Benefits Of A Solo 401

Solo 401s provide some advantages over other types of retirement accounts available to you.

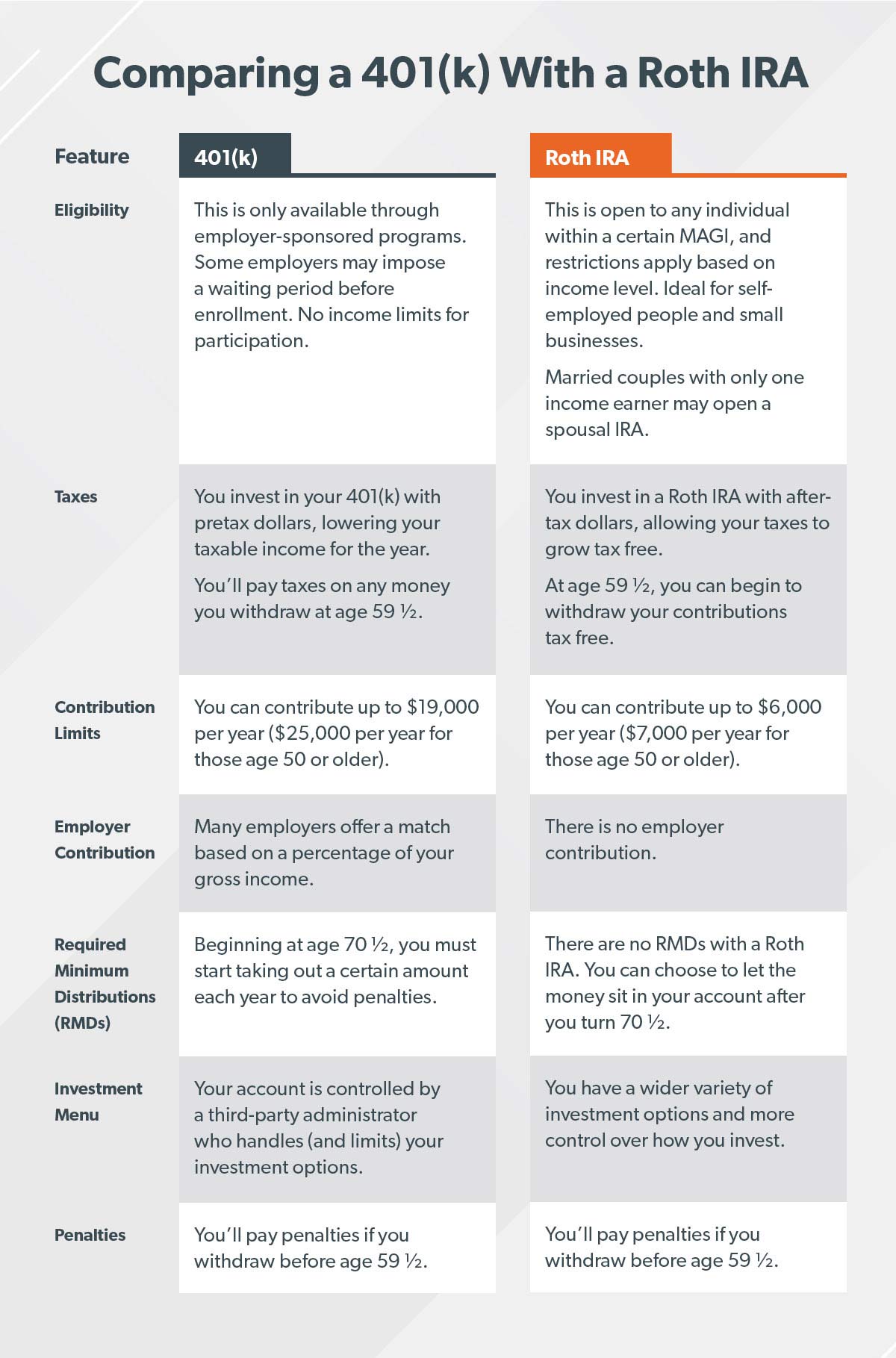

One big advantage is the availability of the Roth option as well as the traditional version. Only the traditional option can be used by those who invest using the SEP IRA, a Keogh plan, or a SIMPLE IRA. The plain-vanilla IRA that is available to all who have earned income is available in Roth or traditional versions but the annual contribution limits are far lower.

One of the main advantages of the solo 401 is that it can accept contributions from both an employee and an employer. That is, if you have a solo 401, you wear both hats and can make contributions in both roles.

