Advantages And Disadvantages Of A Co

Your circumstances may have other reasons that make a qualified joint venture preferred. However, the three most universal reasons are:

Solo 401k Plan Also Known As Owner

A sole proprietor with no employees has the option of establishing a solo 401k plan . While owner-only 401 plans have been available since the inception of the 401 plan, the self-employed saw no reason to open a solo 401k over a SEP IRA or SIMPLE IRA until the Economic Growth and Tax Relief Reconciliation Act of 2001 was passed. The new law changed the way deferrals are included in determining the employers deductible contribution, resulting in higher contribution amounts. Some of the other benefits of the solo 401k over the other types of self-employed plans include the ability for the business owner to process a solo 401k participant loan from the plan as well as the option to make both Roth designation account contributions as well as after-taxa contributions. To learn more about the solo 401k .

Should I Defer My Salary

A deferred comp plan is most beneficial when youre able to reduce both your present and future tax rates by deferring your income. The key is, the longer you have until receiving the deferred income, the smaller amount you should defer unless its apparent there is a tax benefit to deferring more significant amounts.

Also Check: Can You Do A Partial 401k Rollover

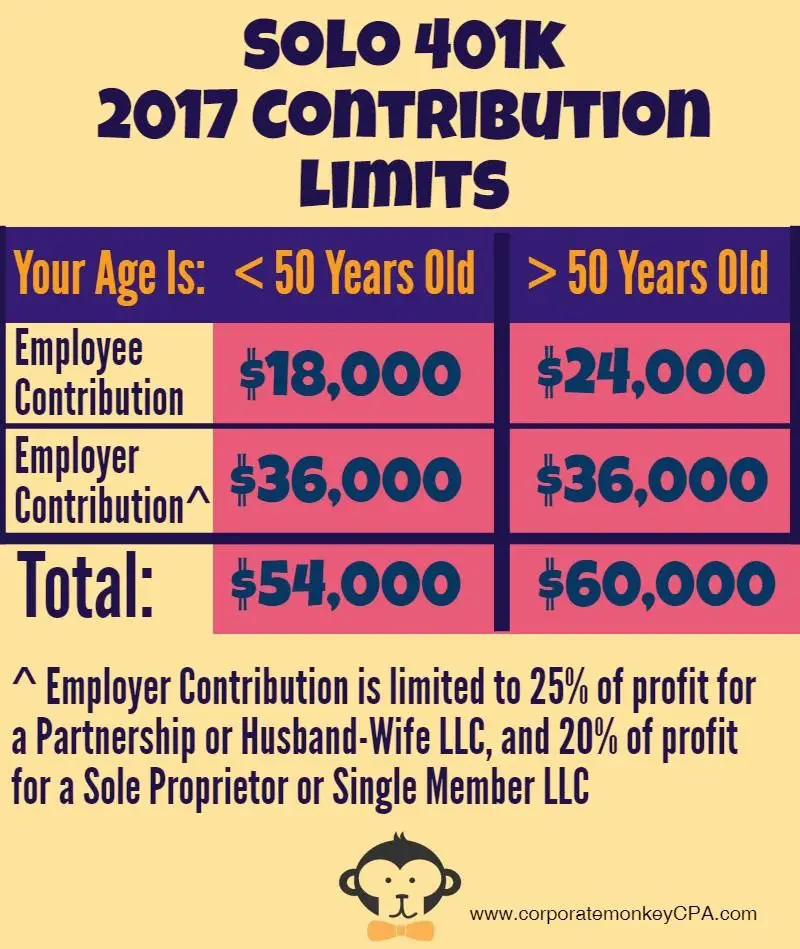

What Are The Contribution Levels And Limits Of A Solo 401

To take full advantage of contributions to a Solo 401 plan you must understand your limits as an employee and employer, as well as contributions allowed on behalf of a spouse if applicable.

