Can You Contribute To A Simple Ira And A 401k In The Same Year

If you belong to a 401 and a SIMPLE IRA in the same year, your contributions to either plan count toward the overall limit of $17,500, or $23,000 if youve reached age 50. If youve reached age 50, you can contribute up to $5,500 to your SIMPLE IRA to bring your total annual contributions to $23,000.

Recommended Reading: How Do You Pull Out Your 401k

Other Benefits Of A 401

Even for employers who do not offer any matching program, every employer with a 401 plan is responsible for administering the plan. That may seem like its no big deal, but it actually saves quite a bit of trouble for the employees. As an employee in a 401 plan, you dont have to worry about the complicated rules and regulations that need to be followed, or about making arrangements with the funds in which you invest your moneyyour employer takes care of all of that for you. Thats quite a bit of saved paperwork.

At the same time, employees who participate in a 401 maintain control over their money. While employers provide a list of possible investment choices, most commonly different sorts of mutual funds, employees have quite a bit of freedom to decide their own strategy. Whether you are willing to take on a little more risk with your investments, or if you would rather play it safe, theres probably an option for you.

How Much Money Is Too Much For A Roth Ira

Earning Too Much to Contribute Income Limits for Roth IRAs are adjusted periodically by the IRS. This may interest you : Is a Roth IRA Right for You? Ask Yourself These 2 Questions to Find Out | Personal Finance. In 2021, people who are married to propose together or widows who qualify must make less than $ 198,000 in order to give the maximum contribution.

Can I invest in a Roth IRA if I make over 200k? Roth IRA contributions are unlimited for the high -income that is anyone who has an annual income of $ 144,000 or more if filing taxes as a sole or head of household in 2022 , or with an annual income of $ 214,000 or more if marriages are filing together .

Also Check: How Do I Get My 401k From Walmart

Rolling Out To Iras After An In

After completing a Roth conversion within your workplace retirement plan, rolling out to IRAs should be relatively straightforward if you choose to do that. If youre planning to roll the money out to a Roth IRA at some point and dont already contribute to a Roth IRA, it may make sense to open an account and make at least one contribution now, if possible, so the 5-year clock starts ticking on this account. Roth IRAs have a 5-year aging requirement as wellif youve never contributed to a Roth IRA and roll in money from a Roth 401 another 5-year clock starts in January of the year in which the rollover was done.

If you earn too much to contribute to a Roth IRA, you do have options. Read Viewpoints on Fidelity.com: Do you earn too much for a Roth IRA?

When Can I Contribute To A Roth Ira For 2021

You can make IRA contributions for a specified year anytime between January 1 and the following years tax filing deadline . The IRS has extended the 2020 tax filing and IRA contribution deadline to Monday, May 17, 2021.

What is the last day to contribute to an IRA for 2021?

As a general rule, you have until tax day to make IRA contributions for the year in advance. In 2021, that means you can contribute to your 2020 tax year limit of $ 6,000 until May 17th. And from January 1, 2021, you can also contribute to your 2021 tax year limit until tax day in 2022.

Can I open an IRA in 2021 and contribute for last year?

Make Sure You Choose The Right Tax Year. If you open an IRA before the tax deadline, you can make contributions for the previous or current year. For 2021, the maximum IRA contribution is $ 6,000. People age 50 and older can make an additional $ 1,000 in holding contributions, totaling $ 7,000.

How much can I put in a Roth IRA 2021?

More On Retirement Plans Note: For other retirement plan contribution limits, see the Topic Retirement â Contribution Limits. For 2022, 2021, 2020 and 2019, the total contributions you make each year to all of your traditional IRAs and Roth IRAs cannot be more than: $ 6,000 , or.

You May Like: What Age Can I Start Withdrawing From My 401k

Think About How Much Youll Need In Retirement

Contributing the maximum to your 401 requires a lot of money especially as an ongoing, year-after-year commitment. It may or may not be enough to fund your retirement, or it could be even more than you need. Your 401 contribution amount should be guided by your retirement savings goal.

