Borrowing Money From My 401k

It may seem like an easy way to get out of debt to borrow from your retirement accounts for DIY debt consolidation, but you can only borrow $50,000 or half the vested balance in your account, if its less than $50,000. You wont face a tax penalty for doing so, like you would with an out-right withdrawal, but youll still have to pay the money back.

And unlike a home equity loan where payments can be drawn out over a 10-to-30-year period, most 401k loans need to be paid back on a shorter time table like five years. This can take a huge chunk out of your paycheck, causing you even further financial distress. Borrowing money from your 401k also limits the ability of your invested dollars to grow.

Paying off some of your debt with a 401k loan could help improve your debt-to-income ratio, a calculation lenders make to determine how much debt you can handle. If youre almost able to qualify for a consolidation or home equity loan, but your DTI ratio is too high, a small loan from your retirement account, amortized over 5 years at a low interest rate may make the difference.

Recommended Reading: Should I Pay Someone To Manage My 401k

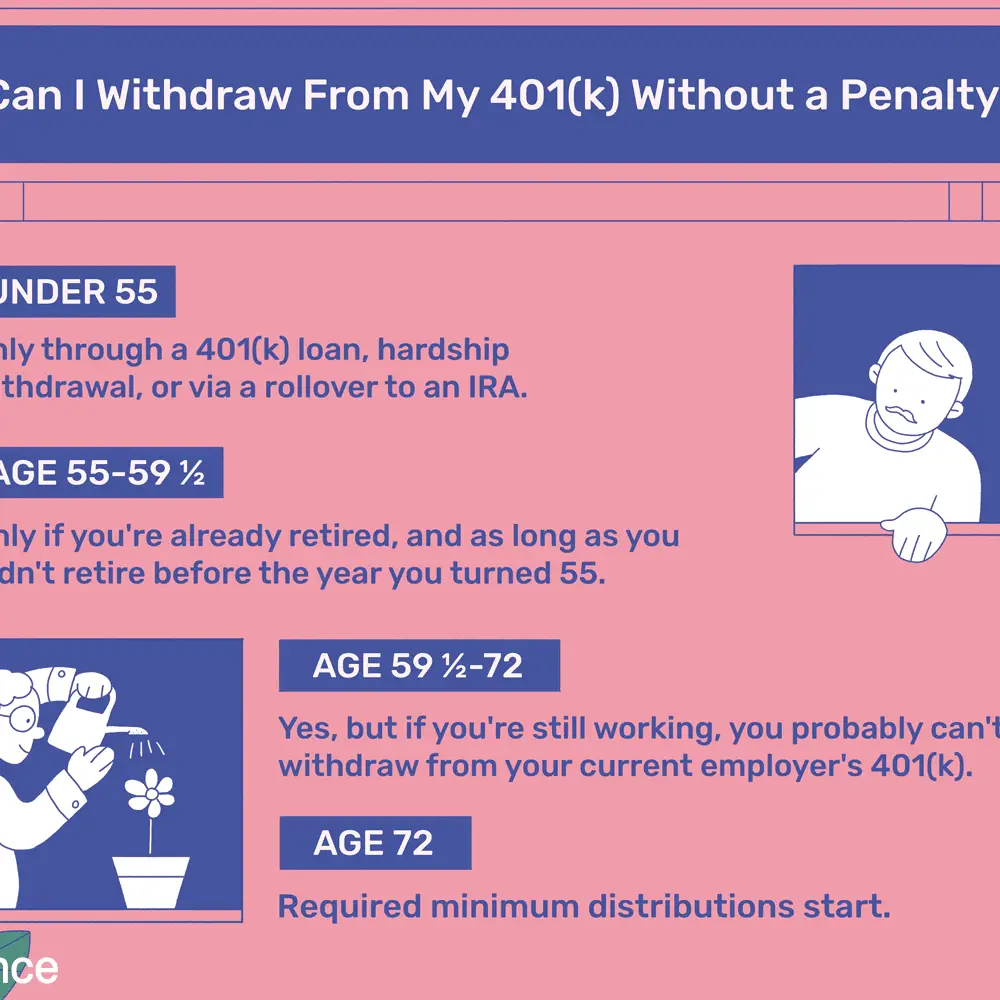

Are You Still Working

You can access funds from an old 401 plan after you reach age 59 1/2, even if you haven’t retired. The best idea for old 401 accounts is to roll them over when you leave a job. If you are 59 1/2 or older, you will not be hit with penalties if you withdraw from your old accounts. However, you need to check with your human resource department about the rules around withdrawing from your current 401 if you are still in the workplace.

