S To Take Now To Improve Your Retirement Readiness

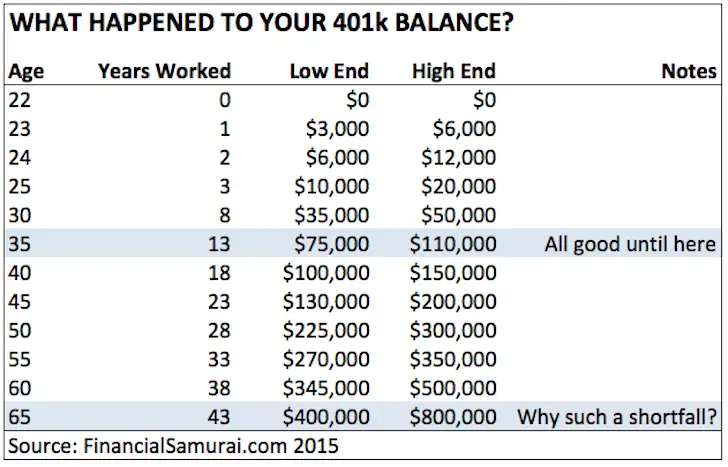

While the average 401k balance at pre-retirement age is around $600K, that balance still falls far below even the no growth column of the savings potential chart for the same age. And while $600,000 is no chump change, its also probably not enough to retire comfortably for most people.

Needless to say, many people are falling way below their savings potential. But the good news is, its not too late to turn things around.

How Much Money Do I Need To Retire At 40

Over the last decade, the “financial independence, retire early” movement has become one of the hottest mantras of the millennial generation. But the reality is that leaving the workforce in the prime of your life requires even higher investment contributions and more severe cost-cutting than you might think.

Wondering how much money do I need to retire at 40? Here’s what to know.

How Much Savings Should I Have At 40

By age 40, you should have saved a little over $175,000 if you’re earning an average salary and follow the general guideline that you should have saved about three times your salary by that time. … A good savings goal depends not just on your salary, but also on your expenses and how much debt you’re carrying.

You May Like: Can I Roll My 401k Into A Brokerage Account

What Should Your Net Worth Be At 40

Net Worth at Age 40 By age 40, your goal is to have a net worth of two times your annual salary. So, if your salary edges up to $80,000 in your 30s, then by age 40 you should strive for a net worth of $160,000. Additionally, it’s not just contributing to retirement that helps you build your net worth.

How Much Should I Have In Retirement At 40

How much should I have saved for retirement by age 40? The table below illustrates how much money should be saved in an annuity by age 40 to generate $50,000 per year and $100,000 per year guaranteed to start at retirement ages 60, 65, and 70. This table does not include Social Security Income.

Example: If you have saved $948,944 by age 40, the annuity will generate $100,000 annually for the rest of your life, starting at age 60.

Read Also: When Can You Withdraw From 401k Without Penalty

Two Favorite Real Estate Platforms

Fundrise: A way for accredited and non-accredited investors to diversify into real estate through private eFunds and eREITs. Fundrise has been around since 2012 and has consistently generated steady returns, no matter what the stock market is doing. For most investors, investing in a diversified portfolio is the best way to go.

CrowdStreet: A way for accredited investors to invest in individual real estate opportunities mostly in 18-hour cities. 18-hour cities are secondary cities with lower valuations. They also have higher rental yields, and potentially higher growth due to job growth and demographic trends.

Both platforms are free to sign up and explore.

Ive personally invested $810,000 in real estate crowdfunding across 18 projects. My goal is to take advantage of lower valuations in the heartland of America. My real estate investments account for roughly 50% of my current passive income of ~$300,000.

Follow my 401k savings by age guide. But in the meantime, also build a passive income portfolio so you can live a better life today. Given you cannot withdraw from your 401k without penalty until 59.5, it is your passive investment portfolio that matters even more.

How Much Should I Have Saved In My 401k By Age is a Financial Samurai original post.

Filed Under: Most Popular, Retirement

I spent 13 years working at Goldman Sachs and Credit Suisse. In 1999, I earned my BA from William & Mary and in 2006, I received my MBA from UC Berkeley.

Current Recommendations:

Set Limits On Helping Out Family

Many people become part of the sandwich generation in their 40s because they’re raising their own families while also trying to help their aging parents.

