Why Roth Ira Is Bad

Roth IRAs may seem ideal, but they have their drawbacks, including a lack of direct tax deductions and a low maximum contribution. In the world of retirement accounts, the Roth IRA is the child of choice. Whats not to love about tax-free growth on your retirement savings?

What are the disadvantages of a Roth IRA? One major drawback: Roth IRA contributions are made on an after-tax basis, meaning there is no tax deduction in the year of contribution. Another drawback is that withdrawals of account earnings must not be made before at least five years have elapsed since the first contribution.

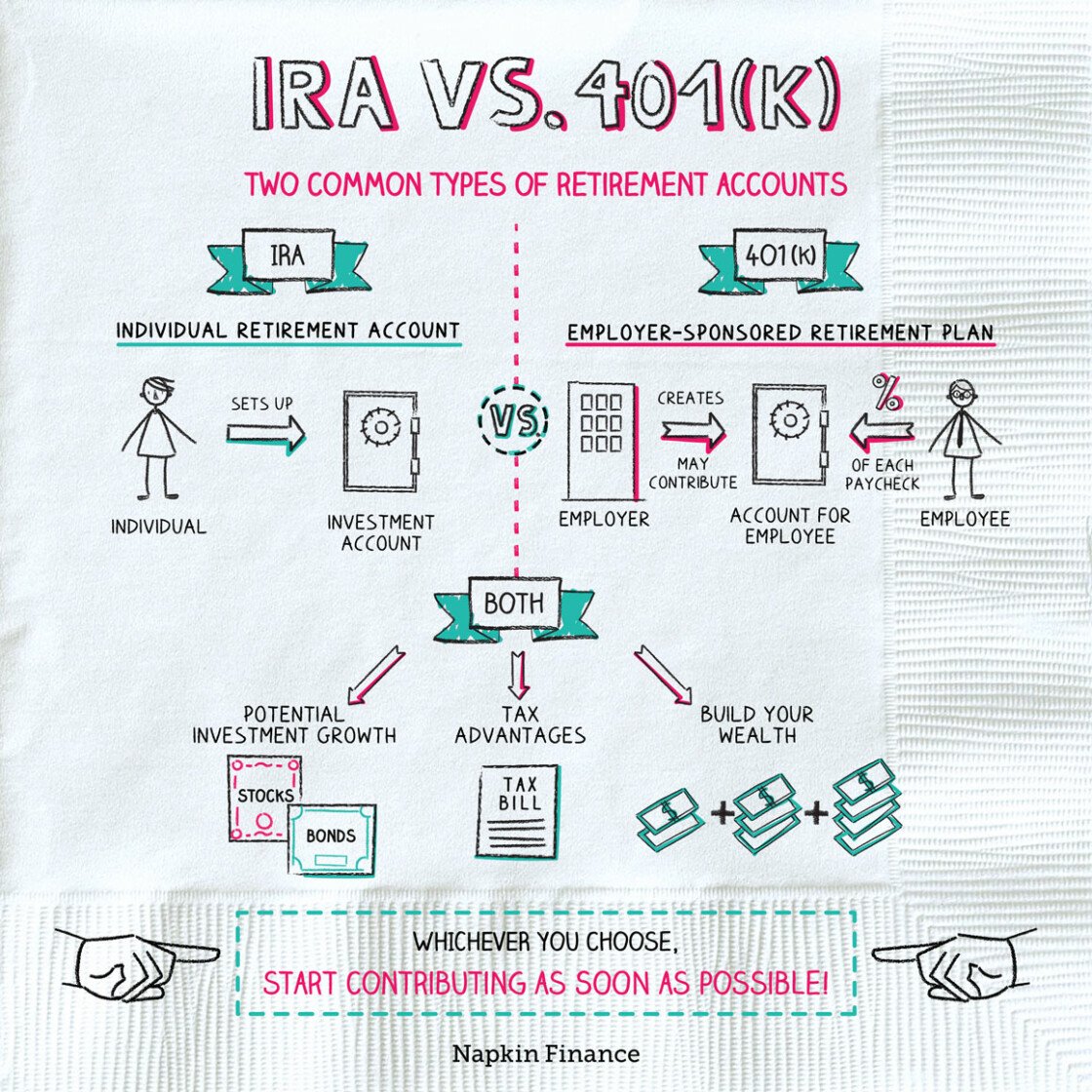

The Differences Between An Ira And A 401

401s are employer-sponsored retirement plans that are part of an employee’s benefits package. Many employers will match your 401 contributions up to a certain percentage or dollar amount. In most cases, your 401 is held at an investment firm of your employer’s choice and may have certain investment options.

