Can I Contribute To A Traditional Ira And A 401

If you prefer contributing pre-tax money towards your retirement accounts, the two options you have are a traditional IRA and an employer-sponsored 401.

Like a Roth IRA, a traditional IRA is set up through an outside institution, like Fidelity. However, instead of allocating after-tax dollars like a Roth IRA, a traditional IRA uses money before taxes are taken out.

This means you can contribute more to your traditional IRA and have less tax burden during your working years. However, like a 401, the distributions you take during retirement will be taxed.

You can contribute up to $6,000 towards your traditional IRA while still contributing towards your 401. Like the previous scenario, you can contribute a total of $25,500 towards retirement, $33,000 if you’re 50 and older.

Additionally, you can rollover old 401s into an IRA. Rather than transferring old 401s into your current 401, you can consolidate them into an IRAand take advantage of the increased investing options.

How Much Can I Put Into Traditional And Roth Ira

The best you can give to all your old and Roth IRAs are: At 2020, $ 6,000, or $ 7,000 if you are 50 years old or older at the end of the year not at all. your annual tax return.

Can I contribute $5000 to both a Roth and traditional IRA?

You can provide for both types of IRAs as long as you meet the requirements. With the Roth IRA, donations are made in dollars following the tax Contributions to traditional IRAs are usually made with initial tax dollars.

Can you put money in both a traditional and Roth IRA?

You can donate to both the Roth and the traditional IRA, up to the threshold set by the IRS, which amounts to $ 6,000 between all IRA accounts in 2021 and 2022. These two types of IRAs also have requirements to meet your requirements.

When A Roth 401 Can Make Sense

Taxes are a key consideration when it comes to deciding on a Roth 401 over a traditional 401.

If youre young and currently in a low tax bracket, but you expect to be in a higher tax bracket when you retire, then a Roth 401 could be a better deal than a traditional 401. Think of it this way: With a Roth 401 you can get your tax obligation out of the way when your tax rate is low and then enjoy the tax-free earnings later in life.

The same argument can apply to mid-career workers as well, especially those concerned about the prospects for higher tax rates in the future. After all, current tax rates are fairly low by historical standards. The top rate for married couples filing jointly is 37% in 2021, but it was 70% in 1981 and an eye-watering 91% back in 1963.5

On the flip side, it may make less sense to contribute to a Roth 401 if you think your tax bracket will be lower in retirement than it is now, Rob says.

And high earners who expect to maintain their income and spending standards into retirement could consider using Roth 401s to simplify their taxes by paying them up front while theyre still working. Doing this would mean that you still take RMDs from your Roth 401, but it would have less of a tax impact since distributions are tax-free. RMDs from a traditional 401 would be treated as taxable income.

You May Like: Can I Pull Money From My 401k

How Much You Can Invest

If you’re under age 50, your annual contribution limit is $19,500 for 2020 and $19,500 for 2021.

If you’re age 50 or older, your annual contribution limit is $26,000 for 2020 and $26,000 for 2021.

If you’re under age 50, your annual contribution limit is $6,000 for 2020 and 2021.

If you’re age 50 or older, your annual contribution limit is $7,000 for 2020 and 2021.

How Much Should You Contribute To A Roth Ira And A 401

This is the most exciting part. Now that you understand the basics of 401 vs Roth IRA, how much should you contribute to each account?

If you are going to have both 401 and Roth IRA, it would make sense to make contributions that maximize your retirement savings and reduce taxes at the same time.

The first thing you should always do is to contribute an amount equal to your employerâs matching percentage for a 4001 plan. You donât want to leave free money on the table. If your main focus is to reduce your taxable income, then add more contributions to your 401. This way you will end up paying less tax each year you make higher contributions to your 401.

If you are not interested in lowering your taxes now and are worried about paying taxes during retirement switch your focus from 401 to Roth IRA after contributing up to your employerâs matching percentage. Also, if your employer does not offer a matching percentage and you are not interested in reducing your taxes keep your focus on Roth IRA. Your Roth IRA will let you grow your account tax-free and you will not pay income tax on acceptable withdrawals during retirement.

In addition, your Roth IRA will come with a much wider range of investment options and your fees will be lower. By default, 401 accounts come with higher fees and limited investment options. That is why it may not be a good idea to only focus on 401 especially when there is little to no employer matching.

You May Like: Should I Get A 401k

Roth Ira Income Limits

The Roth IRA income limits are different for 2021 versus 2022. How much you can contribute to a Roth IRA depends, in part, on how much you earned in that year. In other words, the contribution amount allowed can be reduced, or phased out, until it’s eliminated, depending on your income and filing status for your taxes .

