Impact Of A 401 Loan Vs Hardship Withdrawal

A 401participant with a $38,000 account balance who borrows $15,000 will have $23,000 left in their account. If that same participant takes a hardship withdrawal for $15,000 instead, they would have to take out $23,810 to cover taxes and penalties, leaving only $14,190 in their account, according to a scenario developed by 401 plan sponsor Fidelity. Also, due to the time value of money and the loss of compounding opportunities, taking out $23,810 now could result in tens of thousands less at retirement, maybe even hundreds of thousands, depending on how long you could let the money compound.

Not All Retirement Accounts Are Alike

First off, you need to know the difference between a 410 and an individual retirement account . Simply put, a 401 is offered through your place of work and involves your contributions . An IRA is a private investment funded solely by your own money. It can be a bit more difficult, and in some cases costly to take money from a 401 plan, if you are still working, Blayney notes.

But what if you have to take money out, or feel compelled to do so? Blayney lists a number of circumstances when tapping or leveraging retirement funds might be a possibility.

Just Because You Can Cash Out Your 401 Doesnt Mean You Should

Technically, yes: After youve left your employer, you can ask your plan administrator for a cash withdrawal from your old 401. Theyll close your account and mail you a check.

But you should rarelyif everdo this until youre at least 59 ½ years old!

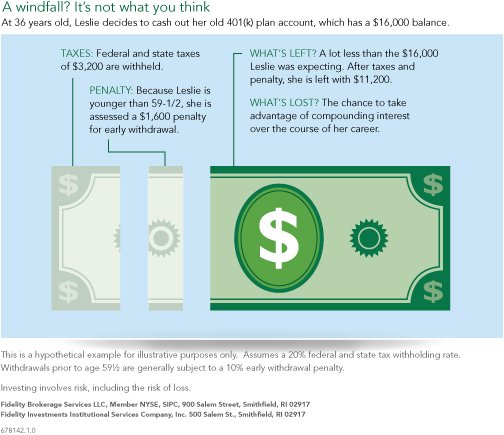

Let me say this again: As tempting as it may be to cash out an old 401, its a poor financial decision. Thats because, in the eyes of the IRS, cashing out your 401 before you are 59 ½ is considered an early withdrawal and is subject to a 10% penalty on top of regular income taxes. Oh, yes, thats another thing: Since the 401 is funded with pre-tax money, you also have to pay taxes on it when you cash out.

In most cases, your plan administrator will mail you a check for 70% of your 401 balance. Thats your balance minus 10% for the withdrawal penalty and 20% to cover federal income taxes .

Its financially prudent to save for retirement and leave that money invested. But paying the 10% early withdrawal penalty is just dumb money its equivalent to taking money youve earned and tossing it out the window.

Recommended Reading: How Do I Combine My 401k From A Previous Job

Roll Your Assets Into A New Employer Plan

If youre changing jobs, you can roll your old 401 account assets into your new employers plan . This option maintains the accounts tax-advantaged status. Find out if your new plan accepts rollovers and if there is a waiting period to move the money. If you have Roth assets in your old 401, make sure your new plan can accommodate them. Also, review the differences in investment options and fees between your old and new employers 401 plans.

Exceptions To 401 Early Withdrawal Penalty:

- You stopped working for the employer sponsoring the plan after reaching age 55

- Your former spouse is taking a portion of your 401 under a court order following a divorce

- Your beneficiary is taking a withdrawal after your death

- You are disabled

- You are removing an excess contribution from the 401

- You are taking a series of equal payments that meet certain rules under the tax laws

- You are withdrawing money to pay unreimbursed medical expenses that exceed 10% of your adjusted gross income

Ubiquity is amazing! Always ready to answer questions and never makes me feel ridiculous for asking them. Additionally, she’s wonderful at returning calls and really making her clients feel valued and listened to! I feel 100% secure in all things related to retirement because I know Meli has our back :).

Don’t Miss: How To Open A Roth 401k On My Own

Retirement Funds Don’t Have To Be Off

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

For those who invest in their 401 plan, the traditional thinking is to wait until retirement before taking distributions or withdrawals from the account. If you take funds out too early, or before the age of 59½, the Internal Revenue Service could charge you with a 10% early withdrawal penalty plus income taxes.

However, life events can happen, which might put you in a position where you need to tap into your retirement funds earlier than expected. The good news is that there are a few ways to withdraw from your 401 early without incurring a penalty from the IRS.

Consequences Of A 401 Early Withdrawal

- IRS Penalty. If you took an early withdrawal of $10,000 from your 401 account, the IRS could assess a 10% penalty on the withdrawal if its not covered by any of the exceptions outlined below.

