How To Calculate Your Required Minimum Distributions

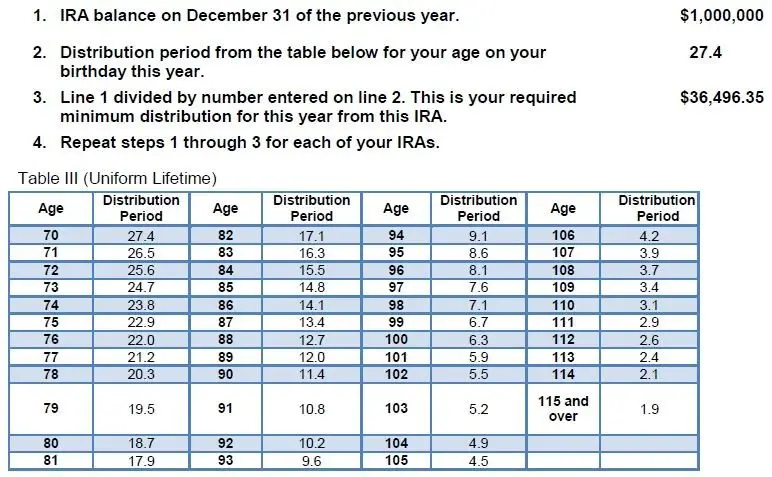

Use IRS Publication 590-B to calculate your 401k RMDs it includes life expectancy tables that correspond to your specific age. Take the value of your 401k as of Dec. 31 of the previous year and divide that number by the number of your IRS life expectancy remaining years. The resulting number is your RMD, which is the minimum amount you must withdraw from your 401k that year.

Use this guide to determine which table to work from in Publication 590-B and keep in mind that 403b plans might be subject to different rules:

- Single life expectancy table: Use this table if you are the beneficiary of an inherited retirement account.

- Joint and last survivor table: Use this if your spouse is more than 10 years younger than you and is the sole beneficiary of your account.

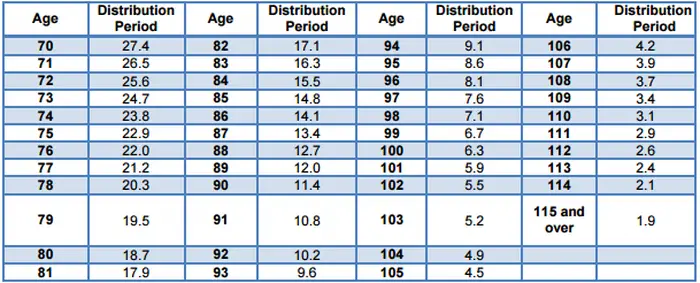

- Uniform lifetime table: Consult this table if your spouse is not more than 10 years younger than you or is not the sole beneficiary of your account.

Different rules and requirements apply if you have 457 plan because its not considered a qualified plan. You can take regular distributions from a 457 plan as soon as you retire, regardless of whether youve turned 59.5. The 10 percent early withdrawal penalty does not apply to these plans, but all distributions are still taxed as ordinary income.

How To Calculate Rmd

Except for an Inherited IRA, you can calculate your RMD by dividing your tax-deferred retirement account balance as of December 31 of the previous year by your life expectancy factor.

The IRS provides the worksheet for the life expectancy factor. It is wise always to confirm that you are using the latest information from the IRS website.

There are two tables provided for the Life expectancy factor:

- Uniform Lifetime Table, for use by unmarried owners, married owners whose spouses aren’t more than ten years younger, and married owners whose spouses aren’t the sole beneficiaries of their IRAs.

- Joint Life and Last Survivor Expectancy Table, for use by owners whose spouses are more than ten years younger and are the sole beneficiaries of their IRAs. Thus, this Joint Life Expectancy Table considers the last survivor’s expectancy and reduces the RMD.

The RMD formula is:

RMD = Account balance as of December 31 / Life expectancy factor

Example: How to calculate RMD when one spouse is more than ten years younger and is the IRA’s sole beneficiary.

Farouk turned 72 last year, and his wife is 60. She is the sole beneficiary of his IRA.