How much money youll need in retirement depends on when you plan to retire, how much of your current income youd like to replace and how much you want to rely on Social Security.

Most experts recommend saving 10% to 15% of your income, but our suggestion is to get a more detailed goal from a retirement calculator.

If you need to start at a lower contribution and work your way up, thats fine. Aim to contribute at least enough to grab the match, then bump up the percent you contribute by 1% or 2% each year.

A Traditional 401s Vs A Roth 401

According to Melissa Brennan, a certified financial planner in Dallas, a 401 works best for someone who anticipates being in a lower income tax bracket at retirement than they’re in now. For example, someone in the 32% or 35% tax bracket may be able to retire in the 24% bracket. “In that case, it makes sense to save on a pretax basis and defer income taxes until retirement,” Brennan says.

Employers have been increasing tax diversification in their retirement plans by adding Roth 401s. These accounts combine features of Roth IRAs and 401s. Contributions go into a Roth 401 after you have paid taxes on the money. You can withdraw contributions and earnings tax- and penalty-free if you’re at least age 59 1/2 and have owned the account for five years or more. You’ll also be required to take minimum distributions from a Roth 401 once you turn age 72. However, you might be able to avoid RMDs if you can move the money from a Roth 401 into a Roth IRA, which isn’t subject to required minimum distributions.

and a Roth 401, the total amount of money you can contribute to both accounts can’t exceed the annual limit for your age, either $19,500 or $26,000 for 2020. If you do exceed it, the IRS might hit you with a 6% excessive-contribution penalty.)

Recommended Reading: How To Check How Much Money Is In My 401k

What Is A 401k

A 401k is a powerful type of retirement account that many companies offer to their employees as a perk. With each pay period, you put a portion of your paycheck into the account. It happens automatically so you dont have to do anything special and there are a ton of benefits.

A 401k is called a retirement account because it gives you huge tax advantages if you dont touch your money until you reach the minimum retirement age of 59 1/2 years. While you will have to pay a penalty if you touch your 401k savings before you reach retirement age, the benefits far outweigh the risk.

Here is a snapshot of the benefits of having a 401k:

How To Claim Your Retirement Savings

Normally, getting at your money can be difficult, and the rules are often imposed by the plan design rather than regulations.

For instance, regulations allow you to access the money without a bonus penalty by:

- Getting a hardship withdrawal before age 59 ½.

- Waiting until age 59 ½.

- Leaving your employer in the year you turn age 55 or after.

While most plans do have loan provisions, many dont allow hardship withdrawals, and some plans require that a person be terminated before accessing their money, even if they are 59 ½ or older.

Due to COVID-19, the Coronavirus Aid, Relief, and Economic Security Act, or CARES Act, made it easier to get at your money up to $100,000 in loans or distributions, if the plan allowed it. These withdrawals had to be taken before the end of 2020. If you took a hardship loan in 2020, you could avoid paying the 10 percent penalty on the money, as well as take the option to repay the loan tax-free over the next three years.

Unless youre really in a bind, Brewer advises against taking a distribution or a loan. Theres no replacing time in the market, she points out, and consistent saving over time is one of the best ways to build wealth for the future.

Recommended Reading: Where Can I Move My 401k Without Penalty

Knowing These Rules Can Save You A Lot Of Trouble With The Irs

A 401 is a tax-advantaged retirement account, so the government sets limits on how much you can contribute every year. But it also understands that inflation makes retirement more expensive over time, so it reevaluates its limits every year and sometimes raises them. Heres an overview of all of the contribution limits the government imposes on 401s in 2020 and 2021.

