Rolling Over To A New 401

The first step in transferring an old 401 to a new employer’s qualified retirement plan is to speak with the new plan sponsor, custodian, or human resources manager who assists employees with enrolling in the 401 plan. Because not every employer-sponsored plan accepts transfers from an outside 401, it is imperative for a new employee to ask if the option is available from the new employer. If the plan does not accept 401 transfers, the employee needs to select one of the three other options for the 401 account balance.

If the new employer plan accepts 401 transfers from other companies, there is often a substantial amount of paperwork that must be completed by the employee. The paperwork is provided by the new plan sponsor or human resources contact and requires the name, date of birth, address, Social Security number, and other employee identifying information.

In addition, the 401 transfer form must provide details of the old employer plan, including total amount to be transferred, investment selections held in the account, date contributions started and stopped, and contribution type, such as pre-tax or Roth. A new plan sponsor may also require an employee to establish new investment instructions for the account being transferred on the form. Once the transfer form is complete, it can be returned to the plan sponsor for processing.

A transfer from one 401 to another is a tax-free transaction, and no early withdrawal penalties are assessed.

You Get More Investment Options

In a 401 plan, your mutual fund investment options can be limited, points out Dominique Henderson, certified financial planner , founder of DJH Capital Management.

Often you have between six and 24 fund choices in a 401, Henderson says. With an IRA, you can choose individual stocks as well as fundsand even use alternative investments. Alternative investments can include everything from real estate to Bitcoin, but youll also have access to a wider range of index funds as well as exchange-traded funds , which are often missing from 401 offerings.

Should You Roll Over Your 401 Into Another 401

There are some situations that might make an IRA rollover the wrong move for you. Heres what to consider before completing a 401 rollover.

Retirement account protection. In general, 401 accounts offer better protections from creditors than IRAs.

Rule of 55. With a 401, you can actually start withdrawing funds at age 55 penalty-free if you leave your job. You dont have that advantage when you roll your 401 to an IRA, though you can emulate it by taking subsequently equal periodic payments from your IRA

Performance. If you like your current plan, and its performing well, theres no reason to complete a rollover.

You can always choose to roll your old 401 balance into your new employers 401 plan. If you value the simplicity of having everything in one place, you like the features of the plan at your new job or you want to maintain the legal protections of a 401, it may make more sense to roll your old 401 into a new 401.

Also Check: Is It A Good Idea To Borrow From Your 401k

How Long Do I Have To Deposit The Check

You should deposit the check you get right away. Even if the check is made out to your IRA provider , you should try to do it within 60 days of receiving it.

Get a prepaid envelope sent directly to your door with a tracking number! Start a rollover with Capitalize and well send you a prepaid priority mail envelope with detailed instructions to make sure your rollover is transferred successfully. Get started

How To Do A 401k Rollover At Vanguard

Advertiser Disclosure: Opinions, reviews, analyses & recommendations are the authors alone. This article may contain links from our advertisers. For more information, please see our .

I recently rolled over a 401k plan from my former employer-sponsored plan into a Rollover IRA at Vanguard. Rolling a 401k into an IRA is not a difficult process, but it does take a little time and preparation.

I put together this visual guide to walk you through the process of doing a 401k rollover into an IRA. Though this tutorial shows how to do it at Vanguard, the process should be fairly similar at other brokerages or financial institutions. I chose Vanguard because I have been with them for the better part of a decade and I prefer to keep my accounts as consolidated as possible.

Choose the best IRA custodian for your needs. You dont have to go with Vanguard there are many institutions that can serve as your IRA custodian. Here are more tips on Where to Open an IRA, and What to Look For When Opening an IRA.

Don’t Miss: How Do I Roll A 401k Into An Ira

How Much Money Do I Need To Open A Vanguard Ira

At Vanguard, you can open an account with a $0 balance. But there are a few minimums to keep in mind as you begin to invest.

- Vanguard ETFs: You only need enough money to cover the price of 1 share, which can generally range from $50 to a few hundred dollars.

- Vanguard mutual funds: Some Vanguard mutual funds have a $1,000 minimum . Most of our other Vanguard mutual funds have a $3,000 minimum.

