Rollover My 401k Into A Precious Metals Ira

If you are considering rolling a 401k into an IRA, you may want to consider a Precious Metals IRA. The main advantage of a precious metals IRA is that it allows you to store physical gold and silver in an IRA account. While you can have paper assets such as stocks and bonds in an IRA, the IRS does not allow you to keep actual precious metals in one.

The only way around this is by having a self-directed IRA that allows you to hold physical gold and silver.

When You Leave A Job You Don’t Have To Leave Your 401 Behind

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

A Tea Reader: Living Life One Cup at a Time

When you change jobs, you usually have four options for your 401 plan account. You can cash it out , leave it where it is , transfer it into your new employer’s 401 plan , or roll it over into an individual retirement account . For most people, rolling over a 401 cousin for those in the public or nonprofit sector) is the best choice. This article explains why and how to go about it.

What Is A Reverse Rollover

Most rollovers move in one direction from an employer plan like a 401 or 403 to an Individual Retirement Account. Rollovers typically happen when you leave an employer and are no longer eligible to participate in the workplace plan. Instead of leaving the cash sitting in the old account, you can move it to an IRA that you control.

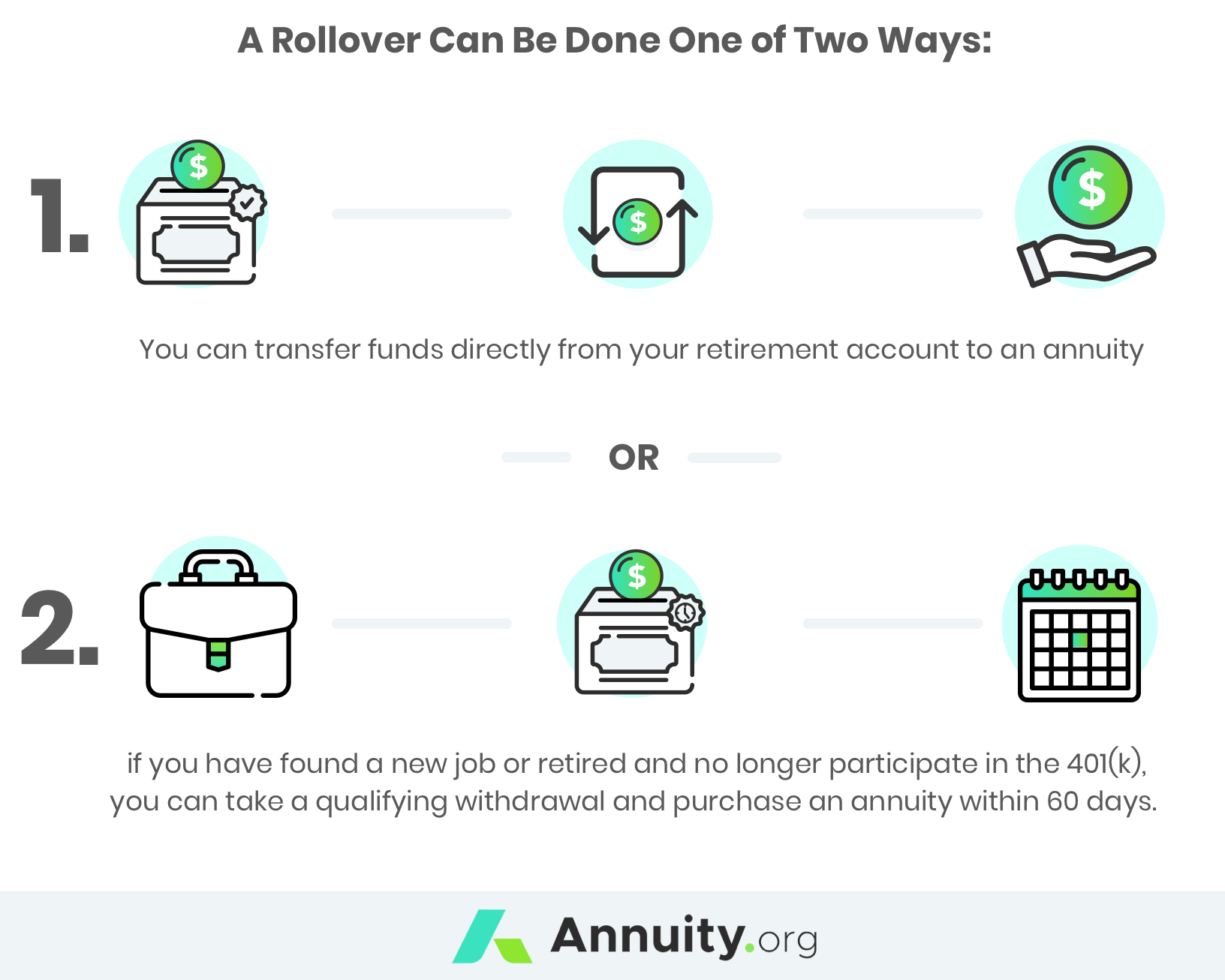

Moving money the other way, from an IRA into a 401, is known as a reverse rollover. A rollover is tax terminology for when you move the balance from one retirement plan into another plan. As long as you complete the rollover within 60 days, it’s penalty-free and non-taxable. It’s also easy to do as long as you follow the rules.

Don’t Miss: How To Calculate 401k Match

Where Should You Transfer Your 401

You have several options on what to do with your 401 savings after retirement or when you change jobs. For example, you can:

The right choice depends on your needs, and thats a choice everybody needs to make after evaluating all of the options.

Want help finding the right place for your retirement savings? Thats exactly what I do. As a fee-only fidicuary advisor, I can provide advice whether you prefer to pay a flat fee or youd like me to handle investment management for you, and I dont earn any commissions. To help with that decision, learn more about me or take a look at the Pricing page to see if it makes sense to talk. Theres no obligation to chat.