Be Smart With Your 401

Opening a 401 is a smart step on the road to a comfortable retirement, but it’s not quite as simple as signing some papers and setting aside a percentage of your paycheck. You have to understand the rules, choose your investments wisely, and continue to maintain your plan for as long as you own it. If you do that, you can feel confident that you’re giving yourself the best shot at a secure retirement.

How To Start A 401k On Your Own

You have a right and a need to take control of your own retirement destination if you are a freelancer, independent contractor, are otherwise independently employed, or even if you have a side business and are still employed by someone else. Self-determination of your retirement comes with all the tax benefits associated with saving for your retirement.

Corporate work no longer offers job security. And certainly, the traditional corporate pension is not an option. You must take responsibility and control of your retirement planning. In 2016 a BNP Paribas Global Entrepreneur Report , found that millennipreneurs have started an average of 7.7 businesses, and collectively hold $5.6 billion in investable wealth. The prospering self-employed must have a tax-shelter that preserves and grows this into a wealthy retirement.

Being able to open a this account without an employer fits the needs of independent-minded people like a glove. Full control of all your retirement funds in a Solo 401k includes rolling over orphaned retirement accounts from earlier employers, accounts from previous businesses you have owned, and continuing to contribute for tax advantages that all flow into in a single consolidated account with the highest number of investment options available.

Recommended Reading: What Is The Difference Between 401k And 403b

What Are The Tax Benefits Of A Solo 401

Solo 401s share the same tax benefits as their traditional 401 counterparts.

You can elect to contribute pre-tax earnings to your Solo 401 and pay taxes when you distribute your funds during retirement. In turn, youâll lower your immediate income tax obligation.

Or, you can choose to contribute after-tax earnings into a Roth Solo 401, then your distributions during retirement would be tax-free.

Additionally, any matching contributions you make as your employer are tax-deductible for your business, lowering its tax obligation as well.

How Do Small Business Owners Choose The Best 401 For Their Needs

To find the right 401 for their small business, employers generally look for plan providers that:

- Charge reasonable plan and investment fees and have no hidden costs

- Provide real-time integration between the 401 recordkeeping and payroll systems to eliminate manual data entry and reduce errors

- Offer a simplified compliance process

- Make administrative fiduciary oversight available

- Offer ERISA bond and corporate trustee services

- Help with investment fiduciary services and plan investment responsibilities

- Make investment advisory services available for employees

Recommended Reading: How To Do A 401k Rollover

Read Also: When Can I Take Out My 401k

How Do You Open A 401

Do the following to open your 401:

What Are The Factors That Differentiate The Solo 401 From An Employer 401

Three main factors distinguish a self-employed 401 plan from an employer 401 including:

-

You are the employer and employee on the plan as the business owner.

-

Solo 401 plans allow you to make far higher contributions to your retirement plan than if you are an employee in an employer 401.

-

Any self-employed person can open a solo 401 plan regardless of the product or service you provide.

You can also run a self-employed 401 account as a self-directed plan. It allows you to invest your contributions on specific assets with an investment broker trustee.

A solo 401 plan is ideal if you want to set up a retirement plan as a self-employed person. It has the highest contribution restrictions, which allows you to grow your retirement savings faster and you can also enjoy solo 401 tax benefits. It is also easy to set up and administer.

Self-employed 401 plans give you complete control of your investment choices if you open them in a self-directed brokerage account. If your business hires employees at a later date, you only need to convert the solo 401 account into a standard employer 401 plan.

Article By

The Human Interest Team

We believe that everyone deserves access to a secure financial future, which is why we make it easy to provide a 401 to your employees. Human Interest offers a low-cost 401 with automated administration, built-in investment advising, and integration with leading payroll providers.

Recommended Reading: Can You Invest In 401k And Roth Ira

Is Solo 401 Tax Deductible Solo 401 Tax Advantages

The nice thing about a solo 401 is you get to pick your tax advantage: You can opt for the traditional 401, under which contributions reduce your income in the year they are made. In that case, distributions in retirement will be taxed as ordinary income. The alternative is the Roth solo 401, which offers no initial tax break but allows you to take distributions in retirement tax-free.

In general, a Roth is a better option if you expect your income to be higher in retirement. If you think your income will go down in retirement, opt for the tax break today with a traditional 401.

Because of these tax perks, the IRS has pretty strict rules about when you can tap the money you put into either type of account: With few exceptions, youll pay taxes and penalties on any distributions before age 59 ½.

Read Also: Where To Rollover 401k To Ira

How To Open A Solo 401

You can open a solo 401 at most online brokers and traditional brokers or directly through a financial services company. You’ll want to do some research ahead of time to identify the best solo 401 company for you.

You’ll need an employer identification number to get started with the enrollment process. If you don’t have one already, you can apply online directly to the IRS.