IRAs

Based on your situation, you can determine whether to continue adding money to your 401 and/or open an IRA. You can open an IRA at most banks and investment firms. These accounts are not tied to your employer and are transferable between institutions. Though there are some limitations, most people can fund an IRA.

IRAs may also allow you more flexibility in your investment choices, since you’re able to choose the firm you invest with as well as the types of investments that make sense for you.

What Is The Max I Can Contribute To My 401k

For 2021, your individual 401 contribution limit is $ 19,500, or $ 26,000 if you are 50 years or older. By 2022, 401 contribution limits for individuals are $ 20,500, or $ 27,000 if you are 50 or older. These individual limits are cumulative over 401 plans.

| $ 197,322 | $ 69,097 |

How much money does the average person have in their 401K when they retire? The average 401 balance is $ 106,478, according to Vanguards 2020 analysis of over 5 million plans. But most people have not saved so much for retirement. The median 401 balance is $ 25,775, a better indicator of what Americans have saved for retirement.

Don’t Miss: What Is My Fidelity 401k Account Number

Can You Contribute 5500 To Both Roth And Traditional Ira

For 2018, 2017, 2016 and 2015, any contributions you make each year to all your old IRAs and Roth IRAs may not exceed: $ 5,500 , or. If less, your annual tax return.

Can you contribute 6000 to multiple ROTH IRAs?

There is no limit to the number of IRAs you can have. You may already have multiple types of IRA types, which means you can have multiple Roth IRAs, SEP IRAs and traditional IRAs. There are Roth IRAs and traditional IRAs, which are $ 6,000 in 2021 and 2022 .

Can you contribute to multiple ROTH IRAs?

â How many Roth IRA accounts can I have? â You can have more than one Roth account. Therefore, the total amount of your donations should not exceed the maximum donations for each year.

Prev Post

Early 401 Withdrawal Rules

Early withdrawals are those that are taken from a 401 before you reach age 59 1/2. They’re taxed as ordinary income. They’re also subject to an extra 10% penalty, but there are some exemptions to this rule. You can take the money penalty-free if you’re totally and permanently disabled, if you lose your job when you’re at least age 55, or under the terms of a qualified domestic relations order after a divorce.

You can also use 401 money to pay for medical expenses that exceed 7.5% of your modified adjusted gross income , as long as your insurer doesn’t cover them. In other words, they came out of your own pocket.

Not only will you lose a good chunk of your savings to taxes when you make an early withdrawal, but you’ll also miss out on the growth that would have been made on the withdrawn amount.

Some 401 plans allow for hardship distributions, but these often must be approved by your employer. They have to be made for purposes of meeting a significant, immediate need. They also can be no more than the amount necessary to meet that need.

Recommended Reading: How To Find Your Lost 401k

Pros And Cons Of Rolling Over 401k To Ira

Learn the pluses and the minuses of getting all of your IRA and 401k ducks in a row.

According to the Bureau of Labor Statistics, on average, individuals between the ages of 18 and 52 may change jobs as frequently as 12 times. Some of those jobs probably came with some type of employer sponsored retirement plan such as 401k or an IRA account . When switching jobs, many people choose to rollover any accounts to their new employers plan rather than taking them as a withdrawal. When you roll over a retirement plan distribution, penalties and tax are generally deferred. So let’s look at a few of the pros and cons of consolidating them into one IRA with one institution.

How Much Can I Contribute To A 401 And Simple Ira

In 2022, the contribution limit for traditional 401 plans is $20,500, with an additional catch-up contribution of $6,500 for plan participants who are age 50 and older.

The contribution limit for SIMPLE IRA plans is $14,000 for 2022. Participants who are age 50 and older may make catch-up contributions up to $3,000, if the plan permits it. If an employee participates in any other employer retirement plan during the year, the total amount of contributions that they can make to all plans is limited to $20,500.

Also Check: How To Find Out If You Have A 401k Account

The Option To Convert To A Roth

An IRA rollover opens up the possibility of switching to a Roth account. s, a Roth IRA is the preferred rollover option.) With Roth IRAs, you pay taxes on the money you contribute when you contribute it, but there is no tax due when you withdraw money, which is the opposite of a traditional IRA. Nor do you have to take required minimum distributions at age 72 or ever from a Roth IRA.

If you believe that you will be in a higher tax bracket or that tax rates will be generally higher when you start needing your IRA money, switching to a Rothand taking the tax hit nowmight be in your best interest.