Check with your 401 plan administrator to find out whether your plan allows what’s referred to as an in-service distribution at age 59 1/2. Some 401 plans allow this, but others don’t.

How Much You’ll Get

After the administrator withholds 20 percent for federal taxes, you’ll get 80 percent of your account balance, or $8,000 of a $10,000 account, for example. If you’re in a higher tax bracket, you may owe more on this withdrawal when you actually file. You’ll also pay an early-withdrawal penalty of 10 percent if you’re under age 59-1/2 and don’t qualify for an exception. For example, you don’t have to pay the penalty if you’re older than 55 and no longer working for the employer that sponsors the plan. At any age, you can avoid the penalty in some emergency situations, for example, if you lose your job, become disabled or incur extreme medical expenses. If you must pay a 10 percent penalty in addition to 20 percent in taxes, you’ll only receive 70 percent of your account balance. For example, a $10,000 account will net only $7,000.

You May Like: How To Look Up An Old 401k Account

What Determines How Long A Company Can Hold Your 401 After Leaving A Job

The retirement money you have accumulated in your 401 is your money. This gives you the freedom to change jobs without worrying that your savings may get lost in the process. The money can stay in your employerâs retirement plan for as long as you want, but there are certain cases when an employer may force a cash out or rollover the funds into another retirement account.

These factors may determine how long an employer can hold your 401 money after you leave the company:

Withdrawals From A 401

-

401 hardship withdrawals If you find yourself facing dire financial concerns and need cash urgently, your 401 plan may offer a hardship withdrawal option. Unlike a 401 loan, you wont have to repay the money you take out, but you will owe taxes and potentially a premature distribution penalty on the amount that you withdraw. In addition, IRS 401 hardship withdrawal rules state that you may not take out more money than what is needed to cover your hardship situation. In order to qualify for a 401 hardship withdrawal, your plan administrator must offer this option and you must be facing an immediate and heavy financial need. According to the IRS, approved 401 hardship withdrawal reasons include:

- Postsecondary tuition for you or your family

- Medical or funeral expenses for you or your family

- Certain costs related to buying, or repairing damage to, your primary residence

- Preventing your immediate eviction from or foreclosure of your primary residence

If you experience a financial hardship from a circumstance not on this list, you may still be able to qualify for a hardship withdrawal, so check with your plan administrator.

- In-service, non-hardship withdrawals

This type of withdrawal is only allowed under certain plans and is mainly used by those who would like to explore other investment options. Learn more about in-service distributions. An Ameriprise financial advisor can provide more detailed information on in-service 401 distributions.

Don’t Miss: How To Maximize Your 401k

What Are My 401 Options After Retirement

Generally speaking, retirees with a 401 are left with the following choices: Leave your money in the plan until you reach the age of required minimum distributions convert the account into an individual retirement account or start cashing out via a lump-sum distribution, installment payments, or purchasing an annuity through a recommended insurer.

How Are 401 Withdrawals Taxed

If a rollover-eligible withdrawal is made to you in cash, the taxable amount will be reduced by 20% Federal income tax withholding. Non-rollover eligible withdrawals are subject to 10% withholding unless you elect a lower amount. State tax withholding may also apply depending upon your state of residence.

However, your ultimate tax liability on a 401 withdrawal will be based on your Federal income and state tax rates. That means you will receive a tax refund if your actual tax rate is lower than the withholding rate or owe more taxes if its higher.

