What Is A 401

A 401 is an employer-sponsored retirement plan enabling workers to save money in a tax-deferred way. Often employers will match contributions up to a percentage of salary. Its just like any other retirement plan in the sense that youre trying to save money and reduce taxes as you do it. Like an IRA, you will pay taxes once you start taking withdrawals in retirement.

If you opted for it when you were hired, every paycheck a percentage of your salary is taken out and put into a 401 retirement account. Your employer may add some more money, maybe even the same amount, on top of that. That money is usually invested, and has been accumulating. How much is in there?

There are different types of 401s. A Roth 401 operates much in the same fashion as a Roth IRA. While still employer-sponsored, it uses after-tax income to fund itself, so you pay the taxes now, and not later in retirement. While one can deliberate the merits of which to use, the general consensus is that a Roth format is useful if one believes they will be in an higher tax bracket later in life when withdrawing from their retirement accounts.

Conversely, a traditional 401 advocate might argue that the ability to put more money into an account in the beginning and through time, allows the saver to make the most of compound interest.

Read more about how a 401 works in this article from TheStreet.

Vanguard Vs Fidelity Iras: The Biggest Differences

When it comes to IRAs, Vanguard and Fidelity are neck and neck in many areas. Both offer traditional IRAs, Roth IRAs, SEP IRAs, SIMPLE IRAs, and many other retirement accounts for individuals and small businesses. The two platforms also give investors the option to manage eligible IRAs on their own or utilize automated portfolios and/or advisor assistance.

Fidelity, however, has a wider range of IRA options. Unlike Vanguard, Fidelity offers a Roth IRA account for minors. The brokerage could also suit those in search of lower costs, mainly because most of its index mutual funds have no minimum requirements .

Vanguards advisor-assisted, automated investing account has Fidelitys equivalent account beat when it comes to advisory fees, but Fidelity is still hard to pass up on the account minimum end.

| Vanguard |

What Type Of Ira Should I Open

During the process of opening your new account, you may get asked which type of IRA youd like to open. You might see the following options: Rollover IRA, Traditional IRA, or Roth IRA. Heres how to pick the right one:

- If you had a Traditional 401 pick a Rollover IRA or, if thats not available, Traditional IRA or, if thats not available, just IRA. The only exception would be if youre considering a Roth conversion, but this is an advanced tax planning strategy that most people dont need to worry about.

- If you had a Roth 401 pick a Roth IRA. Youll need to match the Roth 401 to a Roth IRA for tax reasons.

- If your 401 has mixed assets youll need to open two IRAs, one Roth and one Traditional to for their respective assets.

Also Check: How Do I Use My 401k To Start A Business

Read Also: Can I Switch My 401k To A Roth Ira

Check Your 401 Investments

For 401 plans with Fidelity, go to your account and look at your rate of return . Underneath the rate of return click on investment performance and research. Here, there are more details about the performance of each fund.

Some 401 plans offer target date funds which are funds aligned to the assumed year you will retire. If youre enrolled in one of these plans, they tend to come with higher fees but require the least amount of effort from you to maintain. That way, the mix in your portfolio will shift automatically for you as the person who is managing it will change the investments over time. If youd prefer to set it and forget it, you may decide this is worth the higher fees.

If youre not invested in the target date funds, determine how the investments within your 401 plan are performing. While your 401 investments are in it for the long haul, it is always good to look at your investments once or twice or year. Should you be overweight or overweight in certain segments like international, large cap or small cap? Should you change only your future elections or current investments?

Lastly, how many years has it been since youve changed the mix in your portfolio? If you set your portfolio mix 10 years ago, you may be overweight on stocks and need to rebalance your portfolio to include more fixed income.

Make Sure Your Ira Is Being Invested Appropriately

Remember there are two goals of rolling over an old 401 into an IRA the first is to consolidate your 401 assets, and the second is to grow those assets by allocating them into investments that will increase in value over time.