The Build Back Better infrastructure billpassed by the House of Representatives and currently under consideration by the Senateincludes provisions that would eliminate or reduce the use of Roth conversions for wealthy taxpayers in two ways, starting January 2022: Employees with 401 plans that allow after-tax contributions of up to $58,000 would no longer be able to convert those to tax-free Roth accounts. Backdoor Roth contributions from traditional IRAs, as described below, would also be banned. Further limitations would go into effect in 2029 and 2032, including preventing contributions to IRAs for high-income taxpayers with aggregate retirement account balances over $10 million and banning Roth conversions for high-income taxpayers.

But this can be tricky, so if a serious amount of money is involved, its probably best to consult with a financial advisor to weigh your options.

Move Over To Another 401k

As long as youve been offered another job with a 401k, you should be able to roll over your balance to the next employers plan.

What youll want to do then is engage in a direct rollover so you arent charged penalties or fees.

A direct rollover is done by getting a 401k account address from your new employer and sending it to your former employer so you can get the entire balance transferred over.

Don’t Miss: Can You Withdraw Your 401k If You Quit Your Job

What Is The Biggest Advantage Of A Roth Ira

Roth IRAs offer several key benefits, including tax-free growth, tax-free withdrawals in retirement, and no minimum distribution required, but they also have their drawbacks. One major drawback: Roth IRA contributions are made on an after-tax basis, meaning there is no tax deduction in the year of contribution.

Are there any tax advantages to a Roth IRA?

There are many advantages to keeping your money in a Roth IRA. Roth IRAs offer tax-free growth on both contributions and income earned over the years. If you play by the rules, you will not pay taxes when you take the money.

What is the main advantage of a Roth IRA?

A Roth IRA is a retirement savings account that allows your money to grow tax-free. You fund Roth with after-tax dollars, meaning youve paid taxes on the money you put in. In return for no upfront tax deductions, your money grows and grows tax free, and when you withdraw in retirement, you pay no taxes.

What Is A Simple 401 Plan

The SIMPLE 401 plan offers a cost-effective way for small businesses to offer retirement benefits to employees. It is a qualified plan and must follow the rules for required distributions. However, SIMPLE 401 plans are not subject to annual nondiscrimination testing. Contributions are immediately vested , which means that an employee who meets the requirements to receive distributions from the plan may withdraw their entire account balance at any time. Also, the annual contribution limits are lower for a SIMPLE 401 plan than for a traditional 401 plan.

SIMPLE 401 plans have a few stipulations that employers and employees must follow:

- Eligible employers must have no more than 100 employees.

- Employees must have received at least $5,000 in compensation from the employer for the previous year.

- Employers cannot maintain any other qualified retirement plan for employees who are eligible to participate in the SIMPLE 401. A second plan may be offered to employees who are not eligible.

- Employers must make either a matching contribution of up to 3 percent of an employee’s pay or a 2 percent non-elective contribution based on employee’s pay.

Don’t Miss: How To Pull Out 401k

Taxes With 401k Or Traditional Iras

No matter the type of retirement account you choose to open, there will likely be associated tax questions. At H& R Block, were here to help. With many ways to file your taxes with H& R Block, you can opt for in-office or virtual tax preparation, keeping all tax laws related to retirement savings accounts in mind, we can make sure youre producing an accurate tax return that maximizes allowable tax deductions.

Not in need of tax preparation at the moment? Read more about taxes on retirement income, pensions and annuities.

Related Topics

If youve contributed too much to your IRA for a given year, youll need to contact your bank or investment company to request the withdrawal of the excess IRA contributions. Depending on when you discover the excess, you may be able to remove the excess IRA contributions and avoid penalty taxes.

Did you sell property over the past tax year? Find out from the experts at H& R Block how to calculate cost basis for your real estate.

Iras Are Easier To Obtain

While the IRA and 401 share many similarities, the IRA is easier to obtain. If you have earned income in a given year, then you can contribute to an IRA. You can set them up at many financial institutions, including banks and online brokerages. And if you open an IRA online, you can do it in 15 minutes or less.

Thats not the case with a 401 plan, which is created and sponsored by your employer. If your employer doesnt offer the plan, then you simply wont have the option, though youll still have the possibility to open an IRA.

In addition, an employer may have a waiting period for its 401 plan. New employees may have to wait a period to join up to six months or a year in some cases, says Burke.

Thats not the case for IRAs, which can be opened at any time.

Don’t Miss: How Much Money Can I Contribute To My 401k

Ira Deduction Limits For 2021

If you save with both a 401k and a traditional IRA, you may also face some limits on your ability to deduct your contributions depending on your income. Contributions to a Roth are never deductible.

For instance, if you are covered by a retirement plan at work:

- You can deduct up to the contribution limit, if youre single and your modified AGI is $66,000 or less for 2021. You can take a partial deduction if your income is between $66,000 and $76,000 in 2021. Theres no deduction for people who earn more than $76,000 in 2021.

