Do You Pay Taxes On 401k After Age 65

Tax on a 401k Withdrawal after 65 Miscellaneous Whatever you take from your 401k account is a taxable income, as would a regular regular payment when you contributed to the 401k, your contributions were pre-tax, and so you are taxed on retirees.

How old can you get your 401k without paying taxes? After you turn 59, you can withdraw your money without having to pay an early retirement penalty. You can choose a traditional plan or Roth 401 . The traditional 401 offers deferred tax savings, but you still have to pay taxes when you take the money.

Leave Your Assets Where They Are

If the plan allows, you can leave the assets in your former employers 401 plan, where they can continue to benefit from any tax-advantaged growth. Find out if you must maintain a minimum balance, and understand the plans fees, investment options, and other provisions, especially if you may need to access these funds at a later time.

Cashing Out A 401 Is Popular But Not So Smart

Intellectually, consumers know that cashing out retirement accounts isnt a smart move. But plenty of people do it anyway. As discussed, you may be forced out of your former plan based on your account balance, but that doesnt mean you should cash the check and use it for non-retirement related purposes. In the long run, your financial future will be better served by rolling the money over into an IRA or if applicable, your new employers 401 plan.

A 2020 survey by Alight, a leading provider of human capital and business solutions, found that 4 out of 10 people cashed out their balances after termination between 2008 and 2017. About 80 percent of those who had an account balance of less than $1,000 cashed out, while 62 percent who had balances between $1,000 and $5,000 did the same.

Based on historical rates of return, a $3,000 cash out at age 24 leads to a $23,000 difference , in your projected account balance at age 67, so even a small amount of money invested into a retirement vehicle today can make a big difference in the long run.

Don’t Miss: How To Lower 401k Contribution Fidelity

Will My Credit Score Be Impacted If I Withdraw Early

Withdrawing funds from your 401 early won’t impact your credit directly since the credit bureaus don’t track activity on your retirement accounts.

Making an early withdrawal can indirectly affect your credit when you use the money to pay down outstanding debt. It may seem like an easy way to ease a debt burden or boost your credit, but in most cases, this shouldn’t be the only reason to withdraw funds from your 401. Such a move should only be considered in a financial emergency when you have exhausted all other options.

Rolling 401k Into Ira

When you leave an employer, you have several options for what to do with your 401k, including rolling it over into an IRA account.

Its possible to do the same thing while still working for an employer, but only if the rules governing your workplace 401k allow for it.

The negative for rolling the money into an IRA is that you cant borrow from a traditional IRA account.

Another option when you leave an employer is to simply leave the 401k account where it is until you are ready to retire. You also could transfer your old 401k into your new employers retirement account.

If you are at least 59 ½ years old, you could take a lump-sum distribution without penalty, but there would be income tax consequences.

Recommended Reading: How To Direct Transfer 401k To 403b

Check Your Plan Documents

Employers are supposed to give 401 participants a copy of the summary plan description, which has the provisions for receiving payouts. Your SPD might list the actual time it takes to process your 401. Or it might simply say as soon as is administratively possible.

In some instances, participants might have to wait until retirement age before they can take their money out even if they no longer work for the company. Check your SPD for the companys distribution timing to get an accurate picture of your situation. If you dont have a copy of the SPD, contact your human resources department or the plan provider to request it.

Leave The Account Alone

If your 401 investment balance is more than $5,000, most plans allow you to just leave it where it is. This is often the simplest choice. If you dont urgently need the money, leaving your 401 account alone allows it to continue growing from investment gains.

It may make sense to roll over the 401, though, if youre paying high fees for the management of the account where it is, or if you want more control over how your money is invested.

If the account balance is less than $5,000, your old company may also opt to distribute the money to you. Then its largely on you to roll it over into a new retirement account if you want to avoid having to pay taxes on it nowand possibly a penalty.

Don’t Miss: How To Rollover 401k To New Employer

Types Of Qualified Retirement Accounts

Direct rollovers or transfers from qualified retirement plans occur when the retirement plan administrator pays the plans proceeds directly to another plan or IRA. The IRS provides a guide to common qualified plan requirements.

In general, qualified retirement plans meet the requirements of Internal Revenue Code Section 401 and are thus eligible to receive certain tax benefits. They usually come in two forms: the defined benefit plan, such as a pension plan, and the defined contribution plan, such as a 401. A cash balance plan is a hybrid of these two.