Your very last step in executing a rollover is to make sure that second goal is being met and that the funds in your IRA are being appropriately invested. If you chose an automated IRA then this should happen automatically. Thats because as soon as your funds arrive theyll be allocated into a portfolio that was created for you during the sign-up process for your new IRA account. You should still log in and check to make sure thats the case, but usually theres nothing more for you to do.

If you choose a self-directed account then youll have to invest the money yourself. Often the simplest option is to purchase a target-date retirement fund this is an investment vehicle that puts your money into a combination of higher-risk, higher-return stocks and lower-risk, lower-return bonds. The exact mix changes as you age so that you have more stocks when youre younger and less as you get older: because stocks generate higher returns but are more volatile we should own more of them early on when we can withstand their fluctuations in order to achieve their higher long-term returns.

Otherwise you can assemble a portfolio on your own by making trades.

Also Check: What Happens To My 401k When I Leave My Job

Check Your 401 Beneficiary

While youre in your online account dont forget to check that youve named a beneficiary for your 401 account. Typically, a spouse must be the beneficiary unless they sign a waiver. If youre not married its important to name a beneficiary in your account. The Motley Fool shares additional tips on when someone inherits a 401.

Average 401 Balance Age 30

When you hit your 30s, odds are your career is beginning to accelerate. You no longer are working that entry-level position. You are most likely making more money which means it would be wise to increase your 401k contribution.

Sadly enough, most Americans are not doing this. They seem to be behind, on average, if they want to have a large 401 to retire with.

Focus on increasing the amount you contribute to your 401k every raise. You still have decades to allow compound interest to pick up speed.

Average 401 balance by age 30-39: $47,500

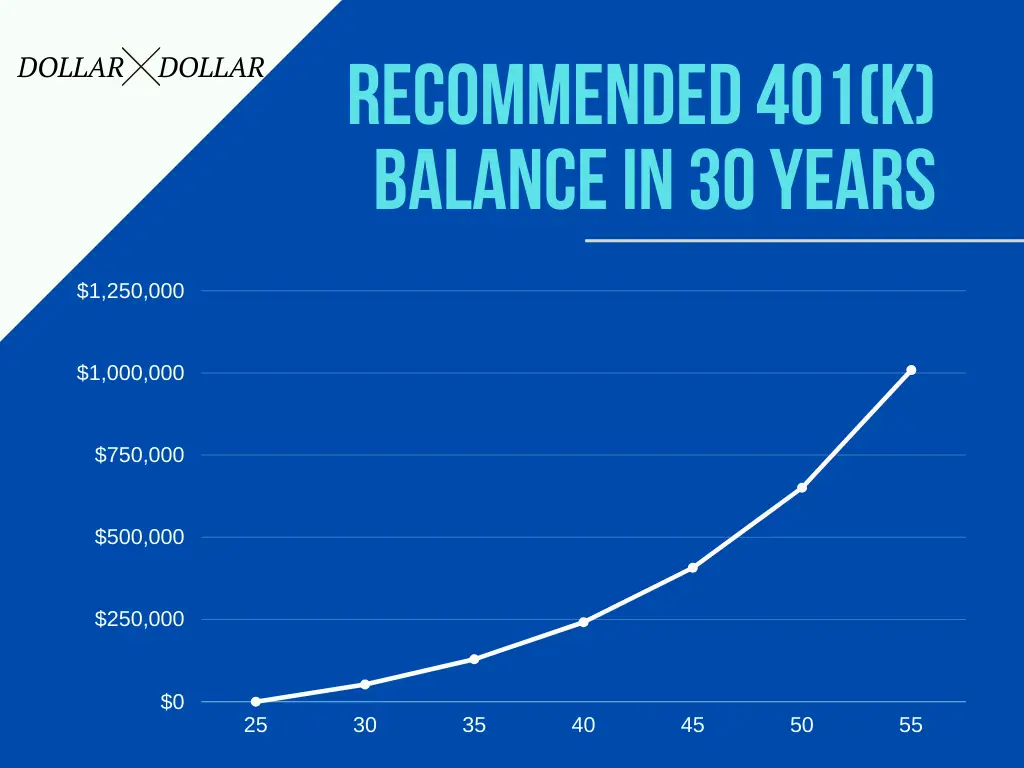

Recommended 401 balance by the end of your 30s to be a millionaire is $242,653.81

Also Check: How To Contribute To 401k Without Employer

Is It Worth It To Take A 401k Withdrawal

Sometimes you just dont have a better option. If withdrawing from the 401 plan is the only way to pay your bills without incurring expensive credit card debt, go for it. There is no point in leaving your retirement assets alone if it jeopardizes your current financial security and your ability to save more for your future retirement.