2021

For individuals with a tax filing status of single, you can make a full contribution if your income is below $125,000. The income phase-out range has been increased to $125,000 to $140,000.

If you’re a married couple filing jointly, for 2021, full contributions are allowed if you make less than $198,000, while the income phase-out range is $198,000 to $208,000.

2022

For individuals filing taxes as single, you can make a full contribution to a Roth if your income is less than $129,000. Your contributions would be reduced or phased out if your income was between $129,000 and $144,000. If you earned more than $144,000, you couldn’t make any contributions to a Roth IRA.

If you were married filing jointly, you could make a full contribution to a Roth if your income was less than $204,000. Your contributions would be reduced or phased out if your income was between $204,000 and $214,000. If you earned more than these IRS-imposed limits, you couldnt contribute to a Roth IRA.

Can I Contribute To A Roth Ira And A 401

Most retirement savings are made through employer-sponsored 401 plans. If your employer offers to match a percentage of your contributions, it’s a great way to increase your retirement savings with free money.

In addition to your 401 contributions, you can contribute to a Roth IRA. A Roth IRA will be held outside of your employer-sponsored plan but is just as easy to set up.

Adhere to the contribution limits bothâ$19,500 and $6,000 respectivelyâand you can grow your retirement savings by $25,500 annually plus any employer contributions.

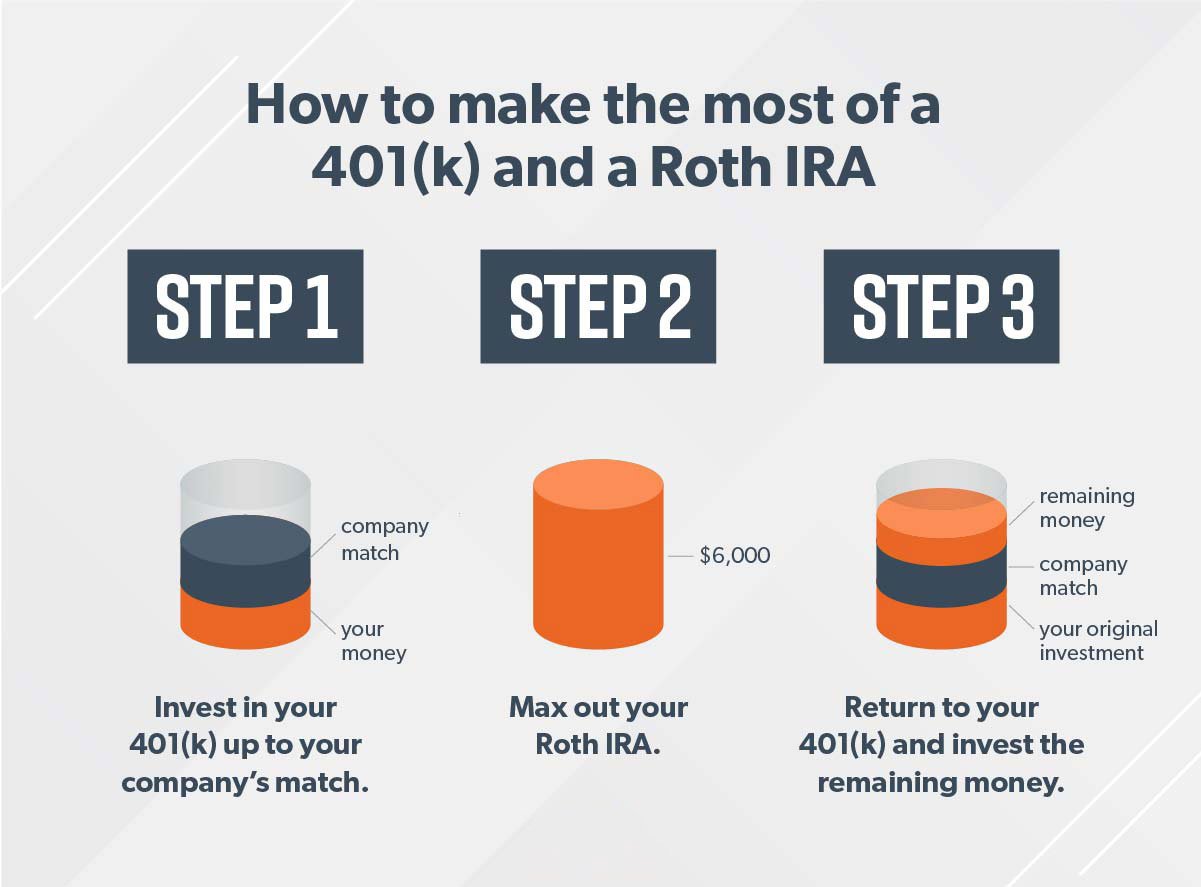

A good strategy would be to contribute to your 401 up to the amount your employer matches. Then, contribute as much as you can towards your Roth IRA until you reach the limit. This way, you’ll maximize the free money you’ll receive from your employer and increase the amount of tax-free distributions you’ll have during retirement.