-

Find IRA balance as of December 31 of the previous year: his IRA balance was $270,000.

-

Find the life expectancy factor according to the IRS Joint Life Expectancy Table: Farouk’s life expectancy factor is 27 which is the corresponding factor for 72 and 60 .

-

Divide the account balance by the factor number to get RMD:

RMD = $270,000 / 27 = $10,000

What Happens If I Dont Take An Rmd

The penalties for not taking RMDs are steep. If you do not withdraw the necessary RMD by December 31, or take less than is required, you may have to pay a 50% excise tax on the amount that wasnt distributed as required.

For example, if you were supposed to withdraw $8,000 but only withdrew $4,000, you would be charged a 50% penalty on the $4,000 difference and would owe $2,000 in excise taxes.

If you realize you didnt take the correct RMD amount, file Form 5329 Additional Taxes on Qualified Plans with the IRS when you submit your taxes. The IRS generally waives penalties for incorrect or missed RMDs if you take action and report them promptly.

If youre reluctant to take an RMD because you dont need it for immediate living expenses, you do have a few options to use it efficiently. You might donate it to charity, invest it in tax-friendly investments like municipal bonds or purchase a QLAC to decrease the size of your RMD.

Read Also: What Is Qualified Domestic Relations Order 401k

How Is The Amount Of The Required Minimum Distribution Calculated

Generally, a RMD is calculated for each account by dividing the prior December 31 balance of that IRA or retirement plan account by a life expectancy factor that IRS publishes in Tables in Publication 590-B, Distributions from Individual Retirement Arrangements . Choose the life expectancy table to use based on your situation.

- Joint and Last Survivor Table – use this if the sole beneficiary of the account is your spouse and your spouse is more than 10 years younger than you

- Uniform Lifetime Table – use this if your spouse is not your sole beneficiary or your spouse is not more than 10 years younger

- Single Life Expectancy Table – use this if you are a beneficiary of an account

See the worksheets to calculate required minimum distributions and the FAQ below for different rules that may apply to 403 plans.

Retirement Savers Who Are 72 Must Start Withdrawing Funds From Tax

After decades of squirreling away money in tax-advantaged retirement accounts, investors entering their 70s have to flip the script. Starting at age 72, Uncle Sam requires taxpayers to draw down their retirement account savings through annual required minimum distributions. Not only do you need to calculate how much must be withdrawn each year, you must pay the tax on the distributions.

Theres no time like the present to get up to speed on the RMD rules. Once you know the basic rules, you can use smart strategies to minimize taxable distributions and make the most of the money that you must withdraw.

Here are 12 things you should consider regarding required minimum withdrawals.

You May Like: Can I Transfer My Ira To My 401k

Pro Rata Payout For Rmds

If you cant reduce your RMD, you may be able to reduce the tax bill on the RMDthat is, if you have made and kept records of nondeductible contributions to your traditional IRA. In that case, a portion of the RMD can be considered as coming from those nondeductible contributionsand will therefore be tax-free.

Figure the ratio of your nondeductible contributions to your entire IRA balance. For example, if your IRA holds $200,000 with $20,000 of nondeductible contributions, 10% of a distribution from the IRA will be tax-free. Each time you take a distribution, youll need to recalculate the tax-free portion until all the nondeductible contributions have been accounted for.

How To Calculate Solo 401k Plan Or Individual K Required Minimum Distribution

The annual Solo 401k required minimum distribution is calculated by dividing the Solo 401kaccount balance by the applicable distribution period pursuant to Treas. Reg. 1.401-5, Q& A 1.

Solo 401k Account Balance

For Solo 401k plan or Individual K, the account balance is the balance as of the last valuation date in the calendar year immediately preceding a year for which an RMD is due. This is called the Solo 401k valuation year. This valuation amount is then adjusted by adding to the balance any contributions allocated to the Solo 401k plan balance after the valuation date, but during the valuation year. You must then subsequently subtract any distributions made in the valuation year that may have occurred after the Solo 401k plan valuation date.

Solo 401k plans are also allowed to exclude contributions for the valuation year not actually made in the valuation year in accordance with Treas. Reg. 1.401-5, Q& A 3. And if the first years RMD is taken between January 1 and April 1 of the year following the first distribution year , the final RMD regulations do not require that the first years RMD be subtracted from the December 31 balance when determining the RMD for the second distribution year.