When contributing as the employee, you are allowed up to $19,500 or 100% of compensation in salary deferrals for tax years 2020 and 2021. If you are over 50, an additional $6,500 catch-up contribution is allowed for tax years 2020 and 2021. This is the type of contribution that can be made as pre-tax/tax-deferred or Roth deferral or a combination of both. Additionally, as the employer, you can make a profit-sharing contribution up to 25% of your compensation from the business up to $57,000 for tax year 2020 and $58,000 for tax year 2021. When adding the employee and employer contributions together for the year the maximum 2020 Solo 401 contribution limit is $57,000 and the maximum 2021 solo 401 contribution is $58,000. If you are age 50 and older and make catch-up contributions, the limit is increased by these catch-ups to be $63,500 for 2020 and $64,500 for 2021.

Compensation from your business can be a bit tricky. This is calculated as your business net profit minus half of your self-employment tax and the employer plan contributions you made for yourself plan). The limit on compensation that can be factored into your tax year contribution is $285,000 for 2020 and $290,000 for 2021.

See Our Complete Guide To The Best Retirement Plan For Independent Workers

- Individual 401 plans allow you to start taking deductions after you turn 59.5 years old.

- You cannot employ any full-time employees and have a solo 401.

- In 2021, an employee can contribute up to $19,500 in one year, assuming you’re under 50 years old.

- Annual or maintenance fees for solo 401 plans usually run between $20 and $200, and they are tax deductible.

The number of people who run their own business continues to trend up. The most recent data from the Bureau of Labor Statistics found that 9.6 million people worked for themselves in 2016. That is projected to increase to 10.3 million by 2026.

Working for yourself may give you the ability to make more money than you would working for someone else, but it also means you need to have your own retirement plan in place. One of the most popular retirement plans for independent workers is a self-employed 401. We spoke to two financial experts to find out how these retirement plans work.

Logan Allec, CPA and owner of the personal finance site Money Done Right, and Adam Bergman, a trained tax attorney and president of IRA Financial Trust and IRA Financial Group, offered their insights about these plans, including the maximum contributions, taxes, investments and fees.

Editor’s note: Looking for the right employee retirement plan for your business? Fill out the below questionnaire to have our vendor partners contact you about your needs.

You May Like: Do I Have A 401k Or Ira

No Employees In Other Businesses

If you have a business that fits the qualification guidelines for Solo 401, you may not be eligible, however, if you or certain family members have ownership in other businesses that do have employees. The IRS defines a Controlled or Affiliated Service Group. If the same 5 or fewer owners have either 80% ownership or more than 50% effective control of one or more businesses, then those businesses are looked at as being one for purposes of plan qualification. If any business within such a group has employees, then all businesses within the group are treated as if they have employees.

When Are Contribution Deadlines For A One

You must establish an owner-only 401 plan by the last day of your business tax year, but no later than Dec. 31 of the year for which contributions will be made. For 2022, you must have established your one-person 401 plan by December 31, 2021 and make your employee contribution elections by the end of the calendar year. Employer contributions must be made by the due date of your business tax return plus extension.

Read Also: When Can You Use Your 401k

How Do You Start One Of These 401 Plans

Bergman says you first need to select a provider. One of the most common ways to establish one of these plans is to go through a bank. You usually aren’t charged a fee for these, but your investment options are limited to the financial products the bank or financial institution sells. You can also go through a brokerage. In addition, there are self-directed solo 401 plan document providers, which do not sell investments and will allow you to establish a self-directed solo 401 plan to make alternative asset investments, such as real estate, as well as gain access to all other available plan options, such as Roth contributions and a $50,000 loan option.

Why Does A Sole Proprietor Need To Get An Ein

In most cases, a sole proprietor does not need to get an EIN. Usually, it is totally acceptable for a sole proprietor to use his or her social security number in the place of any other tax identification number.

However, there are some times when a separate number is necessary. In fact, in some instances, having a separate EIN for ones business may even be preferable. Read on to get a rundown of when having a separate EIN is required and makes sense for your sole proprietorship.