How Much You Should Have Saved In Your 401k By Age 50

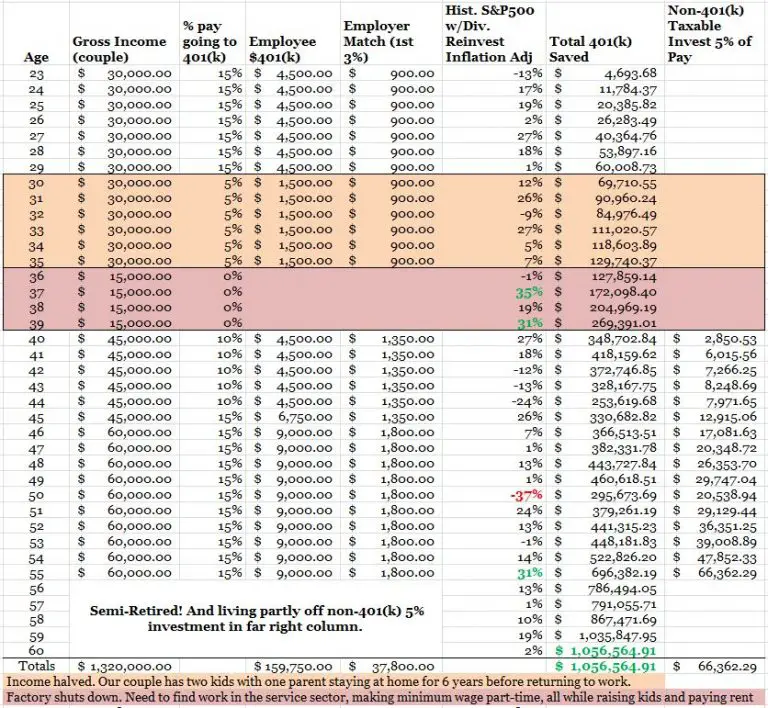

The assumptions for the below chart are as follows:

* The Low End column accounts for lower maximum contribution amounts available to savers above 45.

* The Mid End column accounts for lower maximum contribution amounts available to savers below 45.

* The High End column accounts for savers who are under the age of 25. After the first year, one maximizes their contribution every year to their 401k plan without failure.

* Average starting working age is 22. But you can follow the number of years working as a different guideline if you graduate later or earlier.

* $18,000 is used as the conservative base case maximum contribution amount for ones entire working life. Hopefully the government will increase the max contribution amount over time.

* No after tax income contribution, although more power to you if you have the disposable income to do so.

* The rate of return assumptions are between 0% 10%.

* Company match assumption is between 0% 3%.

* The Low, Mid, and High columns should successfully encapsulate about 80% of all 401K contributors who max out their contributions each year. There will be those with less, and those which much, MUCH greater balances thanks to higher returns.

* You are logical and not a knucklehead. Just by searching this topic, you are taking ownership of your retirement and are thinking ahead with an action plan.

Read Also: Can You Merge 401k Accounts

Recommended Reading: How Do Companies Match 401k

How Much Should I Put In My 401k

There are two sets of answers when it comes to the question of how much should I put in my 401k?

The first answer is the technical side as in, how much are you actually allowed to put in your 401k each year? As youll soon see, the IRS caps how much you can put in your 401k each year.

The other answer is more qualitative and much more personal. If youre unable to contribute the maximum amount, then how much should you contribute? Or better yet, should you contribute to your 401k at all?

But first

This blog is about 401ks, but the rules were about to discuss also apply, for the most part, to other types of employer retirement plans like 403bs and TSPs. For simplicitys sake we will use the term 401k as a catch-all since it is the most popular type of employer retirement account.

Can You Contribute $6000 To Both Roth And Traditional Ira

The Bottom Line

As long as you meet eligibility requirements, such as having earned income, you can contribute to both a Roth and a traditional IRA. How much you contribute to each is up to you, as long as you dont exceed the combined annual contribution limit of $6,000, or $7,000 if youre age 50 or older.

You May Like: Can You Move Money From One 401k To Another

Total 401 Employer And Employee Annual Contribution Limits

| 2021 | ||

|---|---|---|

|

Total with Catch-Up Contributions for those 50 or Older |

$64,500 |

$67,500 |

Vanguard data from 2018 show that among 401 plans the firm administered, 95% of employers provided matching or non-matching contributions to their employees. Approximately 85% of employers provided a 401 match to their employees. Approximately 10% of employers provided non-matching 401 contributions, with no requirement that employees also contribute.

While the annual limits for individual contributions are cumulative across 401 plans, employer contribution limits are per plan. If you were to participate in multiple 401 plans in one calendar year , each of your employers could max out their contributions.