When you’re behind on your own savings goals, you need to set hard limits on how much you can afford to help with others’ expenses. If you want to help support your parents, then work the amount you can afford into your budget. Communicate with your parents and siblings about what they can expect from you.

You also need to prioritize your retirement savings over saving for your kids’ college education. This may be difficult, but your kids have more options for funding their education — such as financial aid, student loans, and working part-time — than you’ll have if you retire with little savings.

Read Also: Can I Transfer My 403b To A 401k

How Much Should I Really Have In My 401

Saving for a financially secure retirement is a long-term project with a sometimes indistinct final objective, especially when people are just starting in their careers. Retirement is far in the future at that point and key concerns such as career earnings, investment returns and post-retirement living expenses seem remote. One rule of thumb is that by age 30 people should have approximately a years salary in a 401 or other retirement account. Other benchmarks suggest more or less may be appropriate. If youd like some help planning for retirement you can find a financial advisor who serves your area with our free online matching tool.

401 Basics

One of the most common retirement savings vehicles is a 401 plan. These plans offer tax advantages and flexibility in investment choices. Employees contribute to these plans through payroll deductions. And many employers will match savers contributions. Combined with tax-deferred investment gains, these features allow 401 owners to build sizable balances over time.

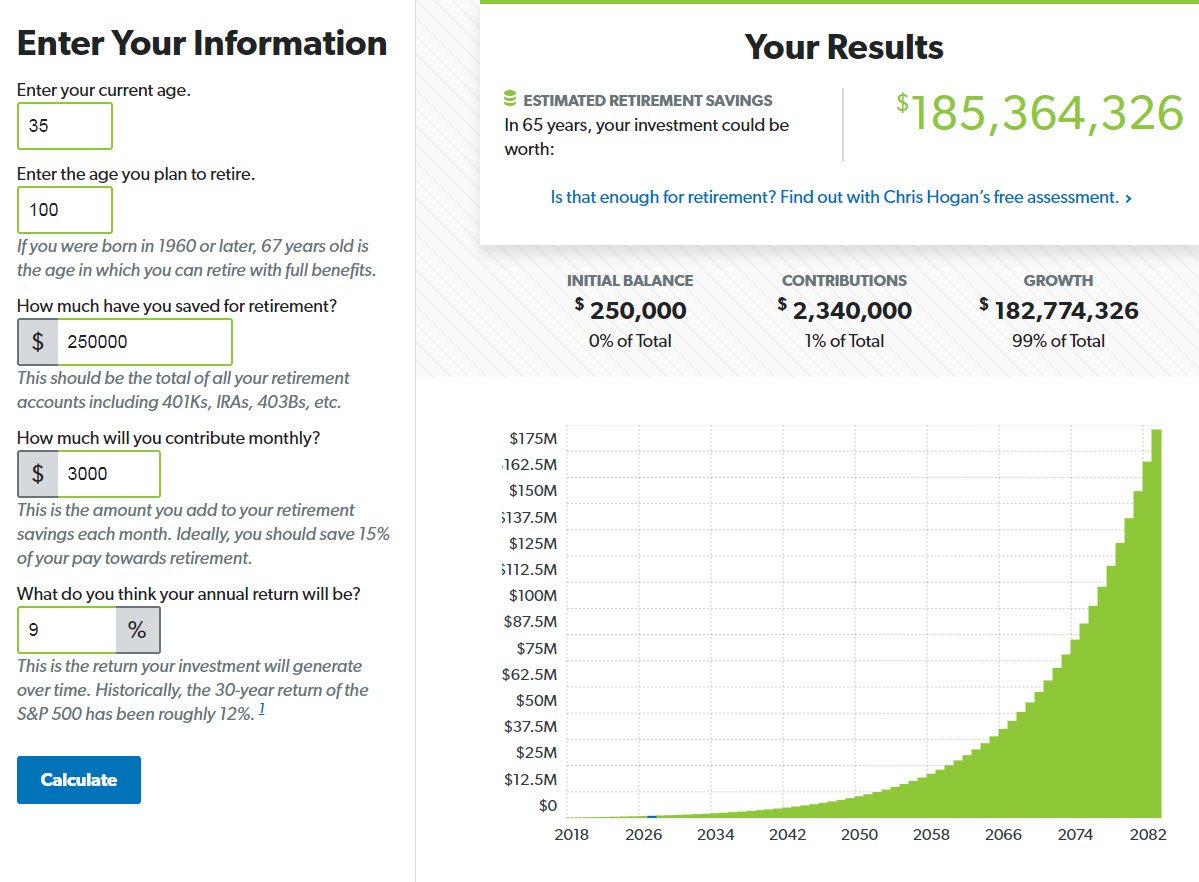

Whether a given balance will be adequate depends on a number of factors, including age at retirement, annual income, local cost of living, healthcare needs and projected expenses in retirement. To find out more on how a 401 can perform over time, you can use the SmartAsset 401 calculator.

What 30-Year-Olds Actually Save

Retirement Savings Benchmarks

Additional Retirement Saving Insights

Bottom Line

Tips on Saving for Retirement

How Much Do You Need To Retire Comfortably

Planning for retirement takes work, and unfortunately, many Americans are woefully under-prepared when it comes to the state of their savings. What you need to retire isnt about hitting a specific dollar amount, instead, youll want to be able to replace enough of your income to live comfortably. This suggestion isnt black and white because the standard of living looks different for each individual consider what it takes to live comfortably and maintain your lifestyle. Many experts suggest that youll need roughly 80% of your salary after retirement to avoid making sacrifices.

Create a post-retirement budget based on the lifestyle youd like to maintain. This will serve as a guideline that determines how much you might spend when you retire. In some cases, it may be beneficial to seek financial advice to make sure you are planning accordingly. Most people hope to enter their retirement years debt free, but for some, this wont be the case. You may need to consider these expenses:

- Monthly debt payments

- Replacement vehicles or repair