Important:The different rules that apply to 401 and IRA accounts are confusing. Discuss any transfers with a professional advisor before you make any decisions. This article is not tax advice, and you need to verify details with a CPA and your employers plan administrator. Likewise, only an attorney authorized to work in your state can provide guidance on legal matters. Approach Financial, Inc. does not provide tax or legal services. This information might not be applicable to your situation, it may be out of date, and it may contain errors and omissions.

Why Roll Over An Ira Into A 401

There are a few reasons you might want to roll a traditional IRA into a 401, though it should be noted you can do this only if your company plan accepts incoming transfers . Here are the pro IRA-to-401 rollover highlights:

-

Potential for earlier access to that money: If you leave your job, you could start tapping your 401 as early as age 55. Qualified distributions from traditional IRAs cant begin until 59½ unless you start a series of substantially equal distributions a commitment to take at least one distribution per year for at least five years or until you turn 59½, whichever comes last. The distribution amount is based on IRS calculation methods that take into account your IRA balance, age, life expectancy and, in some cases, interest rates. It could mean taking more than you need, for longer than you want to.

Compare costs among your retirement plans to find out where youre getting the better deal.

» See how a 401 could improve your retirement: Try our 401 calculator.

Don’t Miss: How To Use 401k Money To Start A Business

Is There A Limit On How Much I Can Roll Over Into A Roth

No, there arent any limits on the whole quantity you may roll out of your different retirement account right into a Roth IRA. However, it could be helpful to unfold out your rollovers over a number of tax years to restrict your tax invoice. In distinction, the annual contribution restrict for direct contributions to Roth IRAs for the tax years 2021 and 2022 is simply $6,000 per yr .

Roth Ira Conversion Methods

There are a number of methods to enact a Roth conversion, relying on the place you maintain your retirement accounts:

- With a 60-day oblique rollover, you obtain a distribution within the type of a examine paid on to you out of your conventional IRA. You then have 60 days to deposit it into your Roth IRA.

- A less complicated option to convert to a Roth IRA is a trustee-to-trustee direct switch from one monetary establishment to a different. Tell your conventional IRA supplier that you justd prefer to switch the cash on to your Roth IRA supplier.

- If each IRAs are on the similar agency, you may ask your monetary establishment to switch a certain amount out of your conventional IRA to your Roth IRA. This technique is known as a same-trustee or direct switch.