Also Check: How To Provide 401k To Employees

Roth 401 Vs Traditional 401

Although the contribution limits are the same for traditional 401 plans and their Roth counterparts, a designated Roth 401 account is technically a separate account within your traditional 401 that allows for the contribution of after-tax dollars. The elected amount is deducted from your paycheck after income, Social Security, and other applicable taxes are assessed. The contribution doesn’t garner you a tax break in the year you make it.

The big advantage of a Roth 401 is that no income tax is due on these funds or their earnings when they’re withdrawn after you retire. A traditional 401 works in the opposite way. That is, savers make their contributions on a pretax basis and pay income tax on the amounts withdrawn when they retire. Neither of these 401 accounts imposes income limitations for participation.

When available, savers may use a combination of the Roth 401 and the traditional 401 to plan for retirement. Splitting your retirement contributions between both kinds of 401s, if you have the option, can help you ease your tax burden in retirement.

Where Should I Invest After Maxing Out A Roth Ira And A 401

If you have access to a health savings account , this is a great and lesser-known third option for retirement investing. If you accumulate more money than you need for medical expenses in your HSA, you can withdraw this money for any reason with no penalty after age 65. You’ll just pay ordinary income tax on your withdrawals if you don’t use them for medical expenses. After that, you might want to look into standard, taxable investment accounts.

Don’t Miss: How Do I Stop My 401k

Can A Qualified Charitable Distribution Satisfy My Required Minimum Distribution From An Ira

Yes, your qualified charitable distributions can satisfy all or part the amount of your required minimum distribution from your IRA. For example, if your 2018 required minimum distribution was $10,000, and you made a $5,000 qualified charitable distribution for 2018, you would have had to withdraw another $5,000 to satisfy your 2018 required minimum distribution.

How Does The Effective Date Apply To A Roth Ira Conversion Made In 2017

A Roth IRA conversion made in 2017 may be recharacterized as a contribution to a traditional IRA if the recharacterization is made by October 15, 2018. A Roth IRA conversion made on or after January 1, 2018, cannot be recharacterized. For details, see “Recharacterizations” in Publication 590-A, Contributions to Individual Retirement Arrangements .

Disclaimer

This FAQ is not included in the Internal Revenue Bulletin, and therefore may not be relied upon as legal authority. This means that the information cannot be used to support a legal argument in a court case.

- Certain other tangible personal property.

Check Publication 590-A, Contributions to Individual Retirement Arrangements , for more information on collectibles.

IRA trustees are permitted to impose additional restrictions on investments. For example, because of administrative burdens, many IRA trustees do not permit IRA owners to invest IRA funds in real estate. IRA law does not prohibit investing in real estate, but trustees are not required to offer real estate as an option.

Also Check: How Can I Get Money From My 401k

Pros And Cons Of Maxing Out Roth Ira Contributions

-

No taxes on qualified withdrawals during retirement

-

Can withdraw contributions at any time

-

Have until Tax Day in mid-April to max out your contributions

-

May access a greater range of investments in a Roth IRA than a 401

-

Traditional IRA might be better for your situation

-

No employer matching benefit as with some 401 retirement plans

-

Other financial goals might be more important than maxing out your Roth IRA

-

Contribution limits decrease or contributions may not be allowed at higher income levels

Benefits Of Contributing To Both A 401 And Roth Ira

Contributing to both a 401 and Roth IRA allows you to maximize your retirement savings and benefit from tax advantages. With a 401 account, you’ll contribute money you haven’t yet paid taxes on. Your employer may also match contributions up to a certain percentage of your annual income.

With your Roth IRA, contributions are made after you’ve paid taxes, but qualified distributions, or withdrawals, are not taxed. Additionally, contributing to these accounts may make you eligible for a tax credit known as the Saver’s Credit, which could be up to 50% of your contributions. When you combine these accounts, you can stack your tax benefits while saving for retirement.