How To Rollover A 401k Into An Ira At Vanguard

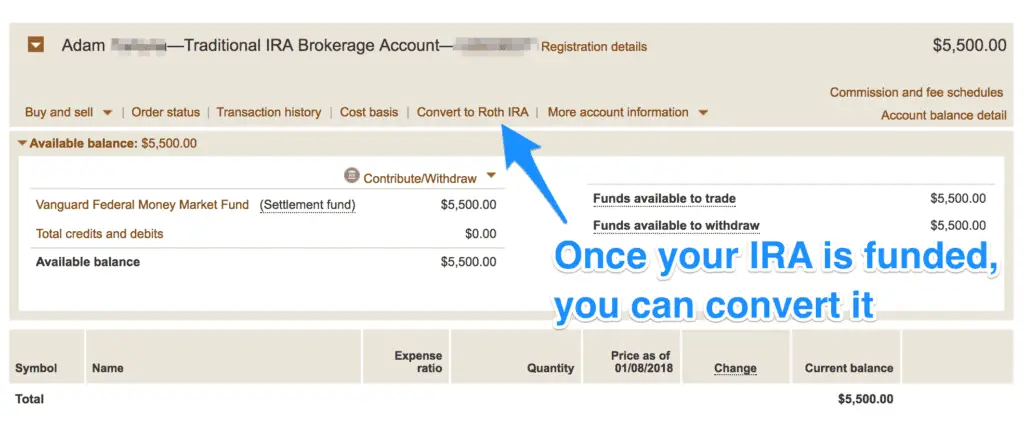

The basic process is simple, open a Rollover IRA, then transfer in your funds to the Rollover IRA. Of course, there are a few more details, which we will cover. Before you get started with Vanguard you will want to contact your current 401k plan custodian to determine how to initiate a transfer to another custodian. Some companies require several signed forms, while the company I transferred my retirement account from would only release the funds via a phone call . Armed with this information, you are ready to start the transfer process.

Recommended Reading: Can I Get A 401k

What If I Have Employer Stock In My Employer

You can choose to roll company stock into an IRA or a taxable brokerage account. If you decide to roll the stock to an IRA, its full value will be taxed as income at your regular rate if you move the stock to a taxable brokerage account, you might be able to save money by paying capital gains taxes on the difference between the stocks value and the price you paid for it. There are tax benefits to each, so consult your tax advisor and ask about the net unrealized appreciation strategy.

Is There A Service Out There Than Can Handle This Process For Me

Yes thats where Capitalize comes in!

Weve made it our mission to make this process easier for everyone. If you choose to do a 401-to-IRA rollover, we can handle the entire process for you. Most of the process can be done online and our rollover experts will guide you through any of the manual parts.

Its 100% free to you .

Recommended Reading: How Much Does Fidelity Charge For 401k

My Experience With A 401k Rollover

Modified date: Dec. 20, 2020

Editor’s note –

I recently changed jobs. And as part of the transition, I decided to rollover my 401k from my old employer to a rollover IRA. My 401k was with Fidelity, and my plan was to move it over to an existing IRA at Vanguard. In this article I want to walk through the reasons I made that decision, how the process works, and things to watch out for if you decide to rollover a 401k.

Advantages Of Rolling Over Your 401

1. You can consolidate your 401 accounts

Especially if you change jobs often, you might find yourself with many 401 accounts scattered around. The more accounts you have, the harder it may be to actively make decisions. By having your retirement funds all in one place, you may be able to manage them more carefully.

2. Youll have more investment choices in an IRA

With your 401, you are restricted to the investment and account options that are offered in that plan. An IRA can give you a more diverse option of items to invest in. In an IRA you may be able to invest in individual stocks, bonds or other vehicles that may not be available in your 401.

You cant add to the 401 at your previous employer. But if you roll this money over into a traditional IRA, you can add to that traditional IRA over time, up to the annual maximum. Youll have to follow the IRA contribution guidelines.

3. Youll have the choice to bring the account anywhere youd like

With an IRA, you can take your money with you to any advisor, if you already have a financial advisor or financial planner that you work with, for example. Or maybe you already have a brokerage where some of your money is being managed, and you want all your funds there.

Also Check: How To Use Your 401k Money

Confirm A Few Key Details About Your 401 Plan

First, get together any information you have on your old 401. Its okay if you dont have a ton, but any details like an old account statement or an offboarding e-mail from your former HR team can help. 401 paperwork can be confusing, so just focus on identifying the following three items:

Do I Have A Deadline To Take Money Out Of My Old 401

When you leave a job, you arent forced to decide what to do with your 401 immediately.

The money already in your 401 is yours, so you can usually leave it as long as you want or roll it into an IRA at any time.

However, there are a few exceptions:

- If you contributed less than $5,000 to your 401, your employer is legally allowed to tell you to take the money and move it elsewhere .

- Contributions of $1,000 to $5,000 are subject to involuntary cash-outs. Thats when your former employer moves the full amount into an IRA.

- If you contributed less than $1,000, your former company can mail you a check for the full amount. You can deposit this amount into another retirement account within 60 days to avoid tax penalties.

You May Like: Can I Roll A 401k Into An Existing Ira

Contact The Company Holding Your 401

Next, contact the company that is currently holding your 401 funds. If its a larger company, you should be able to call the phone number provided on your statement. The number may also be available via Google. You can then inform the company that you want to rollover your 401 into an IRA. Theyll take you through the necessary steps.