- If youre married and filing jointly, you can deduct the full amount if your modified AGI is $105,000 or less in 2021. You can take a partial deduction if your income is between $105,000 and $125,000 in 2021. Theres no deduction if you earn more than $125,000 in 2021.

Deducting your contributions is always an added bonus, but keep in mind even that if youre above the limit to make a contribution and reduce your taxes, there are alternative and potentially better strategies to explore than the nondeductible Traditional IRA.

Is A Roth Better Than A Traditional Ira

In general, if you think you will be in a higher tax bracket when you retire, a Roth IRA may be a better choice. Youll pay taxes now, at a lower rate, and withdraw tax-free funds in retirement when youre in a higher tax bracket.

Why traditional IRA is better than Roth?

The biggest difference between a Roth IRA and a traditional IRA is how and when you get tax breaks. Contributions to a traditional IRA are tax-deductible, but withdrawals at retirement are taxable. In comparison, contributions to a Roth IRA are not tax-deductible, but withdrawals in retirement are tax-free.

What is the downside of a Roth IRA?

One major drawback: Roth IRA contributions are made on an after-tax basis, meaning there is no tax deduction in the year of contribution. Another drawback is that withdrawals of account earnings must not be made before at least five years have elapsed since the first contribution.

Don’t Miss: How To Find Out 401k Balance

Is It Better To Contribute To 401k Or Roth 401k

The biggest benefit of a Roth 401 is this: Because youve already paid taxes on your contributions, any withdrawals you make in retirement are tax-free. On the other hand, if you have a traditional 401, you must pay taxes on the amount you withdraw based on your current tax rate at retirement.

Is it better to contribute to Roth 401k or Roth IRA?

Roth 401s tend to be better for those who earn higher, have higher contribution limits, and allow employer matching funds. Roth IRAs allow your investment to grow longer, tend to offer more investment options, and allow for easier early withdrawals.

What Is A Roth Ira

A Roth IRA is a retirement savings account you can open yourself. Unlike a 401, you contribute to a Roth IRA with after-tax money. When you hear the word Roth, think happybecause a Roth IRA allows your savings to grow tax-free. And when you celebrate turning 59 1/2, you can withdraw money from your account tax-free!

An IRA is a great option for people who are self-employed or who work for small businesses that dont offer a 401 plan. And if you do have a 401, you could save extra money and diversify your investments by opening an IRA.

You May Like: What Percent To Put In 401k

Eligibility And Contribution Limits

There are no modified adjusted gross income limits for saving to a 401, so you can make use of this type of account, no matter how much or how little money you earn. You might not be able to save the full amount allowed each year to a Roth IRA, or you may not be able to contribute at all if you earn above certain MAGI limits.

The amount of your contribution also depends on your income tax filing status.

| 2022 Roth IRA Income Limits | ||

|---|---|---|

| If Your Filing Status Is: | And Your MAGI Is: | |

| $10,000 | Zero | |

| Single, head of household, or married filing separately, and you didnât live with your spouse at any time during the year | < $129,000 | Up to the limit |

| Single, head of household, or married filing separately, and you didnât live with your spouse at any time during the year | $129,000 but < $144,000 | A reduced amount |

| Single, head of household, or married filing separately, and you didnât live with your spouse at any time during the year | $144,000 | Zero |

The IRA contribution limit for 2021 is $6,000. Itâs $7,000 if youâre 50 or older. These limits will remain the same in 2022. Subtract from your MAGI one of three amounts to figure out the amount of your permitted reduced contribution in 2022:

- $204,000 if youâre married and filing a joint return or are a qualifying widow or widower

- $0 if youâre married and filing a separate return, and you lived with your spouse at any time during the year

- $129,000 if you have any other filing status

Simple Retirement Plans For Small Businesses

Savings Incentive Match Plan for Employees plans are designed for businesses with 100 employees or fewer who earn $5,000 or more per year. A SIMPLE plan can apply for both 401 and IRA plans. SIMPLE plans are easy to set up, with lower initial and ongoing costs than other retirement savings options, but they don’t offer all the features found in a traditional employer-sponsored 401.

Also Check: Can I Manage My Own 401k

When Must I Receive My Required Minimum Distribution From My Ira

You must take your first required minimum distribution for the year in which you turn age 72 . However, the first payment can be delayed until April 1 of 2020 if you turn 70½ in 2019. If you reach 70½ in 2020, you have to take your first RMD by April 1 of the year after you reach the age of 72. For all subsequent years, including the year in which you were paid the first RMD by April 1, you must take the RMD by December 31 of the year.

A different deadline may apply to RMDs from pre-1987 contributions to a 403 plan .