It Never Hurts To Save More

Twenty percent is a great goal, but some retirement experts actually suggest saving more like 25% or even 30. Why?

You know that saying, Past returns are no guarantee of future performance? Thats why. Its true that the annual average return of the S& P 500 between 1928 and 2014 was 10%. But that doesnt mean well get that average return over the next 86 years.

Jack Bogle, the father of index funds and founder of Vanguard, says that investors should plan on lower returns in the coming decade and other commenters suggest lower yields even beyond that.

We have no way of knowing what future returns will bethey could be 8%, they could be 4%. But the only way to hedge against an uncertain future is to save more money. The more you have, the less you need jaw-dropping returns to meet your goals.

When To Start Saving For A 401k

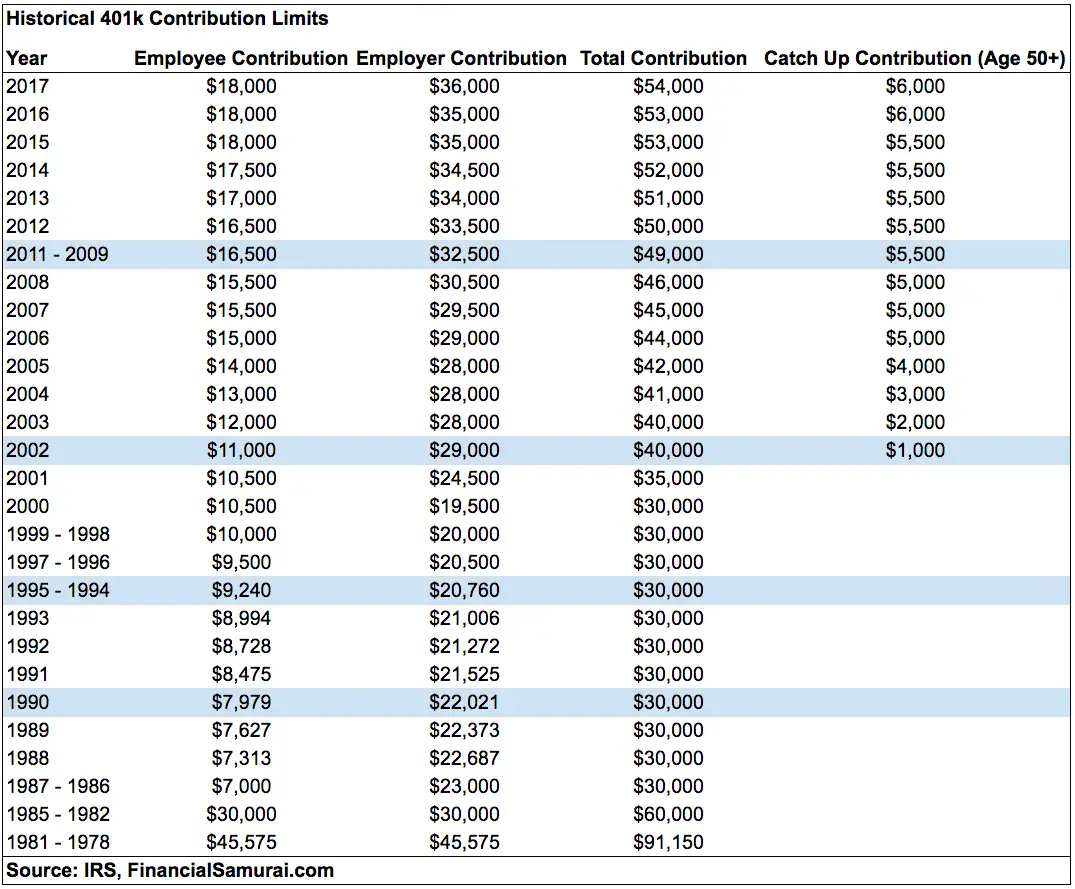

Not everyone gets the opportunity to invest in their 401k early on. As soon as it becomes available, consider taking advantage of this benefit. As of 2017, individuals under 49 could legally contribute $18,500 per year. Those 50 years or older, can save an additional $6,000 for a total annual $401k contribution of $24,500.