If a 401 withdrawal is made to you before you reach age 59½, the taxable amount will be subject to a 10% premature withdrawal penalty unless an exception applies. This penalty is meant to discourage you from withdrawing your 401 savings before you need it for retirement. You can avoid the 10% penalty under the following circumstances:

- You terminate service with your employer during or after the calendar year in which you reach age 55

- You are the beneficiary of the death distribution

- You have a qualifying disability

- You are the beneficiary of a Qualified Domestic Relations Order

- Your distribution is due to a plan testing failure

A full list of the exceptions to the 10% premature distribution penalty can be found on the IRS website.

Read Also: How To Tell If You Have A 401k

Criteria For Qualifying Individuals

- Anyone diagnosed with SARS-CoV-2 or COVID-19 by a test approved by the Centers for Disease Control and Prevention

- Anyone whose spouse or dependent is diagnosed with SARS-CoV-2 or COVID-19 by an approved test

- Anyone facing adverse financial consequences after being furloughed, laid off, quarantined or having reduced work hours because of SARS-CoV-2 or COVID-19

- Anyone unable to work because of lack of child care related to SARS-CoV-2 or COVID-19

- Anyone who had to close a business or reduce business hours because of SARS-CoV-2 or COVID-19

How Can I Cash Out A 401

Provided youre eligible to make a 401 withdrawal, youll need to follow the plan administrators rules for requesting one. You may be required to have an online account, speak to a representative directly or complete some necessary paperwork to make the withdrawal.

Contact your plan administrator for guidance.

Recommended Reading: Can I Move My 401k Into A Roth Ira

Your Retirement Money Is Safe From Creditors

Did you know that money saved in a retirement account is safe from creditors? If you are sued by debt collectors or declare bankruptcy, your 401k and IRAs cannot be liquidated by creditors to satisfy bills you owe. If youre having problems managing your debt, its better to seek alternatives other than an early withdrawal, which will also come with a high penalty.

Cashing Out Your 401 After Leaving A Job

Based on the amount of money in your 401 account, your employer may allow you to leave the account with them. However, you will not be able to contribute any more to your old account.

Leaving your account with the old employer may not be prudentespecially when you have access to more flexible Individual Retirement Account plans from most brokers. You may roll over your 401 account to your new employer or transfer the funds into an IRA. If you meet the age criteria, you may start taking distributions without having to pay any penalty for early withdrawal.

Don’t Miss: How Do I Access My 401k Account

The Amount Of Contribution

The amount of money in your 401 plan may determine how long your employer takes to make a distribution. Here are the rules for different 401 amounts:

If your 401 balance is less than $1000, your employer will automatically cash out the funds and send you a check with your lump sum amount. In this case, the check will take a few days to reach your mail from the date when you leave your job.

If you have saved up more than $1000 but below $5000, your employer cannot force a cash out. Instead, it is required by law to transfer the funds to a new retirement plan, usually an IRA associated with your employer. The transfer can be completed in a few weeks up to 60 days.

If you don’t want the employer to decide for you, you should act quickly before your retirement savings are transferred to an unwanted retirement plan. You can ask your 401 administrator to rollover to an IRA of your choice, which generally takes about 5 days to two weeks to complete. This way, your distribution will not be subjected to income taxes and penalties.

If your 401 balance exceeds $5000, your former employer cannot force a cash out or transfer the funds to another retirement plan without your instructions. In this case, the employer must leave your retirement savings in your 401 for an indefinite period until you provide instructions on what to do with the retirement money.

Consider All Of Your Financial Options

When you need cash in a crunch, ideally you have options: using money saved, dipping into emergency savings, getting a loan, or possibly as a last resort withdrawing money saved for retirement. Consider the relief available if youve been impacted by a FEMA declared disaster , and talk to your plan sponsor and/or retirement services provider before taking any next steps.

You May Like: What Is 401k In Usa

Don’t Miss: How To Cancel 401k Plan

How Much Will I Get If I Cash Out My 401 Early

Dylan Telerski / 19 Jun 2020 / 401 Resources

Considering a 401 withdrawal? Heres how much you can get if you choose to cash out your 401:

- Traditional 401 : Youll get 100% of the balance, minus state and federal taxes.