If its a smaller company or a government agency that holds your money, you may need to contact your former employers benefits department or HR department. There will be some paperwork that you will have to fill out to indicate that you want to rollover your 401 to your IRA.

What Happens If You Cash Out Your 401

If you take your 401 money before you reach age 59 ½, you might have to pay taxes at your regular tax rate, on top of a penalty from the IRS, on any money that hasnt been taxed before. You may be able to avoid any penalties for certain life events or purchases, but youll still probably owe taxes on any previously untaxed money.

Read Also: How Much Can I Convert From 401k To Roth Ira

What If I Have Both Pretax And After

Generally, pretax assets are rolled into a rollover IRA or traditional IRA. After-tax assets or after-tax savings) are rolled into a Roth IRA.

You can choose to roll pretax savings into a Roth IRA, but doing so would be treated as a taxable event. Similarly, you can roll after-tax savings into a traditional IRA, but this requires careful tracking of your assets for when you start taking distributions. Before deciding, please consult your tax advisor about your personal circumstances.

Youll Lose Control And Flexibility

The most significant benefit of an IRA is the power and flexibility to invest your money how you want. By rolling over your IRA, youll be forfeiting a lot of that control and freedom. Your 401 plan likely offers a limited number of mutual funds and exchange-traded funds, so you may feel restricted by those offerings if you value greater diversification and oversight.

Don’t Miss: Can I Rollover From 401k To Roth Ira

Ask Your 401 Plan For A Direct Rollover Or Remember The 60

These two words “direct rollover” are important: They mean the 401 plan cuts a check directly to your new IRA account, not to you personally.

Here are the basic instructions:

Contact your former employers plan administrator, complete a few forms, and ask it to send a check or wire for your account balance to your new account provider.

The new account provider gives you instructions for how the check or wire should be made out, what information to include and where it should be sent. You can opt for an indirect 401 rollover instead, which essentially means you withdraw the money and give it to the IRA provider yourself, but that can create tax complexities. We generally recommend a direct rollover.

If you do an indirect rollover, the plan administrator may withhold 20% from your check to pay taxes on your distribution. To get that money back, you must deposit into your IRA the complete account balance including whatever was withheld for taxes within 60 days of the date you received the distribution. .)

For example, say your total 401 account balance was $20,000 and your former employer sends you a check for $16,000 . Assuming youre not planning to go the Roth route, you’d need to come up with $4,000 so that you can deposit the full $20,000 into your IRA.

At tax time, the IRS will see you rolled over the entire retirement account and will refund you the amount that was withheld in taxes.

Finish Any Last Transfer Steps

Chances are that by this stage youre done, and your 401 provider has initiated the process of rolling over your 401 into your new Vanguard IRA. If so, congrats on getting to the finish line!

But there can sometimes be a small extra step at this stage. Thats because some 401 providers will only distribute your 401 funds to you, not to another institution. If thats the case then theyll send a check with your money to your mailing address. Its then up to you to deposit the check to your Vanguard account. Vanguard offers a few methods for depositing a check:

Recommended Reading: How Do I Roll Over My 401k To An Ira

Tips For Retirement Investing

- Consider finding a financial advisor to steer you in the right direction in terms of savings and investments. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- When youre starting to plan for retirement, you should consider the tax laws of the state you live in. Some have retirement tax laws that are very friendly for retirees, but others dont. Knowing what the laws apply to your state, or to a state you hope to move to, is key to getting ahead on retirement planning.

Why Transfer Your 401 To An Ira

Why would you move savings from an old 401 plan to an IRA? The main reason is to keep control of your money. In an IRA, you get to decide what happens with the funds: You choose where to invest and how much you pay in fees, and you dont need anybodys permission to take money out of the account.

More Control

Cost and providers: In your 401, your employer controls almost everything. Employers choose vendors for the plan, which determines the investment lineup available. Those might not be investments you like, and they might be more expensive than you want. If you want to practice socially-responsible investing, the 401 may lack options for that.

Timing: 401 plans also require extra steps when you want to withdraw funds: An administrator needs to verify that you are eligible to access your money before youre allowed to take a distribution. Plus, some 401 plans dont allow partial withdrawalsyou might need to take your full balance.

Easy Withdrawals

If you need access to your 401 savings for any reason, its easier when the money is in an IRA. In most cases, you call your IRA provider or request a withdrawal online. Depending on what you own in your account, the funds might go out as soon as the next business day. But 401 plans might need a few extra days for everybody to sign off on the distribution.

Complicated Situations

Control Tax Withholding

Recommended Reading: How To Select 401k Funds