Many 20-something-year-olds have student debt, changed jobs a handful of times, have not started saving, or are not in a job where a 401k plan is offered. In this case, well look at the amount you should have saved starting at age 30.

A good rule of thumb is to add on one year of salary saved for every five years of age for example, at age 30 youd want to have saved one year of salary, at age 35, two years, at age 40, three years, and so on. Use these guidelines along with your post-retirement budget to gauge if you are on track for a comfortable retirement.

Average 401k Balance At Age 65+ $471915 Median $138436

The most common age to retire in the U.S. is 62, so its not surprising to see the average and median 401k balance figures start to decline after age 65. Once you reach age 65, there are still several considerations for your retirement, even if you are no longer working and accumulating wealth. Some of these include making decisions about Medicare, creating a plan around withdrawing money from your retirement accounts, and evaluating any additional insurance needs.

You May Like: How Long Does It Take To Rollover 401k To Ira

What Are The Advantages Of A 401 Plan

Financial planners often speak of there being a three-legged stool for funding retirement: government-provided benefits, employer-provided benefits and personal savings. But with Social Security’s future in doubt and pension plans going the way of the dodo bird, it’s a good idea to depend on your own resources as much as possible.

One of the best ways for you to save toward your own retirement and ensure your future security is through an employer-sponsored 401 plan. If you don’t participate, you’re missing a golden opportunity to save for retirement while lowering your tax burden on those savings.

Some of the features offered by many 401 plans include:

Matching Contributions Many employers will match a portion of your savings. It’s like passing up free money if you don’t participate. A common match might be 50 percent of the first 6 percent of pay you save. Under that scenario, someone whose annual salary is $35,000 and who contributes 6 percent to the plan would receive an additional $1,050 in matching employer contributions. It’s pretty hard to find a 50 percent return on any investment. Even if your employer doesn’t offer matching contributions, the tax advantages of a 401 still make this one of the best ways to save money for retirement.

Could You Invest Just 2 Percent More

Use this calculator to see how much more you could accumulate in your employer retirement plan over time by increasing the amount that you contribute from each paycheck. Even 2 percent more from your pay could make a big difference. Enter information about your current situation, your current and proposed new contribution rate, anticipated pay increases and how long the money might be invested, as well as your own assumptions about the growth rate of your investments, and see the difference for yourself*. For additional information, see How to use the Contribution Calculator.

*This calculator is intended to serve as an educational tool, not investment advice. It enables you to enter hypothetical data. The variables you choose are not meant to reflect the performance of any security or current economic conditions. The examples are intended for illustrative purposes only and are not a prediction of investment results.

Calculations are based on the values entered into the calculator and do not take into account any limits imposed by IRS or plan rules. Also, the calculations assume a steady rate of contribution for the number of years invested that is entered.

You May Like: How To Rollover A 401k Into An Ira

Don’t Forget The Match

Of course, every person’s answer to this question depends on individual retirement goals, existing resources, lifestyle, and family decisions, but a common rule of thumb is to set aside at least 10% of your gross earnings as a start.

In any case, if your company offers a 401 matching contribution, you should put in at least enough to get the maximum amount. A typical match might be 3% of salary or 50% of the first 6% of the employee contribution.

It’s free money, so be sure to check if your plan has a match and contribute at least enough to get all of it. You can always ramp up or scale back your contribution later.

“There is no ideal contribution to a 401 plan unless there is a company match. You should always take full advantage of a company match because it is essentially free money that the company gives you,” notes Arie Korving, a financial advisor with Koving & Company in Suffolk, Va.

Many plans require a 6% deferral to get the full match, and many savers stop there. That may be enough for those who expect to have other resources, but for most, it probably won’t be.

If you start early enough, given the time your money has to grow, 10% may add up to a very nice nest egg, especially as your salary increases over time.