- Withdrawals are taxed. Even if it were covered by an exception, all early withdrawals from your 401 are taxed as ordinary income. The IRS typically withholds 20% of an early withdrawal to cover taxes. So if you withdrew $10,000, you might only receive $7,000 after the 20% IRS tax withholding and a 10% penalty.

- Less money for retirement. Perhaps the biggest consequence of an early 401 withdrawal is missing out on long-term returns in the market. The stock markets average returns have been around 9.6% a year since the end of the Great Depression. If you withdrew $10,000 from your 401 and were about 30 years away from retirement, you could be giving up more than $117,000 in total returns.

Read Also: Should I Transfer My 401k To A Roth Ira

What If You Are The Beneficiary Of A 401 Plan

If you are the beneficiary of a 401 plan, you’ll have a little bit different set of rules that apply to taking money out of the 401 plan. Your choices will depend on whether you were the spouse or non-spouse of the 401 plan participant and whether the 401 plan participant had reached age 70 1/2the age for required minimum distributions .

If you or your spouse turned 70 1/2 before Jan. 1, 2020, the age for RMDs is still 70 1/2. If you or your spouse turned 70 1/2 on or after Jan. 1, 2020, the age for RMDs is 72.

How Fica Tax Or Withholding Tax Are Calculated

The amount of tax your employer withholds from your check largely depends on what you put on your Form W-4, which you probably filled out when you started your job. Here are some things to know:

-

Form W-4 asks about your marital status, dependents and other factors to help you calculate how much to withhold. The less you withhold, the less tax comes out of your paycheck.

-

What you put on your W-4 then gets funneled through something called withholding tables, which your employer’s payroll department uses to calculate exactly how much federal and state income tax to withhold.

-

You can change your W-4 any time. Just , fill it out and give it to your human resources or payroll team.

Recommended Reading: What Is A Roth 401k Vs 401k

Choosing Funds With High Fees Attached

Some people invest their 401s in mutual funds. That’s not automatically a bad idea. Some mutual funds have a strong performance history and could lead to solid returns on your money.

But mutual funds are also notorious for charging high fees, so you’ll need to be careful when going heavy on them, since those fees can eat away at your returns. You may, at the very least, want to split your 401 dollars between mutual funds and index funds, which are passively managed and charge much lower fees.

Ask yourself: How much do you know about the fees you’re paying on your 401?

Calculating The Basic Penalty

Assume you have a 401 plan worth $25,000 through your current employer. If you suddenly need that money for an unforeseen expense, there is no legal reason you cannot simply liquidate the whole account. However, you are required to pay an additional $2,500 at tax time for the privilege of early access. This effectively reduces your withdrawal to $22,500.

Read Also: How To Close My 401k And Get My Money

Withdrawing Funds Between Ages 55 And 59 1/2

Most 401 plans allow for penalty-free withdrawals starting at age 55. You must have left your job no earlier than the year in which you turn age 55 to use this option. You must leave your funds in the 401 plan to access them penalty-free. But there are a few exceptions to this rule. This option makes funds accessible as early as age 50 for many police officers, firefighters, and EMTs.

Make sure to understand the rules around the age requirement for penalty-free withdrawals. For example, the age 55 rule won’t apply if you retire in the year before you reach age 55, and your withdrawal would be subject to a 10% early withdrawal penalty tax in this case.

The age 55 and up retirement rule won’t apply if you roll your 401 plan over to an IRA. The earliest age to withdraw funds from a traditional IRA account without a penalty tax is 59. 1/2.

You might retire at age 54, thinking that you can access funds penalty-free in one year. It doesn’t work that way. You must wait one more year to retire for this age rule to take effect.

Tips On Retirement Accounts

- Whats the right retirement plan for you? Should you roll your 401 into another employers program or an IRA? What other options might you even have? A financial advisor can provide valuable insight and guidance on this. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- Part of what will help you decide what to do with 401 money is how far long you are in reaching your financial goal for retirement. Use this no-cost retirement calculator to get a quick estimate of how youre doing.

Don’t Miss: How To Find Out Whats In Your 401k

Your 401 K And Income Tax

You may be wondering if your 401 k is subject to income tax. Once you’ve withdrawn the money from the 401 k, you need to pay tax on it. It is considered part of your taxable estate. This is why you must check the terms of your 401 k before you get any money from it. Terms like these should be clearly outlined in the plan. Withdrawing funds without understanding the implications of doing so is one common mistake that people make when changing employers in the USA. It’s important to consider the other options you have.

