Contribution Limits In 2020 And 2021

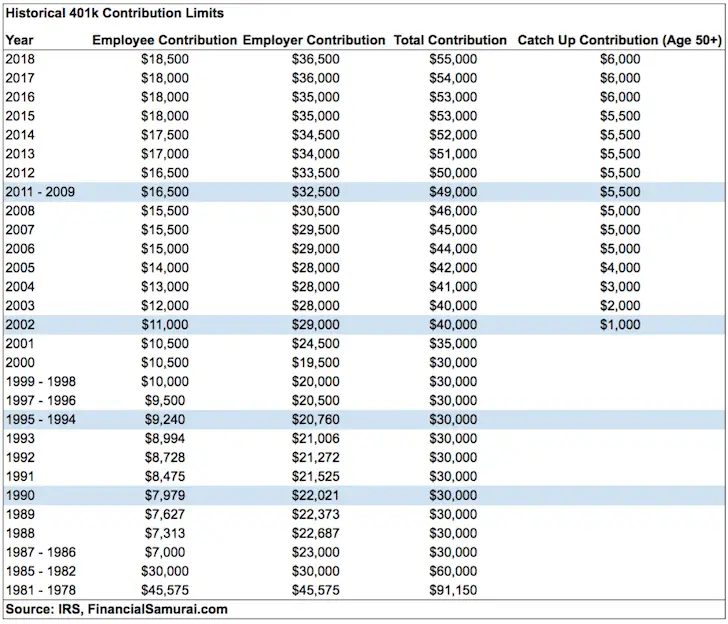

For 2021, the 401 limit for employee salary deferrals is $19,500, which is the same amount as the 401 2020 limit. Employer matches dont count toward this limit and can be quite generous.

However, the total contribution limit, which includes employer contributions , has increased to $58,000 in 2021, up from $57,000 in 2020.

On top of these amounts, workers aged 50 and older can add up to $6,500 more annually as a catch-up contribution.

The 401 contribution limits also apply to other so-called defined contribution plans, including:

- 403 plans, available to education and non-profit workers.

- Most 457 plans used by state and local government employees.

- The federal governments Thrift Savings Plan.

| 401 plan limits |

|---|

Two Annual Limits Apply To Contributions:

How Much Could Your 401 Grow If You Stop Contributing

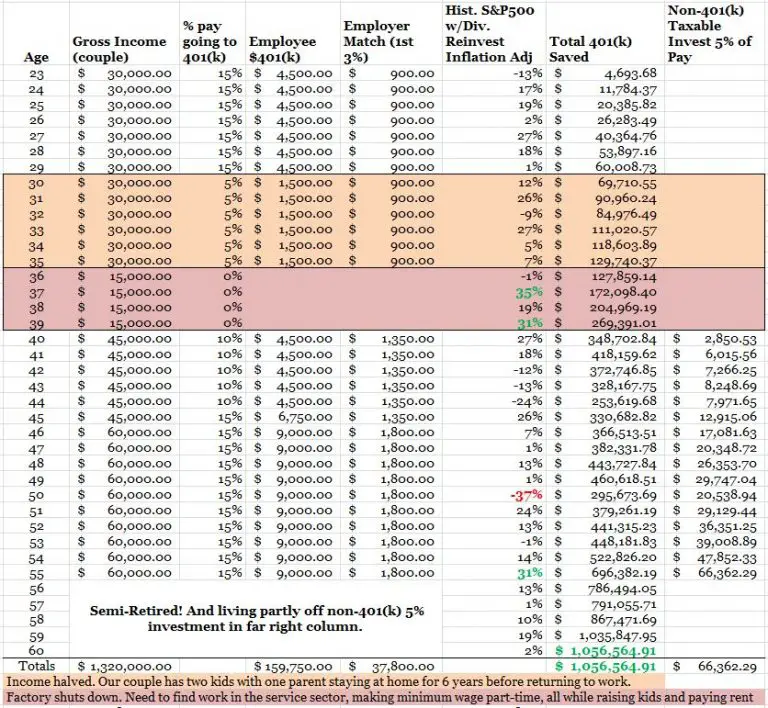

Now lets examine what happens to your 401 when you stop contributing and your employer does not make any matching contributions either. Using most of the same parameters as before, lets use our 401 Growth Calculator to see how much your 401 will be worth if you stop contributing at age 30, after you have already accumulated $10,000 in your account:

- You are 30 years old right now.