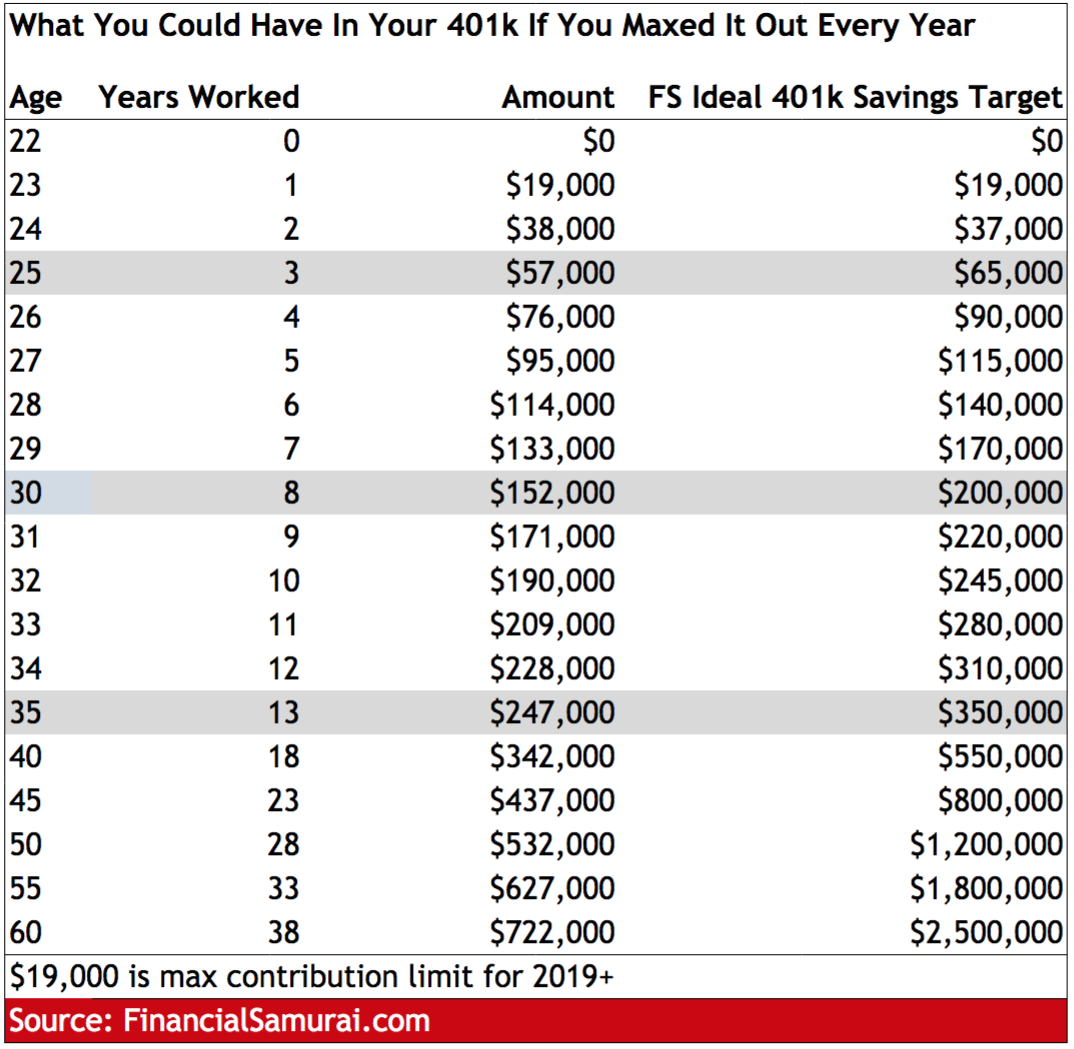

How Much You Should Have Saved In Your 401k By Age

In order to determine how much one should have in his or her 401k by age 40, Ive made the following assumptions.

* The Low End column accounts for lower maximum contribution amounts available to savers above 45.

* The Mid End column accounts for lower maximum contribution amounts available to savers below 45.

* The High End column accounts for savers who are under the age of 25. After the first year, one maximizes their contribution every year to their 401k plan without failure.

* Average starting working age is 22. But you can follow the number of years working as a different guideline if you graduate later or earlier.

* $18,000 is used as the conservative base case maximum contribution amount for ones entire working life. Hopefully the government will increase the max contribution amount over time.

* No after tax income contribution, although more power to you if you have the disposable income to do so.

* The rate of return assumptions are between 0% 10%.