According To 401k Statistics 58% Of 401k Participants See Themselves As Savers

Interestingly, the remaining 42% of 401k plan participants think of themselves as investors. Whats more, 72% believe its more important to save now so you could have a comfortable retirement. These attitudes show a changing dynamic towards savings. Hopefully, it will prompt more Americans to choose a retirement plan as soon as possible.

Read Also: When Can You Rollover A 401k Into An Ira

Don’t Miss: What Is The 401k Retirement Plan

Cashing Out Your 401k While Still Employed

The first thing to know about cashing out a 401k account while still employed is that you cant do it, not if you are still employed at the company that sponsors the 401k.

You can take out a loan against it, but you cant simply withdraw the money.

If you resign or get fired, you can withdraw the money in your account, but again, there are penalties for doing so that should cause you to reconsider. You will be subject to 10% early withdrawal penalty and the money will be taxed as regular income. Also, your employer must withhold 20% of the amount you cash out for tax purposes.

There are some exceptions to the rule that eliminate penalties, but they are very specific:

- You are over 55

- You are permanently disabled

- The money is needed for medical expenses that exceed 10% of your adjusted gross income

- You intend to cash out via a series of substantially equal payments over the rest of your life

- You are a qualified military reservist called to active duty

Also Check: Can You Use Your 401k To Pay Off Debt

Who Should Use Vanguard

Vanguard built a reputation as a platform that creates and offers low-fee mutual funds and exchange-traded funds. This makes it a good brokerage for clients who want to make basic investments and not think too much about them.

In addition, if you want low-cost funds, Vanguard has also grown to offer stocks and bonds. Though, trading these individual equities is much more limited.

Vanguard might also make sense for clients who want to open an IRA and manage it in a very hands-off manner.

At its core, the brokerage is designed for investors who want a simple and straightforward experience. Its accounts and tools are easy to use, and its website boasts a number of educational resources. This makes it extremely welcoming to beginners.

Also Check: When Can I Rollover 401k To Ira

See If You Have Enough Money To Retire Soon

Ask TIAA or Fidelity for a retirement income illustration

Your retirement savings account balance is one major source of income during these later-in-life years.

When youre close to retirement, ask for a retirement income illustration so you can compare income choices based on your total account balance. TIAA or Fidelity will give you a report that helps answer these questions:

- How much income can I receive from my retirement accounts?

- What income choices are available to me?

- What is the best way for me to withdraw my retirement assets while I am retired?

The Median And Average 401 Balance At Every Age

Slightly more useful are the median and average balances by age. Thats because the IRS sets contribution limits for 401 accounts, $19,500 in 2021 and $20,500 for 2022 .

Even if you made the maximum contribution every single year and posted double-digit investment returns both of which are highly unlikely combine them and youd be a retirement superhero it would take nearly 20 years to hit a million. That makes it unfair and fruitless for, say, a 25-year-old to compare her balance to the average for savers of all ages.

The below numbers show how 401 balances increase with age, at least until participants start drawing on their money in retirement.

You May Like: How To Set Up A 401k Plan

How Can I Create Custom Groups In Order To Organize My Accounts

To create your own groups, click Name, Categorize, or Hide Accounts and follow the Create a Custom Group link. You can assign accounts to these groups using the check boxes provided when you set them up, or you can create your custom groupsfirst, then assign accounts to them later on. You may create up to ten custom groups. You can delete a custom account group, but you cannot delete a default account group.

The Average 401 Balance By Age

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks or securities.

A record number of 401 holders at Fidelity Investments hit millionaire status in 2018. Not one of them? Youre in very good company: A seven-figure 401 balance is the exception, not the rule.