- You have 37 years until you retire.

- You make $50,000/year and expect a 3% annual salary increase.

- Your current 401 balance is $10,000.

- You get paid biweekly.

- You expect your annual before-tax rate of return on your 401 to be 5%.

- Your employer match is 100% up to a maximum of 4%.

- Your current before-tax 401 plan contribution is now 0% per year.

What happens to your previous 401 balance of $795,517? It plummets to $63,485 $732,032 less than before. When you stop contributing to your 401 and have no employer matching contributions, your total 401 balance in year 37 is 92% less. Procrastinating with your retirement savings and your 401 contributions means you have to work much harder and save even more to catch up to where you need to be in order to reach your retirement goals. Learn more about the cost of waiting to save for your retirement.

Don’t Miss: How Old Do You Have To Be To Start 401k

Anything Else I Should Know

Yep. A few things, actually.

Once you contribute to a 401, you should consider that money locked up for retirement. In general, distributions prior to age 59½ will be hit with a 10% penalty and income taxes.

If you leave a job, you can roll your 401 into a new 401 or an IRA at an online brokerage or robo-advisor. The IRA can give you more control over your account and allow you to access a larger investment selection.

401s typically force you to begin taking distributions called required minimum distributions, or RMDs at age 72 or when you retire, whichever is later. You may be able to roll a Roth 401 into a Roth IRA to avoid RMDs.

Contribution Limits For Highly Compensated Employees

Some 401 plans have extra contribution limits on employees who are highly compensated. plan and you are a high earner, these limits may not apply to you.)

Highly compensated employees can contribute no more than 2% more of their salary to their 401 than the average non-highly compensated employee contribution. That means if the average non-HCE employee is contributing 5% of their salary, an HCE can contribute a maximum of 7% of their salary. In addition to the federal limit, your company may have specific caps established to remain compliant.

The IRS determines you are a HCE if:

Either you owned 5% or more of a company last year and are participating in its 401 plan this year.

Or you earned $130,000 or more in 2020 from a company with a 401 plan youre participating in this year.

Unlike most other 401 limit guidelines, HCE classifications are based on your status from the previous year. For the 2022 plan year, the employee compensation threshold is $135,000.

If HCE contribution rates exceed non-HCE contribution rates by more than 2%, companies workplace retirement plans may lose their tax-advantaged status. As a HCE, you may be prevented from contributing to your 401 to the employee contribution max due to low 401 participation rates. You should still be able to make catch-up contributions on top of your HCE cap if you are eligible, though.

Don’t Miss: What’s The Most I Can Contribute To My 401k

What Kind Of Investments Are In A 401

401 accounts often offer a small, curated selection of mutual funds. Thats a good thing and a bad thing: On the plus side, you may have access to lower-cost versions of those specific funds, especially at very large companies that qualify for reduced pricing.

The negative is that even with discounted costs, that small selection narrows your investment options, and some of the funds offered may still have higher expense ratios than what youd pay if you could shop among a longer list of options. That can make it harder to build a low-cost, diversified portfolio.

Some plans also charge administrative fees on top of fund expenses, which can add up. If your 401 is expensive, contribute enough to earn your company match, and then direct any additional retirement savings contributions for the year into an IRA.

How Much Should I Have In My 401k

Laurie BlankSome of the links included in this article are from our advertisers. Read our Advertiser Disclosure.

If youre wondering how much money you should have in your 401k, your wait is over. Retirement savings is much of the talk in todays personal finance world.

You want to make sure youre saving enough to meet your retirement goals. Otherwise, you may have to find ways to save more or possibly delay retiring.

While each person has a different financial situation, these insights can improve your retirement plan.

In This Article

You May Like: When Can I Withdraw From My 401k

What Is A 401k

A 401k is a powerful type of retirement account that many companies offer to their employees as a perk. With each pay period, you put a portion of your paycheck into the account. It happens automatically so you dont have to do anything special and there are a ton of benefits.

A 401k is called a retirement account because it gives you huge tax advantages if you dont touch your money until you reach the minimum retirement age of 59 1/2 years. While you will have to pay a penalty if you touch your 401k savings before you reach retirement age, the benefits far outweigh the risk.

Here is a snapshot of the benefits of having a 401k:

What To Do If You Exceed The 401 Limit

If you’re planning to put away more than the $19,000 401 limit, you’ll need to find additional ways to invest your money. Here are three steps to follow to get the most out of your investment dollars.

