reading: Can I Move My 401k

How Do I Transfer My Old 401 To A Self

In general, in order for a 401-plan participant to move their 401 funds to a self-directed IRA, they would generally need to satisfy a plan triggering event. It is hard for many 401 plan participants to believe that they do not have unfettered control over their current employer 401 plan funds. In general, to rollover funds from a 401 plan to another retirement account one must generally be:

- Over the age of 59 ½

- Leave your job

- Rolled funds into 401 plan

Reaching the Age of 59 ½

Tips to consider before doing a 401 rollover:

- Direct rollover is the answer. Even if you want to pull money out of the plan, roll the funds directly into a self-directed IRA and then you can take a distribution without a 20% withholding tax. If under the age of 59 ½, tax and a 10% early distribution penalty would be due, but not payable until April 15 of the next year which gives you more use of the funds without tax.

- If you do an indirect rollover remember you can only do once every 12 months and you will likely be subject to a 20% withholding tax

- I you have less than $5000 in your 401 plan and you do not tell your employer what to do with the funds, many employers will roll your funds into a safe harbor IRA on your behalf which will earn very little return since it will be controlled by the IRA custodian. Hence, when you leave your job make sure to notify your employer that you wish to do a direct rollover to an IRA so you can control the IRA investments.

Other 401 Plan Triggering Events

How The Rollover Process Works

If you decide to roll over a previous employer 401 to a Self-Directed IRA, the process is really pretty simple. One important thing to remember is that all activities related to the rollover should be compliant with IRS procedures to avoid any tax penalties. With a direct rollover, you will initiate the rollover with your previous employer custodian and complete the required paperwork. Then, you will direct your previous custodian to roll over your funds to the new custodian to create your new Self-Directed IRA.

You May Like: How Do You Move Your 401k When You Change Jobs

Investment Options With Self

Once the rollover is complete, you will be ready to start making some new investment choices. With the wealth already accumulated through your former 401, you can invest in many options with a Self-Directed IRA, such as:

- Real estate, including apartments, single family homes, commercial properties, or undeveloped land

- Limited Liability Companies

- Equipment leasing

- Other investments options

With such a varied list of alternative investments, you can build a strong, versatile portfolio that will utilize the funds you accumulated with your previous employer 401 while also enjoying the benefits of a Self-Directed IRA. To learn more about how to set up a new Self-Directed IRA, contact us for a free consultation today.

Can An Employee Roll Over A 401 Into A Self

Some 401 plans include a provision for in-service IRA rollovers.

Employer-sponsored 401 plans usually include investment options such as stock funds, bond funds and money market accounts. But in some instances, you may not like the options your employer offers. The good news is that you always have the option of investing your money on your own.

If you’ve already put money into your employer’s plan, you can also roll that money over into an account of your choosing. But be aware that you may experience different contribution limits with the new plan you choose.

Don’t Miss: Should I Invest In 401k

What’s The Difference Between A Rollover And An Asset Transfer

The main difference between a rollover and an asset transfer is where the money is held before it’s moved to Vanguard. If you’re moving money to Vanguard from:

- An employer-sponsored plan, such as a 401 or 403, you can initiate a rollovertypically, when you change jobs or retire. When you roll over retirement plan assets, you’re moving them from a group plan into an IRA .

- An IRA at another financial institution, you can initiate an asset transfer, tax-free. You can also transfer securities held in a brokerage IRA at another financial institution into a Vanguard Brokerage IRA.

Givemethegoldcom: Gold Investing And Retirement Planning

Affiliate Disclosure: The owners of this website may be paid to recommend the following companies: Goldco, Augusta Precious Metals, Noble Gold Investments, Birch Gold, and Regal Assets. The content on this website, including any positive reviews of the mentioned companies, and other reviews, may not be neutral or independent.