Applicable Solo 401k Distribution Period

Exception to Uniform Lifetime Table: Spouse Beneficiary More Than 10 Years Younger

Don’t Miss: How Much Does 401k Cost Per Month

Required Minimum Distribution Planner

When you reach the age of 72, you must begin annual withdrawals from most retirement accounts in accordance with IRS regulations. These withdrawals are known as required minimum distributions, or RMDs.

Except for your first year taking RMDs, each RMD must be taken by December 31 to avoid a hefty penalty.

Need to take an RMD but dont need the funds for retirement? Learn how your RMD can be a great way to contribute to a 529.

Use this RMD calculator to determine your projected required minimum distributions for multiple years based on a hypothetical rate of return.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. Heres an explanation forhow we make money.

Read Also: Can I Roll My 401k Into A Brokerage Account

Inheriting A 401k From Your Spouse

If youre the spouse inheriting a 401 you can rollover the funds into your own existing 401, or you can rollover the funds into whats known as an inherited IRA the IRA account is not inherited, but it holds the inherited funds from the 401. Then you would take RMDs from these accounts when you turned 72, based on the IRS tables that apply to you.

A Word About Roth Iras

Roth IRAs do not require RMD withdrawals until after the death of the owner. If you have a Roth account in an employer-sponsored plan, the IRS recommends that you contact your plan sponsor or plan administrator regarding RMD information.

7. What happens if a retirement plan account owner or IRA owner dies before RMDs have begun?

8. Do I have to take an RMD if I own an annuity?

The answer depends on the type of annuity you own. If you own a variable annuity, and it is held in an IRA, the answer is yes. This is referred to as a qualified annuity by the IRS, meaning that it likely was funded with pre-tax money that requires you to pay taxes on your withdrawals, as well as take RMDs. Non-qualified annuity contracts offer tax-deferred growth of after-tax funds they are taxed when annuitized, but as a general rule are not subject to RMDs. , see the IRSs Form 1098-Q info page.)

9. What reporting obligations does my brokerage firm have with respect to RMDs?

10. What if a mistake is made?

All is not lost if you or someone you entrust to do your RMD calculations makes a mistake. In one of its FAQs, the IRS states that penalties may be waived if the account owner establishes that the shortfall in distributions was due to reasonable error and that reasonable steps are being taken to remedy the shortfall. In order to qualify for this relief, you must file Form 5329 and attach a letter of explanation.

Read Also: How Do You Take A Loan Out Of Your 401k

Retirement Plan And Ira Required Minimum Distributions Faqs

Information on this page may be affected by coronavirus relief for retirement plans and IRAs.

The Setting Every Community Up for Retirement Enhancement Act of 2019 became law on December 20, 2019. The Secure Act made major changes to the RMD rules. If you reached the age of 70½ in 2019 the prior rule applies, and you must take your first RMD by April 1, 2020. If you reach age 70 ½ in 2020 or later you must take your first RMD by April 1 of the year after you reach 72.

For defined contribution plan participants, or Individual Retirement Account owners, who die after December 31, 2019, , the SECURE Act requires the entire balance of the participant’s account be distributed within ten years. There is an exception for a surviving spouse, a child who has not reached the age of majority, a disabled or chronically ill person or a person not more than ten years younger than the employee or IRA account owner. The new 10-year rule applies regardless of whether the participant dies before, on, or after, the required beginning date, now age 72.

Your required minimum distribution is the minimum amount you must withdraw from your account each year. You generally have to start taking withdrawals from your IRA, SEP IRA, SIMPLE IRA, or retirement plan account when you reach age 72 . Roth IRAs do not require withdrawals until after the death of the owner.

For more information on IRAs, including required withdrawals, see:

At What Age Do Rmds Start

You must take your first RMD the same year you turn age 72. For your first RMD only, you are allowed to delay the withdrawal until April 1 of the year after you turn 72.