1. Figure out which retirement savings account makes the most sense for you

First, determine which tax-advantaged retirement savings accounts are the best options for you, depending on your income and tax status, Nick Holeman, a certified financial planner and senior financial planner at Betterment, tells CNBC Make It. These can include a 401, Roth IRA, traditional IRA and/or a health savings account.

Traditional 401 plans, for example, offer tax savings up front, while Roth-style accounts offer tax-free withdrawals in retirement. Here’s a breakdown of how different types of plans work.

2. Max out your retirement accounts

Once you’ve determined the best account for you, contribute as much as you can to it. “Most people should start with their 401 if there’s a match,” Holeman says. But, “if your 401 has really high fees or really bad investment options, you might be better off starting with a traditional or Roth IRA and then going to your 401 after you’ve maxed that out.”

Once you’ve maxed that out, “waterfall your way down” through other tax-advantaged accounts, Holeman says. “Figure out how much you need to save, then rank the accounts from best to worst and fill up the buckets as you go until you’re unable to save anymore.”

3. Branch out to other investments

You May Like: How Can I Get Access To My 401k

Retirement Savings Plan Contribution Limits

The information below summarizes the retirement plan contribution limits for 2022.

| Plan |

|---|

More details on the retirement plan limits are available from the IRS.

457 Plans

The normal contribution limit for elective deferrals to a 457 deferred compensation plan is increased to $20,500 in 2022. Employees age 50 or older may contribute up to an additional $6,500 for a total of $27,000. Employees taking advantage of the special pre-retirement catch-up may be eligible to contribute up to double the normal limit, for a total of $41,000.

401 Plans

The total contribution limit for 401 defined contribution plans under section 415 increased from $58,000 to $61,000 for 2022. This includes both employer and employee contributions.

401 Plans

The annual elective deferral limit for 401 plan employee contributions is increased to $20,500 in 2022. Employees age 50 or older may contribute up to an additional $6,500 for a total of $27,000.

The total contribution limit for both employee and employer contributions to 401 defined contribution plans under section 415 increased from $58,000 to $61,000 .

403 Plans

The annual elective deferral limit for 403 plan employee contributions is increased to $20,500 in 2022. Employees age 50 or older may contribute up to an additional $6,500 for a total of $27,000.

The total contribution limit for both employee and employer contributions to 403 plans under section 415 increased from $58,000 to $61,000 .

IRAs

Are There Income Limits For 401s

While theres not a universal income limit on 401 contributions, in some cases the IRS does impose contribution limits on highly compensated employees when a company encounters disproportionate contribution levels among its workers. The IRS has a test that helps employers who sponsor 401 plans assess whether employees are participating in their plan at levels proportionate to their compensation.

If the test determines that people across compensation levels arent participating in a manner the IRS deems proportionate, employee contribution levels for highly compensated employees can be lowered. In these cases, your employer may need to return some of your excess contributions.

The IRS defines a highly compensated employee in one of two ways:

An individual who either owned more than 5% of the interest in a business at any time during the year or the preceding year, no matter how much they were paid.

An individual who received over $130,000 from the business in the preceding year and, if the employer ranks employees by compensation, was in the top 20%.

Recommended Reading: How Can I Withdraw My 401k

How Much Can You Contribute To A 401

The most you can contribute to a 401 is $19,500 in 2021 and $20,500 for 2022 . Employer contributions are on top of that limit. These limits are set by the IRS and subject to adjustment each year.

That limit dictates how much you can contribute, but it doesnt tell you how much you should contribute. To figure that out, consider the following.

How Much Should I Contribute To My 401

Planning for retirement is a complex process that starts with an easy first step: saving money. A commitment to regular savings, as early as possible, will launch your retirement planning in the right direction.

As you get closer to retirement, you may want to be more purposeful about your savings. How much should I contribute to my 401? is one of the most common questions that financial services folks hear.

Figuring out how much to put in your 401 depends on your overall goals and financial situation, so it will vary for each person. The amount you can save is also determined by the Internal Revenue Service , because there are limits on how much money can be put aside.