* Company match assumption is between 0% 3%.

* The Low, Mid, and High columns should successfully encapsulate about 80% of all 401K contributors who max out their contributions each year. There will be those with less, and those which much, MUCH greater balances thanks to higher returns.

* You are logical and not a knucklehead. Just by searching this topic, you are taking ownership of your retirement and are thinking ahead with an action plan.

You May Like: Can You Use 401k To Buy Investment Property

Choosing Investments Within A Plan

Generally, 401 plans offer several options in which to invest contributions. Such options generally include mutual funds that may invest in stocks for growth, bonds for income, or money market investments for protection of principal. This flexibility may help lower investment risk by diversifying a portfolio amongst different types of classes, manager styles, investment styles, and economic sectors.

Diversify Plans If Possible

Matthew Yu, Loan Originator for Socotra Capital

Some employers have small matches, but some match dollar for dollar on your first 3-5 percent. Thats 100 percent ROI at the end of each year for your 3-5 percent contribution!

For those with less generous employee matches and limited investment funds, you should carefully gauge your companys 401 plan to see if you could get better returns investing in a Self-Directed IRA. The amount you put into the 401 is just as important as the type of investment that your 401 is invested in.

For best diversification, I would recommend those new to the workforce to split up their retirement savings into their 401 and Roth IRAs. Set aside an investment budget that stings, but isnt too painful. Your 401 will be automatically withdrawn every month. Money that doesnt hit your pocket is much easier to invest than the money that comes out of it. Investing early pays dividends.

Recommended Reading: How Much Should I Have In My 401k At 60

Anything Else I Should Know

Yep. A few things, actually.

Once you contribute to a 401, you should consider that money locked up for retirement. In general, distributions prior to age 59½ will be hit with a 10% penalty and income taxes.

If you leave a job, you can roll your 401 into a new 401 or an IRA at an online brokerage or robo-advisor. The IRA can give you more control over your account and allow you to access a larger investment selection.

401s typically force you to begin taking distributions called required minimum distributions, or RMDs at age 72 or when you retire, whichever is later. You may be able to roll a Roth 401 into a Roth IRA to avoid RMDs.

Save Early And Often In Your 401k By 40

Contribute the maximum pre-tax income you can to your 401k for as long as you work. This is the absolute MINIMUM you can do to help ensure a comfortable retirement. After you have contributed a maximum to your 401k every year, try and contribute at least 20% of your after-tax income after 401k contribution to your savings or retirement portfolio accounts.

This way, you will have potentially DOUBLE the amount in total retirement saving if your household income is $100,000 or more. If your household income is closer to $50,000, you should still see a nice 30% boost to your retirement savings if you consistently save 20% of your after tax income.

At age 40, you should really have closer to $500,000 or more in your 401k. Challenge yourself to raise your after-tax and 401k contribution savings percent to possibly 50%. It wont be easy, but if you practice raising your savings rate by 1% a month until it hurts, youll find it easier than you think.

Once you maximize your 401k and save over 50% of your after-tax income for at least 10 years in a row, you will be financially free to do whatever you want.

Take it from me, someone who left the work force at the age of 34 after saving 50%+ for 13 years. Theres not a day that goes by where Im not thankful for working extra hard and making certain financial sacrifices to be free.

Also Check: Can I Rollover My 401k To A Money Market Account

What Percentage Should I Contribute To My 401k

How much cash should you stash away for your retirement? Here is the recommended percentage you should contribute to a 401 to build a sufficient nest egg.

One of the common ways of saving for retirement is through a 401 plan. If your employer offers a 401, you should join and start making contributions towards your retirement. While there is no rule on how much you should contribute to a 401, you should consider contributing as much as possible to max out your contributions.

Financial advisors recommend contributing 10 to 15% of your salary into a 401 plan up to the annual contribution limit. The ideal contribution percentage depends on age and your take-home pay. For example, if you have a few years remaining to retirement, you should contribute a higher percentage of your salary to catch up. Also, if you have other monthly payments, you should consider the remaining take-home pay, and contribute the amount you can afford.

Contribute Up To The Employer Match

You have enough saved up to cover your expenses. You emergency fund is there in case you need it. Now youre starting to think about 401 contributions. Where do you you start?