This is a mixed blessing however, because the second RMD would be due on Dec. 31 of that year as well. For tax purposes, you might want to take your first RMD the same year you turn 72, to avoid the potentially higher tax bill from taking two withdrawals in the same calendar year.

Also Check: How To Transfer A 401k Account

Did Covid Change Rmd Rules

Owing to a strange overlap, there was an RMD rule change that raised the required age to 72 but this coincided with a suspension of all RMDs in 2020 owing to COVID. Heres what happened, and what that means for your RMDs now.

First, in 2019 the SECURE Act changed the required age for RMDs from 70½ to 72, to start in 2020.

But when the pandemic hit in early 2020, RMDs were suspended entirely for that year under the CARES Act. So, even if you turned 72 in the year 2020 the new qualifying age for RMDs RMDs were waived.

The waiver also applied to those who were RMD-eligible in 2019, but planned to take their first RMDs by April of 2020.

As of early 2021, though, required minimum distributions were restored. So heres how it works now, taking into account the 2020 suspension and the new age for RMDs.

If you were taking RMDs regularly before the 2020 suspension, you need to resume taking your annual RMD by Dec. 31, 2021.

If you were eligible for your first RMD in 2019 and youd planned to take your first RMD by April 2020, but didnt because of the waiver, you must take that RMD by Dec. 31, 2021.

If you turned 72 in 2020, and are taking an RMD for the first time, then youd have until April 1, 2022 to take that first withdrawal.

Remember that whenever you choose to take your first RMD, whether its the year you turn 72 or the April of the year after, all subsequent RMDs are due on Dec. 31 each year.

Joint Life And Last Survivor Expectancy Table

On the other hand, if your spouse is 10 years younger than you, and is the sole beneficiary of your retirement account, you must use the IRS Joint Life and Last Survivor Expectancy table to calculate RMD withdrawals. Under this table, your life expectancy factor is based on you and your spouses age. Unlike the Uniform Lifetime table, this table usually results in lower RMDs.

Below is a section of the Joint Life and Last Survivor Expectancy table for account holders between 70 to 79 years old. The ages on top refers to your age , while the ages listed vertically on the left represents your spouses age . For example, if youre 73 years old and your spouse is 58 years old, your distribution period is 28.3.

| Your Age | |

|---|---|

| 30.2 | 30.1 |

To understand how RMD is calculated, lets take the following example. Suppose youre turning 73 in October 2021 and you want to know the minimum distribution you can withdraw. By December 31, 2020, your IRA account had a balance of $110,000. For this example, your spouse is only 4 years younger than you. Thus, you must use the Uniform Lifetime table to calculate your RMD. The distribution factor for 73 is 24.7.

RMD = $110,000 / 24.7RMD = $4,453.44

For 2021, you must withdraw a minimum of $4,453.44 from your IRA account.

RMD = $110,000 / 28.3 RMD = $3,886.93

In this example, you must withdraw a minimum of $3,886.93 in 2021 from your IRA account.

The following chart shows your projected RMDs and account balance till you turn 100:

| Age | |

|---|---|

| $5,508 | $30,581 |

Also Check: Can I Cash In My 401k

How To Calculate Required Minimum Distribution For An Ira

To calculate your required minimum distribution, simply divide the year-end value of your IRA or retirement account by the distribution period value that matches your age on Dec. 31st each year. Every age beginning at 72 has a corresponding distribution period, so you must calculate your RMD every year.

For example, Joe Retiree, who is age 80, a widower and whose IRA was worth $100,000 at the end of last year, would use the Uniform Lifetime Table. It indicates a distribution period of 18.7 years for an 80-year-old. Therefore, Joe must take out at least $5,348 this year .

The distribution period also decreases each year, so your RMDs will increase accordingly. The distribution table tries to match the life expectancy of someone with their remaining IRA assets. So as life expectancy declines, the percentage of your assets that must be withdrawn increases.

If you need further help calculating your RMD, you can also use Bankrates required minimum distribution calculator.

RMDs allow the government to tax money thats been protected in a retirement account, potentially for decades. After such a long period of compounding, the government wants to be sure that it eventually gets its cut in a clear timeframe. However, RMDs do not apply to Roth IRAs, because contributions are made with income that has already been taxed.