Read Also: Can You Transfer 401k To Roth Ira

Is A 401k Better Than An Ira

The 401 is simply objectively better. The employer-sponsored plan allows you to add much more to your retirement savings than an IRA $20,500 compared to $6,000 in 2022. Plus, if you’re over age 50 you get a larger catch-up contribution maximum with the 401 $6,500 compared to $1,000 in the IRA…. continue reading

Can I Contribute 100% Of My Salary To My 401k

The maximum salary deferral amount that you can contribute in 2019 to a 401 is the lesser of 100% of pay or $19,000. However, some 401 plans may limit your contributions to a lesser amount, and in such cases, IRS rules may limit the contribution for highly compensated employees…. continue reading

Employees can contribute up to $19,500 to their 401 plan for 2021 and $20,500 for 2022. Anyone age 50 or over is eligible for an additional catch-up contribution of $6,500 in 2021 and 2022…. read more

401 contribution limit increases to $19,500 for 2020 catch-up limit rises to $6,500 | Internal Revenue Service…. view details

Recommended Reading: Can I Take A Loan From My 401k

The Average 401k Balance By Age

401k plans are one of the most common investment vehicles that Americans use to save for retirement.

To help you maximize your retirement dollars, the 401k is an employer-sponsored plan that allows you to save for retirement in a tax-sheltered way. You can contribute up to $19,500 in 2021 and $20,500 in 2022.

If your employer offers a 401k and you are not utilizing it, you may be leaving money on the table especially if your employer matches your contributions.

While the 401k is one of the best available retirement saving options for many people, only 32% of Americans are investing in one, according to the U.S. Census Bureau. That is staggering given the number of employees who have access to one: 59% of employed Americans.

So how much do people actually have saved in their 401k plans? And how does this stack up against what they could have saved if they were maxing out their 401k every year?

Best Places For Employee Benefits

SmartAssets interactive map highlights the counties across the country that are best for employee benefits. Zoom between states and the national map to see data points for each region, or look specifically at one of four factors driving our analysis: unemployment rate, percentage of residents contributing to retirement accounts, cost of living and percentage of the population with health insurance.

Don’t Miss: How Do You Know If You Have An Old 401k

How Much Should You Have In Your 401k By Age

Now that we have established that you need a 401k in your life and explained how much you can contribute, lets talk cash. Aside from investing enough to meet your employer match, how much should you have in your 401k, really?

One way to answer that question is to look at your age.

While there is no one-size-fits-all answer to the question, How much should I have in my 401k? there are some best practices you can keep in mind to guide your efforts. Yes, while you should start investing in a 401k as soon as possible, some people might not get that opportunity right away and thats okay. The point is to do it when you can.

When you do finally start investing, there are a few good rules of thumb to help you make a sound decision on how much you should have in your 401k.

How To Invest 401 Money

Youll also need to decide how to invest your 401 money. One option, which most 401 plans offer, is target-date funds. You pick a fund with a calendar year closest to your desired retirement year the fund automatically shifts its asset allocation, from growth to income, as your target date gets nearer.

These funds also have model portfolios you can choose from and online tools to help you assess how much risk you want to take. You can also decide which fund choices would match up best with your desired level of risk.

You May Like: What Is A 403b Vs 401k

What Happens If I Exceed The Roth 401 Limit

If your 401 contributions exceed the annual limit, you risk being taxed twice on your excess contributions. Its advisable to contact your HR, payroll department, or plan administrator as soon as you notice an overcontribution. If you inform them before the tax-filing deadline, you may be able to fix the issue in time.

Solo 401 Establishment Deadline:

For 2021, in order to make employee contributions for 2021, the self-employed business owner had to establish the solo 401k plan by December 31, 2021. However, if the plan was established on January 1, 2022 or after by your business tax return due date including the business tax return extension, then you cam make employer profit sharing contributions for 2021 but cannot make employee contributions. For example, an employer operating the plan on a calendar-year basis had to complete the solo 401k plan documentation no later than .

For makin 2021 solo 401k plan contributions, the solo 401k has to be adopted by December 31, 2021 for self-employed businesses operating the plan on a calendar-year basis in order to preserve the right to make both employee and employer contributions in 2022 for 2021 by the business tax return including business tax return extensions. Otherwise, if the solo 401k plan is adopted on January 1, 2022 or after but by your business tax return due date including extensions, you will only be allowed to make employer contributions not employee contributions to the solo 401k plan. To learn more about the December 31, 2021 plan adoption/establishment deadline VISIT HERE.

Recommended Reading: How To Fill Out 401k