The first thing you should figure out is if you have an employer matching program with your 401. With an employer match, your employer will match your 401 contributions up to a certain percentage of your gross salary. Say your employer offers 100% match on the first 5% you contribute. That means if you contribute 5% of your gross salary to your 401, your employer will contribute an amount equal to 5% of your gross salary. The total contribution to your 401 would then equal 10% of your gross salary.

An employer match allows you to increase your contribution, and you should always take advantage of matching programs. Unfortunately, many people pass up free money by not contributing up to their employer match.

Recommended Reading: How Does A 401k Retirement Plan Work

The Importance Of The 401k For Retirement

The 401k is one of the most woefully light retirement instruments ever invented. The maximum amount you can contribute for 2021 is $19,500. It should go up by $500 every 2 4 years based on history.

Give me a pension that pays 70% of my last years salary for the rest of my life over a 401k or IRA any time! At least with the 401k, anybody can contribute.

The average 401k balance as of 2022 is around $120,000 according to Fidelitys 12 million accounts. The bull market since 2009 has significantly helped boost the average 401k balance. Who knew the S& P 500 would rise by 16% in 2020, and 27% in 2021 as the coronavirus pandemic froze global economies.

$120,000 sounds like a lot of money. However, it is an incredibly low amount given the median age of an American is 36.5. Further, the median 401k amount is closer to only $28,000.

As an educated reader who is logical and believes saving for retirement is a must, Ive proposed a table that shows how much each person should have saved in their 401ks at age 25, 30, 35, 40, 45, 50, 55, 60, and 65.

We stop at 65 because you are allowed to start withdrawing penalty free from your 401k at age 59 1/2. Meanwhile, I pray to goodness you dont have to work much past 65 because youve had 40 years to save and investment already!

The Power Of Compound Returns

The earlier you start saving for retirement, the less youll need to save each month. You can thank compounding, which is basically the returns you make on returns. Once youre making money on your earnings, your returns compound at an accelerated rate.

Suppose you want to retire at age 60 with $2 million and that you get average returns of 10%. Thats slightly less than what the S& P 500 index has delivered before inflation over the past 60 years with dividends reinvested.

Heres what youd need to invest, between your own contributions and your employers match, if you have a $50,000 annual salary.

- If you started investing at 20: Youd need to invest $316.25 per month, or 7.6% of your salary.

- If you started investing at 30: Youd need to invest $884.76 per month, or 21.2% of your salary.

- If you started investing at 40: Youd need to invest $2,633.76 per month, or 63.2% of your salary.

The examples above show not only how much more youll have to contribute to your 401 each month if you start saving later, but also how much more youll have to save overall. In the first example, youd invest just under $152,000 total by starting at 20. But if you didnt get started until 40, youd wind up investing more than $632,000 to reach your goal.

Keep in mind that 10% is an average, not the 401 rate of return you should expect every year. Your returns will vary, based on how your investments perform, along with the risk tolerance you indicate when you choose your investments.

Recommended Reading: Which Investments Should I Choose For My 401k

When Should You Change Your 401 Contribution Amount

Once you’ve decided how much to contribute to your 401, revisit the amount you contribute to the plan from time to time. It’s good to be aware of how your income changes and how the plan limits change.

Most importantly: Don’t stop contributing to the plan. And don’t use it for purposes other than retirement. Taking out 401 loans or making early withdrawals for other expenses robs you of investment gains that you’ll need later in life.

What Kind Of Investments Are In A 401

401 accounts often offer a small, curated selection of mutual funds. Thats a good thing and a bad thing: On the plus side, you may have access to lower-cost versions of those specific funds, especially at very large companies that qualify for reduced pricing.

The negative is that even with discounted costs, that small selection narrows your investment options, and some of the funds offered may still have higher expense ratios than what youd pay if you could shop among a longer list of options. That can make it harder to build a low-cost, diversified portfolio.

Some plans also charge administrative fees on top of fund expenses, which can add up. If your 401 is expensive, contribute enough to earn your company match, and then direct any additional retirement savings contributions for the year into an IRA.

Read Also: How To Open Your Own 401k