Read Also: How To Pull Money Out Of My 401k

The Downside Of A Self

The downside of using a self-directed IRA for your 401 rollover fund is that you are in charge, nobody else is. That’s right. Instead of paying a manager that makes millions of dollars a year to manage billions of dollars of managed assets, a self-directed IRA basically puts you on the driver seat. You make the call. Unfortunately, you better make the right call or your retirement fund and your 401 rollover fund will suffer. This is a very heavy burden to bare alone. This is a lot of responsibility. If anything, you get the psychological benefit of having somebody to blame when you invest in a group fund or a mutual fund because somebody else is managing your money.

However, with a self-directed IRA, all the blame is on you. This is why it’s very important to study your options carefully. You have to know where to put your 401 rollover fund, and you have to pick the right investments. The good news is that with enough practice and enough research, you can start picking winning investments.

Recommendation:Protect Yourself From Stock Market Bubbles By Investing in a Gold IRA

Why Choose Irar For Your Self

The answer is clear and simple!

Your account will be serviced by an experienced team of Certified IRA Services Professionals with expertise in self-directed IRAs. Our knowledge and experience in self-directed IRA rules, regulations, and recent trends, will assist you in making smart educated decisions.

Youll also be able to save over 50% compared to fees charged by other industry providers. We believe in maintaining lower fees because were committed to helping you build long-lasting retirement wealth.

At IRAR we see many cases in which IRA owners transfer their existing self-directed IRA to IRAR because theyve grown unhappy with their current provider account fees were too high, poor service, or the provider has gone out of business or changed in management.

Regardless of the reason, we want to help.

Read Also: Can You Invest Your 401k In Stocks

How To Rollover Your Old 401 To Invest In Real Estate

If you have changed jobs or retired and have left savings in a former employer’s retirement plan , 403, governmental 457 ), you can move these funds to a self-directed IRA and invest in real estate without loss or penalty. Real estate investments in self-directed IRAs grow tax-deferred or tax-free until withdrawal. This means that when your property generates income or is sold, these profits are not taxed at the time because they go back to the IRA. It is not until you start taking distributions at retirement that the income will be taxed, depending on the type of plan you have.

Its important to note that if you are currently employed and have a retirement savings plan with your employer) this plan may not be transferable to a self-directed IRA. However, as long as the plan administrator allows, you can invest in almost everything imaginable . Note that the investment must be for the benefit of your retirement plan and not for your personal benefit.

IRAR Trust is a self-directed IRA provider and has 21 years of experience with rollovers of 401 plans into self-directed IRAs to invest in real estate. Our clients invest in an extraordinary variety of different types of real estate: single family, commercial property, land, notes, mortgages, real estate investment trusts , and more.

Here is what you need to know to get your old 401 in a self-directed IRA and start investing:

Taking Control Of Your Retirement Plan

As you prepare for your future, its crucial to perform your due diligence with any investment matter. As you take charge of your retirement savings with a self-directed account, be sure to follow any regulations set up by the IRS. Explore every option as you set-up a secure retirement for you and your family.