When It Is Required

A sole proprietor must get a separate EIN for a business if any one of these things are true:

- That individual wants to hire employees, wants to open a Keogh or solo 401, or chooses to file for bankruptcy protection.

- When that individual plans to purchase an existing business and operate it as a sole proprietorship

- When a partnership or limited liability corporation is formed, or incorporated.

Finally, while not required by the federal government, some banks will not allow you to open a bank account in your business name if you do not have a separate EIN.

When It May Be Preferable

No matter where your sole proprietorship falls on this scale, you can find everything you need to get your status set at www.irs-ein-tax-id.com.

Member of NSTP

Also Check: How Do I Cash Out My 401k After Being Fired

Also Check: Can I Manage My Own 401k

Sole Proprietorship Solo 401k Contributions

A sole proprietorship is the most common business structure. Thats probably because its the easiest structure to use! A sole proprietorship means a single owner. As a sole proprietor, you might do business under your own name, or you could have a DBA fictitious business name. You might have an employer identification number for your business, or you might use your social security number.

Once your business is generating revenue, you can start contributing to a retirement plan. The easiest way to do this is to setup a Self-directed Solo 401k plan.

What Is Best Retirement Plan For Sole Proprietor

As a sole proprietor, you generally can choose between two kinds of tax-advantaged plans the SEP IRA and the individual 401 to save for retirement. If your goal is simplicity and ease of administration, the SEP may be the answer.

A sole proprietor with no employees has the option of establishing a solo 401k plan . To learn more about the solo 401k CLICK HERE.

Recommended Reading: Can You Have A Roth Ira And A 401k

Can A Partnership Open A 401k

An individual who wants to participate in an IRA for solo contributions needs to complete self-employment activities. Thus, a self-employed business owner or business partner, a limited liability company , or any other type of corporation, which may include a Subchapter S corporation, are eligible for a self-directed 401k plan.

Solo 401 Vs Sep Ira Contribution Example

Consider John Smith who, in addition to his regular corporate salary, earns $150,000 of consulting income. The consulting income is earned and paid to his business, John Smith LLC, which files as a sole proprietorship. John wants to save more dollars from this consulting income in a tax-advantaged way. The below compares the total contribution possible with an SEP IRA vs. a Solo 401 plan:

Recommended Reading: Is A 401k Worth It Anymore

What Is The Process To Secure A Small Business Loan Using The Individual 401k

Who Should Choose A Solo 401 Instead Of A Sep Ira

The conventional wisdom regarding the Solo 401 vs SEP IRA question is that self-employed people should choose the Solo 401 because in most cases, the potential tax savings are higher.

The primary question many taxpayers ask when deciding between a SEP and a Solo 401 is What is the maximum I can contribute? In most cases, the Solo 401K allows for a greater contribution and tax deduction, especially in cases where the individuals self-employment income is limited, says Dave Cherill, a certified public accountant and member of the American Institute of CPAs Personal Financial Planning Executive Committee.

But thats not the only reason to pick a Solo 401. Solo 401s also offer features more on par with other employer-sponsored retirement plans that SEP IRAs lack: You can, for example, generally take out a loan from your Solo 401 equal to the lesser of $50,000 or 50% of your account balance. Solo 401s also offer catch-up contributions for people 50 and older as well as a Roth option, which lets you pay income tax now in exchange for tax-free withdrawals in retirement.

I would say that the biggest benefit of all is the Roth option, says Desmond Henry, a certified financial planner based in Topeka, Kan. For someone who is a high earner, the Solo makes sense because of the Roth option.

Also Check: Can Anyone Have A 401k

How To Open A Sep Ira

Nearly all brokerage firms offer SEP IRAs, and in most cases they can be opened online. A formal written agreement is required, known as IRS Form 5305-SEP, but the brokerage will usually take care of that. Opening fees and annual fees are often zero.