If you’re changing employers, you still have plenty of time to build up passive capital via investment and your 401 k. You’re unlikely to get much out of rushing into a decision that you aren’t completely ready for. Roll all of the funds out of your 401 k at once, and you might end up drowning in taxes.

Roth 401 Early Withdrawal Taxes

Since Roth 401s are post-tax retirement plans, savers dont pay any withdrawal fees once they retire.

However, employees who cash out their 401 early while still employed can face double taxes on an income and penalty basis.

An early Roth 401 withdrawal consists of contributions and earnings. Their amount must be proportional to the ratio in the retirement account. So, with an early cashout, the IRS collects income and penalty taxes on the earnings and a 10% penalty fee on the contributions.

Roth 401 has the same compulsory RMDs as a traditional retirement plan.

You May Like: How To Move 401k Into Ira

Exceptions To The 401 Early Withdrawal Tax Penalty

In most cases, you can’t get out of paying taxes on the money you withdraw from a 401. But people in some situations can avoid the 10% penalty. The IRS will consider waiving the penalty if any of the following situations apply:

- You become or are permanently disabled: If you are or become disabled for life, you won’t owe the penalty.

- You are dividing assets in a divorce: Withdrawals made to satisfy a court order to divvy up the 401 with a former spouse or dependent are penalty-exempt.

- You are a qualified military reservist: You can take penalty-free withdrawals during your service period if you’re called to active duty for at least 180 days.

- You leave your job at age 55: Also known as the rule of 55, this provision allows anyone who retires, quits, or is fired at age 55 to withdraw without penalty.

- You enroll in “substantially equal periodic payments”: With , you withdraw a specific amount from your 401 every year for five years or until you turn 59½, whichever comes later. One catch: This account can’t be the one you have at your current job it has to be one you’ve kept from a previous employer. Also, if you quit the SEPP plan early, you’ll owe all the penalties, plus interest.

In addition to these events and situations, there are two other main ways to cash out early without a tax penalty: hardship withdrawals and loans.

Pros & Cons Of Cashing Out 401 While Still Employed

It takes years of work to save up sufficient 401 funds for a long retirement. Thus, cashing out the nest egg earlier is undoubtedly a big and risky decision.

The good thing for 401 savers is that, usually, time is on their side.

Good management can help retirement funds bounce back from financial cuts and protect 401 against a stock market crash. But pulling money from 401 has its limitations despite the apparent benefit.

So, before opting for this option, one must look at both the pros and the cons.

Don’t Miss: How To Stop Your 401k

Withdrawing From A Roth 401k

Most 401k plans involve pre-tax contributions, but some allow for Roth contributions, meaning those made after taxes already have been paid.

The benefit of making a Roth contribution to your 401k plan is that you already have paid the taxes and, when you withdraw the money, there is no tax on the amount gained as long as you meet these two provisions:

- You withdraw the money at least five years after your first contribution to the Roth account

- You are older than 59 ½ or you became disabled or the money goes to someone who is the beneficiary after your death

Rolling 401k Into Ira

When you leave an employer, you have several options for what to do with your 401k, including rolling it over into an IRA account.

Its possible to do the same thing while still working for an employer, but only if the rules governing your workplace 401k allow for it.

The negative for rolling the money into an IRA is that you cant borrow from a traditional IRA account.

Another option when you leave an employer is to simply leave the 401k account where it is until you are ready to retire. You also could transfer your old 401k into your new employers retirement account.

If you are at least 59 ½ years old, you could take a lump-sum distribution without penalty, but there would be income tax consequences.

Recommended Reading: Can I Max Out My 401k And Roth Ira

Reasons You Can Withdraw From 401k Without A Penalty Include

You’ll Owe Taxes And Possible Penalties

If you cash in your 401 plan, and you have not yet reached age 59 1/2, then the dollar amount you withdraw will be subject to ordinary income taxes and a 10% penalty tax.

If you are not yet age 59 1/2, your plan will likely enforce a required 20% amount withheld from any balance that you cash out to cover federal taxes. So, for every $1,000 you cash in, you would receive about $800. The other $200 would be sent to the IRS by your 401 administrator. At the end of the year, the 401 plan will send you a tax form called a “1099R” that shows the amount of taxes withheld on your behalf.

In general, you should not cash out your 401. Instead, roll it over into an IRA. When you calculate how much money you would lose by cashing out the account, the choice will become clear. Use an early-withdrawal calculator to help you see how much a withdrawal will cost you.

When you file your income tax return, you must include any cashed-out amounts from your 401 plan as regular income, along with your other sources of income. The amount flows into your tax return on the first page, and, based on your total income and deductions, you will either owe additional tax or receive a refund.

Read Also: How To Do Your Own 401k