You May Like: How To Roll Your 401k From Previous Employer

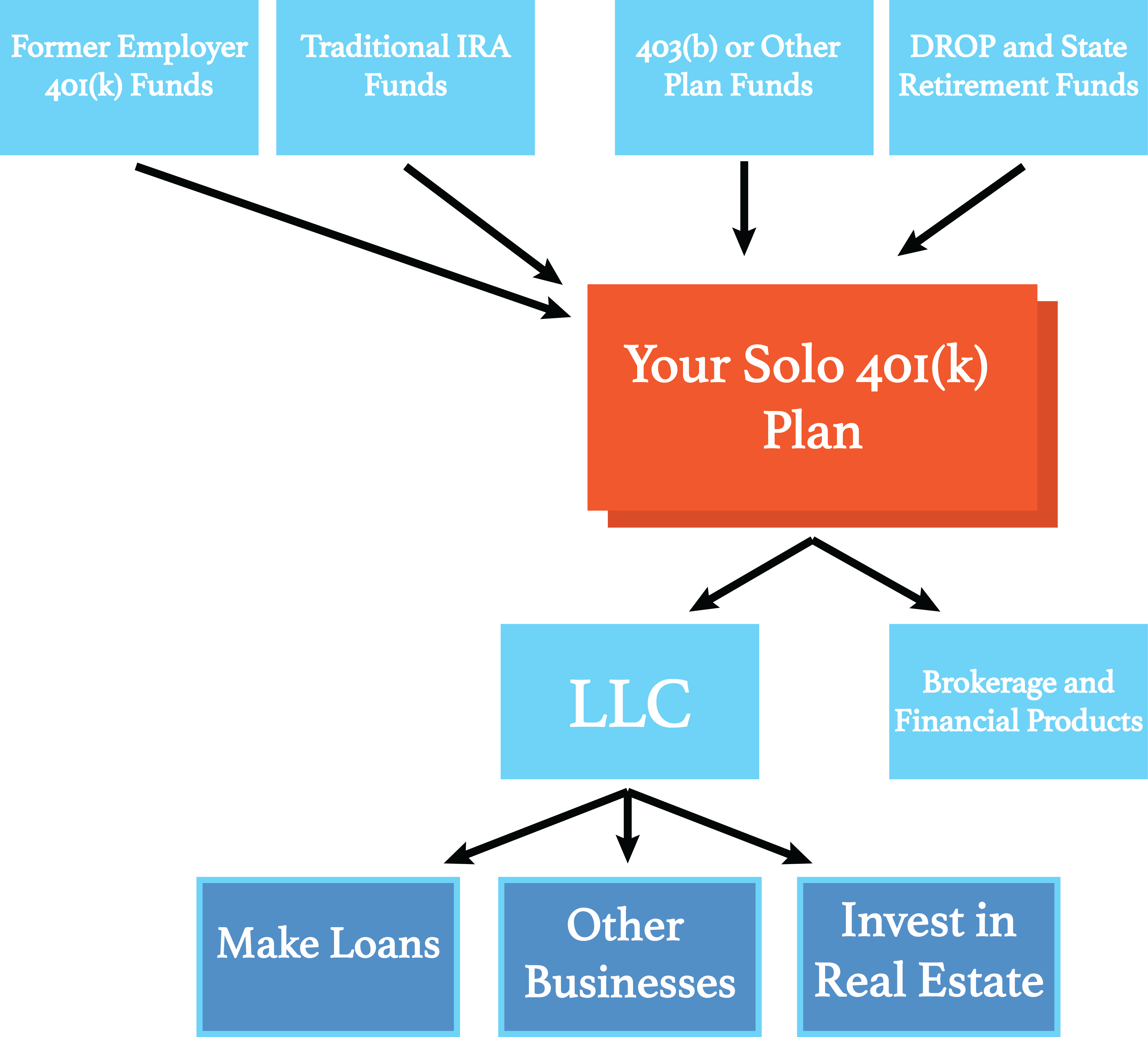

Benefits To Funding Your Solo 401k From An Employer 401k Rollover

If youre considering other alternative retirement plans , the contribution limits available through a Solo 401k cannot be beat. Contribution limits go up annually. For 2021, the IRS Defined Contribution Limit is $58,000 . If you are still contributing to an employer 401k, it likely limits your allowable contribution and ability to defer taxes. Your Solo 401k allows more than twice the contributions available from other plans. When your spouse also participates in a Solo 401k, the potential contribution limit doubles to $129,000! And the over age 50 catch-up provision is the most generous of all IRS retirement plans. It allows an extra $6,500 in tax-free deposits compared to $1,000 or $3,000 for traditional IRAs or SIMPLE IRAs.

More benefits when you rollover an employer 401k to a Solo 401k:

- Annual funding is flexible. Once established, you can fund it to the max each year or anywhere between zero and the max. There is no minimum funding requirement.

- Immediate access to your assets with full decision-making authority.

- Stop paying transaction and asset-based fees to a financial advisor who may limit your investment options.

- Have all profits from your investments build your retirement account tax-free.

- More diversification in your retirement account.

How To Pick An Ira To Roll Over To

The most important question you need to ask is whether you want to start a traditional IRA or a Roth IRA. Traditional IRAs work much like traditional 401 plans. You contribute money before you pay taxes. The 2021 maximum contribution limit for traditional and Roth IRAs is $6,000.