Ira Rollover Without An In

You can roll over after-tax contributions to a Roth IRA, and it is possible to do that before age 59½. There is a big catch though: Not all plans allow withdrawals while youre still with the company and your retirement plan may have some rules around the requirements for rolling out of the plan. In-service withdrawals come with some potentially complicated rules so its important to understand the rules the IRS has and those of your retirement plan.

In general, to roll after-tax money to a Roth IRA, earnings on the after-tax balance must, in most cases, also be withdrawn. You may have a few options.

If you have both pre-tax and after-tax contributions, you may be able to take a partial distribution from your retirement plan, consisting of just one or the other, if the plan separately tracks the sources of all of your contributions. In that case, you may want to roll out only the after-tax source balances and associated earnings directly into a Roth IRA.

The pre-tax contributions, along with the earnings from both the pre-tax and the after-tax contributions, can be rolled to a traditional IRA, incurring no current income tax.

Alternatively, you can roll everything into a Roth IRA, but you would need to pay income taxes on the pre-tax contributions and all of the earnings.

Important note: Any partial withdrawals or in-plan conversions may affect eligibility for net unrealized appreciation treatment on appreciated employer stock held in the plan.

Recommended Reading: How To Retrieve 401k Money

Mega Back Door Roth Solo 401k Contribution Limit Question:

Yes and see the following.

- The overall limit in 415C applies on a per employer basis Provided that the employers are unrelated.

- This limit is applied without consideration of contributions made to a plan sponsored by an unrelated employer

- The elective deferral limit in 402G applies only to elective deferrals and does not impact after-tax contributions

- Here is an Example:

- For 2021, an individual contributes $19,500 of the elective deferrals to a 401 plan sponsored by his W-2 employer & additional matching and profit-sharing contributions are made up to the limit of $58,000

- Individual has an S-corp side business with no employees that generates self-employment income greater than $58,000 for 2021.

- The individual can contribute after-tax contributions up to $58,000 for 2021 to the solo 401 sponsored by side business and subsequently convert the voluntary after-tax funds to a Roth IRA or to the Roth Solo 401k.

Contribution Limits For 401 403 And Most 457 Plans

| 2020 | |

| $63,500 | $64,500 |

1. If you have contributed to more than one qualified retirement plan during the calendar year, it is your responsibility to ensure that you have not exceeded these limits.

2. Company contributions include any employer matching, profit-sharing, and non-elective contributions.

3. Amount typically not to exceed the lesser 100% of your compensation or this number. Your employers retirement plan might limit the compensation to something less than 100% please refer to your plans Summary Plan Description or plan document for other applicable limits.

The annual compensation limit is $290,000. You can make contributions up to the IRS contribution limits noted above up to $290,000.

Also Check: Should I Borrow From My 401k

Deferral Limits For 401 Plans

The limit on employee elective deferrals is:

- $20,500 in 2022 , subject to cost-of-living adjustments

Generally, you aggregate all elective deferrals you made to all plans in which you participate to determine if you have exceeded these limits. If a plan participants elective deferrals are more than the annual limit, find out how you can correct this plan mistake.

The Contribution Limits Also Apply To Roth 401 Contributions

Contribution limits for Roth 401 contributions are the same as they are for traditional 401 contributions. That means you can contribute up to $19,500 per year to either a regular 401 plan, or a Roth 401 plan.

More likely, you will want to contribute to both, in which case youll have to allocate how much of the $19,500 limit will go into each part of your 401.

Not coincidentally, the 401 limits are virtually the same as the limits for both the 403 plan and the Thrift Savings Plan .

In addition, any employer matching contributions to the plans are not included in the employee contribution limits listed above.

Your employer can contribute a matching contribution that exceeds the $19,500 regular contribution limit, or even the combined $26,000 limit if you are age 50 or older. It is always a good idea to figure out whether a Roth 401k vs Roth IRA is best for you.

Also Check: How Do I Invest In My 401k

Don’t Miss: Does Having A 401k Help You Get A Mortgage