- Roth 401 : Youll get 100% of your balance, without taxation.

- Cashing out before age 59.5: You will be subject to a 10% penalty on top of any taxes owed.

Cashing out early will also result in lost growth. Therefore, its recommended that you let your money sit as long as possible to reap the full reward of your retirement savings. Of course, in some scenarios, its easier said than done to let the cash sit.

Convert To An Ira And Keep Contributing

You cannot contribute to a 401 after you leave your job, so if you want to continue adding money to your retirement funds, youll need to roll over your account into an IRA. Previously, you could contribute to a Roth IRA indefinitely but could not contribute to a traditional IRA after age 70½. However, under the new Setting Every Community Up for Retirement Enhancement Act, you can now contribute to a traditional IRA for as long as you like.

Keep in mind that you can only contribute earned income, not gross income, to either type of IRA, so this strategy will only work if you have not retired completely and still earn taxable compensation, such as wages, salaries, commissions, tips, bonuses, or net income from self-employment, as the IRS puts it. You cant contribute money earned from either investments or your Social Security check, though certain types of alimony payments may qualify.

To execute a rollover of your 401, you can ask your plan administrator to distribute your savings directly to a new or existing IRA. Alternatively, you can elect to take the distribution yourself. However, in this case, you must deposit the funds into your IRA within 60 days to avoid paying taxes on the income.

Traditional 401 accounts can be rolled over into either a traditional IRA or a Roth IRA, whereas designated Roth 401 accounts must be rolled over into a Roth IRA.

Read Also: Can I Take Monthly Distributions From My 401k

Pros And Cons Of Withdrawals

When you withdraw money from your retirement account instead of taking a loan you dont have to worry about paying it back. If your employment situation is unstable and you dont know when your income will return to its pre-COVID-19 level, not having extra payments can be a relief. Here are some other pros and cons to consider:

- You can spread out the withdrawal over the next three years to lessen the tax burden.

- You have the option of paying back the withdrawal to avoid income taxes.

Cons

- You will miss out on the amount you removed from the account and all the interest that money would have earned over the next few years.

- Your retirement account may not return to pre-COVID-19 levels. The closer you are to retirement, the less time you have to rebuild your savings.

- The money you withdraw is considered taxable income, and you will have to pay your ordinary income tax rate on it unless you choose to pay back the withdrawal.

Early Withdrawals: The 401 Age 55 Rule

If you retireor lose your jobwhen you are age 55 but not yet 59½, you can avoid the 10% early withdrawal penalty for taking money out of your 401. However, this only applies to the 401 from the employer that you just left. Money that is still in an earlier employers plan is not eligible for this exceptionnor is money in an IRA.

Nashville: How Do I Invest for Retirement?

You May Like: What Year Did 401k Start

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

How Do You Withdraw Money From A 401 When You Retire

After retirement, one of the common questions that people ask is âhow do you withdraw money from a 401 when you retire?â. Find out the options you have.

As you plan your retirement, you should think about how you are going to live off your retirement savings once you are out of employment. You will need to figure out how to withdraw your retirement savings in your 401 post-retirement, and the best withdrawal strategies so that you donât exhaust your retirement savings.

When withdrawing your retirement savings from a 401, you can decide to take a lump-sum distribution, take a periodic distribution , buy an annuity, or rollover the retirement savings into an IRA.

Usually, once youâve attained 59 ½, you can start withdrawing money from your 401 without paying a 10% penalty tax for early withdrawals. Still, if you decide to retire at 55, you can take a distribution without being subjected to the penalty. However, any distribution you take after retirement is taxed, and you must include the distribution as an income when filing your annual tax return.

Also Check: How Can I Get My 401k Without Penalty

Can I Cash Out My 401 Without Quitting My Job

The question of whether you can get cash from your 401 without leaving your employer is yes, in most cases.

The actual means to do so can vary from plan to plan. In doing so, it is important to note that an employer offering the plan can opt-in or out of offering some of these methods.

In most cases, it is written within a plan document as to what types of withdrawals are permitted within the plan.

You have two primary options:

- Loans