With a traditional IRA, the money you contribute is deducted from your taxable income for the year. When you reach retirement, the money is taxable as you withdraw it. A Roth IRA, however, works differently. You contribute money post-taxes. The money is then not taxable when you withdraw it in retirement. If you think you might want to keep contributing to your new IRA after the rollover is complete, its important to decide which type of IRA you want.

Its also important to consider the tax implications. If you have a traditional 401 plan, that means you didnt pay taxes on the money when you contributed it to your account. If you want to move that money into a Roth IRA, youll have to pay taxes on it. You can roll over from a traditional 401 into a traditional IRA tax-free. Same goes for a Roth 401-to-Roth IRA rollover. You cant roll a Roth 401 into a traditional IRA.

Don’t Miss: How Can I Lookup My 401k

Reasons You May Want To Wait To Roll Over Your 401

- Temporary ban on contributions. Some plan sponsors impose a temporary ban on further 401 contributions for employees who withdraw funds before leaving the company. You’ll want to determine if the gap in contributions will significantly impact your retirement savings.

- Early retirement. Most 401s allow penalty-free withdrawals after age 55 for early retirees. With an IRA, you must wait until 59 ½ to avoid paying a 10% penalty.

- Increased fees. IRA investors may pay more fees than they would in employer-sponsored plans. One reason: The range of more sophisticated investment options you may choose can be more expensive than 401 investments. Your advisor can help identify what extra cost a rollover may incur and if the benefits of the rollover justify those additional costs.

- Can take loans out. Your 401 may permit you to take out a loan from the account, but this is typically only for active employees. And you may have to pay in full any outstanding loan balances when you leave the company. You cannot take loans from IRAs.

How To Get Started With A Self

You can only open a standard IRA with most IRA providers, and you can only invest in the usual suspects: equities, bonds, and mutual funds/ETFs. Youll need a qualified IRA custodian that specializes in that type of account to start a self-directed IRA.

Not every SDIRA custodian has the same investing options. If youre looking for a specific asset, such as gold bullion, check sure its available from a potential custodian.

Because SDIRAs are self-directed, custodians are not permitted to provide financial advice.

As a result, traditional brokerages, banks, and financial firms rarely provide them to their customers. That implies you must complete your homework independently. If you require assistance in selecting or managing your investments, you should consult a financial counselor.

A list of IRS-qualified account custodians can be found on the website SelfDirectedIRA.

Recommended Reading: How To Use 401k To Invest

Putting Money Into A Self

Self-directed Roth IRAs provide access to a vast array of investing options. You can own assets that arent generally part of a retirement portfolio in addition to the standard investments .

You can, for example, invest in real estate and hold it in your SDIRA account. Partnerships, tax liens, and even a franchise firm might be held.

In self-directed IRAs, whether Roth or regular, the Internal Revenue Service prohibits a few specific investments. Life insurance, S corporation stocks, any investment that constitutes a prohibited transaction , and collectibles, for example, are prohibited.

Antiques, artwork, alcoholic drinks, baseball cards, memorabilia, jewelry, stamps, and rare coins are all examples of collectibles .

Consult a financial professional to ensure you arent breaking any restrictions by accident.

Invest Your Newly Deposited Funds

You’ll have to choose investments in your new IRA so your money can grow. Make sure to maintain an appropriate asset allocation given your age, and consider your risk tolerance.

Finally, when your new IRA has been opened, be sure to read up on common IRA mistakes to avoid, such as forgetting required minimum distributions, not designating beneficiaries, and trading too often in the account.

Recommended Reading: How Can I Get A 401k Plan Without An Employer

Got $1000 The 10 Top Investments Wed Make Right Now

Our team of analysts agrees. These 10 real estate plays are the best ways to invest in real estate right now. By signing up to be a member of Real Estate Winners, youâll get access to our 10 best ideas and new investment ideas every month. Find out how you can get started with Real Estate Winners by .