Examples of qualified retirement plans include:

- 401 plans

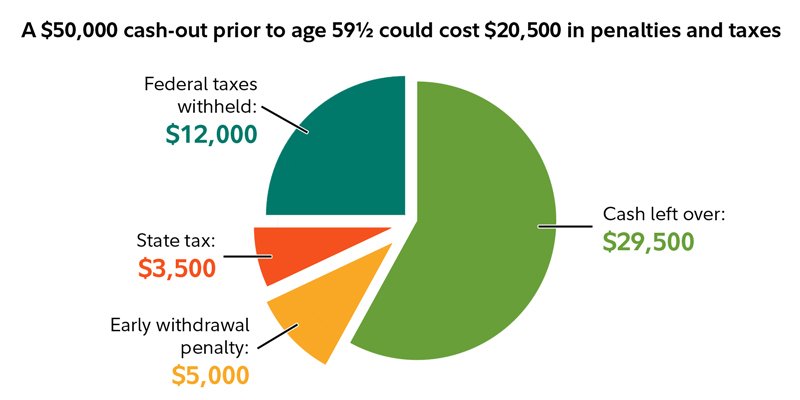

Taking The Cash Distribution May Cost You

Avoiding cash distributions can save you from taxes and penalties, because any amount you fail to roll over will be treated as a taxable distribution. As a result, it would also be subject to the 10% penalty if you are under age 59 1/2.

Since the taxable portion of a distribution will be added to any other taxable income you have during the year, you could move into a higher tax bracket.

Using the previous example, if a single taxpayer with $50,000 of taxable income were to decide not to roll over any portion of the $100,000 distribution, they would report $150,000 of taxable income for the year. That would put them in a higher tax bracket. They also would have to report $10,000 in additional penalty tax, if they were under the age of 59 1/2.

Only use cash distributions as a last resort. That means extreme cases of financial hardship. These hardships may include facing foreclosure, eviction, or repossession. If you have to go this route, only take out funds needed to cover the hardship, plus any taxes and penalties you will owe.

The CARES Act, enacted on March 27, 2020, provided some relief for those who need to make withdrawals from a retirement plan. It lifted penalties for withdrawals made through December 2020 and provides three years to pay back any early withdrawals.

You May Like: How To Sell 401k Plans

What Is The Rule Of 55

Your 401 account is likely one of the most valuable assets you have, so it’s essential to know when and how you can access it. These accounts are intended to fund your retirement, and as such you can access them penalty-free when you reach age 59½. In most cases, taking money out of your 401 before then will cost you a pretty penny: Early withdrawals come with a 10% penalty.

There are a few exceptions, however, and one of them could help you if you want or need to retire early. The Rule of 55 is an IRS provision that allows you to withdraw funds from your 401 or 403 without a penalty at age 55 or older. Read on to find out how it works.

What Is The 595 Rule

Most Americans that are lucky enough to have money stashed away for retirement in an Individual Retirement Account are probably familiar with the age 59.5 rule, whereby a distribution from the IRA before that age will trigger not only taxes on the amount withdrawn, but a 10% penalty on early distributions.

Also Check: Should You Roll Your 401k Into An Ira

You Asked We Answer: How Long Can A Company Hold Your 401k After You Leave

Having a strong 401 k plan is a priority for most Americans. In the USA, a 401 k plan or IRA is the basis of your retirement savings. The absence of a universal welfare plan means that these accounts are the responsibility of your employer. However, some jobs dont work out. You might end up resigning before you reach retirement age. When this happens, it can affect your 401 k plan. If you resign early, you may need to figure out what to do with your old 401 k account.

Depending on the amount in your 401 k and your age at retirement, you may have full access to the funds. Otherwise, you might need to wait a certain period of time. You might also be required to transfer the 401 k funds to a new account from the old account. Withdrawing the money before youre old enough can mean you face penalties. This article discusses your options when you leave your job before youve reached retirement age.

What Reasons Can You Withdraw From 401k Without Penalty

Here are some ways to get a free-kick off your IRA or 401

- Unpaid medical bills.

- If you are indebted to the IRS.

- They are buying houses for the first time.

- The cost of higher education.

- For financial purposes.

Is there a penalty for withdrawing from 401k in 2021?

The first 10% withdrawal penalty is back in 2021. The proceeds from the take are calculated as the tax revenue for the 2021 year.

Also Check: What Do I Do With 401k When I Retire

Where Can I Find My Old 401k Account

You can learn more about consolidating old 401k from previous jobs, and other current accounts here. 1National Association of Unclaimed Property Administrators. Creating and maintaining a financial plan can help you keep tabs on all your money. If you need help, visit a Schwab Financial Consultant at your local branch or call us at 800-355-2162.

Compound Interest Only Works If You Leave The Money Alone

We talk a lot at Money Under 30 about compound interest. Its what makes a comfortable retirement possible for most of us. When you cash out your 401 early, youre not just subtracting that balance from your eventual retirement fund. Rather, youre deducting your balance, plus any interest your balance will earn over the next few decades, plus the interest the interest would earn! Taking a few hundred bucks now could cost you thousands down the road. Not to mention that you immediately lose almost 30% of your balance to taxes and fees.

It might feel like a small windfall now, but over the long term, youre taking yourself to the cleaners.

Most retirement funds are set up to allow your money to grow with few interruptions: Hence why the money you put into a 401 isnt taxed, why the interest you earn while your money is in the 401 isnt taxed, and why its relatively hard to remove money from your account until youre close to retirement age.

While we know its tempting to take that small pot of cash, we urge you to resist. And once youve gotten a new job, you should roll your old 401 into your new employers plan. Thatll take away the temptation entirely.