In fact, the average 401 balance at Fidelity which holds 16.2 million 401 accounts and is consistently ranked as the largest defined contribution record-keeper was $103,700 as of March 2019.

If that still seems high, consider that averages tend to be skewed by outliers, and in this case, that number is being propped up by those rare millionaires. The median, which represents the middle balance between the highs and lows, is just $24,500.

No matter which number is closer to your reality and certainly for some, both will feel out of reach its important to remember that numbers like this are akin to train wrecks: They will tempt you to gawk, but they wont likely offer you much actionable information.

Also Check: How To Start Withdrawing From 401k

Check Every Corner Of Your 401

Once you gain access to your account online or review your statement, check how your money is invested.

Most 401 administrators automatically invest your money into a target-date fund. Target date funds are portfolios of various mutual funds and investments tailored to your estimated retirement date. Using your age, the percentage mix of these investments changes to match your risk tolerance as you near retirement.

If you don’t want to hold your money in a target-date fund, you have the option to change investments.

However, if your plan hasn’t automatically allocated your money, it may be waiting to be invested. In this case, your money will be sitting in your account, not growing in a glorified savings account.

Itâs a rare occurrence, but checking your 401 balance will help catch any funds not adequately invested.

Balances Hit A New All

- Retirement account balances are at new highs, according to Fidelity Investments.

- Thanks to the markets recent run-up and increased savings, the number of 401 and IRA millionaires also hit all-time records in the second quarter of 2021.

Although many Americans continue to face financial uncertainty due to the pandemic, the outlook for retirement savers is only improving.

Retirement account balances, which took a sharp nosedive in 2020 when the coronavirus outbreak caused economic shock waves, are now at new highs, according to the latest data from Fidelity Investments, the nation’s largest provider of 401 savings plans.

The overall average 401 balance hit $129,300 as of June 30, up 24% from the same time last year, according to Fidelity.

Individual retirement account balances were also higher reaching $134,900, on average, in the second quarter, up 21% from a year ago.

Despite Covid case numbers rising in the U.S. and around the world, the year’s market highs have been a boon for savers. In the second quarter, the S& P 500 ended up 8.2%, before retreating more recently.

Nearly 12% of workers increased their contributions during this time, while a record 37% of employers also automatically enrolled new workers in their 401 plans.

As a result, the number of 401 and IRA millionaires hit fresh highs, as well.

Together, the total number of retirement millionaires has nearly doubled from one year ago.

Read Also: Should I Pay Someone To Manage My 401k

The Average 401 Balance By Age According To Fidelity

Fidelity announced that 401 balances reached records highs. This is due to the surging stock market during that time in addition to a great economy. In fact, in the last decade, assets nearly doubled. This is what you want to see as an investor. Watching compound interest work its magic.

The following are the average and median balances of over 22,000 businesses employee benefit programs under Fidelitys management.

These metrics will show you how lousy Americans are at saving. If your 401k is your primary retirement plan, and you are below these numbers, try to increase your savings by 1% every other month. This will allow you to ramp up your savings over time.

Borrowing Money From My 401k

It may seem like an easy way to get out of debt to borrow from your retirement accounts for DIY debt consolidation, but you can only borrow $50,000 or half the vested balance in your account, if its less than $50,000. You wont face a tax penalty for doing so, like you would with an out-right withdrawal, but youll still have to pay the money back.

And unlike a home equity loan where payments can be drawn out over a 10-to-30-year period, most 401k loans need to be paid back on a shorter time table like five years. This can take a huge chunk out of your paycheck, causing you even further financial distress. Borrowing money from your 401k also limits the ability of your invested dollars to grow.

Paying off some of your debt with a 401k loan could help improve your debt-to-income ratio, a calculation lenders make to determine how much debt you can handle. If youre almost able to qualify for a consolidation or home equity loan, but your DTI ratio is too high, a small loan from your retirement account, amortized over 5 years at a low interest rate may make the difference.

You May Like: How Do You Take Money From Your 401k