The rest of the documentation will be provided by the broker or financial services company you choose for the account.

Read Also: How To Start A 401k Account

How Do I Open A Solo Roth 401k

You can open a solo 401 at most online brokers, even if you need an Employer Identification Number. The broker will provide the plan adoption agreement for you to complete, as well as the account application. After that, you can set up contributions.

Can I open my own Roth 401k? Unlike Roth IRAs, there is no income limit on Roth 401 s, so anyone can open one regardless of how much they earn. The IRS offers information about Roth 401 accounts for both employers and employees on its website.

What Are The Maintenance Costs For Setting Up A 401

Once you establish a 401, your business will have ongoing costs in the form of administrative fees and any matching contributions. Fees generally fall into three categories: day-to-day operations, investment fees, and individual service fees.

There are also potentially fees or penalties associated with being non-compliant with regular 401 benchmarking, which you’ll want to avoid at all costs. A few examples of 401 penalties include:

- Non-compliance with ERISA for failing to meet certain filing and notification requirements

- Failing to file Form 5500 with the IRS each year

- Not providing 402 notices to plan participants who are seeking distributions from their retirement plan accounts

One way to avoid fines and penalties is working alongside a knowledgeable retirement services provider that can help ensure compliance when it comes to retirement plan forms, deadlines, and notifications.

Don’t Miss: How Does 401k Work In Divorce

Set Up A 401k For An Llc

Related Links

Benefits are an important part of an employees compensation package. One popular benefit you can offer is a retirement plan for employees. In the private industry, about 66% of workers have access to retirement benefits. Of the retirement plans you could offer, 401 plans are the most popular. Learn how to set up a 401 plan for small business.

Recommended Reading: Can I Roll Over A 403b To A 401k

Pick A Plan And Start Saving

Time is one of the most important factors when it comes to building up your retirement fund. While you’re young, time is on your side. Don’t let the absence of a workplace retirement plan like a 401 stand in your way. There are plenty of other retirement savings optionspick a plan and start saving and investing.

Read Also: How To Use 401k Money To Start A Business

Who Qualifies For Solo 401k

Who qualifies for the Solo 401k? To qualify for the Solo 401k scheme, you must be self-employed and generate some form of self-employment income and provide proof. If you are a business owner, you should not have a full-time employee, except yourself, a business partner and a wife involved in the business.

Who can invest in a Solo 401k? If you are self-employed and do not hire others, you have the right to open only 401 . The two business partners are also eligible. You can contribute 401 alone as an employer and as an employee. By 2021, you can contribute a total of $ 58,000 .

Retirement Account Conversion Eligibility

Anyone can convert a Traditional IRA or 401 account fully or partially to a Roth account. You do not have to be eligible for a regular contribution to open a Roth IRA through a conversion.

Making a conversion to a Roth will not affect your eligibility to make regular Roth contributions. In addition, there are no income or earnings restrictions for contributions to a traditional IRA, so you can contribute to a traditional IRA and immediately convert it to a Roth IRA.

Also Check: Can 401k Be Transferred To Another Company

You May Like: Should I Move My 401k To Safer Investments

Roth 401 & Roth Ira Faqs

At what age should I stop contributing to my Roth IRA?

There is no age limit. You can contribute to your Roth IRA until death if you choose to.

Can you lose money in a Roth IRA?

Yes, a Roth IRA is a vehicle that holds investments. If your investments lose value you will lose money.

Can I max out my 401 and Roth 401?

Theoretically no. Your total contribution would be divided between both, so neither one would technically be maxed out. Aggregate contributions to 401 and Roth 401 are capped at $19,500 .

How much should I put in my Roth IRA monthly?

That depends on your retirement goals. A good financial plan will lay that out for you.

How can I withdraw from my Roth IRA without penalty?

All contributions can be withdrawn tax and penalty-free. Earnings, however, will be taxed and penalized if you have not met the five-year rule and they are not used for a qualified exception.

When can I take money out of my Roth 401 without penalty?

You are free to take any contributions out of your Roth 401 without penalty at any time. Only earnings will be subject to penalty.

Who qualifies for Roth 401?

Anyone who works for an employer that offers a 401 to their employees qualifies for a 401.

Also Check: How To Collect Your 401k From Previous Employer

Retirement Accounts For Self

Small business owners and self-employed people get a few other retirement savings options.

Most major brokerage firms offer Simplified Employee Pension IRAs and theyre easy to set up.

A formal written agreement is required, but the brokerage usually takes care of that for you.

Any business with one or more employees can open a SEP IRA, including independent contractors, self-employed people, sole proprietorships, LLPs, C corporations and S corporations.