Also Check: How To Make 401k Grow Faster

Roth Ira Contribution Limit In 2022

The max contribution you can make to your Roth IRA in 2022 did not change from what it was in 2021. According to IRS, the Roth IRA contribution limit for 2022 remained $6,000 or $7,000 for those who are 50 or older.

Keep in mind that your Modified Adjusted Gross Income and filing status will determine your eligibility to contribute to a Roth IRA plan.

If your income and filing status falls outside of these windows, you may not be able to contribute to a Roth IRA.

How Much Must I Take Out Of My Ira At Age 70 1/2

Required minimum distributions must be taken each year beginning with the year you turn age 72 . The RMD for each year is calculated by dividing the IRA account balance as of December 31 of the prior year by the applicable distribution period or life expectancy. Use the Tables in Appendix B of Publication 590-B, Distributions from Individual Retirement Arrangements . RMDs are not required for your Roth IRA.

See the discussion of required minimum distributions and worksheets to calculate the required amount.

You May Like: When Can I Withdraw From 401k

What Happens If I Contribute To A Roth Ira But Make Too Much Money

If you contribute more than is allowed to the IRA, you have contributed ineligible or in excess. See the article : Daniel Calugar outlines 7 benefits of starting to invest at a young age DU Clarion. You will pay an additional 10% early withdrawal penalty on earnings if you cannot take a qualified distribution from your IRA to correct the error.

What to do if you made too much for a Roth IRA?

I Do Too Much To Contribute To A Roth IRA â What I Do.

- Withdraw excess contributions plus any workable income.

- Proposed return corrected.

- Apply the excess to next years contribution.

- Transfer excess contributions to a Traditional IRA through a recharacterization, including your earnings.

Can you have a Roth IRA if you make too much money?

Roth IRA Income limits You can contribute to a traditional IRA regardless of how much money you earn. But you dont have the right to open or contribute to a Roth IRA if you make too much money.

What happens if you contribute to a Roth IRA and your income is too high?

The IRS will charge you a 6% penalty tax on the excess amount for each year where you do not take action to correct the error. For example, if you donate $ 1,000 more than is allowed, you should owe $ 60 each year until you correct the mistake.

Suggested Next Steps For You

Whether youre looking for additional tax deductions or just a way to boost your savings, talk to your Personal Capital financial advisor about opening an IRA in addition to your workplace 401k. Once you retire, youll be glad you saved for all those years.

The content contained in this blog post is intended for general informational purposes only and is not meant to constitute legal, tax, accounting or investment advice. You should consult a qualified legal or tax professional regarding your specific situation. Keep in mind that investing involves risk. The value of your investment will fluctuate over time and you may gain or lose money.

Any reference to the advisory services refers to Personal Capital Advisors Corporation, a subsidiary of Personal Capital. Personal Capital Advisors Corporation is an investment adviser registered with the Securities and Exchange Commission . Registration does not imply a certain level of skill or training nor does it imply endorsement by the SEC.

Don’t Miss: How To Avoid Penalty On 401k Withdrawal

How A 401 Works

The contributions that you make to your 401 are excluded from your taxable income, which is why this is called a tax-deferred account. So if you earn $40,000 annually and contribute $3,000 to your 401 for the year, the IRS will consider your taxable income to be $37,000 . In some cases, reducing your taxable income could mean less of your income is in a higher tax bracket and save you even more money come tax season.

For the 2022 tax year, you can contribute up to $20,500 to your 401 account. If you are 50 years old or older, some 401 plans will let you add “catch-up contributions” of up to $6,500, allowing for a total of $27,000 in contributions for 2022. Each year, these contribution limits change, so be sure to check the latest IRS publications for updates.

When you invest through your 401 account, your earnings grow tax-free. But once you start withdrawing your 401 account balance, at age 59½ or later, the distributions are taxed as ordinary income. This has benefits if your income is lower in retirement, since you should expect to get taxed at a lower rate. Withdrawing money from your 401 before you’re 59½ years old results in a 20% tax withholding and carries an additional 10% penalty, so it is not advisable.

Next Steps To Consider

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Past performance is no guarantee of future results.

Investing involves risk, including risk of loss.

Fidelity does not provide legal or tax advice. The information herein is general and educational in nature and should not be considered legal or tax advice. Tax laws and regulations are complex and subject to change, which can materially impact investment results. Fidelity cannot guarantee that the information herein is accurate, complete, or timely. Fidelity makes no warranties with regard to such information or results obtained by its use, and disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information. Consult an attorney or tax professional regarding your specific situation.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

Read Also: Is 401k Required By Law In California