You May Like: What Happens To Your 401k If You Leave Your Job

Potential Tax Pitfalls With An Indirect Rollover

While a “direct” rollover is free from tax penalties, be careful if the IRA administrator sends you a personal check for the account balance. This will trigger an “indirect rollover,” which basically is a short-term loan from the account. You now have 60 days to deposit the money into your 401 otherwise, the IRS will treat the rollover as a distribution and you’ll be forced to pay taxes and a 10 percent penalty on the money if you’re aged under 59 1/2. Only, there’s a catch.

Since taxes are due on IRA distributions, the account administrator is legally obligated to withhold 20 percent of your account balance for federal tax withholding. So, if you request a $20,000 distribution, you will only receive $16,000. The remaining $4,000 is sent to the IRS to cover the taxes. But you must deposit the full $20,000 into your 401 to avoid tax penalties. If the amount of the distribution from your IRA and the amount you deposit into your 401 don’t match, you’ll owe taxes and a 10 percent penalty on the difference.

Really watch the 60-day deadline too it’s not the date you mail the check to your employer that stops the clock, it’s the date the money is deposited. The safest bet is to transfer the IRA to the 401 directly and avoid these potential pitfalls.

What If I Have Employer Stock In My Employer

You can choose to roll company stock into an IRA or a taxable brokerage account. If you decide to roll the stock to an IRA, its full value will be taxed as income at your regular rate if you move the stock to a taxable brokerage account, you might be able to save money by paying capital gains taxes on the difference between the stocks value and the price you paid for it. There are tax benefits to each, so consult your tax advisor and ask about the net unrealized appreciation strategy.

You May Like: How Do You Find Your 401k

How To Complete An Ira To 401 Rollover

The first step is checking whether your employers 401 plan accepts IRA rollovers. Not all plans will allow you to roll over IRA assets. If they do, youll want to request a direct transfer to avoid any income tax or the 10% early withdrawal penalty.

If a direct transfer isnt an option, your IRA provider will send you a check for 80% of your accounts value and withhold the remaining 20% for taxes. You must deposit 100% of the value of your IRA into your 401 within 60 days or the transaction will be treated as an early distribution, triggering the 10% penalty and income taxes. The 20% that your IRA provider withheld will serve as a tax credit when you file your tax return.

Which Types Of Distributions Can I Roll Over

IRAs: You can roll over all or part of any distribution from your IRA except:

Retirement plans: You can roll over all or part of any distribution of your retirement plan account except:

Distributions that can be rolled over are called “eligible rollover distributions.” Of course, to get a distribution from a retirement plan, you have to meet the plans conditions for a distribution, such as termination of employment.

You May Like: How Do I Transfer 401k To New Employer

Rolling Your Annuity Into A 401

Can you roll your annuity over into your 401? It depends.

First, your annuity would need to already be an IRA annuity. And second, your 401 plan would have to allow you to roll money from other tax-deferred retirement plans into it.

You should check with the person in charge of your employers plan. You should also check with your annuity provider and review the contract to make sure youre able to take the funds from the annuity.

Should I Roll Over Traditional Ira Funds To A Roth

It depends upon your tax state of affairs. If youre in a decrease tax bracket this yr than you intend to be throughout retirement, a rollover might make sense. For instance, for those who had been furloughed or laid off as a result of coronavirus pandemic, that yr is likely to be a superb yr to contemplate transferring a few of your retirement funds right into a Roth IRA. On the opposite hand, for those who count on to be in a decrease tax bracket throughout retirement, its clever to maintain your funds the place theyre presently.

Recommended Reading: Can I Take A Loan From My 401k

When It Might Make Sense

Here are some of the most common reasons people roll IRAs into 401 accounts.

Avoid required minimum distributions : After you reach age 70 1/2, the IRS may require you to take money out of pre-tax retirement accounts, which helps generate tax revenue. But if you are still working, you might be able to wait until you retire to take RMDs from your 401 . Some owners of the business even partial owners arent allowed to use that strategy, so check with the IRS or a good CPA before you attempt this. Switching from an IRA to your 401 allows you to delay taxes, potentially resulting in more compounding.

Backdoor Roth and conversions: If you plan to convert traditional IRA money to Roth IRA money or make back door Roth contributions you might want to minimize pre-tax money in IRAs. Doing so may neutralize the pro-rata rule, which causes complications and taxes when you have pre-tax money in an IRA. By shifting that pre-tax IRA money to your 401, only post-tax money remains in the IRA, which simplifies things substantially.