You can benefit from SEP IRA tax breaks for a given tax year by opening your account by your annual tax filing deadline, which is usually in mid April.

When opening an account, be sure to note minimum investment requirements and investment options. While SEP IRAs usually have a broader range of choices than 401 accounts, the choices are more limited than those available in a standard brokerage account.

What Fees Are Associated With A Solo 401

Annual or maintenance fees for these plans, according to Allec, usually run between $20 and $200. You’ll pay the least if your needs are simple you don’t have any employees besides yourself, there’s no rollover and you’re OK with investing in a budget brokerage firm’s products. If you have more interesting investment appetites, another provider can accommodate those. These providers usually charge higher fees to maintain your plan, but you also have more flexibility with your investment and plan options.

Don’t Miss: Is Roth Better Than 401k

How A Solo 401 Works

Solo 401s are available only to self-employed workers with no employees, with an exception for business owners who employ their spouses. To open one of these accounts, you must have an employer identification number , which you can get from the U.S. Internal Revenue Service .

You’re allowed to make two types of contribution to your solo 401: an employee contribution and an employer contribution. Your employee contribution limit is the same as the 401 contribution limit for any traditionally employed worker — $19,500 in 2021, or $26,000 if you’re 50 or older. These rates increase in 2022 to $20,500, or $27,000 if you’re 50 or older.

If you’d like to contribute more than this, you can make additional contributions as an employer, but this calculation is a little more complicated. You may contribute up to 25% of your net self-employment income for the year. That is all the money you’ve earned from your business minus any business expenses, half of your self-employment taxes, and the money you contributed to your solo 401 as an employee contribution.

Only the first $290,000 in net self-employment income counts for the year, and the total amount you may contribute to your solo 401 as employee and employer in 2021 is $58,000, or $64,500 if you’re 50 or older. In 2022, those increase to $61,000, or $67,500 if you’re 50 or older.

Other Financial Benefits Of A Solo 401

The solo 401 can be an excellent choice for those with a side gig as well, especially if theyre already able to live comfortably on their main salary. With the solo 401 you can go above the usual limits of a 401.

While you may contribute to multiple 401 accounts, your total employee contribution to all types of 401s may not exceed the annual maximum contribution, that is, $19,500 in 2020 and 2021.

But the solo 401 can be valuable even if you already have a 401 plan and even if youve maxed out that other plan for a given year. Thats because you can still make an employer contribution, allowing you to exceed the smaller employee-only contribution amount. So the solo 401 allows you to save more with the employer contribution, reducing your business taxes.

Another benefit of the solo 401 is that it doesnt prevent you from taking advantage of other retirement plans such as the IRA. You can still contribute up to the annual maximum there. If youre an individual looking to set up a traditional IRA or Roth IRA, then youll want to look at the benefits of those plans.

Like the typical 401 plan, the solo 401 also allows you to take out a loan against your account. loan.)

While I generally encourage clients to avoid that strategy, it can come in handy at times, Conroy says.

Read Also: How Many Days To Rollover 401k

When I Receive An Individual 401k Loan Do I Have To Pay Interest

Yes. Loan payments are made monthly or quarterly and each loan payment will consist of principal and interest. Generally, the loan interest rate charged is the Prime Rate plus 1% or 2%. The interest rate depends on the 401k providerâs plan document. An Individual 401k loan is unique because the payments of principal and interest are paid back directly to your own Individual 401k plan.

A World Of Investment Opportunities

With a Solo 401k Plan, you will be able to invest in almost any type of investment opportunity that you discover. Your only limit is your imagination. The income and gains from these investments will flow back into your Solo 401k) Plan completely tax-free. Making investments with your plan are fast and simple. As trustee of the Solo 401k Plan, you gain complete control over your retirement assets. This allows you to make alternative investments and traditional investments tax-free and without a custodian.

Also Check: How To Find Your 401k