That makes these accounts ideal for freelancers, solo entrepreneurs and gig workers.

A SEP IRA offers much higher contribution limits than a traditional or Roth IRA.

In 2022, you can contribute up to 25% of adjusted net earnings or $61,000 whichever is less.

Because you can add employees to a SEP IRA, these accounts are also attractive for solo business owners who plan to add workers to their payroll in the future.

Solo 401

If youre self-employed or own a business with no employees, you can open a self-employed 401, also known as a solo 401.

You get two opportunities to save as an employee, and again as the employer.

As the employee, you can make tax-deductible or Roth retirement contributions up to 100% of your compensation, with a maximum of $20,500 in 2022 .

On top of that, as the employer you can put in up to 25% of your earned income. However, total contributions cant exceed $61,000 in 2022.

Unique Features of Self-Employed 401s

Also Check: How To Borrow From Your 401k

You May Like: Can I Move My 401k To Roth Ira

What Are The Contribution Levels And Limits Of A Solo 401

To take full advantage of contributions to a Solo 401 plan you must understand your limits as an employee and employer, as well as contributions allowed on behalf of a spouse if applicable.

When contributing as the employee, you are allowed up to $19,500 or 100% of compensation in salary deferrals for tax years 2020 and 2021. If you are over 50, an additional $6,500 catch-up contribution is allowed for tax years 2020 and 2021. This is the type of contribution that can be made as pre-tax/tax-deferred or Roth deferral or a combination of both. Additionally, as the employer, you can make a profit-sharing contribution up to 25% of your compensation from the business up to $57,000 for tax year 2020 and $58,000 for tax year 2021. When adding the employee and employer contributions together for the year the maximum 2020 Solo 401 contribution limit is $57,000 and the maximum 2021 solo 401 contribution is $58,000. If you are age 50 and older and make catch-up contributions, the limit is increased by these catch-ups to be $63,500 for 2020 and $64,500 for 2021.

Compensation from your business can be a bit tricky. This is calculated as your business net profit minus half of your self-employment tax and the employer plan contributions you made for yourself plan). The limit on compensation that can be factored into your tax year contribution is $285,000 for 2020 and $290,000 for 2021.

Contribution Limit As An Employer

Wearing the employer hat, you can contribute up to 25% of your compensation.

The total contribution limit for a solo 401 as both employer and employee is $58,000 for 2021, and $61,000 in 2022 or 25% of your adjusted gross income, whichever is lower.

People ages 50 and above can add an extra $6,500 a year as a “catch-up contribution.”

In other words, in 2021 you can contribute a total of $58,000 along with a $6,500 catch-up contribution if applicable for a maximum of $64,500 for the year.

You can have a solo 401 even if you’re moonlighting. If you have a 401 plan at both jobs, the total employee contribution limits must be within the maximum for the year, but the employer contribution is not limited. If you’re one of these lucky folks with two retirement savings plans, talk to a tax adviser to make sure you follow the IRS rules.

Also Check: How Much Can I Loan From My 401k

Choose A Type Of Plan

Private 401k providers require a written investment plan from each investor that includes the type of plan you wish to start. You have two options: traditional and Roth. Traditional plans entail investing money pre-tax. When the time comes for you to retire, you pay taxes on your money as you make withdrawals. Consider the potential tax rate increases before choosing this option. Instead, also consider your other option. If you open a Roth private 401k, you will invest your funds after-tax. While this could decrease the amount you can afford to invest while you are working, you have more funds to obtain when you retire. Determine which type will benefit you the most when starting a private 401k.

Solo 401 Contribution Limits

The total solo 401 contribution limit is up to $58,000 in 2021 and $61,000 in 2022. There is a catch-up contribution of an extra $6,500 for those 50 or older.

To understand solo 401 contribution rules, you want to think of yourself as two people: an employer and an employee . Within that overall $58,000 contribution limit in 2021 and $61,000 in 2022, your contributions are subject to additional limits in each role:

-

As the employee, you can contribute up to $19,500 in 2021 and $20,500 in 2022, or 100% of compensation, whichever is less. Those 50 or older get to contribute an additional $6,500 here.

-

As the employer, you can make an additional profit-sharing contribution of up to 25% of your compensation or net self-employment income, which is your net profit less half your self-employment tax and the plan contributions you made for yourself. The limit on compensation that can be used to factor your contribution is $290,000 in 2021 and $305,000 in 2022.

Keep in mind that if youre side-gigging, employee 401 limits apply by person, rather than by plan. That means if youre also participating in a 401 at your day job, the limit applies to contributions across all plans, not each individual plan.

Read Also: How To Cash Out 401k Without Penalty