Age 55 withdrawals: 401s can be more flexible than IRAs if youre between the ages of 55 and 59 1/2. With an IRA, you have to wait until age 59 1/2 to take withdrawals without penalty taxes . With a 401, you can take withdrawals without penalty if you retire at 55 or older. Its probably not ideal to cash out all of your retirement money when youre that young, but its an option.

Expect Higher Taxes In Future

Since you pay income taxes on the funds you contribute to a Roth IRA, you won’t pay taxes on the distributions. If you expect your income to increase in the future, it means you will be in a higher tax bracket in retirement. You can decide to pay taxes now so that future withdrawals will be tax-free.

Don’t Miss: How To Maximize Your 401k

How To Prepare Your M1 Account For Your Incoming Transfer

There are a few additional steps that you can take to ensure that your M1 Finance rollover is successful.

Unless you want to liquidate your assets during the rollover process, make sure that your M1 pie selection of stocks and funds matches your current portfolio.

Lets say that at your current brokerage your portfolio is a mix of Apple, Amazon, and Microsoft. If your M1 Finance pie is set up with just Apple and Amazon, Microsoft will either need to be added to the pie or those assets will be liquidated during the transfer.

M1 Finance states that target percentages created for your retirement pie will not impact your incoming transfer.

If Apple represents 10% of your current portfolio but you set it to represent 25% in your M1 retirement pie, the entire amount will transfer over to M1 and then the M1 algorithm will slowly adjust to the portfolio weight through future investments and withdrawals.

So, the key thing to remember here is to make sure you include each stock and ETF within your M1 Finance portfolio that you are transferring in. Don’t worry about the percentages as much for now.

Simple Ira Rollovers To Another Simple Ira

Another way to carry out a tax-free rollover is to move assets from your SIMPLE IRA into another SIMPLE IRA if you can’t wait two years. You’re free to transfer any amount from one SIMPLE IRA to another SIMPLE IRA in a tax-free trustee-to-trustee transfer during either the two-year period or after. The IRS doesn’t make you wait two years to make this kind of transfer.

You can only make one IRA-to-IRA rollover per 12-month period, so you would have to wait until the following year to roll over your SIMPLE IRA to another SIMPLE IRA if you’ve already completed one rollover within this timeframe.

Also Check: How Can I Get A 401k Plan Without An Employer

Ira Fees To Be Aware Of

If you do opt for a self-directed IRA account, there may be some fees to be aware of.

However, self-directed IRA fees are almost always lower than 401 fees.

Examples include:

Transfer Funds From Your Old Qrp

Contact the plan administrator of the QRP you are rolling , and request a direct rollover distribution payable to Wells Fargo. Make sure to:

- Ask to roll over the funds directly to Wells Fargo for benefit of your name.

- Reference both your name and the account number of the new IRA you set up.

They will either send the funds directly to Wells Fargo, or you will receive a check in the mail made payable to your IRA to deposit into your Wells Fargo IRA.

Don’t Miss: Can You Use Your 401k To Buy Real Estate

When You Don’t Roll Over

Cashing out your account is a simple but costly option. You can ask your plan administrator for a checkbut your employer will withhold 20 percent of your account balance to prepay the tax youll owe. Plus, the IRS will consider your payout an early distribution, meaning you could owe the 10 percent early withdrawal penalty on top of combined federal, state and local taxes. That could total more than 50 percent of your account value.

Think TwiceThe repercussions of taking money out now could be enormous: If you took $10,000 out of your 401 instead of rolling it over into an account earning 8 percent tax-deferred earnings, your retirement fund could end up more than $100,000 short after 30 years.

If your former employers plan has provided strong returns with reasonable fees, you might consider leaving your account behind. You dont give up the right to move your account to your new 401 or an IRA at any time. While your money remains in your former employers 401 plan, you wont be able to make additional contributions to the account, and you may not be able to take a loan from the plan. In addition, some employers might charge higher fees if youre not an active employee.

Further, you might not qualify to stay in your old 401 account: Your employer has the option of cashing out your account if the balance is less than $1,000 though it must provide for the automatic rolling over of your assets out of the plan and into an IRA if your plan balance is more than$1,000.