- Miscellaneous expenses like travel

What role will Social Security play in your income? Generally speaking, Social Security is designed to replace about 40% of the average seniors income. If youll need roughly 80% of your salary to live comfortably, its up to you to make up the remaining 40%. This may be where your 401k comes into play.

Read Also: How To See How Much 401k You Have

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

How Does Medical Consideration Affect Early Retirement

Early retirement means that you are forgoing some of the conventional retirement benefits because most of them are not available for retirees under the age of 65.

One of these benefits is Medicare entitlement, except you are a young person with terminal illness or disabilities, then you cannot apply for Medicare entitlements at a very young age. So, to retire early, you have to factor in other ways for affordable medical insurance.

Even with the best health insurance policy, medical expenses can still pile up quickly because you have to factor in dental, vision, and hearing disorder fees.

Recommended Reading: How To Buy Gold In Your 401k

What Percentage Of My Income Should I Contribute To My 401

You can use the 401 calculator to get straightforward, dollars-and-cents answers to many important questions about your retirement. When it comes to how much you ought to be saving, however, things arent quite so simple. It depends on your age, how many years you plan to work and, ultimately, on the kind of lifestyle you want to have after you retire.

Some advisors recommend saving 10-15% of your income as a general rule of thumb. If you save that much from the time you first start working in your 20s until you retire, that may be fine. If youre starting your retirement savings later in life, however, you will want to save more than that to try to catch up. While there are few hard and fast rules on exactly how much you should save, here are some general guidelines:

Make A Budget For Retirement Savings

Customizing your retirement budget is easy with Mint!

Most of us look forward to our retirement years where the money weve worked so hard for is now working for us. A 401k is one way to achieve a nest age, so its important to take advantage of this benefit if your employer offers it. Planning for a comfortable retirement takes time, due diligence, and budgeting. Its important to consider your future lifestyle and know where you stand financially, so you dont have to worry when you reach your golden years. As this material has been prepared for information purposes only, you should consult your tax advisor before making any financial decisions.

You May Like: Can You Take From 401k To Buy A House

How Do You Get On Track

If you’re not setting aside 10 to 15 percent of your income or you don’t have the equivalent of three times your salary saved by age 40, don’t panic. There are strategies you can use that will help you get to, or nearer to, where you need to be.

First things first: “When you are hired with an employer, make sure that you are inquiring about 401 benefits,” says Taylor. “Find out what kind of 401 they have and make sure you get enrolled as soon as you’re eligible. A lot of employers will automatically enroll you, but you can always proactively enroll.”