Don’t Miss: How To Borrow From Your 401k

How Does Severance Pay Affect Your Unemployment Benefits In Texas

Under Texas law, you cannot receive benefits while you are receiving certain types of severance pay. We will mail you a decision on whether your severance pay affects your unemployment benefits. Wages paid instead of notice of layoff are payments an employer makes to an employee who is involuntarily separated without receiving prior notice.

Option : Roll Over Your 401 Into An Ira

Instead of keeping your funds in a 401, you may also choose to roll over your plan into an IRA. Youll do this with a bank or brokerage firm separate from your employer. This is a common choice for people who are leaving the workforce or for those who dont have an employer that offers a 401 plan.

The main benefit of an IRA versus a 401 is more flexibility in withdrawing money penalty-free before reaching the age of 59 ½. You also have direct access and more control over your investment options. You may have other investments and can now move this money to the same brokerage so that everything is in one plan, which consolidates logins.

If you choose to withdraw money from a rollover IRA, it may be used for a qualifying first-time home purchase or higher education expenses in addition to the exceptions for 401s.

The drawbacks of an IRA is that youll lose some hardship distribution options as well as qualified status, which means less protection of your assets. For example, if you were to be sued, some states would allow money in IRAs to be collected but not if it was in a 401.

Recommended Reading: How To Collect My 401k Money

Cash Out Or Roll Over Your 401 What To Do If You Lose Your Job

More than 22 million jobs have been lost since the coronavirus pandemic shuttered businesses across the country this spring.

If youre among the millions of Americans whove lost a job, and were fortunate enough to have an employer-sponsored 401 plan, what to do with that money is a common questionespecially if youre struggling financially.

Here are some options and what to consider before you take the next step.

Cash out or rollover your 401? What to do with your retirement plan if you lose your job.

Scott Graham for Unsplash

What Determines How Long A Company Can Hold Your 401 After Leaving A Job

The retirement money you have accumulated in your 401 is your money. This gives you the freedom to change jobs without worrying that your savings may get lost in the process. The money can stay in your employerâs retirement plan for as long as you want, but there are certain cases when an employer may force a cash out or rollover the funds into another retirement account.

These factors may determine how long an employer can hold your 401 money after you leave the company:

Don’t Miss: Can A Spouse Get Your 401k In Divorce

Making The Numbers Add Up

Put simply, to cash out all or part of a 401 retirement fund without being subject to penalties, you must reach the age of 59½, pass away, become disabled, or undergo some sort of financial hardship . Whatever the circumstance though, if you choose to withdraw funds early, you should prepare yourself for the possibility of funds becoming subject to income tax, and early distributions being subjected to additional fees or penalties. Be aware as well: Any funds in a 401 plan are protected in the event of bankruptcy, and creditors cannot seize them. Once removed, your money will no longer receive these protections, which may expose you to hidden expenses at a later date.

Read Also: When Can I Set Up A Solo 401k

Tax Implications Of Cashing Out A 401 After Leaving A Job

The following are some tax rules regarding your old 401:

-

When you leave your 401 account with your old employer, you wont need to pay taxes until you choose to withdraw the funds.

-

Even when you roll over your old 401 account to your new employer, you need not pay any taxes.

-

At the time of your 401 distributions, you will be liable to pay income tax at the prevailing rates applicable for such distribution.

-

If you havent reached the age of 59 ½ years at the time of distribution, you may be liable to pay a premature withdrawal penalty of 10%, subject to certain exceptions.

-

Distributions from a designated Roth account are tax-free after you reach the age of 59 ½ years, provided your account is at least five years old.

Although legally, you have every right to liquidate your old 401 account and cash out the entire funds, doing so would reduce your savings for the retired life. Additionally, the distributions will add up to your annual taxable income.

Need further help? Talk to our experts for professional advice on anything and everything related to 401.

Article By

The Human Interest Team

We believe that everyone deserves access to a secure financial future, which is why we make it easy to provide a 401 to your employees. Human Interest offers a low-cost 401 with automated administration, built-in investment advising, and integration with leading payroll providers.

Don’t Miss: How Much Is The Max You Can Contribute To 401k

High Unreimbursed Medical Expenses

This particular exception is similar to the hardship distributions mentioned earlier, and these medical bills might qualify you under either category. You should know that a hardship withdrawal for medical bills will not entitle you to a waiver of the 10% penalty in all cases. To qualify for a penalty-free withdrawal, the amount of the bills must be greater than 7.5% of your adjusted gross income . You must also take the distribution in the same year in which the bills were incurred. You cannot take money for estimated future bills either. The bills must be currently due for services already provided.

Also note the requirement that the bills be unreimbursed. If your insurance covers part of the bills or will reimburse you for the payments, then you cannot use money from your 401 to pay them. Likewise, the bills must be for you, your spouse, or a qualified dependent. You cannot use the money to pay bills for a parent, sibling, or any other family member. The limit to the amount of money you can withdraw for medical bills was recently removed, so you are allowed to withdraw as much as is needed to cover all the expenses.