Next, find out if your company offers a 401 match. If they do, take full advantage of it, says Taylor: “If there is a match that’s 3 percent, make sure that you’re saving at least 3 percent. Otherwise, you’re leaving free money on the table.”

Another useful tool you may have access to is “auto-increase,” which allows you to choose the percentage you want to raise your contributions by and how often. This way, you won’t forget to up your contributions or talk yourself out of setting aside a larger chunk when the time comes.

Most importantly, start setting aside money now. “It’s harder to catch up if don’t save,” says Taylor. “If you spend the first half of your career not saving, you’ve got to do a lot of catch up later in your career and you don’t have the time in the market to ride out any fluctuations. It’s always a good idea to get started as early as possible.”

Retirement Savings In Your 20s

Fresh out of college or other post-secondary education, you are probably starting out with an entry-level job in your 20s.

If you are aiming for a traditional retirement age of 65, your investment timeframe could be up to 40 years or more at this point, which is great.

Start saving if you can. However, if you are carrying high-interest debt , my advice is to pay that off first.

Thereafter, focus on building an emergency fund thatâs equivalent to 3-6 months of your expenses. Use a high-interest saving account to hold your emergency funds so you can easily access them if needed.

If your employer offers a retirement or pension plan and offers to match your contributions, take them up on the offer.

Personally, I saw my 20s as an opportunity to get an education, develop marketable skills, and invest in myself. It was a time for taking risky bets that would eventually make it possible for me to earn a decent income later on.

If you end up with limited savings in your 20s, donât fret. Thereâs still time to catch up.

Recommended Reading: Can I Keep My 401k With My Old Employer

How Much Should You Be Saving

The answer to this is highly personal and depends on your lifestyle and spending habits, but there are a few basic guidelines to follow if you want to retire comfortably.

For starters, Fidelity suggests that everyone set aside 15 percent of their income in a retirement account. “We believe if you save 15 percent throughout your career you will have enough to maintain your lifestyle in retirement,”Katie Taylor, VP of thought leadership at Fidelity Investments, tells CNBC Make It.

That 15 percent can include any matching contributions from your employer, she says.

Other experts, including co-founder of AE Wealth Management David Bach, say that if you set aside at least 10 percent of your income, you’ll set yourself up to be fine. Of course, more is better: Bach adds that if you want to retire “rich,” save 15 to 20 percent.

Another rule of thumb, according to Fidelity, is to have 10 times your final salary in savings if you want to retire by age 67. It suggests a timeline in order to get to that magic number:

- By age 30: Have the equivalent of your starting salary saved

- By age 35: Have two times your salary saved

- By age 40: Have three times your salary saved

- By age 45: Have four times your salary saved

- By age 50: Have six times your salary saved

- By age 55: Have seven times your salary saved

- By age 60: Have eight times your salary saved

- By age 67: Have 10 times your salary saved

Anything Else I Should Know

Yep. A few things, actually.

Once you contribute to a 401, you should consider that money locked up for retirement. In general, distributions prior to age 59½ will be hit with a 10% penalty and income taxes.

If you leave a job, you can roll your 401 into a new 401 or an IRA at an online brokerage or robo-advisor. The IRA can give you more control over your account and allow you to access a larger investment selection.

401s typically force you to begin taking distributions called required minimum distributions, or RMDs at age 72 or when you retire, whichever is later. You may be able to roll a Roth 401 into a Roth IRA to avoid RMDs.

You May Like: Can A Sole Proprietor Have A Solo 401k

With No Savings How To Retire A Millionaire

5 Minute Read | November 16, 2021

Heres something you may not have thought about when you celebrated your 40th birthday: Youre almost as close to traditional retirement age as you are to your high school graduation.

Its true! The year most of us turn 41, were mid-way between receiving our high school diploma and receiving our gold watch .

If that thought stirs a bit of fear in your heart, youre not alone. The Employee Benefits Research Institute reports that 37% of all employees age 3544 and 34% of employees age 4554 have less than $1,000 saved for retirement. If youre one of those folks, youve got your work cut out for you if you want to build a $1 million retirement nest egg. Maybe youve already decided its out of your reach.

Dont give up hope yet! Even if youre 40 years old with nothing saved for retirement, it is possible to reach your $1 million retirement goaland it might be easier than you think.